Trade

The ongoing trade war launched by the United States against its major trading partners (Canada, Mexico, China and Europe) has created a complex environment that’s in a constant state of flux. On-again, off-again tariffs, retaliatory measures, select industry carve-outs for some and concessions for others have left investors’ heads spinning and rattled U.S. and Canadian stock markets.

In this environment, it’s natural for investors to feel uneasy, to worry about their portfolio or to question whether they should shift some of their holdings.

But according to equity investment specialist Kathrin Forrest, it’s more important than ever for investors to tune out the noise, maintain a well-diversified portfolio and stick with their long-term investment plans.

1. Tune out the noise

“With news headlines constantly changing, I encourage investors to take a step back and look at the bigger picture,” says Forrest. She acknowledges that investors may feel compelled to react to startling news and seek to adjust their holdings.

That could be a mistake. The S&P 500 index of U.S. stocks in U.S. dollars has on average over the past 70 years fallen by 5% or more about twice a year and 10% about once every 18 months.

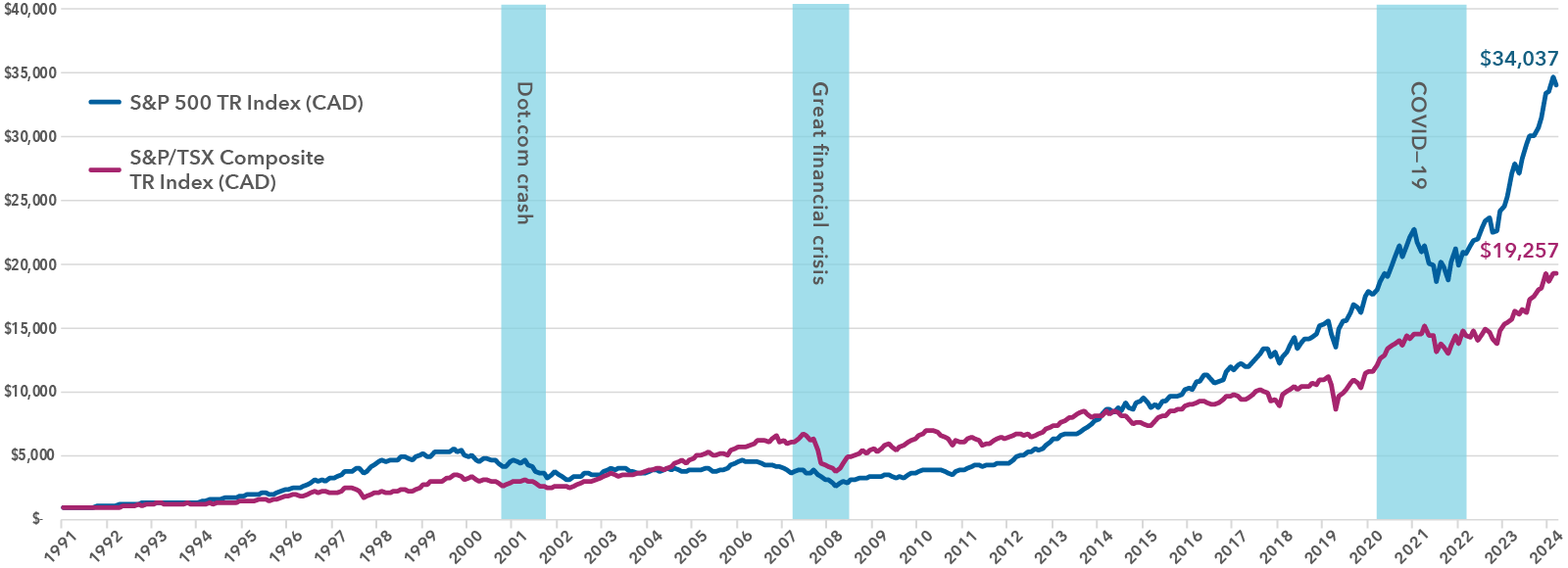

“While past results do not predict future returns, the markets have gone on to new heights each time,” Forrest points out. In other words, investors have weathered upheavals in the past, and by staying invested, you avoid the risk of selling at a low point and missing potential rebounds, as illustrated in the chart below.

