Financial markets have evolved dramatically over the last decade, spurring a new wave of innovation and opportunity across the investment landscape. Private market investments, such as private equity, private credit and direct lending, have changed sharply. These investments have the potential to provide higher returns and diversified risk compared to traditional public market investments like equities. While private market investments can offer potential benefits, there are unique risks that investors should consider.

March 25, 2025

KEY TAKEAWAYS

- Private investments have grown significantly over the past decade.

- The evolving private investment market offers financing opportunities for private companies that are reshaping how capital is allocated across the global economy.

- While private market investments can offer potential benefits, they also come with unique risks.

Why invest in private markets?

For years, sophisticated investors, including endowments, foundations, sovereign wealth funds and high net worth individuals have invested in private assets due to the potentially higher returns compared to (and diversification from) some public market investments. High net worth investors have sought to benefit from private market investments and meaningfully increased allocations in the space.

Retail investors typically face barriers to these markets, such as high investment minimums, strict eligibility requirements and long capital lockup periods, making these investments complex and less suitable for them.

Private investments have limited liquidity. That means investors may not be able to liquidate quickly and could face sharp discounts to fair value. However, innovative investment managers are working to address these challenges and bring private markets opportunities to a broader set of investors.

The basics

Private investments cover a wide range of assets with distinctive characteristics. While precise definitions differ, they can be grouped into three broad categories: private credit, private equity and real assets.

Private credit

Private loans not publicly traded originated by the investors and negotiated directly with the borrowers. Examples include:

- Secured direct lending

- Asset-based finance

- Mezzanine debt

Private equity

Equity investments made to private non-listed companies. Examples include:

- Venture capital

- Growth equity

- Leveraged buyout

Real assets

Investments that involve direct or indirect ownership of tangible, non-financial assets. Examples include:

- Real estate

- Infrastructure

- Farmland

- Timberland

- Commodities

Private investment opportunities have become too big to ignore

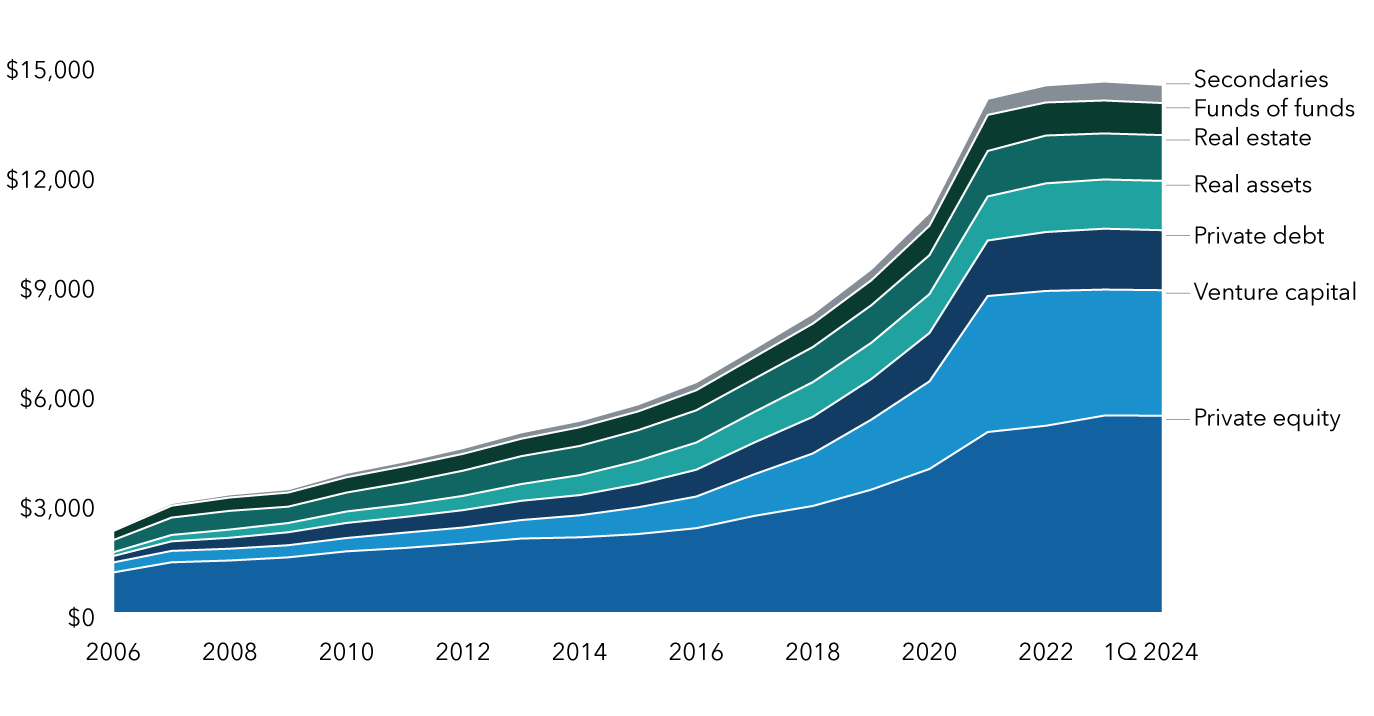

Private investment opportunities have swelled in size and may have become too big to ignore. From 2006 to 2023, the alternative investment industry grew from approximately $2 trillion to more than $14 trillion.1 This growth has been driven by several trends unlikely to reverse going forward. Three important macro trends are:

