Capital Group US High Yield Fund (LUX)

Unser Ziel: Attraktive Renditen durch integriertes Fundamentalresearch.

From 21 March 2025, Capital Group US High Yield Fund (LUX) is classified as an Article 8 fund under the EU’s Sustainable Finance Disclosure Regulation (SFDR).

Aktuelle Mitteilungen für Anteilseigner

Ergebnisse

Informationen zum Index dienen nur zur Erläuterung und zur Illustration. Der Fonds wird aktiv gemanagt. Er wird nicht in Anlehnung an eine Benchmark gesteuert.

Die Ergebnisse der Vergangenheit sind kein Hinweis auf künftige Ergebnisse.

Preis und Ausschüttungen

Portfolio

Risiko-Betrachtungen

Risikofaktoren, die vor einer Anlage zu beachten sind:

- Diese Präsentation ist keine Investmentberatung oder persönliche Empfehlung.

- Der Wert von Anlagen und Erträgen kann schwanken, sodass Anleger ihr investiertes Kapital möglicherweise nicht oder nicht vollständig zurückerhalten.

- Wenn Ihre Anlagewährung gegenüber der Währung aufwertet, in der die Anlagen des Fonds denominiert sind, verliert Ihre Anlage an Wert. Durch Währungsabsicherung wird versucht, dies zu begrenzen, aber es gibt keine Garantie, dass die Absicherung vollständig erfolgreich ist.

- Einige Portfolios können zu Anlagezwecken, zur Absicherung und/oder zur effizienten Portfolioverwaltung in derivative Finanzinstrumente investieren.

- Dieser Fonds ist mit weiteren Risiken verbunden: Anleihen, Kontrahenten, Derivate, High Yield, Liquidität und Operative Prozesse.

Fonds Risiken

Anleihenrisiko: Der Wert von Anleihen kann aufgrund von Zinsänderungen steigen oder fallen. In der Regel fallen die Anleihenkurse, wenn die Zinsen steigen. Fonds, die in Anleihen investieren, unterliegen einem Kreditrisiko. Wenn sich die Finanzlage eines Emittenten verschlechtert, kann der Wert seiner Anleihen fallen, im Extremfall bis auf null.

Kontrahentenrisiko: Andere Finanzinstitute erbringen Dienstleistungen für den Fonds (z.B. als Verwahrstelle) oder können Kontrahenten bei Kontrakten sein, beispielsweise bei Derivaten. Es besteht das Risiko, dass der Kontrahent seinen Verpflichtungen nicht nachkommt.

Derivaterisiko: Derivate sind Finanzinstrumente, deren Wert an einen Basiswert gekoppelt ist. Sie können dazu genutzt werden, Positionen abzusichern oder einzugehen. Derivate können sich anders entwickeln als erwartet oder Verluste erleiden, die größer sind als ihr eigentlicher Wert, sodass auch der Fonds Verluste erleiden kann.

High-Yield-Risiken: Wertpapiere ohne oder mit niedrigem Rating (wie High-Yield-Anleihen) können mit Liquiditäts-, Volatilitäts-, Ausfall- und Kontrahentenrisiken verbunden sein.

Liquiditätsrisiko: Bei schwierigen Marktbedingungen können manche im Fonds enthaltene Wertpapiere möglicherweise nicht oder nur unter Wert verkauft werden. Deshalb kann der Fonds die Rückgabe seiner Anteile aussetzen oder verschieben, sodass Investoren möglicherweise nicht sofort Zugriff auf ihre Anlagen haben.

Operatives Risiko: Aufgrund unzureichender oder fehlerhafter Prozesse und Systeme oder menschlicher Fehler, auch beim Schutz von Vermögenswerten vor externen Ereignissen, kann ein direkter oder indirekter Verlust entstehen.

Ressourcen

Angaben zur Nachhaltigkeit

SUSTAINABILITY-RELATED DISCLOSURES

The sustainability-related disclosures are meant to be revised as necessary from time to time to capture any changes or reviews. The capitalized terms are used in accordance with the definitions and references outlined in Capital International Fund Prospectus.

Capital International Fund – Capital Group US High Yield Fund (LUX) (the “Fund”)

LEI: 549300UUXOXHO7V0TV27

The below section “Summary” was prepared in English and is being translated to other official languages of the European Economic Area. In case of any inconsistency(ies) or conflict(s) between the different versions of this section “Summary”, the English language version shall prevail.

