Artificial Intelligence

Housing

Many investors, economists and policymakers have doubted the strength of the U.S. housing market, largely due to skyrocketing mortgage rates and plummeting affordability.

The near-term dynamics that drive the housing cycle are sending mixed signals today, with prices higher even as sales have been depressed. But I believe longer-term trends point to solid growth in housing over the next decade. People need a place to live, and home ownership remains a centerpiece of the American dream. In my view, housing stands out as one of the more underappreciated growth markets in the U.S. economy.

There are some risks, of course. Chief among them would be a weakening labor market, which could suppress demand even if it led to lower interest rates. Housing can also be volatile, which can result in challenging periods. Nonetheless, I think the industry has bright long-term prospects.

There haven’t been enough new homes in recent years.

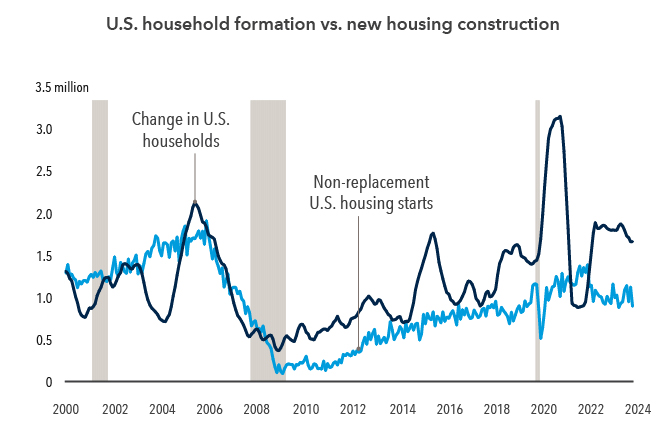

Simply put, new construction has not stepped up to meet demand. By my estimate, there’s a nationwide housing shortfall today of as many as 5 million homes, and that’s only getting worse. The number of households in the U.S. increased by 1.65 million in the 12 months ended in March. Non-replacement housing starts, a measure of new housing units being built, stood at 889,000 over the same period.

This gap between supply and demand extends a trend that has lasted more than a decade, except for a volatile period between 2021 and 2022 in the wake of the pandemic. In other words, we have underinvested in new housing.

Household growth continues to outstrip home building

Sources: Capital Group, National Bureau of Economic Research, U.S. Census Bureau. Non-replacement U.S. housing starts reflect actual housing starts less 0.295% of the housing stock (Census Bureau estimate of housing loss). Grey bars represent recessionary periods. As of March 31, 2024.

We will need at least 1.5 million to 1.6 million new home starts each year just to keep up with population growth. That doesn’t include a potential 300,000 to 400,000 homes that are demolished each year. This suggests the potential for a significant boost in residential construction activity for years.

The “lock-in” effect could drive more construction.

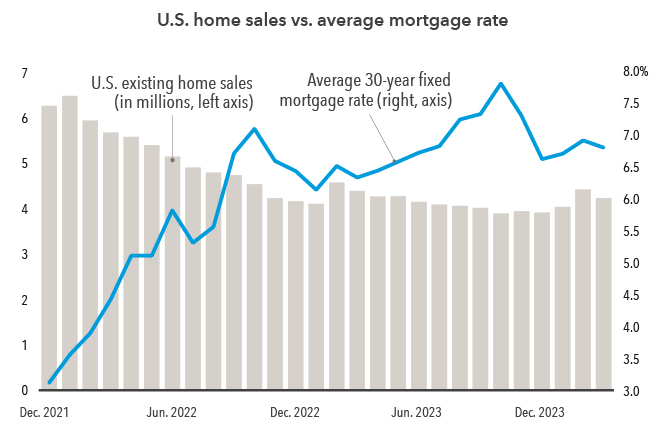

Higher mortgage rates have created distortions in the supply-demand picture that could provide near-term tailwinds for new home construction. As the Federal Reserve hiked short-term interest rates 11 times in 2022 and 2023, mortgage rates soared, and existing home sales plummeted from an annualized rate of 6.4 million in January 2022 to 3.8 million in October 2023 — a 28-year low.

Concerns about affordability may explain some of the decline, but another factor is the sharp rise in mortgage rates that has resulted in a “lock-in” effect for existing homeowners. In typical years, many owners will sell their homes to relocate for a new job or to accommodate a growing family. However, at the end of 2023, some 70% of homeowners held 30-year fixed-rate mortgages that were about three percentage points lower than available rates on new mortgages. Many homeowners with such mortgages will conclude that relocating is financially untenable because their existing mortgage itself is an asset that would be difficult or impossible to replace, locking them in place. This effect has resulted in a substantial decline in homes for sale, and builders are scrambling to begin new construction to meet the supply shortfall.

Higher mortgage rates are correlated to lower sales figures

Sources: Capital Group, Freddie Mac, National Association of Realtors. Existing home sales figures are seasonally adjusted at an annual rate. As of March 29, 2024.

Although much has been written about an affordability crisis, mortgage rates are not extreme by historical standards. It’s worth remembering that in the 1970s and 1980s, when mortgage rates were in the double digits, the housing market remained healthy as millions of baby boomers made initial home purchases. And that was in a period when the U.S. population was around 230 million versus about 340 million today.

Today, I see similarly positive dynamics: In addition to the construction lag of the 2010s, more millennials are beginning to buy their first homes and the pandemic increased demand for single-family homes. I also believe homebuyers will ultimately adjust to a new environment of higher rates and prices.

Many homebuilders are adaptable.

The shortfall in new construction is providing opportunity for homebuilders able to adjust to this new environment. Some builders are providing financing incentives. For example, D.R. Horton, the largest homebuilder in the U.S., slashed prices and offered mortgage rate buydowns to customers to help boost affordability. What’s more, the Federal Housing Administration (FHA) and Veterans Health Administration (VHA) are backing a significant share of home purchases.

Some homebuilders are taking further steps to strengthen their balance sheets in preparation for market volatility should high rates linger. Lennar, for example, adopted an asset-light approach, signing option agreements for land rather than buying it outright — a more cautious approach than was common a decade ago, when many homebuilders went into debt to purchase land up front. Lennar has also invested heavily in digital marketing platforms.

Among building materials companies, TopBuild — the nation’s largest insulation installer — continued to grow its business, improve its margins and add to its organic growth through acquisitions of smaller installers.

And the benefits of a sustained housing recovery could extend beyond homebuilders and material suppliers, potentially lifting sales for home improvement retailers and appliance makers as well as boosting construction jobs.

Related Insights

Related Insights

-

For better or worse, AI fireworks propel the market

-

Equity

Q&A with Greg Miliotes -

India

Despite election surprise, prospects remain strong for India’s economy

Martin Jacobs

Martin Jacobs