environmental-social-governance

Climate change is forcing investors to evaluate two new types of risk: transition risk, the cost of companies transitioning to low-carbon operations; and physical risk, the cost of increased drought, floods, severe weather and a rising sea level. Water stress is one of the most pronounced physical risks from climate change that investors must consider.

Droughts and water scarcity are unpredictable events with a proven ability to stop or reduce production quickly, cause late-stage project cancellations and ultimately alter industry market share. Within water-intensive industries, understanding how companies manage their water supplies can be a key factor in anticipating their longer-term performance.

The semiconductor industry provides a good case study: It is among the most water-intensive industries on a relative basis, and several “hubs” where chips are produced have been exposed to severe, long-term drought in the past. In response, several leading companies have found new approaches to water management, allowing them to recycle upward of 90% of water used and reinforcing long-term sustainability of operations.

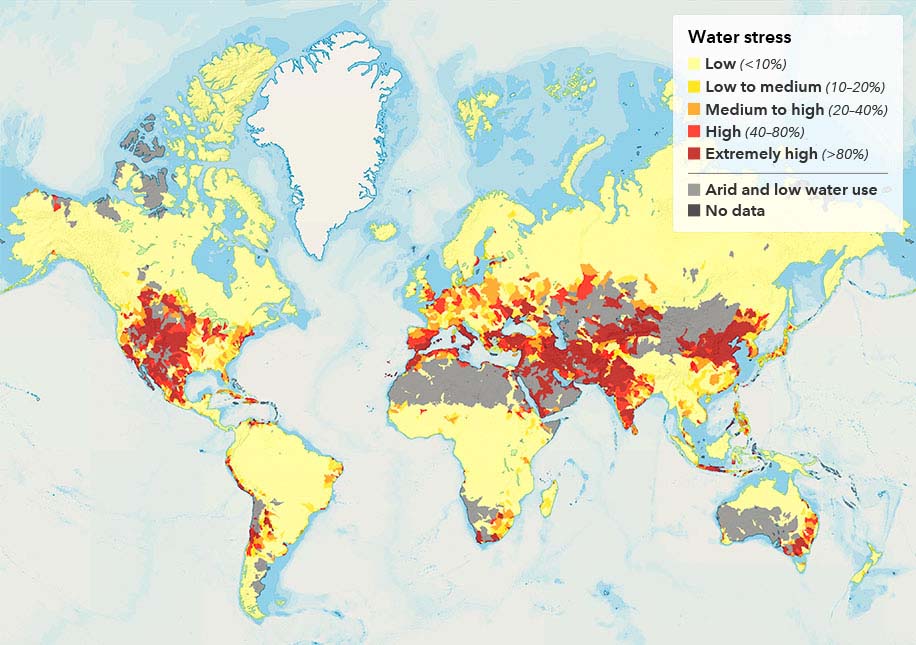

Water risk becomes material when companies operate in high-stress zones

Sources: World Resource Institute Aqueduct, OpenStreetMap. Data accessed March 18, 2022. The chart shows projected water stress levels for 2030 in a "business-as-usual" climate change scenario, under which global greenhouse gas emissions continue growing at their current pace. The World Resource Institute defines water stress as the ratio of total water withdrawals to available renewable surface and groundwater supplies. Higher water stress levels indicate more competition among water users.

In the past year, several large semiconductor companies announced new investments to build capacity in the United States, several of which will be in a growing manufacturing hub in Arizona. At the same time, the drought situation in Arizona is worsening. For the first time ever, in August 2021, the U.S. federal government declared a water shortage on the Colorado River that would trigger cutbacks starting in 2022. Arizona is set to lose 18% of its water allocation, or 63 million cubic meters. This amount represents the equivalent of total annual water consumption for the city of Phoenix, or Intel’s total annual water withdrawal.

Yet despite anticipated water shortages, Intel, the largest producer in the region, is likely able to access the amount of water it needs. In a meeting with Capital Group, the company explained its processes to be able to recycle 80%–90% of water. The company now consumes a very small percentage of fresh water in the region because of its on-site water reclamation facilities, which recycle water back into its own processes or into the municipal water system.