The two lines show how the S&P 500 and S&P/TSX have gone on to new heights following other major events such as the bursting of the internet bubble, the Great Financial Crisis and the COVID-19 pandemic.

Historically, markets go on to new heights over time

Growth of $1,000 – December 31, 1991 to February 28, 2025

Sources: Capital Group, Morningstar Direct. S&P/TSX index reflects Canada and the S&P 500 index reflects U.S.

Another important outcome from staying invested is the benefit that accrues from dollar-cost averaging, a simple system of regularly investing a fixed amount of money. By doing so, investors buy more shares/units when prices are low and fewer shares/units when prices are high, which can lower the average cost per share/units over time. This approach helps mitigate the impact of market volatility and reduces the risk of making poor timing decisions. Additionally, staying invested helps you maintain a diversified portfolio, which is the second key component when fighting trade war market volatility.

2. Maintain a well-diversified portfolio

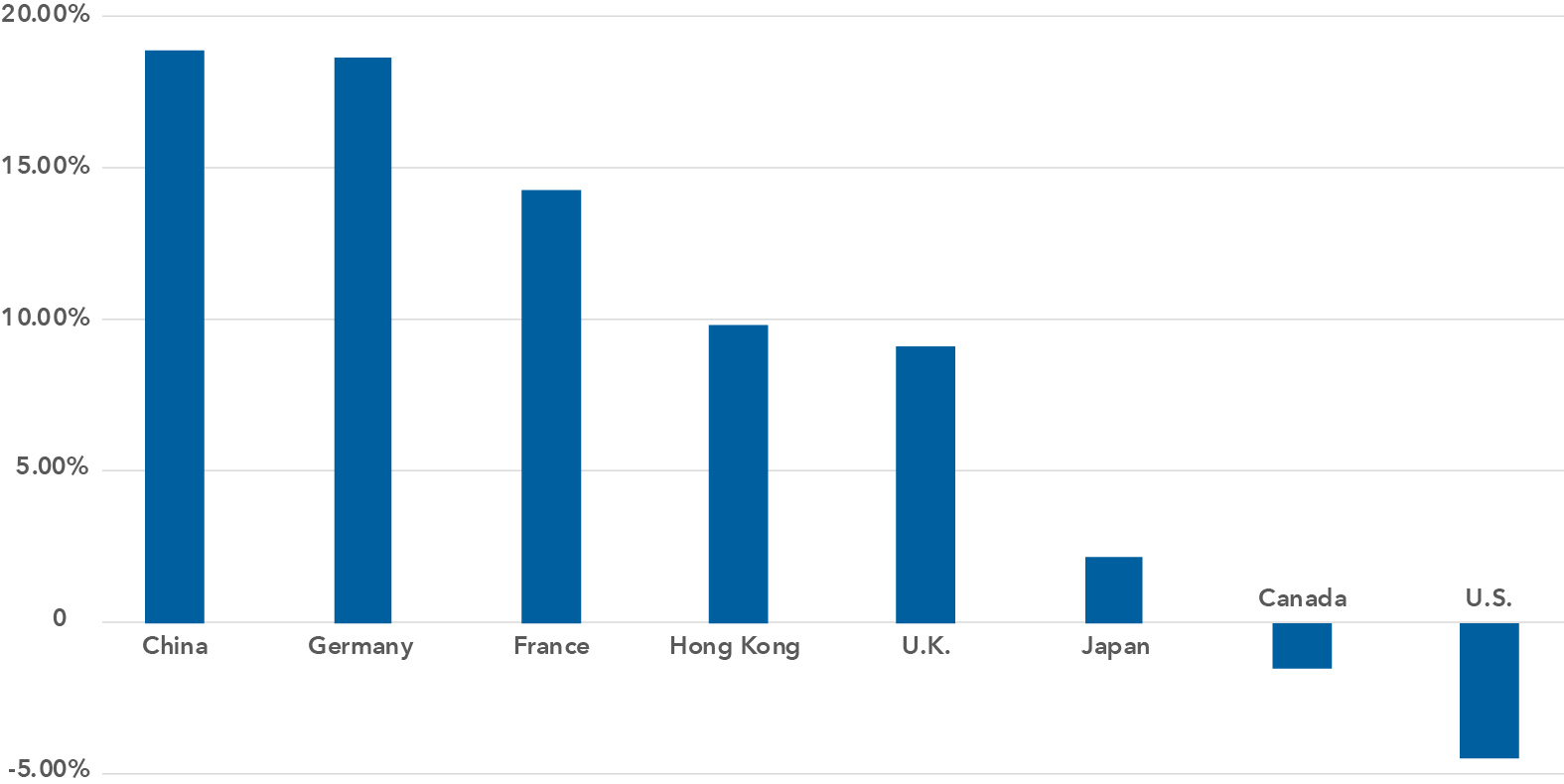

Diversification is the process of spreading your money across different investments in a single portfolio. During volatile markets, some investments may underperform while others outperform, which has certainly been the case thus far in 2025.

As shown below, many international markets have performed well since the start of the year through March 11 despite what’s happening in Canada and the U.S. The same can be said about Japanese and emerging markets stocks, if to a lesser extent. Country-wise, some of the stand-out performers include China, up 18.87%; Germany, up 18.65%; France, up 14.29%; Hong Kong, up 9.80% and the U.K., up 9.13%. In comparison, Canada is down 1.49% and the U.S. declined 4.48%.

Better results overseas

Year-to-date total returns across select equity market benchmarks — December 31, 2024 to March 11, 2025

Sources: Capital Group, Morningstar Direct. MSCI China index reflects China, MSCI Germany index reflects Germany, MSCI France index reflects France, MSCI Hong Kong index reflects Hong Kong, U.K. MSCI index reflects the U.K., MSCI Japan index reflects Japan, S&P/TSX index reflects Canadian stocks, and the S&P 500 index reflects U.S. stocks.

