With the U.S. Federal Reserve widely expected to begin cutting interest rates before year end, investors may be tempted to build a portfolio focused on a rate cut scenario. But recent history shows there are risks in building a portfolio around a single interest rate scenario.

The risk you take in building a portfolio with a singular focus is that your assumptions and expectations might prove wrong. You build a portfolio to thrive in a falling rate environment, but rates don’t fall. Or your assumption about interest rates could be correct, but what if markets don’t behave the way you expect them to?

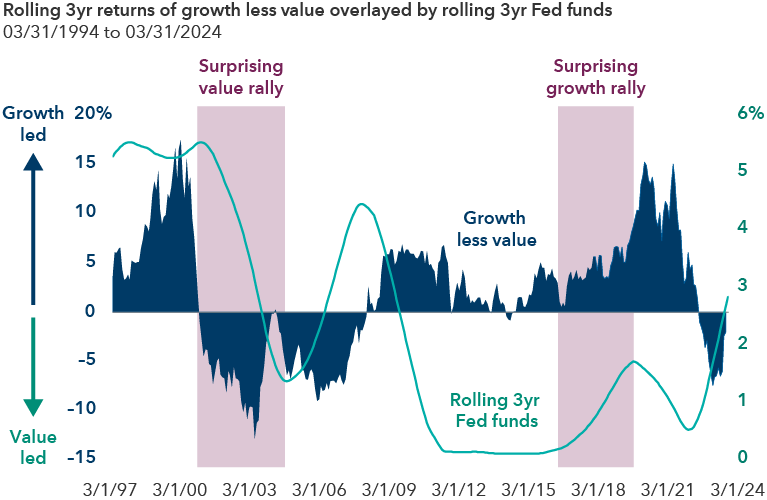

That’s exactly what happened in the red areas on the chart below: Interest rates moved, but stocks didn’t behave as expected.