Bonds

International

International equities, shadowed by a decade of lagging returns relative to U.S. markets, may have turned a corner in November 2020. That’s when news broke of a highly effective COVID-19 vaccine and many cyclical, value-oriented stocks suddenly caught the attention of investors.

Given the value bent of international indices and a rapid global economic recovery, the outlook for stocks in Europe, Japan and many emerging markets looks brighter than it has in several years. Granted, November 2020 to May 2021 is a short time period, but the trends are encouraging so far, says portfolio manager Greg Fuss.

“We’re at a very interesting juncture,” Fuss notes. “Starting in November 2020, for the first time in years, value-oriented sectors have taken centre stage. Energy, financials and industrials have rallied, and that bodes well for international markets where many of those companies are domiciled.”

Are value-oriented companies mounting a sustainable comeback?

Sources: MSCI, RIMES. Industries listed are the 10 worst performers in the MSCI EAFE Index from 1/1/2020 to 11/6/2020. Returns are in U.S. dollars. 11/6/2020 was the last business day before the Pfizer-BioNTech COVID-19 vaccine was revealed to have more than 90% efficacy in global trials.

“As the world continues to recover from the COVID-19 crisis, it’s important to remember that there is no handbook,” Fuss cautions. “We don’t know how it will play out. But if we are at the start of a powerful cyclical recovery, which is exactly what it looks like to me, then cyclical stocks by definition appear to be attractive in this environment.”

Unloved sectors stage powerful rally

Since November 9, 2020 when a COVID-19 vaccine was first presented for emergency use in the U.S., energy stocks — particularly oil and gas companies — have rebounded strongly from the depths of the pandemic. Among international stocks, oil giants such as BP, Total and Royal Dutch Shell have led the way. Oil prices soared as investors anticipated a rapid increase in demand amid a global economic reawakening. Oil and gas company shares in aggregate gained 48% in USD from November 9, 2020, to May 31, 2021.

European banks have proved to be another bright spot following years of poor returns exacerbated by negative interest rates, non-performing loans and plain mismanagement. In sharp contrast to the prior decade, European banks have shined in 2021, returning 30% in USD on a year-to-date basis, even as the eurozone economy has struggled to keep pace with U.S. economic growth.

Europe is a “target-rich environment,” says Fuss, given generally lower valuations compared to U.S. stocks and the preponderance of dividend-paying, value-oriented companies.

In fact, for dividend-seeking investors, international markets provide a much bigger opportunity set, Fuss notes, with 250 companies offering dividend yields of 3% or higher, compared to just 87 such companies in the United States, based on MSCI index data as of May 31, 2021. Among the largest dividend payers in Europe: Roche, Novartis and Unilever. Emerging markets offer 365 such companies.

Value-oriented sectors play a larger role in non-U.S. markets

Sources: MSCI, RIMES. As of 5/31/2021.

This chart illustrates why a cyclical rally is good news for stocks outside the United States. Highly cyclical sectors such as materials, financials and energy have a greater representation in the MSCI All Country World Index ex USA. Meanwhile, in the U.S., growth-oriented sectors are the dominant areas: information technology, health care, communication services and consumer discretionary.

Indeed, the cyclical rally could continue for a considerable period of time as the global economy is still in the early stages of recovery, says portfolio manager Lisa Thompson.

“The reopening trends that we’ve already seen in the U.S. and China are likely to appear in other markets during the months ahead,” Thompson explains. “There are concerns about India and other emerging markets that have not been able to contain the virus, but even in those areas, we are seeing signs of improvement. Vaccination rates are gradually moving up, so I feel confident that the reopening trends will closely trace the events we’ve already experienced elsewhere.”

That should happen even in the face of modestly higher inflation and rising interest rates, which have spooked investors in the first half of 2021, she adds.

“If we see structurally higher but not runaway inflation and modestly better global economic growth, companies with lower valuations should do better under those conditions,” Thompson says. “We’ve seen that framework since November 2020, and I think it could continue as long as interest rates in the U.S. don’t rise too much. For emerging markets, that is essentially a nirvana scenario.”