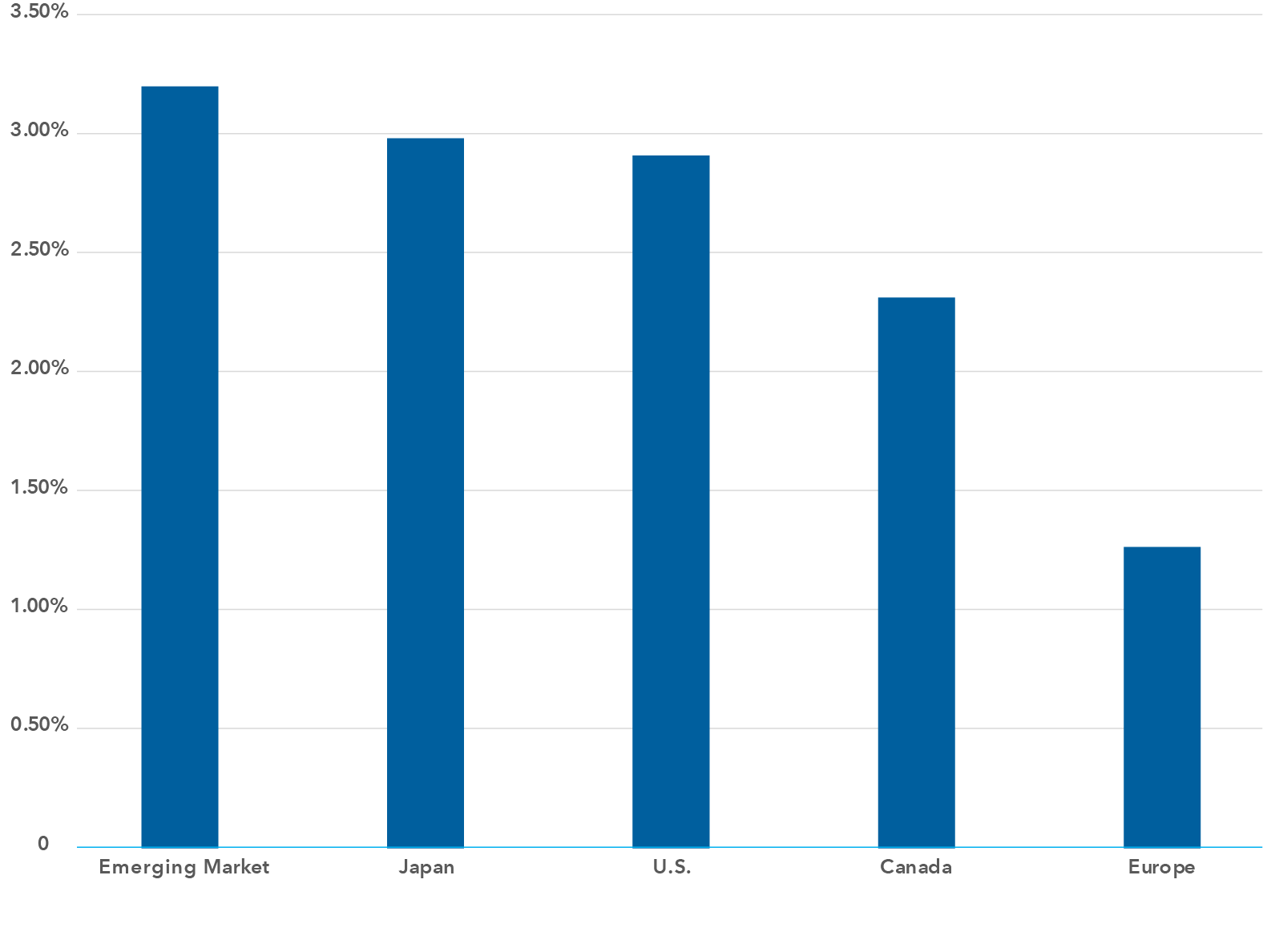

Meanwhile, bonds, a foundational pillar of asset class diversification, are also doing their jobs. In fact, Canadian, U.S., Japanese and European bonds are all up this year, with emerging markets issues leading the others.

Bonds doing their job

Year-to-date total returns across select fixed income benchmarks — December 31, 2024 to February 28, 2025

Sources: Capital Group, Morningstar Direct. The J.P. Morgan Emerging Markets Bond Index Global Diversified reflects emerging markets, Bloomberg Japanese Aggregate Bond index reflects Japan, Bloomberg U.S. Aggregate Bond index reflects the U.S., FTSE Canada Universe Bond index reflects Canada, and the Bloomberg Euro Aggregate Bond index reflects Europe.

3. Stick with your investment plan

As tempting as it may be to sell your investments during periods of market volatility and disconcerting news cycles, your advisor has created an investment plan that’s designed for your financial objectives, risk tolerance and time horizon.

“Deviating from an investment plan can take you off track and hinder the achievement of your long-term goals,” says Forrest.

One of the primary reasons to adhere to an investment plan is to avoid emotional decision-making. Market fluctuations can trigger fear and anxiety, leading investors to make impulsive decisions such as selling assets during a downturn or chasing high-performing investments. These actions can result in buying high and selling low, which is detrimental to long-term returns. By sticking to a well-thought-out plan, investors can maintain discipline and make decisions based on logic rather than emotions.

“We know market turbulence can be painful and even a little frightening,” says Forrest, “but we believe the wisest strategy is to stick to your long-term investment plan.”

This report, and any product, index or fund referred to herein, is not sponsored, endorsed or promoted in any way by J.P. Morgan or any of its affiliates who provide no warranties whatsoever, express or implied, and shall have no liability to any prospective investor, in connection with this report.

© 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; (3) does not constitute investment advice offered by Morningstar; and (4) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from this information. Past performance is no guarantee of future results.

Our latest insights

-

-

Market Volatility

-

-

U.S. Equities

-

Global Equities

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Kathrin Forrest

Kathrin Forrest