In addition to the reclamation facility, Intel’s water efficiency has significantly improved since it began operations at its Arizona manufacturing site. In the 1990s, Intel needed 7.6 litres of municipal water for every 3.8 litres of ultrapure fresh water used in its chipmaking process (50% efficiency). Today, Intel uses only 4.2 litres of municipal water per gallon of ultrapure water (90% efficiency).

Other sectors face tough challenges

The success of semiconductor companies may show a path forward for other water-intensive sectors, but some specific industries, like utilities and food and beverage companies, are likely to struggle. Utilities, which are by a factor of 25 times the largest users of water in Capital Group’s investment universe, cannot currently scale up their water recycling programs to mitigate their risk.

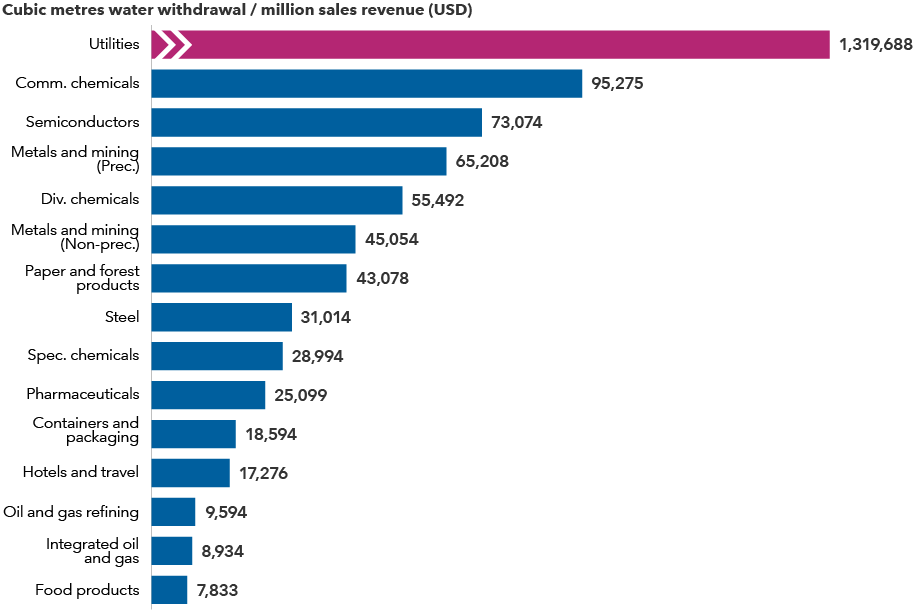

Utility companies’ water usage is off the charts

Source: Capital Group, Bloomberg. Average annual water withdrawal normalized to total revenue of companies within the MSCI World Index split by industry. Water withdrawal includes total water diverted from surface, ground and municipal water sources. The utilities industry data is not plotted to scale due to its much larger relative size. Data as of September 1, 2021.

Utilities use water for two major purposes: 1. hydroelectric power, and 2. cooling thermoelectric and nuclear power. It’s intuitive that hydro-powered electricity requires water, but the scale of water needed for cooling thermal and nuclear power plants is also enormous relative to other industries’ water use. Three of the five largest water users in Capital Group’s universe do not have significant hydro-generation operations. And protecting against drought risk could require these companies to move their production sites or, if that’s not possible, switch away from hydro and thermal power altogether.

The risks facing the sector were on display last year in Brazil, where extreme drought caused a spike in electricity prices. Brazil, which derives about 65% of its energy from hydro, had previously diversified into thermal electricity sources (cutting hydro down from 90% of its total power supply) following an extreme drought in 2001 and 2002 that caused electricity blackouts and energy shortages. However, with the severity of the 2021 drought, the country still experienced massive utility price increases. The largest financial impacts are expected to come from higher energy costs for companies that are asset-heavy and energy-intensive but not self-sufficient in producing electricity.

Food and beverage companies face a different challenge. Because they withdraw and consume vast quantities of water — essentially reselling fresh water extracted near manufacturing plants for their products — these companies can face difficult community and regulatory relations in water-stressed regions. And while companies in other sectors have been able to navigate water cuts, shutdowns, regulatory hurdles and community protests by using a freshwater alternative — typically water treatment and recycling or desalination — this is not usually an option for food and beverage companies.

