Market Volatility

- The U.S. economy is best positioned to weather a coronavirus storm.

- Fed rate cut shows the central bank is committed to a path of aggressive monetary stimulus.

- China and Europe likely face a difficult road ahead amid supply-chain disruptions.

- Investors should consider staying the course until markets settle and the outlook is more certain.

The spread of the coronavirus outside of China to a broader swath of countries in Asia and Europe is fueling a broad re-examination of 2020 global economic growth assumptions. Even with Tuesday’s 50-basis-point rate cut by the U.S. Federal Reserve, our economists say the global economy is headed for a significant slowdown at least in the first half of the year.

The depth and severity of any downturn will depend on how policymakers in the U.S., Europe and China respond, both to the spread of the virus and to changes in the macroeconomic environment. As these events unfold, investors should consider staying the course. Timing the markets can be inherently risky.

Here’s how our economists are assessing conditions in the U.S., Europe and China:

The U.S. remains the most resilient of the world’s major economies

Jared Franz, Capital Group economist in Los Angeles

Among the world’s largest economies, the U.S. remains the most resilient. The U.S. economy had been growing above trend with a solid labour market. Industrial sector activity was starting to pick up as détente was reached in the trade war and the General Motors strike ended.

The Fed’s surprise announcement on Tuesday, March 3, was the first between-meeting rate cut since the 2008—09 financial crisis and clearly shows that the central bank is taking the coronavirus outbreak, and its potential impact on the economy, very seriously. After the announcement, the yield on the 10-year U.S. Treasury note declined to a new record low, falling below 1% for the first time.

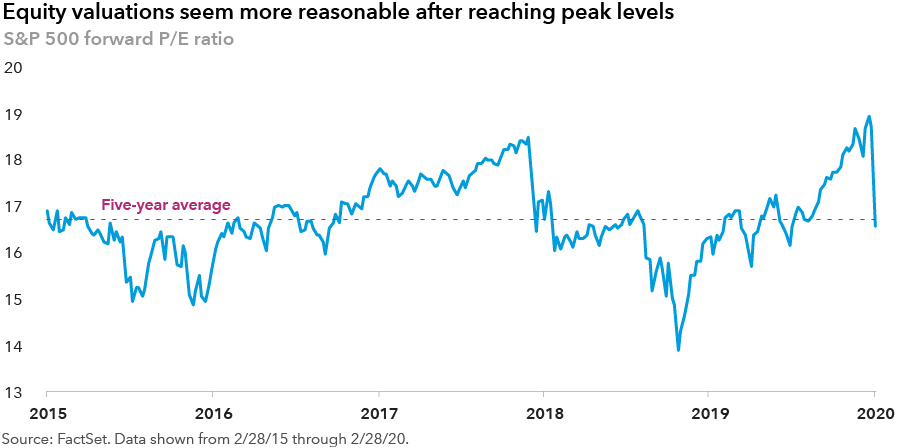

The challenge is that stock markets previously had priced in a goldilocks scenario and entered the year with an elevated price-to-earnings multiple of around 18, providing little cushion. On top of that, in contrast to the consumer, a large part of the corporate sector is burdened by high debt relative to its equity, or high leverage. Earnings expectations for 2020 for companies in the S&P 500 were already muted and have come down further given potential supply disruptions. Amid these challenges, the stock market fell more than 12% over the last seven trading days of February.

Based on the current tightening in financial conditions, I expect the Fed to continue on a path of monetary easing. But it’s important to note that central bank policy has limited influence in an economy potentially hurt by both a demand and supply shock.

If the virus spreads further and dampens economic activity, it could easily shave off one percentage point from my base case annualized GDP growth expectation of 2.0%. And if a negative feedback loop persists, I cannot rule out a recession, although that is not my base case scenario. If the situation comes under control relatively quickly, we could see a pickup in activity in the second half of the year.