Zusammenfassung

Kein nachhaltiges Investitionsziel

Dieser Fonds bewirbt ökologische und soziale Merkmale, hat aber kein nachhaltiges Investitionsziel.

Ökologische oder soziale Merkmale des Finanzprodukts

Der Fonds bewirbt die ökologischen und sozialen Merkmale von Investitionen in Unternehmen mit einer gewichteten durchschnittlichen Kohlenstoffintensität („WACI“), die unter dem Bloomberg US Corporate High Yield 2% Issuer Capped Total Return Index liegt, und den Ausschluss von Investitionen in Emittenten auf der Grundlage von ESG- und normenbasierten Kriterien.

Anlagestrategie

Der Fonds strebt an, bei seinen Investitionen in Unternehmensemittenten einen CO2-Fußabdruck (WACI) zu erzielen, der niedriger ist als der Bloomberg US Corporate High Yield 2% Issuer Capped Total Return Index. Der Fonds wird aktiv verwaltet und ist hinsichtlich der Zusammensetzung des Fondsportfolios (innerhalb der Grenzen des jeweiligen spezifischen Anlageziels und der Anlagepolitik) nicht an einen Referenzwert oder die Einschränkungen eines Referenzindex gebunden. Dennoch verwendet der Fonds diesen Index, um die Kohlenstoffemissionen der Anlagen zu überwachen. Der Anlageberater stützt sich bei der laufenden Überwachung der WACI auf Fondsebene auf die Daten eines Drittanbieters und kann Engagements in bestimmten Unternehmen bei Bedarf verringern oder auflösen.

Zur Förderung ökologischer und sozialer Merkmale wendet der Anlageberater ein ESG- und normenbasiertes Screening in bestimmten Sektoren wie Waffen an (die „Ausschlusspolitik“).

Der Fonds bewirbt unter anderem ökologische und soziale Merkmale, sofern die Unternehmen, in die investiert wird, eine gute Unternehmensführung praktizieren. Praktiken der guten Unternehmensführung werden im Rahmen des ESG-Integrationsprozesses des Anlageberaters bewertet. Bei der Bewertung der Verfahrensweisen sieht sich der Anlageberater mindestens Aspekte an, die er in Bezug auf die vier genannten Säulen einer guten Unternehmensführung für relevant hält (d. h. solide Managementstrukturen, Beziehungen zu Arbeitnehmern, Vergütung von Mitarbeitern sowie Einhaltung der Steuervorschriften). Solche Praktiken werden im Rahmen eines Überwachungsprozesses bewertet, der auf verfügbaren Indikatoren von Drittanbietern in Bezug auf Unternehmensführung und Unternehmensverhalten basiert. Gegebenenfalls wird auch eine Fundamentalanalyse verschiedener Kennzahlen durchgeführt, die unter anderem Prüfungspraktiken, Zusammensetzung des Leitungs- oder Kontrollorgans und Vergütung der Führungskräfte abdecken.

Die Kohlenstoffbeschränkung des Fonds gilt nicht für das gesamte Portfolio, sondern nur für Unternehmensemittenten, für die (gemeldete oder geschätzte) Kohlenstoffemissionsdaten vorliegen. Die Ausschlusspolitik der Capital Group gilt für das gesamte Portfolio mit Ausnahme von Barmitteln, Barmitteläquivalenten und Geldmarktfonds. Indexderivate, die zu Absicherungs- bzw. Anlagezwecken verwendet werden, werden nicht auf Look-Through-Basis bewertet. Daher kann der Fonds unter bestimmten Umständen ein indirektes Engagement in einem Emittenten eingehen, der zu den ausgeschlossenen Kategorien gehört (unter anderem durch Derivate und Instrumente, die ein Engagement in einem Index darstellen). Single-Name-Derivate müssen mit der Ausschlusspolitik übereinstimmen. Der Anlageberater stellt sicher, dass die erhaltenen Sicherheiten mit der Politik übereinstimmen.