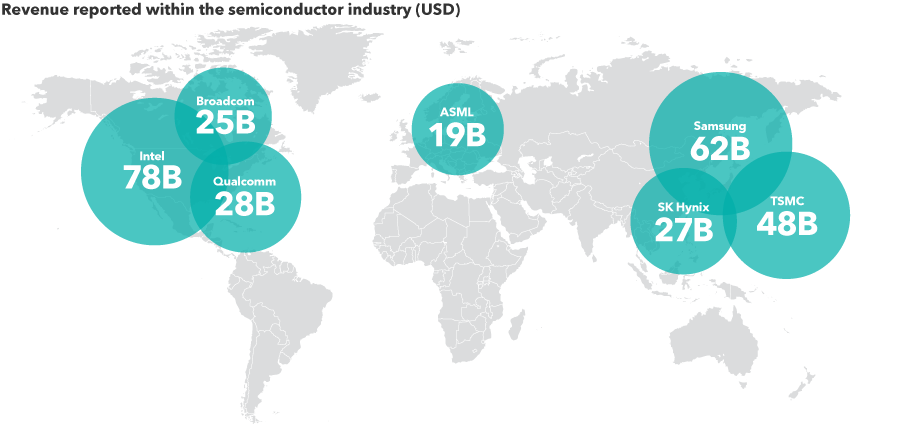

Semiconductors may be the new oil

The semiconductor industry represents another compelling investment opportunity with a significant presence outside the U.S. — primarily in Europe and Asia. Simply put, chips may be the new oil. The semiconductor industry is expected to power the next decade of economic growth, much like oil fueled the rise of the industrial age.

Chips are used in a vast array of products these days, from smartphones and servers to cars, televisions and even washing machines. By various estimates, global semiconductor sales could double from about US$450 billion today to nearly US$1 trillion over the next 10 years.

Chips ahoy! Semiconductors will be everywhere and in everything

Sources: Capital Group, FactSet. Companies selected from the MSCI ACWI Semiconductor Index (plus sales from Samsung's semiconductor division) based on highest 12-month revenue reported in each company's most recent financial statement, as of 4/30/21. Samsung is not listed as a semiconductor company, but their semiconductor division would have the second highest revenue if it was a standalone semiconductor company.

The world’s largest chipmakers — including South Korea’s Samsung and Taiwan Semiconductor Manufacturing Company, or TSMC — are spending billions to meet the surge in demand.

Some chipmakers and their suppliers have essentially gained a monopoly over key aspects of the business. Dutch manufacturer ASML, for example, builds high-tech, one-of-a-kind lithography equipment used by other companies to make the most advanced chips in the world.

“The world has come to appreciate just how important the large semiconductor companies are — for so many different industries,” says portfolio manager Andrew Suzman.

Not all the best stocks are in the U.S.

