Artificial Intelligence

Risk

The devastating wildfires that swept across Los Angeles in the last week are a stark reminder of how quickly disaster can strike. Within hours, lives were upended and homes were reduced to ash, and the path forward for many individuals and families remains unknown. The emotional toll of such a disaster — grief for lost possessions, fear for the safety of loved ones and a profound sense of helplessness — can be overwhelming. While it’s impossible to prevent these life-altering events, there are ways to help soften their financial blow. Preparing for the unexpected is not just about protecting your assets; it’s about trying to ensure you have the resources to rebuild should everything change in an instant.

Make sure your insurance is in good shape.

In a disaster or emergency, it’s crucial to have a clear understanding of what your insurance covers. Your Private Wealth Advisor can help you think through these matters in detail and connect you to an insurance agent should you need more guidance. When assessing your policies, there are several questions to ask. Among them: How much of your personal property is covered? Have you acquired any high-value items — such as art or collectables — that haven’t been accounted for since you purchased a policy?

Pay special attention to homeowners insurance. Coverage typically adjusts annually for inflation, but if the value of your property has appreciated significantly since you purchased the policy, this incremental adjustment alone may not be enough. It may be wise to reassess your policy annually or when it renews to ensure that the coverage you’re paying for is still in line with what you truly need.

Additionally, understand the difference between policies that cover replacement cost — the amount needed to replace a lost or damaged item with a new one — vs. those that cover actual cash value — the amount needed to replace the item after depreciation. Actual cash value coverage will pay for your loss but often not enough to replace your items with new ones. Replacement cost value coverage is more expensive, but generally offers larger reimbursements. It’s up to policyholders to decide which option makes the most sense for them — what’s most important is to fully understand what you’re paying for.

To help smooth the arduous process of filing a claim, it’s advisable to preemptively take inventory of your belongings with photos and videos. In the event you need to rebuild your home or replace a large number of belongings, this can be challenging to do from memory alone.

Another important area of homeowners insurance to understand your loss-of-use coverage, which determines how much your policy will cover if you need to stay elsewhere temporarily. Is the amount sufficient if you have a large family and need to rent a home with multiple bedrooms?

Gather critical documents.

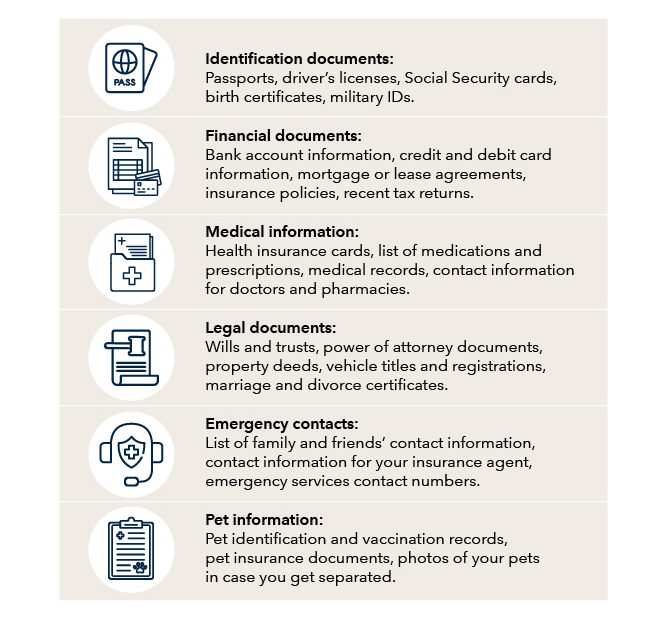

In a disaster, having access to valuable documents is crucial. Include a folder with essential documents in your emergency kit so they are always ready to go. While you don’t need physical copies of every document, make sure you have digital versions. It’s good practice to digitize as many files as you can and to store them on a secure cloud service or USB drive.

Important documents to gather

Using a safety deposit box at a local bank is an option for safely storing documents that you won’t need right away, such as legal or financial paperwork. If you store files at home, a fireproof or waterproof safe could be a secure storage option.

A disaster should not upend your long-term wealth plan.

In partnership with our Private Wealth Advisors, our Wealth Advisory Group creates long-term strategic plans tailored to each client’s specific goals. Just as natural market fluctuations should not disrupt these long-term plans, a disaster should not dramatically change how clients consider their strategic allocations, as disorienting as circumstances may feel in the short term.

Our portfolio allocation guidance includes planning for the unexpected. Aside from a core portfolio of stocks and bonds, we suggest that most clients keep a base portfolio comprised of a year or two of living expenses in cash, money market funds or short-term bond funds. This helps provide funds that are held in accounts and investments that are historically not subject to the same market risk as a client’s core equity, bond and alternative investment holdings.

Additionally, consider keeping a small amount of cash on hand at home. In an emergency that involves a power outage, it may be easiest to transact with cash. Enough cash to cover fuel and meals for a couple of weeks is likely sufficient.

Remember that Capital Group Private Client Services is always here to help — both in an emergency and long before it.

Related Insights

Related Insights

-

For better or worse, AI fireworks propel the market

-

Equity

Q&A with Greg Miliotes -

India

Despite election surprise, prospects remain strong for India’s economy

Aaron Petersen

Aaron Petersen