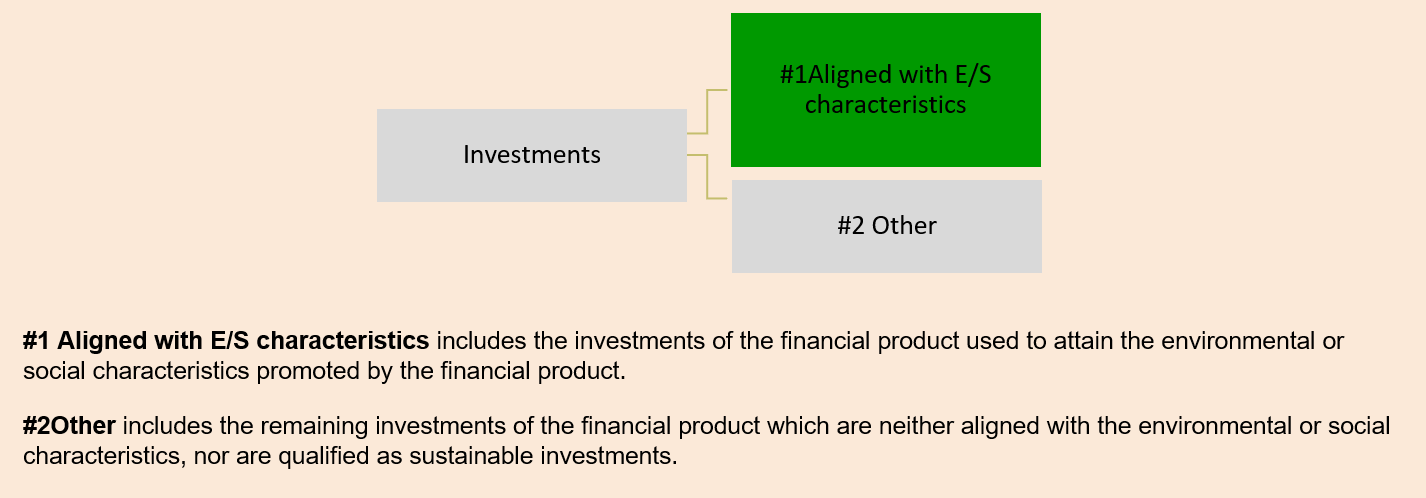

Anteil der Investitionen

Die geplante Vermögensaufteilung wird kontinuierlich überwacht und jährlich bewertet.

Mindestens 60 % der Fondsanlagen fallen in die Kategorie „#1 Ausgerichtet auf ökologische oder soziale Merkmale“ und werden daher zur Erreichung der vom Fonds geförderten ökologischen oder sozialen Merkmale eingesetzt (sie unterliegen der verbindlichen Richtlinie für Negativ-Screening des Anlageberaters und der CO2-Beschränkung). Maximal 40 % der Fondsanlagen, einschließlich Anlagen, die nicht mit den beworbenen ökologischen oder sozialen Merkmalen übereinstimmen, verbriefte Schuldtitel, Derivate und/oder Zahlungsmittel und Zahlungsmitteläquivalente, fallen in die Kategorie „#2 Andere Investitionen“.

Der Fonds verpflichtet sich nicht, nachhaltige Anlagen zu tätigen.

Überwachung von ökologischen oder sozialen Merkmalen

Folgende Nachhaltigkeitsindikatoren werden vom Fonds herangezogen, um die Erreichung der einzelnen ökologischen oder sozialen Merkmale, die durch ihn beworben werden, zu messen:

Die WACI ist die Kennzahl, die für die Berichterstattung über die Kohlenstoffemissionen des Fonds verwendet wird. Sie trägt dazu bei, den CO2-Fußabdruck des Portfolios im Vergleich zum Index aufzuzeigen, und basiert auf den Scope 1- und 2-Emissionen:

- Scope 1: direkte Emissionen aus den Anlagen eines Beteiligungsunternehmens;

- Scope 2: indirekte Emissionen im Zusammenhang mit dem Energieverbrauch eines Beteiligungsunternehmens.

Der Anlageberater verwendet ESG- und normenbasierte Ausschlüsse, um die Fondsanlagen einer Ausschlusspolitik zu unterziehen. Der Fonds überwacht Prozentsatz der Unternehmensemittenten, die im Rahmen der Richtlinie für die Negativprüfung durch das Raster fallen.

