Capital Group’s 2026 Outlook report delves into many market-driving issues, including tariff uncertainty, the challenge of high valuations, corporate earnings expectations, and how sticky inflation and weakening labour markets are influencing the path of interest rates. It also identifies key investment themes and how they’re affecting various asset classes. Here we offer an overview of the opportunities as we see them. Be sure to download the full report for a deeper dive.

The global economy shows its resilience

In our view, investors should expect improved economic stability in the year ahead, with the potential for reacceleration in the second half, as the path of global trade comes into clearer focus. The U.S. has negotiated trade deals with many countries, and tariffs generally have settled at much lower rates than initially feared.

"The clearer picture on tariffs should free up businesses to make capital decisions, like investing in reshoring supply chains."

Jared Franz

Economist

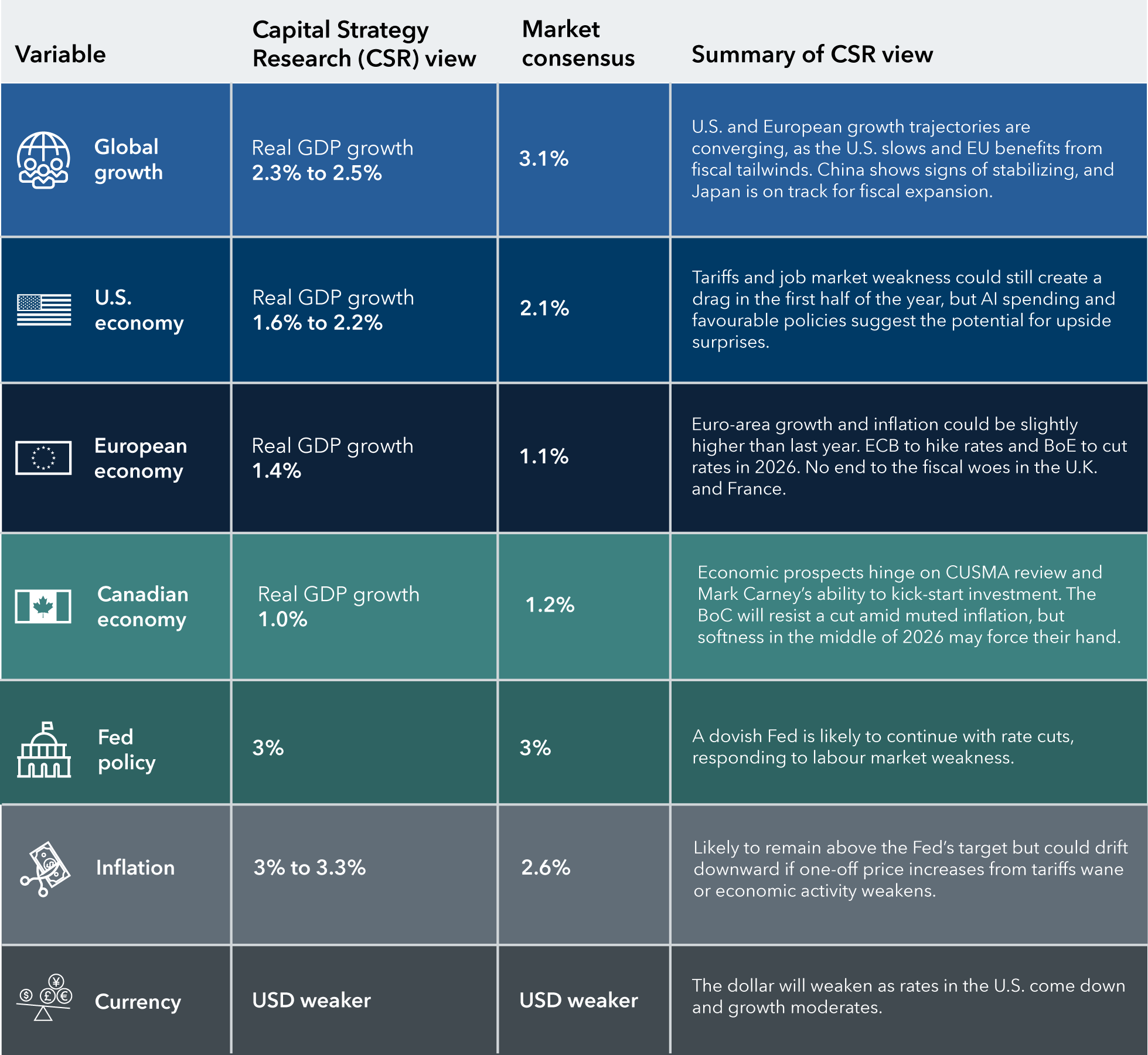

Sources: Capital Group, National Association for Business Economics, International Monetary Fund World Economic Outlook October 2025 (published October 14). Market consensus refers to the general views, expectations or forecasts of market participants about key economic, financial or market metrics. ECB: European Central Bank, GDP: gross domestic product, BoE: Bank of England, BoC: Bank of Canada, CUSMA: Canada-United States-Mexico Agreement. Figures reflect latest available data as of November 30, 2025.

Macro outlook: Less uncertainty, healthy growth

A fragile pause in U.S.-China trade and tech tensions

Fresh breadth? Market concentration in 3 charts

AI opportunity set expands across the economy

With hundreds of billions of dollars invested in just the past few years, the AI build-out continues at a staggering pace. Three distinct areas of AI investment opportunity have emerged: The four layer technology stack that powers AI systems, companies providing infrastructure for operations and organizations adopting applications to enhance productivity.

“Microsoft, Alphabet, Meta and others have the incentive and resources to continue investing aggressively, generating greater demand for advanced semiconductors and infrastructure.”

Mark Casey

Equity portfolio manager

