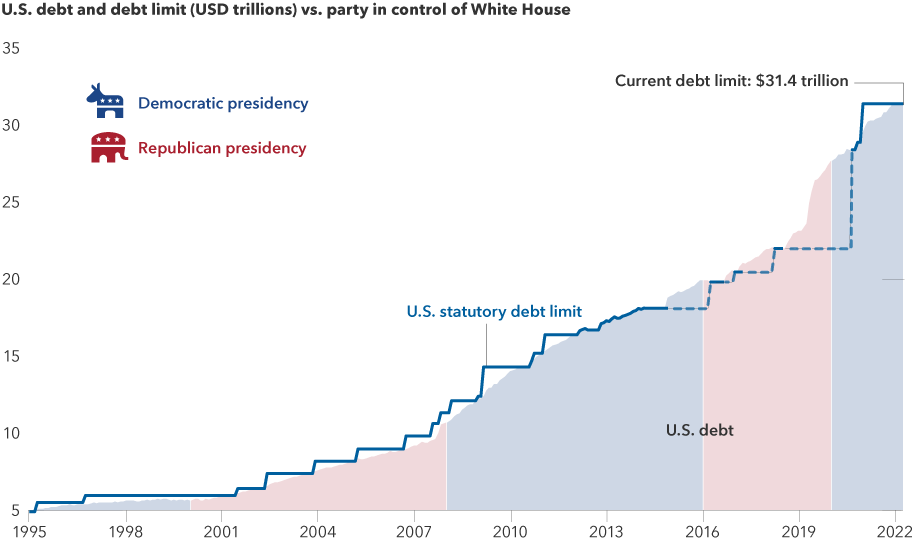

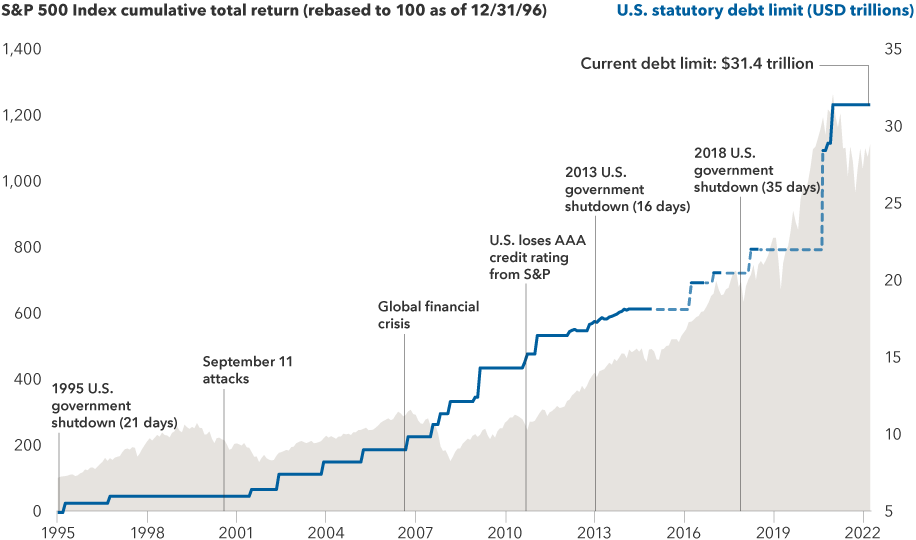

The "debt ceiling," or maximum amount of debt that the U.S. Treasury can issue, makes its way into the news cycle every few years. As part of the U.S. Constitution, Congress must routinely raise the limit to meet increasing obligations. But when the Congress is divided, a standoff can occur — a game of "will they or won’t they?" — with the creditworthiness of the U.S. government at stake.

Since the debt ceiling was established in the early 20th century, U.S. lawmakers have always reached agreement and increased the limit before any potential defaults could occur. But in recent years, Americans have witnessed increasingly contentious showdowns between political parties on whether or not to raise the debt ceiling.

Whether you consider the debt ceiling standoff to be political theater or a legitimate economic threat, your clients may have concerns about whether this latest showdown will impact the markets and their investment portfolios. As a financial professional, it’s important to be conversant in these topics in a way that takes their concerns seriously and reminds clients of the plan they have in place and the progress they have made toward long-term goals.

"One of the most difficult aspects of an advisor's job is managing clients through challenging times, keeping them from acting on instincts that may get in the way of their long-term goals," says Paul Cieslik, an advisor practice management consultant at Capital Group. "The debt ceiling debate may not factor in to your clients’ financial plans, but it offers a great opportunity to demonstrate your value and deepen relationships."

When these conversations come up, it helps to have a systematic and repeatable approach. For example: There are four steps to any effective client conversation, each with a distinct goal. "First, acknowledge where the client stands. Second, provide your perspective. Third, build confidence. And fourth, share any potential opportunities," Cieslik explains. This framework can be used in any discussion but is particularly useful in times of economic uncertainty or market volatility.