Methoden

Der Fonds setzt zwei verbindliche ESG-bezogene Kriterien um: sektor- und normenbasierte Screenings in Form von Ausschlüssen und ein Ziel für die CO2-Bilanz.

Datenquellen und -verarbeitung

Ausschlüsse werden in erster Linie durch einen Drittanbieter, MSCI ESG Business Involvement Screening Research („MSCI ESG“), ermittelt. Weitere Datenpunkte sind Verstöße gegen den MSCI United Nations Global Compact und MSCI Carbon Footprint Metrics.

Einschränkungen bei Methoden und Daten

Die Methoden und Quellen in Bezug auf die Ausschlüsse und den ESG-Integrationsansatz als Ganzes weisen gewisse Einschränkungen auf. Die CO2-Bilanz wird durch die WACI im Verhältnis zum entsprechenden Index gemessen. Falls für einen bestimmten Emittenten keine Daten über die Kohlenstoffemissionen vorliegen, kann der Drittanbieter Schätzungen nach seinen eigenen Methoden vornehmen. Emittenten, für die keine (gemeldeten oder geschätzten) Daten über Kohlenstoffemissionen vorliegen, werden von der WACI-Berechnung ausgeschlossen.

Due Diligence

Die Mitarbeitenden der Compliance-, Risiko- und internen Auditfunktion von Capital Group bewerten regelmäßig den Aufbau und die Wirksamkeit der ESG-Aktivitäten und wichtigen Kontrollsysteme der Firma.

Engagement-Richtlinien

Der Dialog mit Unternehmen ist fester Bestandteil der Vermögensverwaltungsdienste, die der Anlageberater seinen Kunden erbringt. So kann Capital Group mitwirken und einen Dialog über Themen anstoßen, die die langfristigen Aussichten eines Beteiligungsunternehmens beeinträchtigen könnten, wie etwa Risiken im Zusammenhang mit Nachhaltigkeitsthemen.

Bestimmter Referenzwert

Der Fonds hat keinen Referenzwert für die Erreichung der von ihm beworbenen ökologischen und/oder sozialen Merkmale bestimmt.

No sustainable investment objective

This Fund promotes environmental or social characteristics but does not have as its objective sustainable investment.

Environmental or social characteristics of the financial product

The Fund promotes environmental and social characteristics, provided that the companies in which investments are made follow good governance practices.

Carbon constraint: The Fund aims to maintain a Weighted Average Carbon Intensity (WACI) for its investments in corporate issuers that is lower than Bloomberg US Corporate High Yield 2% Issuer Capped Total Return index. The WACI is based on GHG emissions (Scope 1 and 2) divided by the revenue of the investee companies. Should the WACI of the Fund not be lower than the aforementioned index, the Investment Adviser will consider what action is in the best interest of the Fund, its Shareholders and in line with the relevant Fund investment objective to bring the Fund back above the threshold in a reasonable period of time.

Negative Screening Policy: In addition, the Investment Adviser evaluates and applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

For corporate issuers, the Investment Adviser relies on third-party providers who identify an issuer’s participation in or the revenue which they derive from activities that are inconsistent with these screens with respect to certain sectors such as tobacco, fossil fuel and weapons, as well as companies violating the principles of the United Nations Global Compact (UNGC).

The Investment Adviser selects investments to the extent they do not trigger a breach of the carbon target and are in line with the Negative Screening Policy.

Investment strategy

The Investment Adviser applies the following investment strategy to attain the environmental and/or social characteristics promoted:

Carbon constraint. The Investment Adviser aims to manage a carbon footprint lower than the Fund’s selected index level. Therefore, it will aim to manage a carbon footprint (WACI) for its investments in corporate issuers that is lower than the Fund’s selected index level (Bloomberg US Corporate High Yield 2% Issuer Capped Total Return). Should the WACI of the Fund not be lower than the level of the aforementioned indexes, the Investment Adviser will consider what action is in the best interest of the Fund, its Shareholders and in line with the relevant Fund investment objective to bring the Fund back above the threshold in a reasonable period of time. The Investment Adviser carries out ongoing monitoring of WACI at the Fund level, and may reduce or eliminate exposures to certain companies as necessary.