Around the world, the dilemma for central bankers is that the coronavirus poses as much of a negative supply shock as a demand shock. Monetary policy can influence demand, less so the supply side. Plus, with already low rates in the U.S. and negative rates throughout Europe, there is a severe shortage of policy ammunition.

Central banks can accelerate quantitative easing programs, but that generally has a more limited impact than cutting interest rates. This means governments will also consider fiscal expansion to counter the effects of the virus.

Nonetheless, some of the economic damage has already occurred. China’s factories have remained closed for several weeks and are unlikely to quickly become fully functional.

In addition to manufacturing, an equally important economic impact may lie on the services side. On the manufacturing front, companies can catch up when things return to normal: firms ramp up production and rebuild inventories, producing a bounce-back recovery. But on the services side, lost GDP is not often recovered, whether it is the vacation that was not taken or the restaurant meal that was not had. This is why it is much more difficult to estimate the impact of the virus as compared to, say, a natural disaster.

Brace for broad slowdown in China’s economy

Stephen Green, Capital Group economist in Hong Kong

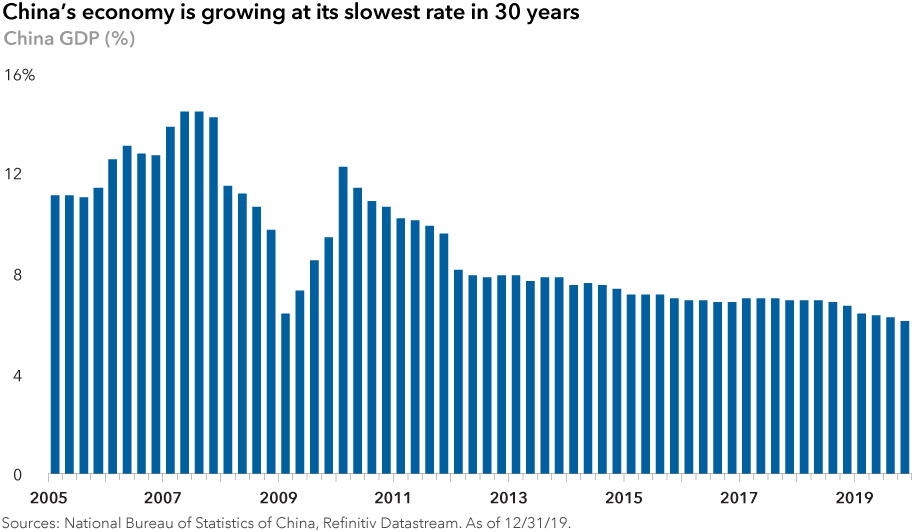

With China now making up almost 20% of global gross domestic product, China’s slowdown from this outbreak will probably have broader impacts than the SARS outbreak in 2002 and 2003. We know for the past month that most people in China have stayed at home and haven’t returned to factories or offices. I believe that China’s economy, which was already growing at the slowest pace in 30 years before the outbreak, will experience negative growth in the first quarter, and a mild growth recovery is likely in the last six months of this year.

When we’ve pressed our industry contacts about the timing of workers returning to manufacturing plants and offices, we have heard that mid-March is a possibility. But analyzing the situation on the ground, I don’t think the Chinese economy will normalize until April at the earliest.

Factory operators must get permission from local government to reopen, and health inspections have to be done. Many cities and industrial zones can require 15 certificates to operate. Factories need enough material on hand to make the product and workers have to be back at full capacity. Once the goods are produced, ships have to be at the port. Once you’ve produced the goods, they need to get to port and then to their end destination.

In early signs of a slowdown, the February factory PMI fell to a record low of 35.7 — compared with a market-consensus estimate of 46. The non-manufacturing PMI fell even more significantly, down 24.5 points to a record low of 29.6 in February, reflecting the scare factor and disruptions in transportation, suggesting a broad-based contraction in the economy.

