Fed

The U.S. Federal Reserve announced on December 15 that it will move more quickly to end its stimulus, doubling the rate at which it winds down (or tapers) its asset purchase program. This puts the Fed on track to stop buying bonds by March, and clears a path for it to raise interest rates shortly thereafter. Fed officials’ latest median projections indicate they may raise rates three times next year, and three more times in 2023.

Here are some top takeaways on the news and thoughts on the year ahead from Capital Group economist Darrell Spence and fixed income portfolio managers Ritchie Tuazon and Tim Ng.

1. Getting ready for rate hikes in 2022

Ritchie Tuazon and Tim Ng

The most important signal from speeding up the taper is that it opens the door to more 2022 rate hikes. But, while Fed policy changes are an inflection point that can rattle markets, it is important to keep this news in perspective.

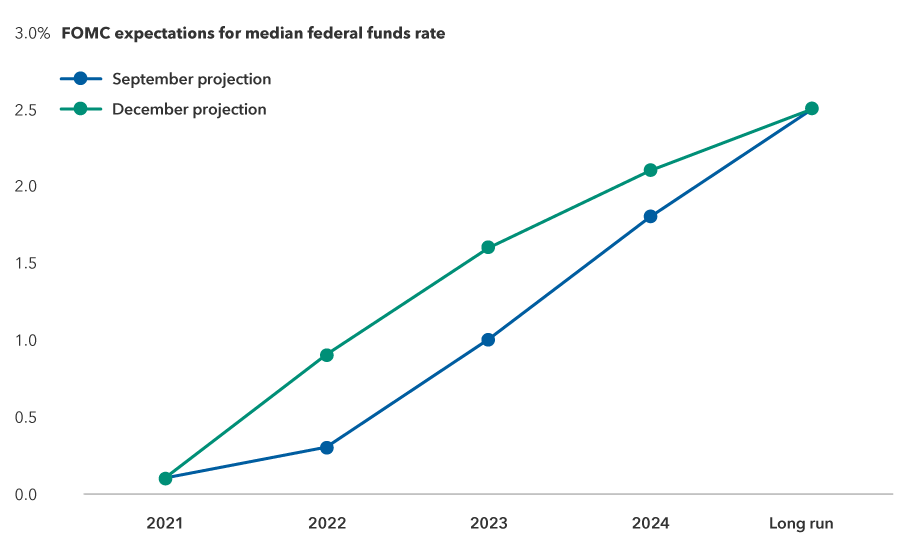

The Fed’s latest “dot plot” chart shows that most of its governors now anticipate three rate increases for 2022. This is a big pivot from September, when only half of the members of the U.S. Federal Open Market Committee predicted rates would rise at all in 2022. It is also above market consensus of two hikes in 2022. Fed Chair Jerome Powell also indicated that the committee will start discussions on reducing the size of its balance sheet.

Now our base case is that the Fed will raise rates three times next year. Despite the hawkish tone of the announcement, U.S. stocks and U.S. Treasury Inflation-Protected Securities (TIPS) did well after the announcement, and the yield curve steepened. If risk assets hold up and financial conditions remain loose, the Fed will have the green light to move even more aggressively to address inflation.

Near-term U.S. interest rate hike expectations have risen due to high inflation

Source: Federal Reserve. As of December 15, 2021.

The December 15 announcement also represents a hawkish shift from Powell, who was renominated by President Joe Biden in November for a second term. Powell had previously defended the view that the inflation we see today was “transitory” and would resolve itself, but he abandoned the term altogether in his statement this week.

In his press conference, Powell stated that the November’s jobs report, which included upward revisions to prior jobs reports, coupled with November’s consumer price index (CPI) update, which showed a substantial increase to inflation, convinced him it was time to speed up the taper.

Powell noted that U.S. labour force participation numbers are still “disappointing” but said that he believes the economy is still making rapid progress toward maximum employment. “We have to make policy now,” he said. “And inflation is well above target. So, this is something we need to take into account.”

The Fed appears to be interpreting the Omicron COVID-19 variant as an inflationary impulse but does not appear to be too concerned about its risks. Powell said that people are learning to live with the virus despite recurring waves, suggesting the economic implications may be limited.

In addition to renominating Powell, Biden has also named new Fed Board appointees in recent weeks who are likely to tilt dovish, but we do not expect that they will rock the status quo and impede the new accelerated tapering schedule. San Francisco Fed President Mary Daly, who has been among the most dovish members of the Federal Open Market Committee, was among the first to come out and say the taper should be sped up.