- Public markets are shrinking: After reaching a peak in the mid-1990s, the number of publicly traded companies has declined. In 1996, there were more than 8,000 publicly traded companies in the U.S. By the end of 2022, that number had dwindled to less than 5,000.2

- IPOs have lost some luster: More companies are sourcing capital from private markets. Companies that once would conduct an initial public offering to finance growth are now selling equity and borrowing directly from private investors. Companies are finding the flexibility and alignment of private investors a welcome alternative to public sources of capital.

- Innovation driving growth: Innovations in fund structures and fintech companies are introducing private investments to new segments of investors, drawing more capital to private markets than ever before.

1Source: Cerulli Associates, Pitchbook. Reflects most recently available data as of December 31, 2024. Includes dry powder and funds of funds.

2Source: World Federation of Exchanges database, World Bank. Reflects latest available data as of February 19, 2024.

Innovation has helped to mitigate private investment’s liquidity risk. One way is through a pooled investment vehicle, such as an interval fund.

Looking ahead

The potential value private markets can provide is leading investors, financial professionals and wealth managers to explore opportunities in this growing financial market segment. Understanding its complexities, potential benefits and risks can help identify whether private investments may be appropriate to integrate into a broader investment strategy or portfolio framework. Expanding into this area may be exciting, but careful consideration is essential to finding investments that support financial goals.

Learn more about Capital Group and KKR’s partnership aimed at bringing Public-Private+ solutions to financial professionals and investors.

Key terms

Endowment — A legal structure managed by nonprofit organizations to invest money gifted from donors to support initiatives such as capital improvements, academic scholarships or other programs to support a nonprofit’s mission.

Sovereign wealth fund — Government-owned investment funds that are financed from savings, tax/tariff revenue or profits from state-sponsored enterprises.

Secured direct lending — Senior loans made directly to companies outside of the banking system.

Asset-based finance — Secured loans backed by specific real or balance sheet assets; the perceived quality of collateral typically dictates potential risk.

Mezzanine debt — Junior unsecured debt sitting between senior loans and equity in the capital structure. Often is the last debt to be repaid in a bankruptcy.

Venture capital — Early-stage startup company investments that often come before a product is produced or before the company is generating revenue.

Growth equity — Later-stage/faster growing companies that are often already generating some revenue but require additional investment to fund growth initiatives.

Leveraged buyout — The act of purchasing outstanding equity in a private company using leverage to restructure or streamline operations.

Real estate — Residential and commercial buildings, land and undeveloped land.

Infrastructure — Physical and organization structures needed to operate a society or enterprise, often essential services.

Farmland — Ownership of land and cash flows generated from growing and harvesting crops.

Commodities— Refined raw materials that can be bought, sold or exchanged for a similar value.

Timberland — Land, existing forests and trees on land. Cash flows are generated from logging or other forestry activities.

Secondaries — An investment in existing interests or assets held by primary private equity fund investors.

Fund of funds — An investment strategy that pools money from investors to purchase structured funds rather than individual securities or individual investment opportunities.

Dry powder — Cash that an investment manager has to dedicate to investments but has not yet invested.

Interval fund — An interval fund is a type of closed-end fund that does not trade on an exchange but is instead continuously offered similar to a mutual fund, but only allows redemptions at regular intervals and up to a certain percentage of the fund's outstanding shares, as predetermined by the fund. This results in interval funds being less liquid than traditional fund structures, meaning investors cannot sell shares as quickly as they can with mutual funds or ETFs, for example, for which they generally have the ability to sell shares daily.

Mutual fund — A mutual fund is a type of investment company, also known as an open-end fund, that pools investment money to invest based on pursuing a particular investment objective. A mutual fund continuously sells and redeems shares to investors. A mutual fund is priced daily based on the underlying value of the assets it holds, also known as net asset value (NAV).

Exchange-traded fund (ETF) — An ETF is a type of investment company that’s similar to a mutual fund because it can provide diversification, but unlike a mutual fund, it trades like a stock. Investors can purchase and sell ETF shares at the current market price in the secondary market, like a stock exchange where most stock trading occurs.

Capital Group and KKR are not affiliated. The two firms maintain an exclusive partnership to manage and seek to deliver public-private investment solutions to investors.