American Balanced Fund®

DEFINED CONTRIBUTION FOCUS FUNDS

A quality balanced fund aiming for

a smoother long-term ride

A 48-year legacy of success

Over its lifetime, American Balanced Fund has had a higher return than its blended benchmark and peers, and can serve as a QDIA.*

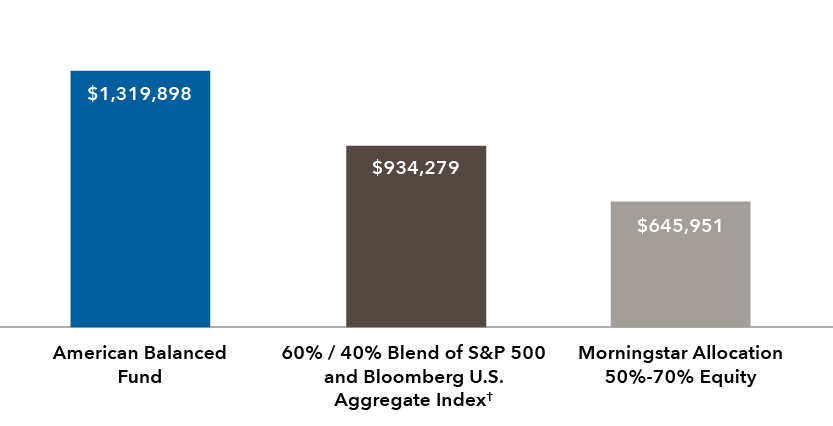

Hypothetical lifetime value of $10,000 investments

Value of hypothetical $10,000 investments since the fund began on July 26, 1975, through December 31, 2023.

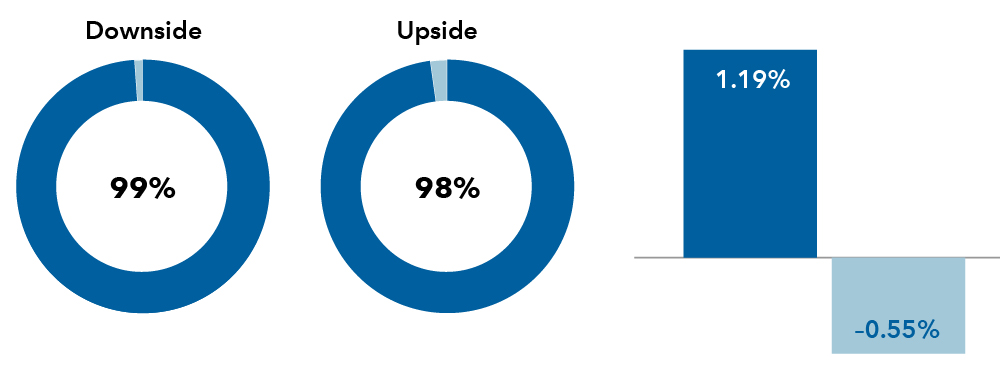

Valuable downside resilience and upside capture

Over monthly rolling 10-year periods since its inception, American Balanced Fund has captured more of its blended benchmark’s gains than losses. And while the fund has led and lagged its benchmark at different times, the fund has outpaced the index by a greater magnitude than it lagged.

Average monthly rolling 10-year periods capture ratio over fund lifetime vs. blended index

Capture ratio1

Excess return when leading/lagging index

Source: Capital Group. Data as of December 31, 2023. Index consists of a 60% weighting of the S&P 500 Index and 40% weighting of the Bloomberg U.S. Aggregate Index.† Up (down) capture ratio is the ratio of a portfolio’s return during periods when the index was up (down), divided by the return of the index during those periods. For example, an up-capture ratio greater than 100 indicates the portfolio produced a higher return than the index during periods when the index was up. Conversely, during periods when the index was down, a down- capture ratio greater than 100 indicates the portfolio produced a lower return than the index.

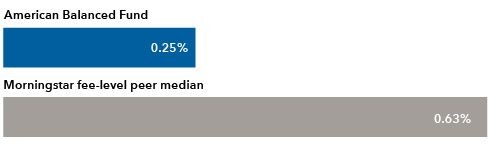

Low fees

American Balanced Fund’s expense ratio was less than half of the median for its peer group.‡ 2

Expense ratio‡ 2

RECOGNITION

Morningstar Analyst RatingTM

of Silver§

Analyst-driven 100%

Data coverage 100%

Morningstar

“Thrilling 36” fund**

Want to learn more about the fund?

We're here to help

Our dedicated retirement plan sales support can help you win and retain plans.

* Plan sponsors should consult a financial professional before selecting an investment option other than a target date series as a qualified default investment alternative (QDIA).

† Blends the S&P 500 Index with the Bloomberg U.S. Aggregate Index by weighting their total returns at 60% and 40%, respectively. Results assume the blend is rebalanced monthly. The Bloomberg U.S. Aggregate Index began on January 1, 1976. For index results prior to that date, the Bloomberg Government/Credit Bond Index was used.

‡ The fund’s Class R-6 share expense ratio is as of the most recent prospectus available at the time of publication. The peer group expense ratio median was calculated based on funds in the following Morningstar Fee Level Group — Distribution category: Moderate Allocation Retirement, Large, as of March 31, 2024.

§ As of March 19, 2024, based on Class R-6 shares.

** Source: Morningstar, "The Thrilling 36" by Russel Kinnel, August 20, 2024. Morningstar's screening took into consideration expense ratios, manager ownership, returns over manager's tenure, and Morningstar Risk, Medalist and Parent ratings. The universe was limited to share classes accessible to individual investors with a minimum investment no greater than $50,000, did not include funds of funds, and must be rated by Morningstar analysts. Class A shares were evaluated for American Funds. Visit morningstar.com for more details.

Unless otherwise indicated, data is as of December 31, 2023, and fund data is for Class R-6 shares.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

These indexes are unmanaged, and their results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

The Morningstar Allocation 50%–70% Equity category includes funds that typically seek to provide both income and capital appreciation by investing in multiple asset classes, including stocks, bonds and cash. These portfolios are dominated by domestic holdings and have equity exposures between 50% and 70%.

Capital Group did not compensate Morningstar for the ratings and comments contained in this material. However, the firm has paid Morningstar a licensing fee to access and publish its ratings data. The payment of this subscription fee does not give rise to a material conflict with Morningstar.

- Class R-6 shares were first offered on 5/1/2009.

- Calculated by Capital Group. Due to differing calculation methods, the figures shown here may differ from those calculated by Morningstar.

- Expense ratios are as of each fund's prospectus/characteristics statement available at the time of publication.