Others who are considered doves — such as Lael Brainard, who has been nominated to be the Fed’s new vice chair, and John Williams, president of the New York Fed — have also been making speeches indicating that, if inflation is above mandate, they will do what is necessary to keep it under control. This concern over inflation is bipartisan, so there is likely to be little political resistance to moving rates up to fight inflation.

At the end of the day, however, we are still going to have low rates and low yields for the foreseeable future. The Fed’s longer run dot plot projections did not move, and calculations from the Atlanta Fed show the market expects the federal funds rate to be around 1.5% at the end of 2024, which is still a highly accommodative stance.

2. U.S. growth likely to slow down but stay solid

Darrell Spence

We see tempered growth for the United States in 2022 as fiscal stimulus wanes and the Fed begins to remove accommodation. Our base case is 2.5% to 3% GDP growth, which is still a respectable rate. And although any period of monetary tightening can generate higher market volatility, we on the Capital Strategy Research (CSR) team expect risk assets to remain supported by strong earnings. Valuations are high relative to history, but they are not exorbitant considering the current, and projected, level of interest rates. A mild correction is not out of the realm of possibility, but we do not expect a systemic market decline.

That said, there are likely to be more headwinds — in particular, inflation — hitting the economy in 2022 than there were in 2021. While this is not a complete surprise, given where we are in the post-COVID rebound, we will be watching closely for signs that they are exerting more of a drag on economic activity than currently expected as we move toward the end of the year.

Rushing to the exits: The Fed has company

As if responding to a cry of “fire” in a crowded theatre, the world’s major central bankers are now running to the exits when it comes to winding down emergency pandemic stimulus due to overheating inflation. Here’s a rundown of the world’s major central banks and where they stand on their way to the exits:

- Bank of Canada ended its bond-buying program — tapering — on November 1, signaling its intent to raise rates by mid-2022

- Bank of England raised interest rates (0.1% to 0.25%) on December 15 but maintained its bond-buying program

- European Central Bank announced December 15 it would scale back its crisis bond buying in response to inflation but would not raise interest rates until 2023

- On December 16, the Bank of Japan said it would wrap up its corporate bond and commercial paper purchases by March 22, 2022 but made no changes to its ultra-loose monetary policies

3. Supply chain issues are set to persist

Darrell Spence

Currently, stimulus-induced demand in the U.S. is meeting COVID-restricted supply, and this is creating imbalances that are keeping inflation elevated.

With no more stimulus checks, federal Paycheck Protection Program (PPP) grants, emergency unemployment benefits, or debt and eviction moratoriums, it seems likely that demand will soften. Where supply goes is more uncertain. If COVID-induced bottlenecks clear up and supply increases, a new equilibrium could occur with inflation around pre-pandemic levels. This is the “transitory” scenario the Fed had been assuming.

While much is still unknown about Omicron, its arrival does suggest that COVID will be with us for a while longer. As such, the “transitory” period — i.e., the period where COVID is impacting supply and generating inflationary pressures — has likely been extended another six to 12 months, and there is a risk that inflation begins to have a more negative impact on economic activity during that period.

Unfortunately, there is very little the Fed can do to increase supply. Rather, to reduce inflation, it would need to suppress demand, which essentially means putting the economy into a slowdown or recession. However, we still do not know how willing it will be to push down an economy, particularly one that may not be at their definition of full employment, just to break the back of inflation.

All that said, if one has a multiyear timeframe, “transitory” still looks like a strong possibility. Many of the factors that caused inflation to remain low in recent decades — in particular, globalization and advances in technology — are still in play. These factors should help moderate inflation in the long term, but in the near term, COVID and its related issues are likely to dominate the inflation outlook.