Implications for investors

As climate change continues to alter the planet, investors need additional approaches to understand essential risks and opportunities for resource-intensive sectors and companies. As part of our fundamental investment research process, we analyze how efficiently water-intensive companies manage their water usage.

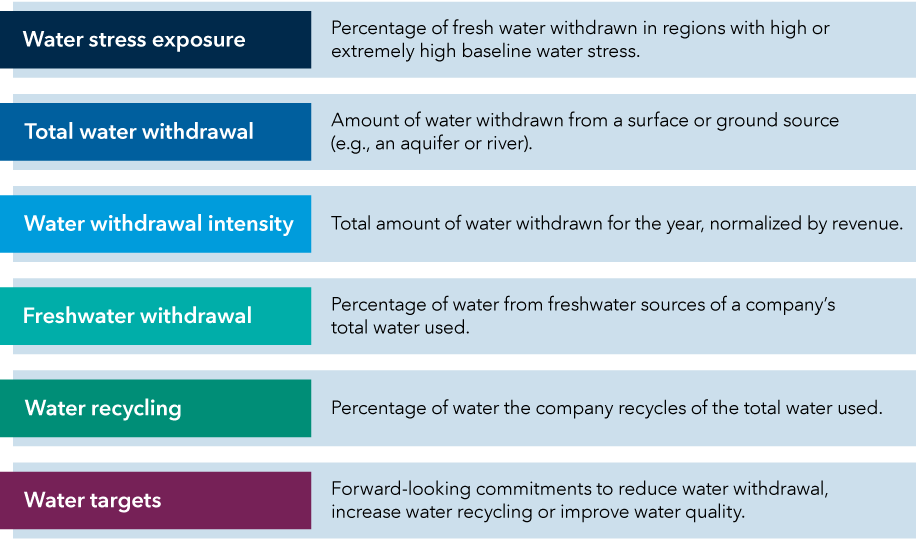

Our analytical framework includes six different factors, which we use to gauge a company’s exposure to water risk:

Source: Capital Group

How well companies score on these factors helps forecast their ability to operate effectively and deliver results — or not — in the future. Investors may also need to reexamine the near-term attractiveness of certain resource-intensive sectors to factor in the prospect that securing ample freshwater supplies may limit their growth ahead.

By integrating these types of frameworks into our analytical processes, we seek to better identify companies that are successfully adapting to meet the new challenges, as well as those that are likely to struggle to keep delivering value as conditions change. This new type of fundamental analysis can provide a crucial filter to help separate likely winners and losers in the future, potentially leading to better outcomes for investors in the years ahead.

Water risk: a global and local problem

Access to clean, fresh water is likely to be a growing concern in the decades ahead for some parts of the globe. A recent report by the Intergovernmental Panel on Climate Change (IPCC) concluded that continued global warming is likely to increase extremes in the hydrological cycle — meaning longer droughts and more severe flooding. In a 1.5-degree Celsius warming scenario, which is approximately the equivalent of “net-zero emissions by 2050” and aligned with the Paris Agreement, heavy precipitation is forecast to be 1.5 times as likely and droughts 2 times as likely to occur. In the most extreme scenarios considered by the IPCC, heavy precipitation could be 3 times as likely and droughts 4 times as likely. The result of these changes is a likely deficit of fresh water. According to the United Nations, the world is expected to face a global freshwater deficit of up to 40% by 2030.

Even though droughts can have global ramifications, water scarcity risk varies greatly by region and needs to be understood and managed locally. Water only becomes a material risk when companies operate (or attempt to expand into) severely water-stressed areas.

Managing water stress: Innovation is providing long-term resilience

Sectors with the greatest material exposure to water stress include utilities, energy, chemicals, food, beverage, hotels, containers and packaging, semiconductors, and construction materials. Companies in many of these sectors may be able to mitigate — and in some cases eliminate — water stress risk through selecting safer production sites, investing in recycling and establishing local freshwater alternatives.

Our latest insights

-

-

Currencies

-

Market Volatility

-

Market Volatility

-

Markets & Economy

RELATED INSIGHTS

-

Global Equities

-

Market Volatility

-

Market Volatility

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Emma Doner

Emma Doner

Matt Lanstone

Matt Lanstone

.png) Matthieu Chateau

Matthieu Chateau