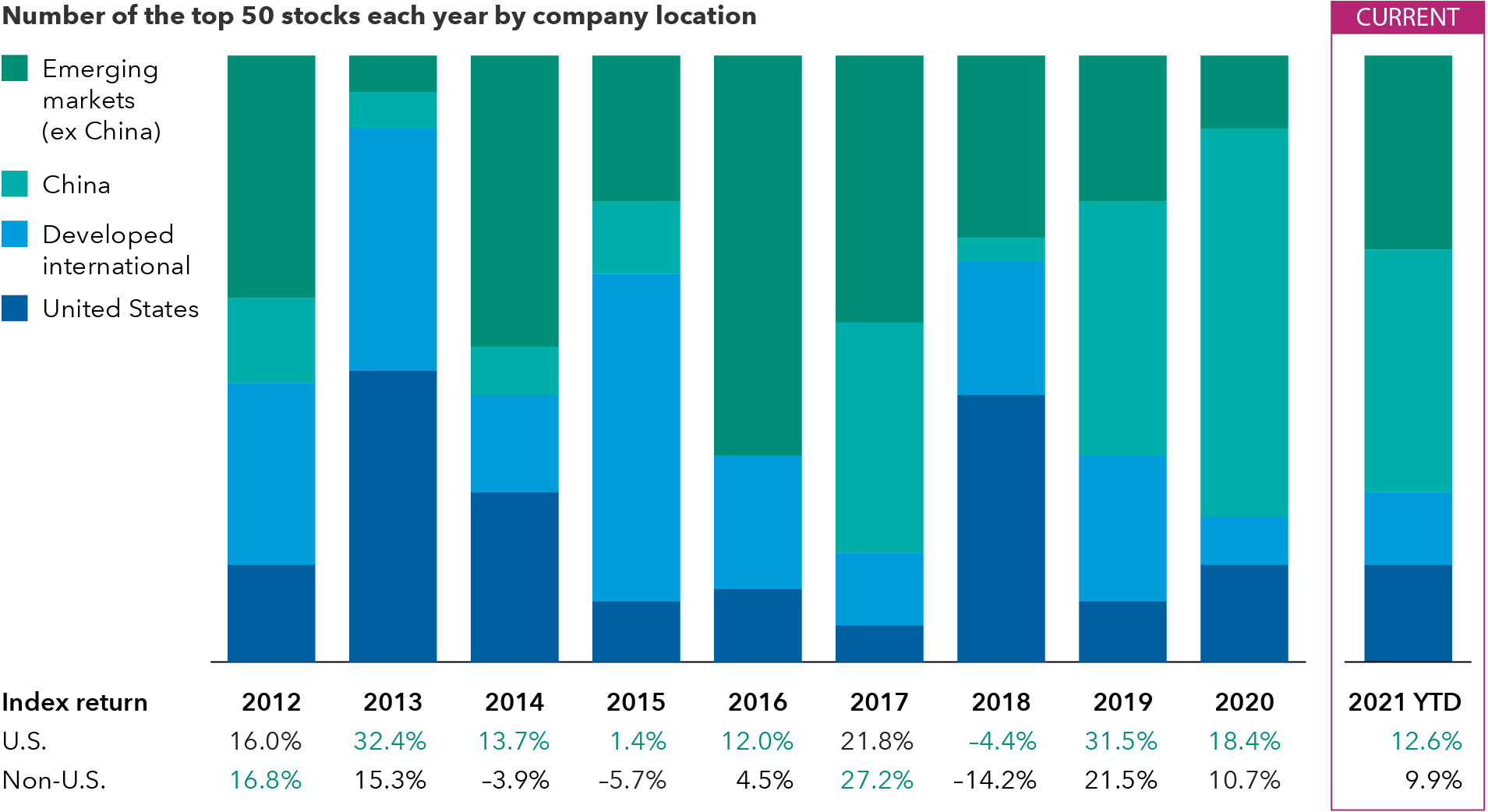

Although it’s understandable for investors to focus on U.S. stocks given their strong outperformance over the past decade, it’s also important to remember the benefits of a balanced, diversified portfolio. There have been many past periods when international markets have done relatively better, as recently as 2000 to 2009.

Think all the best stocks are in the U.S.? Think again.

Sources: MSCI, RIMES. 2021 as of 5/31/2021. Returns in U.S. dollars. Top 50 stocks are the companies with the highest total return in the MSCI ACWI each year. Returns table uses Standard & Poor’s 500 Composite and MSCI ACWI ex USA indexes for U.S. and non-U.S., respectively.

It remains to be seen how the current decade will shape up, but it’s likely that one long-term trend will continue: On a company-by-company basis, the best annual returns each year have primarily been generated by stocks found outside the United States — supporting the view that the world is a stock pickers’ market favouring a borderless-investing approach.

Get the 2021 Midyear Outlook report

Explore the 2021

Midyear Outlook

RELATED INSIGHTS

-

Bond outlook: Opportunities emerge as Fed delays rate cuts

-

Global Equities

Stock market outlook: 3 themes for a broadening market -

Economic Indicators

Economic outlook: U.S. powers global growth

MSCI ACWI is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indices.

MSCI ACWI ex USA Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, excluding the United States. The index consists of more than 40 developed and emerging market country indices.

MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization-weighted index that is designed to measure developed equity market results, excluding the United States and Canada.

MSCI ACWI Semiconductor Index is designed to measure results of semiconductor and semiconductor equipment companies within more than 40 developed and emerging equity markets.

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Greg Fuss

Greg Fuss

Lisa Thompson

Lisa Thompson

Andrew Suzman

Andrew Suzman