Election

- Investors should prepare for higher market volatility in the aftermath of Election Day.

- Patience is key as the outcome of the U.S. presidential race may not be known for days or weeks.

- Republicans will likely hold the Senate, resulting in a split Congress — an outcome that has historically resulted in higher market returns.

- Despite the uncertainty, investors should remember that company earnings, not elections, drive the stock market.

The uncertainty of 2020 continues.

After turning out in record numbers, voters awoke Wednesday morning with no clear winner declared in the U.S. presidential election. In a race that has proven to be much closer than many polls had predicted, the outcome may remain unknown for days or even weeks.

“Patience will be the key to getting through this period of political uncertainty,” says John Emerson, Vice Chairman of Capital Group International and a former U.S. Ambassador to Germany. “There are literally millions of votes that have yet to be counted — including a large number of mail-in ballots — so a delay is not that surprising. We’ve been warning about this scenario for months.”

From an investment perspective, Emerson explains, it is likely that market volatility will persist at elevated levels until President Donald Trump or former Vice President Joe Biden is declared the winner. U.S. equity markets staged a strong rally on Election Day, with the S&P 500 Index rising 1.8% (all returns in USD). On Wednesday morning, stocks continued to climb higher amid the uncertainty as results in several key states remained too close to call. U.S. Treasurys rallied, partially on the view that a split government could curtail prospects for excessive fiscal stimulus.

“There’s understandably a lot of anxiety right now,” Emerson adds, “but investors should think hard about adhering to their long-term investment goals, rather than reacting to near-term political events. That is often a mistake.”

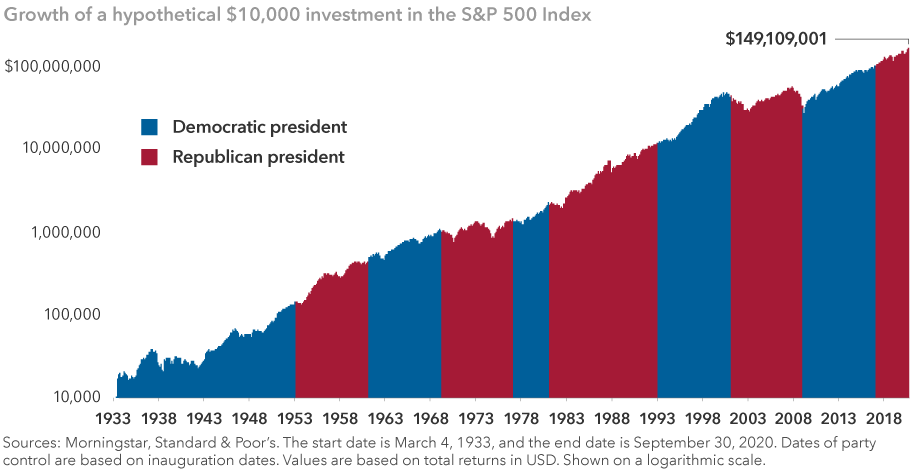

Stocks have trended higher regardless of which party occupies the White House

Over the course of history, markets have powered through contested presidential elections, deadly pandemics and economic recessions — usually not within the same year — but they have powered through, nonetheless. Whether a Democrat or a Republican occupies the White House has made little difference to overall long-term investment returns.

Where do we go from here?

The stage has been set for vote-counting battles and a flurry of lawsuits in swing states that have not yet been called for Biden or Trump. As of Wednesday morning (November 4), those states included Pennsylvania, Michigan, Nevada, North Carolina and Georgia, according to The Associated Press.

“Thursday or Friday is probably the earliest we will know the preliminary vote results for each state, depending on the looming litigation,” says Matt Miller, a political economist and policy analyst with Capital Group. “The presidency could go either way in the fraught overtime ahead.”