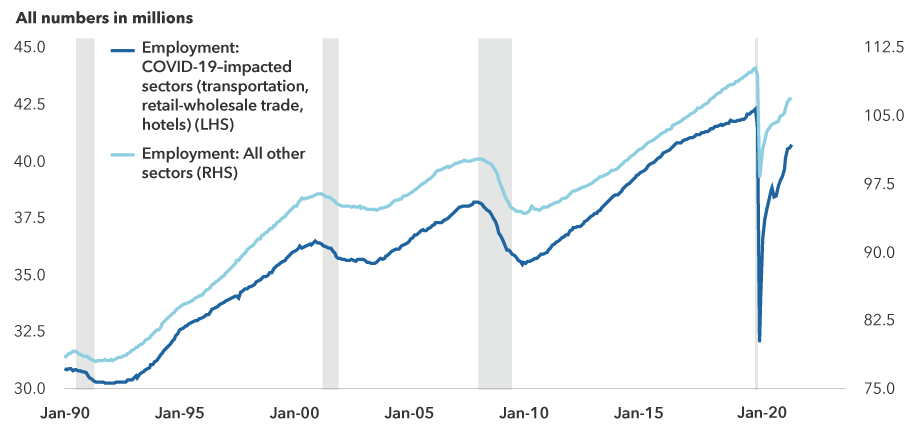

U.S. employment is labouring toward full recovery

Source: Capital Group, Haver. Data as of September 2021. Shaded areas represent recession periods as determined by the U.S. National Bureau of Economic Research.

4. Equity markets are likely to stay resilient

Darrell Spence

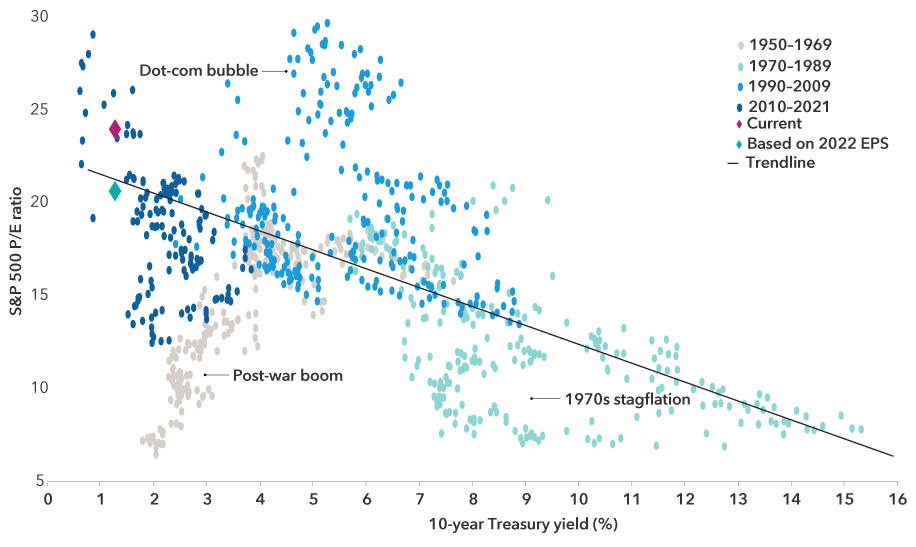

We currently expect that equity markets will be able to ride this out next year, as slow but positive economic growth should support an increase in corporate profits. Understandably, there is a lot of concern about valuations, as the market price-to-earnings ratio does look high relative to history. However, it has been that way for years, yet the market has continued to march higher. Had one stayed out of the market due to concerns about valuations, they would have missed a lot of opportunity.

One cannot look at valuations in a vacuum. They need to be looked at in the context of the interest rate environment. The fact is that low rates can support higher valuations (assuming the economy is not in distress, and we do not think it is). Looking ahead to 2022, it is possible that tighter monetary policy, and higher rates, could put some downward pressure on valuations, but we also expect that an ongoing recovery in earnings could offset much, if not all, of that contraction.

What level of interest rates might be problematic?

Sources: Capital Group, FactSet, Federal Reserve, Standard & Poor's. Dots represent monthly data from January 31, 1950, to August 31, 2021.

As an aside, there is a school of thought that suggests rising yields will not start to exert significant downward pressure on the equity market until the 10-year U.S. Treasury yield reaches 5.0%, because that is the level at which the correlation between bond yields and equity prices has reversed, twice, over time. This flip-flop in correlation could be total coincidence, but it could also have occurred because yields above 5.0% indicate that inflation has become a dominant factor driving valuations. If there is anything to the 5.0% threshold, then the current 10-year yield, at 1.4%, appears to be a long way away from a level that has, at least historically, created a headwind for the equity market.

While we will likely not see the gains that we have seen over the past year or so, we on the Capital Strategy Research team believe single-digit equity returns to be attainable as the market rises in line with, or slightly less than, earnings growth in 2022.

Our latest insights

-

-

-

U.S. Equities

-

Global Equities

-

Emerging Markets

Timothy Ng is a portfolio manager on Capital Group Canadian Core Plus Fixed Income Fund (Canada).

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Ritchie Tuazon

Ritchie Tuazon

Timothy Ng

Timothy Ng

Darrell Spence

Darrell Spence