The fund is designed to incorporate a wide array of opportunities within the entire income universe, all within a single portfolio. It actively pursues the most promising investment ideas throughout the income spectrum. The investment approach is dynamic, with the resulting portfolio allocation steered towards the sector with the greatest opportunities.

OPPORTUNITIES

Income in the new investment regime

With the end of the ultra-low policy rate era and bond yields for income generating sectors at attractive levels, investors could once again derive meaningful income from a globally diversified portfolio of bonds.

- Bond yields: Could history be repeating itself?

- Income generation strategies

.png)

.png)

Past results are not a guarantee of future results.

THE POWER OF 4

Capital Group Multi-Sector Income Fund (LUX)

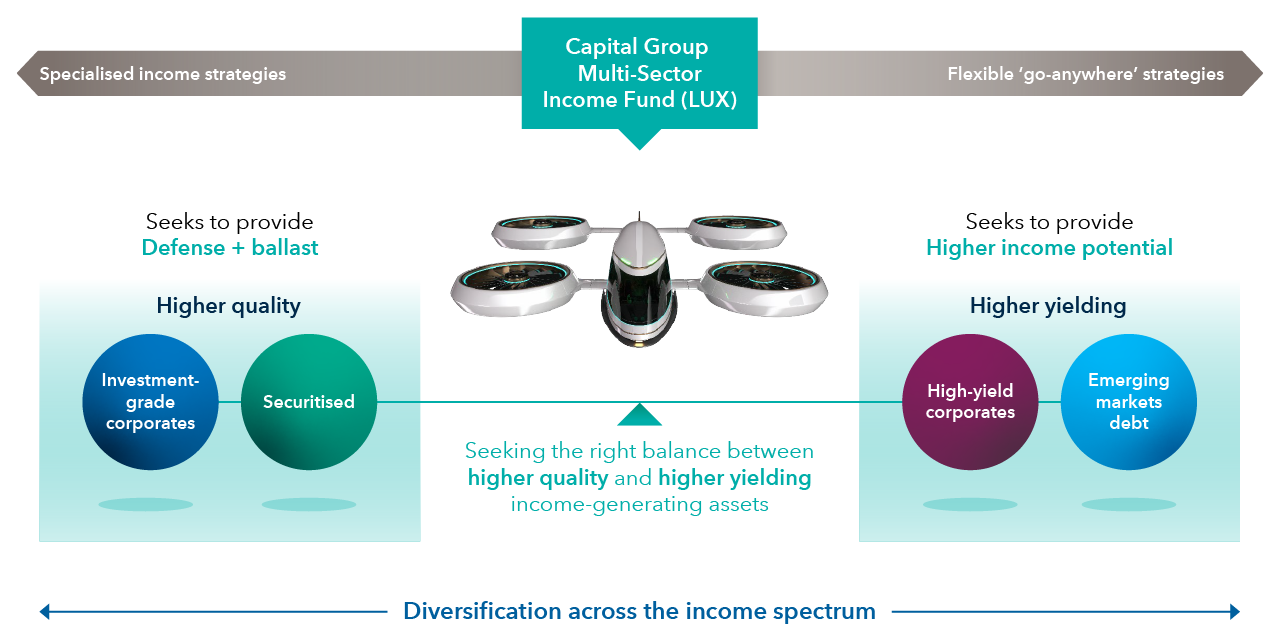

The Multi-Sector Income Fund combines the power of four key fixed income credit sectors, each of which has distinctive income characteristics. We believe that diversifying across multiple income-generating sectors and dynamically adjusting allocations to maintain a balanced risk profile could deliver a reliable income stream.

Hear from Damien McCann, Principal Investment Officer of the Multi-Sector Income Fund, on how the fund’s key characteristics of diversification, balanced, and flexibility can help deliver reliable and attractive income to investors.

The fund seeks an optimal balance between high-quality and high-yielding assets. High-quality bonds offer stability and resilience, while bonds with higher income potential can enhance cash flows and yield. A well-balanced mix of these assets can deliver a robust level of income while aiming to keep risks in check.

