Tax & Estate Planning

Long-Term Investing

Harry Markowitz, one of the pioneers of modern portfolio theory, was an avid mathematician. However, the path that led to his Nobel Prize in Economics in 1990 didn’t start with a complex formula; rather, it began with a simple thought experiment. He considered how terrible he’d feel if his portfolio was all equities and stocks were to fall precipitously. He then thought about how foolish he’d feel if he invested entirely in bonds and stocks soared.

It seems obvious now, but his meditation would revolutionize how investors construct portfolios. Rather than relying solely on intuition, they take account of how various securities have reacted to different market conditions over time. Boiled to its essence, Markowitz’s work underscored the fundamental importance of diversification.

This is a lot more than theoretical — in fact, markets have been undergoing something of a diversification experiment themselves over the last few years. In 2023, the S&P 500, an index that follows the 500 largest U.S. companies by market capitalization, soared more than 26%. The surge was due largely to the so-called Magnificent Seven technology titans — Google parent Alphabet, Amazon.com, Apple, Meta, Microsoft, Nvidia and Tesla. Their gains were so large that they made up 29% of the index by year’s end, an abnormally high level of concentration.

Now consider the seven highest-returning stocks in 2023 from the MSCI EAFE, which tracks large-cap businesses in developed markets based outside the U.S. and Canada. Perhaps unsurprisingly, that list had a much smaller emphasis on AI-heavy tech giants, and it made up only 8.7% of that index. The list features ASML, a photolithography systems manufacturer for the semiconductor industry; Novo Nordisk, a medical device and pharmaceutical firm; SAP, an enterprise software developer; Siemens, a health care and industrial automation conglomerate; Toyota, a car manufacturer; and HSBC and UBS, two banks.

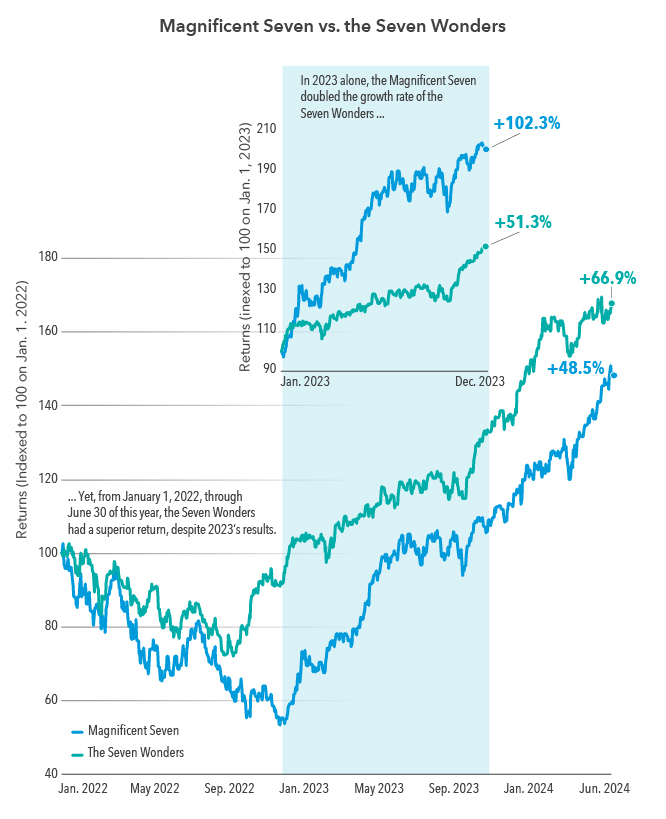

As the chart below shows, the Magnificent Seven more than doubled in value in 2023 — an eye-popping return for such huge companies and twice that of their international counterparts. But widen the timeframe a bit — from the start of 2022 through June 30 of this year — and the storyline changes. The international stocks, which we’ve dubbed the Seven Wonders, fared better — and by a significant margin.

This isn’t to say that investors should avoid the U.S. or technology — on the contrary, several of the Magnificent Seven feature hallmarks of sturdy, long-term investments that our investment professionals look for. But it’s a vivid reminder that short-term returns are just that — short term. We believe that keeping an eye on the long term and looking for the best companies from around the world, instead of from just a single country, can offer better results over time.

Magnificent Seven vs. the Seven Wonders

U.S.-based technology stocks had a banner 2023. But over a longer timeframe, they‘ve trailed a similar slice of high-returning companies outside the U.S.

Sources: Bloomberg, Capital Group. The Magnificent Seven are the seven stocks with the highest return in the S&P 500 in 2023, and are Alphabet, Amazon.com, Apple, Meta, Microsoft, Nvidia and Tesla. The Seven Wonders are the seven stocks with the highest return in the MSCI EAFE in 2023 and are ASML, HSBC, Novo Nordisk, SAP, Siemens, Toyota and UBS. Each hypothetical portfolio bought and hold over the period indicated, and was assembled in equal weights on the first date of the period indicated. Returns are indexed to 100 as of the first date indicated.

Related Insights

Related Insights

-

-

Philanthropy

-

Wealth Planning