Artificial Intelligence

Financial Planning

- The Tax Cuts and Jobs Act lowered many taxes, but several of those provisions came with a built-in expiration date: January 1, 2026.

- Extending those rules or making them permanent is likely to be a priority for the incoming Trump administration, but the final rules may not be worked out for some time.

- Consider reviewing your plan now with your Private Wealth Advisor and tax professionals to make sure you are well positioned.

With President-elect Donald J. Trump returning to the White House and the GOP soon to hold majorities in the Senate and the House, tax cuts currently set to expire at the start of 2026 appear more likely to be extended.

Those cuts are provisions of the of the Tax Cuts and Jobs Act (TCJA) of 2017, one of the central pieces of legislation from Trump's first term. He has loudly voiced support for extending them or making them permanent, part of a larger tax-reduction plan that he championed during the presidential campaign.

But while there is a lot of momentum behind extending these tax cuts, it’s too soon to pinpoint what will happen or when. Congress must vote on any revisions, which may take at least several months as specifics are hammered out and votes are scheduled. Beyond that, Trump has signaled a desire for even more cuts. It’s unclear how far even a Republican-controlled Congress might go in this regard given the possible effect on the federal budget.

Of course, there’s no doubt that high net worth taxpayers are especially sensitive to tax changes. Not only does a larger share of their income fall into the highest brackets, but many families could be impacted by alterations to gift and estate taxes. These taxpayers also tend to have more complex finances, meaning that even small alterations can ripple through their wealth plans.

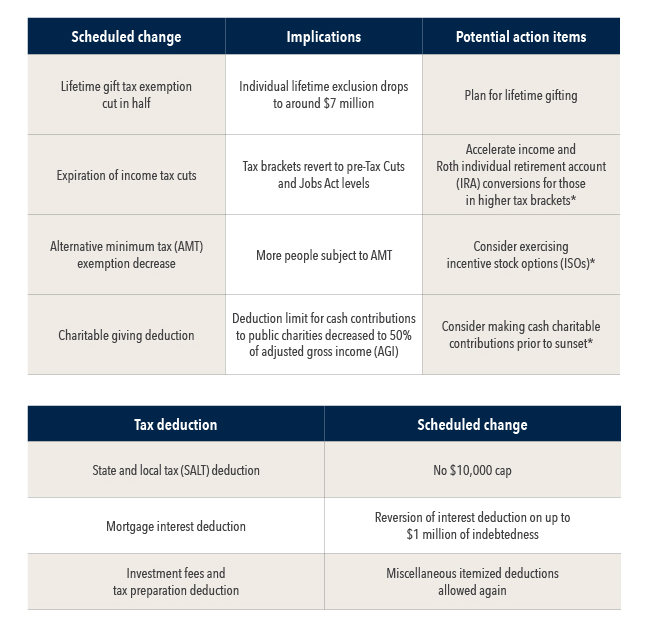

Select scheduled tax changes for 2026

Source: Capital Group Private Client Services. This material does not constitute legal or tax advice. Investors should consult with their legal or tax advisors. *Consult with your certified public accountant (CPA).

Whatever the eventual outcome in Washington, all of this makes now a very good time to review your planning with your Private Wealth Advisor. Though 2026 is not so far off, starting now can provide sufficient time to think through and implement any changes to your plan. Even in the event that the expiring provisions are made permanent with no other changes, a review can help your plan stay on track and up to date.

Expiring provisions mean the tax code is almost certainly going to change.

Unlike many tax changes, the sunset provisions in the TCJA aren’t a new bill in front of Congress. Rather, they were baked into the original law to help it meet certain rules for how it would impact the budget. That’s an important detail: These changes will happen unless the government takes action. They can’t die in committee or be phased out of a bill.

There are many changes tied to these impacted provisions, but three are of particular import for high net worth investors. First, the highest bracket of income taxes will revert to 39.6% from 37%. Second, the lifetime exemption for gift and estate taxes will be halved, to about $7 million. This is the amount of money you can gift, or give away, to individuals over the course of your life and after your death before gift and estate taxes kick in. With the estate and gift tax rate at 40%, this can significantly impact accumulated wealth. Finally, some good news — the $10,000 cap on state and local tax, or SALT, deductions would go away.

Ready to start a conversation?

Speak with one of our Private Wealth Advisors today.

Planning for the future can bear fruit, even if the worst doesn’t come to pass.

When reviewing your wealth plan ahead of these changes, it’s important to keep in mind that the goal isn’t to create a plan perfectly suited for a specific environment. Rather, it’s to create an all-weather plan designed to meet your needs even in a variety of scenarios. Balancing your risk against your expected return is always critical — as great as it can feel to see an aggressive position pay off, the pain of loss on an ill-considered choice is often keener. Your final plan should be designed to work no matter which way the tax regime shakes out in 2026.

Of course, the chances that these tax cuts are extended is much higher than it was before November 5. However, for many investors, a strong wealth plan won’t be structured to assume any given scenario is assured. Rather, it should make allowances for changes without relying on them. For example, a higher income tax rate shouldn’t push you out of taxable bonds if you need regular cash to sustain your lifestyle — but it should inform your approach to your portfolio.

If you’re concerned that potential tax law changes could impact parts of your wealth plan, consult with your Private Wealth Advisor and tax professional to see if it makes sense to shift your timing. However, one of the first rules of a wealth plan is to never put yourself in a position you regret after the fact. Don’t gear your plan to pursue a potential tax break or incentive, as many planning tools can be difficult, or even impossible, to undo.

Your Private Wealth Advisor, in coordination with our wealth advisory group, can help you understand your situation and can walk you through potential options to discuss with your legal and tax professionals.

Related Insights

Related Insights

Let's continue the conversation.

A Private Wealth Advisor will contact you to discuss how we can help you achieve your goals.

Let's continue the conversation.

A Private Wealth Advisor will contact you to discuss how we can help you achieve your goals.

Anne Gifford Ewing

Anne Gifford Ewing