Automotive

Walking the showroom floor of Germany's international auto show used to be a time to admire the latest and greatest gas-powered Mercedes-Benz, Volkswagen or even a Bentley. Not so much this year. One can sense the electric vehicle future coming. Two questions are at the forefront of people's minds: Will European consumers be interested in buying Chinese electric vehicles (EVs), and will China’s automakers slash prices to grab market share?

China has surpassed Japan as the top global automobile exporter so far this year, a feat that was unimaginable a decade ago. Several of China's leading EV makers are starting to charge into Europe's market, marking an early litmus test of demand in developed markets for Chinese EVs.

It's already having ripple effects in Europe, where regulators and politicians are grappling with how best to protect their traditionally strong auto industry. It's too early to know how the situation plays out, but it seems clear it will change the operating dynamic for Europe's automakers and how investors value their businesses moving forward.

Based on conversations with industry officials and company executives during our recent trip to Munich, here are several implications we are watching closely.

China has the technology to compete globally

It's increasingly apparent that China has moved into pole position to dominate EV production and battery technology. The country made a strong push into EV development around 2009 and now accounts for about 60% of global EV production. China's early-mover advantage has been buoyed by strong government financial support — so much so that some of our auto analysts estimate European car makers are three years behind China and Tesla in EV product lineups.

China's dominance in this industry is also a reminder of how the country has moved up the technology curve and can build massive scale when government and entrepreneurs join forces to focus on an industry. Cheaper labour costs, advancements in software development and China's abundance of key minerals used in EV batteries are giving its automakers a strategic edge. For instance, Chinese manufacturers have more capability to build integrated vehicle platforms in-house, rather than rely on foreign vendors.

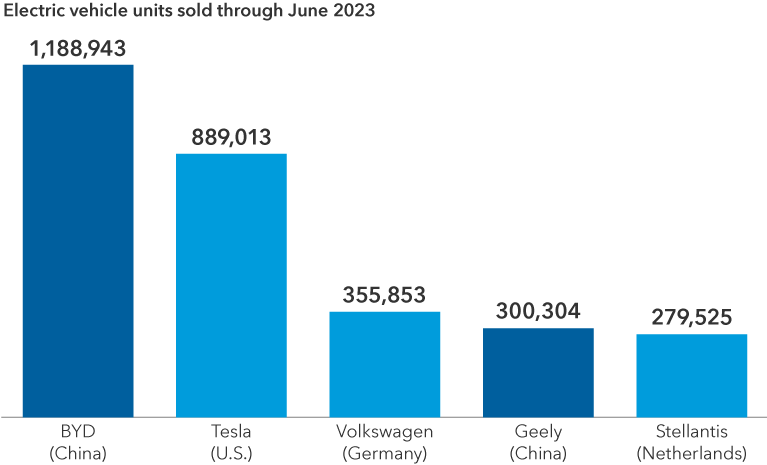

Chinese EV Brands rank among the top inthe world by sales

Source: Bloomberg. Data as of June 30, 2023.

It's also becoming clear that European manufacturers are losing out in China, at least for now. Chinese brands such as BYD, Li Auto and XPeng have gained in popularity, not just among domestic consumers but in several European and Asian markets.

In the past couple of years, Chinese companies have excelled in model design and infotainment software that cater to their domestic customers. The cars are loaded with technology, with 80% of them equipped with LiDAR (Light Detection and Ranging), which measures the distance between points of reference. In Europe, only the premium vehicles are expected to be fitted with LiDAR. Infotainment systems, which are essentially the car’s computer dashboard, are also more advanced. Some car interiors resemble an IMAX on wheels.

European regulators will have to thread the needle geopolitically

Europe is pushing back in an attempt to protect its auto industry, which is a major contributor to overall economic growth and jobs. The European Commission in September launched an investigation into the imports of electric vehicles from China and whether Chinese automakers are benefitting from government subsidies.

In our view, the European Union (EU) is waking up to the challenge posed by its dependence on China. In a world of rising geopolitical risk, the EU likely wants to avoid a situation akin to its over-reliance on Russian energy when Russia invaded Ukraine. We also believe the EU is scarred from its retreat on solar panels over a decade ago, a move that gave the lion's share of the global market to Chinese manufacturers.

The commission will have to carefully weigh the interests of its key member states, namely France and Germany, the two countries with the most vested interests.

So far, the French government has taken a tougher stance because Chinese EVs could affect the low to mid-priced market for cars sold in Europe, the primary market for French automakers. At the same time, France's automakers have never been that successful in China, so they have the least to lose. It's a different matter for Germany, whose automakers have a substantial presence in China but have been gradually losing market share in recent years.

