For investors who identify tax efficiency as a top concern, financial professionals know they can use ETFs to pursue more control over annual tax liabilities. But there are additional ways to leverage ETFs to help minimize capital gain distributions (and help reduce an investor's yearly tax bill), particularly for those who have unrealized losses over the last 12 months. We explore five ideas below.

December 11, 2025

Capital Group active ETFs can be used for:

Idea #1: Tax-loss harvesting

Tax-loss harvesting can be a useful tool because it allows investors to turn a setback into an opportunity. Taxable gains can be reduced by selling investments at a loss and replacing them with other investments. If losses exceed capital gains at year end, the losses can be applied to noninvestment income up to a specific limit to help offset future capital gains.

At Capital Group, we provide investors with a suite of active ETFs that can give their financial professionals the opportunity to tax-loss harvest current investments that no longer meet an objective, or tax-loss harvest current investments in favor of vehicles that may offer greater tax efficiency.

Tax-loss harvesting can be used for both equity and fixed income allocations. Financial professionals should keep in mind that fixed income ETFs may distribute capital gains in certain years for different reasons, and along with the tax efficiencies of an ETF, an active approach can help seek better outcomes.

Idea #2: Constructing fee-based models

Model portfolios allow financial professionals to blend complementary investment approaches, from different asset managers and across a range of investment products, to deliver solutions to help meet investors’ long-term needs. Getting portfolio construction right is especially important during challenging market environments.