Compared with other countries, Chinese party leaders have a wider arsenal of tools at their disposal to stimulate the economy.

For example, they could cut benchmark interest rates by 200 basis points and still be well above zero. They can also provide fiscal stimulus as the country’s deficit is below 5% of GDP. Financing infrastructure projects such as bridges, tunnels and subway lines through bond issuance is an option. Recently, many cities have begun to decrease the percentage of money needed for a down payment to buy an apartment. And the government has told banks to extend loan repayments coming due for small- and medium-sized businesses.

How effective any of these tools will be depends to a large extent on whether workers feel safe enough to return and confident enough about their prospects of buying an apartment.

European economy likely to slow further

Robert Lind, Capital Group economist in London

With major European economies growing only marginally before the outbreak, it is increasingly likely that the widening epidemic could push the eurozone into a recession in early 2020. The risk is most evident in Italy where more than 2,000 infections have been reported, as of March 3. If the virus spreads further, it could deliver a significant shock to one of the eurozone’s weakest economies. A sharp downturn in Italy would inevitably feed into the rest of Europe, weakening the entire region in the process.

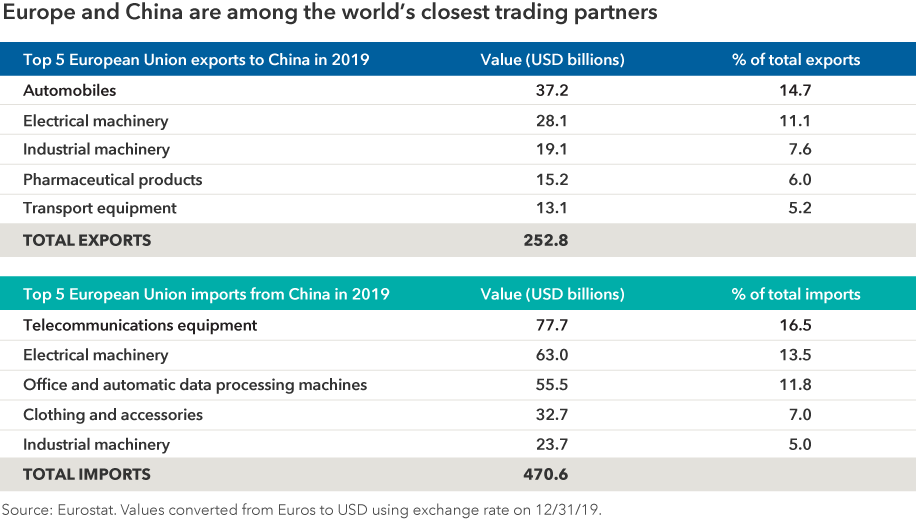

Beyond that, Europe has significant exposure to China’s economy. Falling demand from China, coupled with a breakdown in supply chains, would hit the European economy — with Germany and the U.K. exposed to weaker demand for goods, and France vulnerable to weaker tourism. Luxury goods, electronics and autos would be among the most negatively impacted industries.

In 2019, the eurozone economy grew at an annualized rate of 1.2%. At such a low level, it doesn’t take much pressure for economic growth to go flat or negative. Before the outbreak, Europe was showing tentative signs of recovery from a protracted industrial slowdown.

Given recent events, European Central Bank officials will probably feel the need to do something in the face of a widening outbreak. ECB officials are increasingly conscious of the impact of negative interest rates on the banking sector, which might deter them from lowering the deposit rate. But they may decide to increase their bond-buying stimulus program from a current level of €20 billion a month to something in the range of €25 billion to €30 billion a month.

In this environment, there also will be greater pressure for a fiscal response from governments. In the event of a serious downturn, I’d expect more aggressive fiscal easing, including tax cuts and higher government spending.

Our latest insights

-

-

Market Volatility

-

-

-

U.S. Equities

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Jared Franz

Jared Franz

Stephen Green

Stephen Green

Robert Lind

Robert Lind