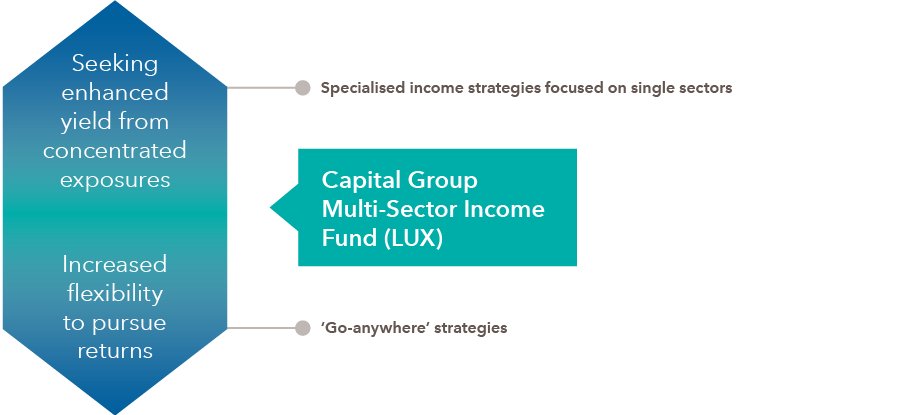

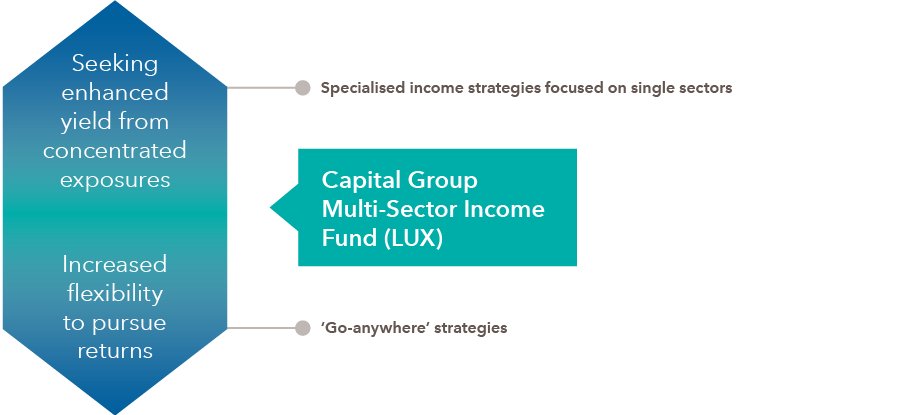

The investment approach occupies the sweet spot between sector-specific and unconstrained ‘go-anywhere’ strategies. It offers the flexibility to seize opportunistic ideas as they arise, while its broad allocation range can mitigate the risk of overconcentration in any single sector.

ESG FOCUS

ESG integration and beyond

ESG is woven into our investment process through three tightly integrated components: investment frameworks, monitoring and engagement. The fund also applies ESG and norms-based screens and has an explicit carbon target.3

For more information on our approach, to ESG please see ESG at Capital Group.

Screens

The fund excludes issuers within certain sectors, those that violate UN Global Compact principles and sovereigns that score below the Capital Group proprietary framework’s ESG threshold.

Carbon target

The fund’s carbon footprint is also monitored and managed to be lower than its reference index (for all eligible corporate bonds in the portfolio).2,3

The fund has adopted Sustainable Finance Disclosure Regulation (SFDR) article 8 requirements. The SFDR classification is related to the EU’s regulation and is not equivalent to approval or recognition as an ESG fund by regulators in Asia Pacific.

EXPERIENCE COUNTS

Managed by an experienced and specialist team

The portfolio is managed by a Principal Investment Officer and a team of seasoned sector specialist portfolio managers. They are supported by large, dedicated investment analyst teams that help create a portfolio built on deep insights into each of the securities the fund invests in.

Damien McCann

Fixed Income Portfolio Manager

Los Angeles

Shannon Ward

Fixed Income Portfolio Manager

Los Angeles

Sandro Lazzarini

Portfolio Manager

Los Angeles

Scott Sykes

Portfolio Manager

New York

Robert Burgess

Fixed Income Portfolio Manager

London

Xavier Goss

Portfolio Manager

Los Angeles

Years of experience as at 31 December 2024.

WHY CAPITAL GROUP

A leader in global investing

For more than 90 years, we’ve been searching the world for long-term opportunities, making Capital one of the oldest global investors. We have also grown to become one of the world’s largest active fixed income fund managers.

Global investing credentials

US$3.0T+

in total assets managed

25 years

average investment experience of our portfolio managers

US$550.3B

Fixed income assets managed*

Capital Group Multi-Sector Income Fund (LUX)

Risk factors you should consider before investing:

- This material is not intended to provide investment advice or be considered a personal recommendation.

- The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

- Past results are not a guarantee of future results.

- If the currency in which you invest strengthens against the currency in which the underlying investments of the fund are made, the value of your investment will decrease. Currency hedging seeks to limit this, but there is no guarantee that hedging will be totally successful.

- Some funds may invest in financial derivative instruments for investment purposes, hedging and/or efficient portfolio management.

- The Prospectus – together with any locally required offering documentation – set out risks, which, depending on the fund, may include risks associated with investing in fixed income, derivatives, emerging markets and/or high-yield securities; emerging markets are volatile and may suffer from liquidity problems.

.png)