Sources: Capital Group, Bloomberg. Return and yield figures are for the Bloomberg U.S. Aggregate Bond Index. “Current” value is based on latest starting yield to worst (the lowest yield an investor can earn if the bond is redeemed or called before its maturity date), using the historical linear trend line to approximate implied forward five-year return as of November 30, 2025. Past results are not predictive of results in future periods.

Stock market outlook: 3 investment strategies for 2026

Powering AI: Energy crunch sparks investment surge

Emerging markets 2026: Can the rally keep rolling?

Bonds should offer ballast

Economic growth prospects are up, just as job growth is weakening. For investors, this unusual backdrop underscores the potential for bonds to offer steady income and a measure of downside protection. Starting yields have historically been a strong indicator of long-term return potential. At today’s valuations, high-quality bonds can play the dual role of generating income and acting as a buffer.

“The biggest question facing investors is whether the labour market weakness will weigh on consumption. That would increase the risk of a sharper downturn in growth.”

Chitrang Purani

Fixed income portfolio manager

Starting yields often indicated long-term returns

Sources: Capital Group, Bloomberg. Return and yield figures are for the Bloomberg U.S. Aggregate Bond Index. “Current” value is based on latest starting yield to worst (the lowest yield an investor can earn if the bond is redeemed or called before its maturity date), using the historical linear trend line to approximate implied forward five-year return as of November 30, 2025. Past results are not predictive of results in future periods. Returns are in USD.

Bond outlook: A robust market underscores nimble investing

Domestic to global: The evolution of balanced funds in Canada

Volatile markets? Multi-sector bonds may offer a solution

Get the 2026 Outlook report

Long-term perspective on markets and economies

Voted #1 for thought leadership by advisors since 2019*

*Source: Marketing Support: The Advisor View, May 2025, June 2024, May 2023, July 2021, June 2020; Fund Intelligence, February 2020. FUSE Research surveys of 500-1,000 U.S. advisors identifying the “most-read thought leaders.” Survey was not conducted in 2022.

Bloomberg U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market.

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.