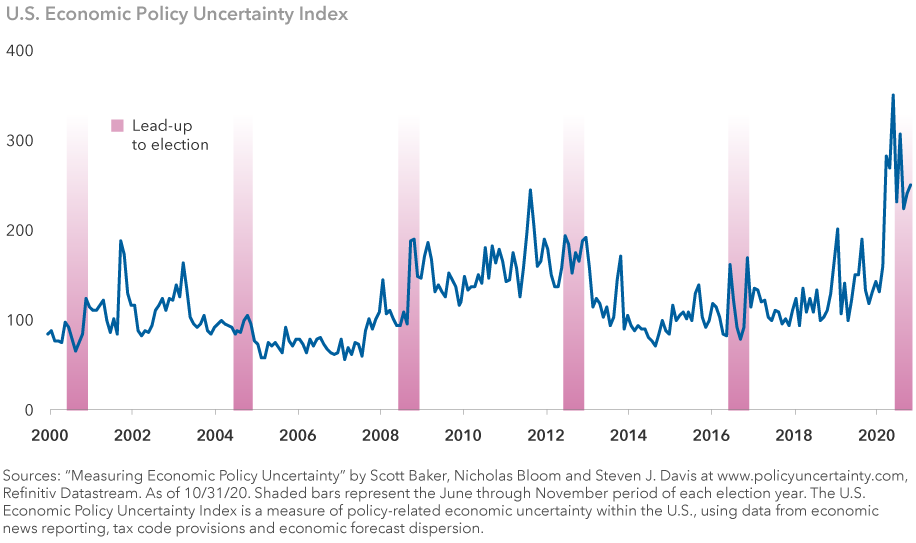

Uncertainty index is elevated and far higher than previous election cycles

Looking at the initial tally on election night, the nation essentially remains just as divided as it was four years ago when Trump unexpectedly won the 2016 election. “At midnight, Biden had 64.6 million votes and Trump had 63.2 million — on the way to what might be a record 160 million total votes,” Miller notes. “Whoever wins this election will have the daunting task of trying to bring unity and healing to a nation that is split right down the middle.”

In other races, it appears likely that Republicans will hold a majority in the U.S. Senate, although that’s not certain just yet, Miller says, while Democrats will maintain control of the House of Representatives, resulting in a split Congress. That’s been the case since the 2018 midterm elections when Republicans lost the House. Coincidentally, according to our analysis, markets have performed best under a split Congress.

Returns have historically been strongest when Congress is split

Two key issues in the race

The U.S. economy and the coronavirus outbreak were the top two issues in the presidential contest, according to most polls. Trump was generally viewed unfavourably for his handling of the pandemic, while voters gave him higher marks for his economic policies. The U.S. fell into a recession earlier this year, as government-imposed lockdowns brought economic activity to a near standstill.

However, in the most recent measure of U.S. economic activity — released just five days before the election — U.S. GDP growth bounced back sharply, rising at a 33.1% annual rate, benefiting from pent-up consumer demand and massive government stimulus measures. A key driver has been U.S. home sales, which have benefited from rising demand and historically low mortgage rates.

Despite extreme volatility during the year, U.S. equity markets also have trended upward. On a year-to-date basis through October 30, the S&P 500 Index gained 2.8% as technology and consumer-tech stocks rallied amid the lockdowns.

“The near-term performance of the economy and the markets may have played a role in this election but, realistically speaking, presidents get far too much credit and far too much blame for what is happening in the economy and the markets,” says Capital Group economist Darrell Spence. “For the most part, the dynamics that contribute to economic growth and market returns are put in place long before the election and they remain long afterward.

“As investors, we try to focus on the underlying fundamentals that are driving the economy and corporate profitability,” Spence notes. “That often has very little to do with who happens to win an election.”

Our latest insights

-

-

-

U.S. Equities

-

Global Equities

-

Emerging Markets

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

John Emerson

John Emerson

Matt Miller

Matt Miller

Darrell Spence

Darrell Spence