The selected index is representative of the investment universe of the Fund. The Investment Adviser assesses the portfolio WACI data on an ongoing basis to help the Fund remain within the target level. This allows the Investment Adviser to measure the carbon footprint and carbon intensity of the portfolio compared to the selected index, and to understand the attribution of the emission results. From an investment perspective, carbon footprint analysis can serve as a tool to engage with the investee company and better understand the investee company’s business. In the event that reported carbon emissions data is not available for a particular issuer, the third party provider may provide estimates using their own methodologies. Issuers that do not have any carbon emissions data available (reported or estimated) are excluded from the WACI calculation. This will not apply to sovereign issuers. It is not the intention of the Investment Adviser to automatically exclude higher carbon emitters on an individual basis as the carbon intensity is monitored at the total portfolio level rather than at the individual holding level.

Negative Screening Policy. The Investment Adviser also evaluates and applies ESG and norms-based screening to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

To support this screening on corporate issuers, the Investment Adviser relies on third party provider(s) who identify an issuer’s participation in or the revenue which they derive from activities that are inconsistent with the ESG and norms-based screens. In this way, third party provider data is used to support the application of ESG and norms-based screening by the Investment Adviser. In the event that exclusions cannot be verified through third-party providers or if the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources). If an eligible corporate issuer held in a Fund subsequently fails a screen, the issuer will not contribute towards the environmental and/or social characteristics of the Fund and will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

What is the policy to assess good governance practices of the investee companies?

The Investment Adviser ensures that the companies in which investments are made follow good governance practices. When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance).

As described above, the Investment Adviser applies a Negative Screening Policy to the Fund. As part of this, the Investment Adviser excludes companies that, based on available third-party data, are viewed to be in violation of the principles of the UNGC, which include Principle 10 (anti-corruption) and Principle 3 (employee relations).

In addition, good governance practices are evaluated as part of the Investment Adviser’s ESG integration process. Such practices are assessed through a monitoring process based on available third-party indicators relating to corporate governance and corporate behavior. Third-party data may be inaccurate, incomplete or outdated. Where the corporate governance and corporate behavior indicators cannot be verified through the third-party provider, the Investment Adviser will aim to make such determination through its own assessment based on information that is reasonably available. Where relevant, fundamental analysis of a range of metrics that cover auditing practices, board composition, and executive compensation, among others, is also conducted. The Investment Adviser also engages in regular dialogue with companies on corporate governance issues and exercises its proxy voting rights for the entities in which the Fund invests.

If a previously eligible company held in a Fund subsequently fails the Investment Adviser’s assessment of good governance practices, the company will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

Capital Group's ESG Policy Statement provides additional detail on Capital Group’s ESG philosophy, integration, governance, support and processes, including proxy voting procedures and principles, as well as views on specific ESG issues, including ethical conduct, disclosures and corporate governance, available on:

http://www.capitalgroup.com/content/dam/cgc/tenants/eacg/esg/files/esg-policy-statement(en).pdf

Information on Capital Group’s corporate governance principles can also be found in its Proxy Voting Procedures and Principles, available on:

Proportion of investments

At least 60% of the Fund's investments are in category “#1 Aligned with E/S characteristics” and so are used to attain the environmental or social characteristics promoted by the Fund (being subject to the Investment Adviser’s binding Negative Screening Policy and carbon constraint). A maximum of 40% of the Fund’s investments including investments non-aligned with the E/S characteristics promoted, securitised debt, derivatives and/or cash and cash equivalents are in category “#2 Other”.

The Fund does not commit to make any sustainable investments.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are the following:

The WACI is the metric used to report the Fund’s carbon emissions. It helps show the carbon footprint of the portfolio compared to the index, and is based on Scope 1 and 2 emissions:

- Scope 1: direct emissions from the investee company’s facilities;

- Scope 2: indirect emissions linked to the investee company’s energy consumption.

The Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments. The Fund will monitor percentage of corporate issuers failing a screen under the Negative Screening Policy.

The Fund applies investment restrictions rules on a pre-trade basis in portfolio management systems to prohibit investment in companies or issuers based on the exclusion criteria. The portfolio also undergoes regular/systematic post-trade compliance checks. The methodology applied in support of this screening is described in detail under the section “Investment Strategy” of this document.

In the event that exclusions cannot be verified through the third-party provider(s), the Investment Adviser will aim to identify business involvement activities through its own assessment. Please refer to Fund’s Negative Screening Policy for further details.