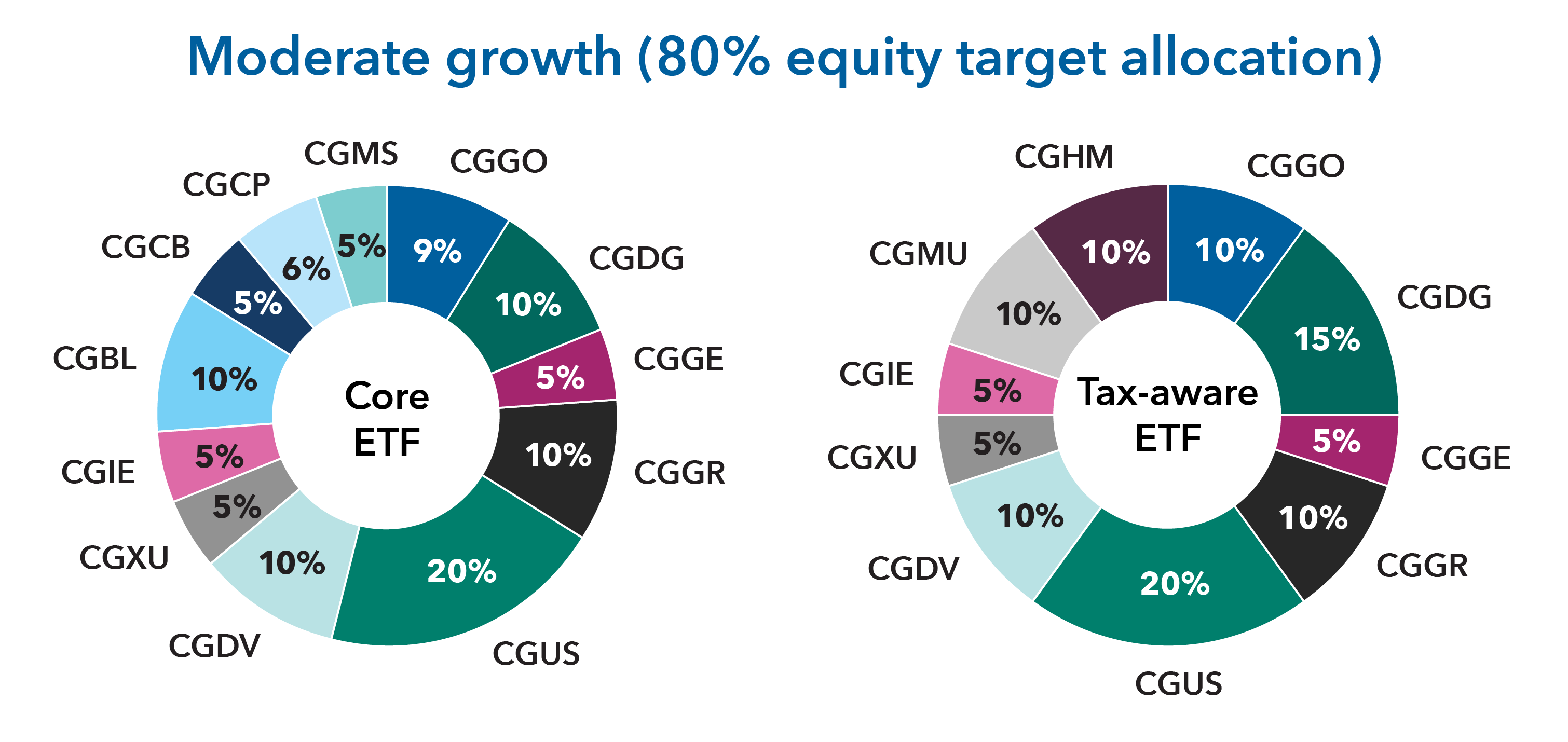

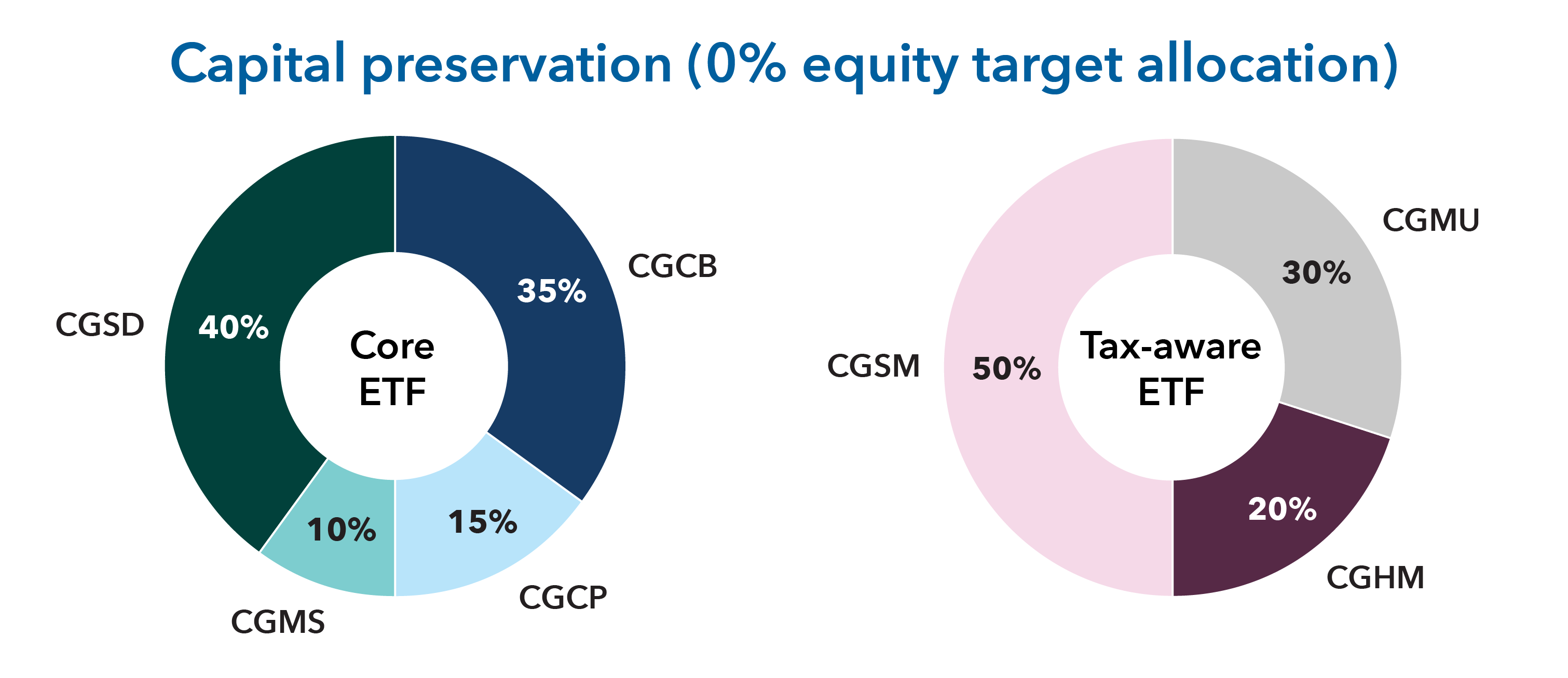

Below is an example of implementation ideas using Capital Group ETFs for an investor looking for moderate growth and an investor looking for capital preservation, available for both core and tax-aware portfolios.

The allocations shown reflect Capital Group’s ideas on how to build portfolios using all Capital Group ETFs across a variety of asset allocation preferences. These implementation ideas are not managed portfolios and should be considered as a part of a more holistic portfolio construction framework.

Curious for more implementation ideas? Explore our brochure for financial professionals that features even more perspectives on how to use our active ETFs in core and tax-aware portfolios.

Need a more personalized discussion? Using a wide variety of investment strategies, Capital Group’s portfolio construction team can perform a portfolio analysis to help financial professionals develop portfolio recommendations that reflect their investors’ long-term financial goals. To partner with our portfolio construction team, request a consultation.

Idea #3: Rebalancing portfolios

When tax-loss harvesting, financial professionals may suggest that instead of having a similar allocation*, clients consider other options that may help position their portfolios to better pursue their long-term financial goals, such as:

- Shifting away from individual holdings in favor of ETFs to improve portfolio diversification

- Moving from investment vehicles that are less focused on tax efficiency and into ETFs

- Reducing passive index ETFs at the core of portfolios in favor of active core ETFs

Idea #4: Investing cash

Inflation can threaten an investor’s bottom line. To potentially avoid the loss of purchasing power and the impact of longer term inflation, consider investing cash in ETFs that align with investors’ short- and long-term financial goals. There are ETFs to pursue income while seeking a low-risk profile that can serve as an alternative to cash or ETFs designed to offer enhanced cash options, such as Capital Group Short Duration Income ETF (ticker: CGSD), a short duration bond fund, and Capital Group Municipal Income ETF (ticker: CGMU), an intermediate-term muni fund.

ETFs appeal to many investors because they:

- Generally offer a relatively low-cost way to easily diversify portfolios

- Can be used to construct a complete portfolio or complement an existing portfolio

Idea #5: Reinvesting dividends into ETFs

Many investors automatically reinvest dividend payments directly back into the fund that produced them. However, some investors may benefit from taking dividend payments as cash and reinvesting them into ETFs, which may have the potential to:

- Reduce capital gain liabilities for investors focused on tax efficiency

- Improve overall portfolio diversification

Investors’ individual circumstances should be carefully considered, but reinvesting dividends could be a way to incorporate tax efficiency into existing portfolios. Capital Group ETFs were built for the core, aiming to provide solutions for some of the most common portfolio allocations and using active management to help investors pursue better outcomes.

See an idea you like? Contact us.

There are many benefits to investing in ETFs for investors in both qualified and nonqualified accounts. These are just a few ways to use ETFs to help manage the tax efficiency of their investments. To further explore these ideas, contact your Capital Group representative or call us at (800) 421-9900.

Anthony Wingate is an ETF sales specialist at Capital Group, home of American Funds, covering the Western U.S. He has 19 years of industry experience and has been with Capital Group for three years. Prior to joining Capital, Anthony worked as a sales executive at Vanguard. He holds an MBA and a bachelor's degree in business administration, both from the University of Arizona. Anthony is based in Los Angeles.