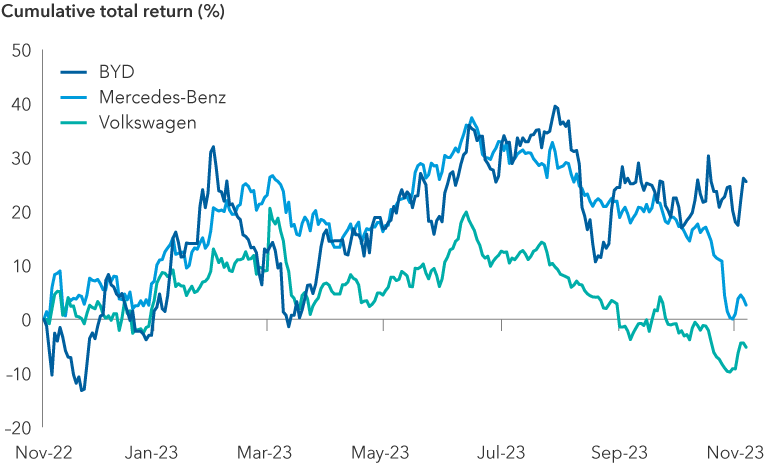

German automakers have lagged China's BYD

Sources: MSCI, RIMES. Data as of November 7, 2023 from November 7, 2022. Past results are not predictive of results in future periods.

Meanwhile, Hungary has been the most China-friendly among EU members. Chinese companies such as CATL, BYD, and Nio have been using Hungary as a launch pad into the EU. Germany itself has welcomed battery production investment from Gotion, a Chinese battery partner of Volkswagen.

As a result, we think a likely direction the European Commission could take is to steer clear of any immediate, large tariff increases on Chinese EVs and focus on greater localization of EV supply chains. Given that there are substantial trade linkages between Europe and China that go beyond autos, the commission would probably prefer to avoid any retaliatory measures from China's government. Currently, Chinese EV imports face a 10% EU import tariff, while European-built imports into China face tariffs of 15% to 25%, depending on the model.

Another potential outcome could resemble Japan’s voluntary export restraints in the early 1980s, in which an agreement was reached that allowed the U.S. to catch up in terms of developing new vehicles. During this time, a U.S. recession impacted demand while Japan improved production efficiencies. This also resulted in layoffs for U.S. autoworkers and became a political issue as the U.S. sought to cool Japan’s auto dominance.

Then there's the EU commitment to end production of all internal combustion engine cars by 2030. Although there has been little debate about pushing the deadline, we are not ruling out that possibility given the dependence on EVs the deadline would create. It will depend on the outcome of the commission's anti-subsidy case.

European automakers must shift gears to catch up

Europe's major car makers are arguably facing the most challenging and complicated business environment in their history. They are at a significant cost disadvantage and substantial investment will be needed to catch up with China’s EV makers and Tesla, the U.S. marquee manufacturer of luxury EVs.

Current valuations for Europe's larger auto manufacturers are not pricing in a bright future. Many are trading at less than four times expected earnings for the next 12 months, according to consensus estimates collected by FactSet as of November 8, 2023.

Automakers have taken notice and are not sitting idle. Volkswagen plans to invest upwards of €180 billion over the next five years to develop its EV strategy. Mercedes-Benz is budgeting more than €40 billion for electric vehicles through 2030. And BMW and Stellantis have also unveiled significant investments.

We believe Germany's premium manufacturers BMW, Mercedes-Benz and Porsche look better positioned for success in EVs. Mercedes, for instance, has previewed an attractive next-generation EV lineup set to roll off assembly lines over the next two to three years.

Where companies recognize they cannot compete, they may well join forces, as they have in the past. The most likely partnerships will be between European and Chinese firms. Recently, China-based EV maker XPeng inked a deal with Volkswagen to leverage technology and supply chains. Stellantis is investing €1.5 billion to buy 20% of China-based EV manufacturer Leapmotor.

Smaller manufacturers may be constrained by limited budgets and may turn to joint ventures. French maker Renault could prove to be an exception. It has carved out a new EV unit and is having early success with its Megane E-Tech model. It plans to make its EVs in northern France and forecasts automation can knock up to 40% off production costs. Like other manufacturers, Renault has shifted some production of traditional gas-powered cars to other international regions, such as India, to reduce its overall cost structure.

It's too early to pick winners and losers

The global push to reduce dependence on traditional combustion engines, the surge of innovation in EV battery technology and software, as well as achieving competitive labour costs, are making the auto industry a challenging place to invest.

Near-term demand concerns along with economic uncertainty have prompted some automakers to dampen their bullish EV outlooks. U.S.-based Ford Motor said in its recent third-quarter earnings it was withdrawing a target to build 400,000 EVs by mid-2024. Tesla expressed concerns about high interest rates and the affordability of EVs.

Despite the initial headway China has made, many of its domestic auto manufacturers are losing money. The rush to drive down costs and prices may force lesser-capitalized EV makers out of business, and we could see a wave of consolidation.

Until then, we believe it would be a mistake to write off European automakers. Low valuations and technology advancements could provide attractive entry points for investors. They have a long and glorious legacy to build upon. They've been here before, staving off competition from Japanese car makers.

European consumers are discerning and historically chose to stay with European manufacturers even at slightly higher price points. But the global dominance of European brands, especially at the luxury end, may not last as EVs gradually replace traditional combustion engine or hybrid technology cars and other automobiles.

Michael Cohen is a portfolio manager for Capital Group International Equity Fund™ (Canada).

Our latest insights

-

-

Currencies

-

Market Volatility

-

Market Volatility

-

Markets & Economy

RELATED INSIGHTS

-

Emerging Markets

-

Economic Indicators

-

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Michael Cohen

Michael Cohen

Talha Khan

Talha Khan