An additional objective of the Fund is to ensure that a carbon footprint (weighted average intensity) for its investment in corporate issuers that is lower than the Fund’s selected index (Bloomberg US Corporate High Yield 2% Issuer Capped Total Return). The selected index is representative of the investment universe of the Fund. The Investment Adviser uses the WACI as a metric to measure the Fund’s carbon footprint. In calculating the Fund’s WACI, the Investment Adviser relies on third party data provider(s). In the event that reported carbon emissions data is not available for a particular issuer, the third-party provider may provide estimates using their own methodologies Issuers that do not have any carbon emissions data available (reported or estimated) are excluded from the WACI calculation.

If the portfolio was in danger of breaching the target, holdings would be adjusted to increase the margin between the portfolio carbon footprint and target level; exposure to selected higher emitters would be reduced with increased exposure to lower emitters, while ensuring the Fund’s investment objective is maintained. Compliance checks are in place to facilitate this and mitigate the risk of any breach, for example as the result of market movement. Carbon footprint reports use MSCI Carbon Footprint Metrics data.

Methodologies

The Fund implements two binding ESG-related criteria: sector- and norms-based screens in the form of exclusions and a carbon footprint target, with the methodology applied to these commitments having already been presented in detail in the previous sections.

The SFDR classification is related to the European Union’s regulation and is not equivalent to approval or recognition as an ESG Fund by regulators in Asia Pacific.

The exclusionary screens are implemented pre-trade and the carbon target is managed and monitored at the aggregate portfolio level.

Data sources and processing

Data sources

The Investment Adviser uses a combination of internal research and third-party data providers to gather ESG-related data.

Third-party providers are used to calculate the carbon footprint of the Fund and for identifying corporate issuers' involvement in activities inconsistent with ESG and norms-based screens. In the event that exclusions cannot be verified through third-party data or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Data quality and processing

Capital Group periodically reviews the performance quality of provider organizations and conducts ongoing monitoring and due diligence activities commensurate with the significance of the services provided.

Data are regularly updated in Capital Group’s internal platforms and made available to relevant teams. When issues are identified in third-party data, they are reported back to the provider(s). The Investment Adviser also applies systematic data quality checks to catch discrepancies and validate with the provider when issues arise.

Proportion of data that is estimated

Third-party providers may estimate data. While reported data are prioritized, Capital Group uses estimated data when reported data are unavailable. The proportion of estimated data varies depending on the data point due to inconsistencies in reporting by investee companies.

Limitations to methodologies and data

The methodology and sources relating to the exclusions and the ESG integration approach as a whole have certain limitations. In order to identify all publicly traded companies globally which are involved in activities such as the production of controversial products and revenue derived from activities that are inconsistent with the ESG and norms-based screens, the Fund uses data from third-party provider(s). In the event that data cannot be obtained through third-party providers or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser will aim to identify business involvement activities through its own assessment (including by using other third-party data sources).

When assessing the ESG characteristics of securities and the selection of such securities, subjective judgement within the investment process might be involved.

The carbon footprint is measured by the WACI score relative to the relevant index. The WACI is calculated based on securities for which data is reported or estimated. Excluded from the WACI determination are cash holdings, derivatives, sovereigns and securitised products.

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s ESG activities and key controls. This includes compliance with internal processes and procedures as well as with the regulatory landscape in the jurisdictions in which the company operates. Capital Group meets regularly with the third-party data providers to review the quality of the services provided.

Pre-trade and post-trade checks are also in place as further explained in section “Monitoring of environmental or social characteristics” above.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. Capital Group’s investment teams meet on a regular basis with company management, including executive and non-executive directors, chairs and finance directors. This enables the company to engage and generate dialogue on any issues that could affect the company’s long-term prospects, including exposures to sustainability issues.

Where Capital Group's investment teams identify an issue material to the long-term value of a company or they are concerned about relative ESG performance, Capital Group's investment professionals and governance teams will engage with management. Management’s response and the steps they take to minimise any associated risks, forms an important part of Capital Group's assessment of management quality, which itself is a key factor in the stock selection decisions.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

Where can more product-specific information be found?

More product-specific information can be found in the pre-contractual template:

https://docs.publifund.com/1_PROSP/LU1577354035/en_LU

More product-specific information can be found in the periodic reports: