American Mutual Fund®

INCEPTION DATE

February 21, 1950

IMPLEMENTATION

Consider for a U.S. large cap value allocation

OBJECTIVE

The fund strives for the balanced accomplishment of three objectives: current income, growth of capital and conservation of principal.

VEHICLE

American Mutual Fund

The focus of American Mutual Fund is on companies, not sectors or styles. In-depth, bottom-up research is used to identify companies with attractive growth-and-income opportunities. The fund's holdings include 173 companies across multiple sectors as of December 31, 2023.

DEEP, COMPREHENSIVE RESEARCH

Conservative, high-quality investment approach

For over 70 years, American Mutual Fund has had a focus on high-quality companies supported by a disciplined eligibility process. The fund's portfolio managers and analysts use a rigorous, research-driven approach to identify companies that can help meet the income and income-growth needs of investors.

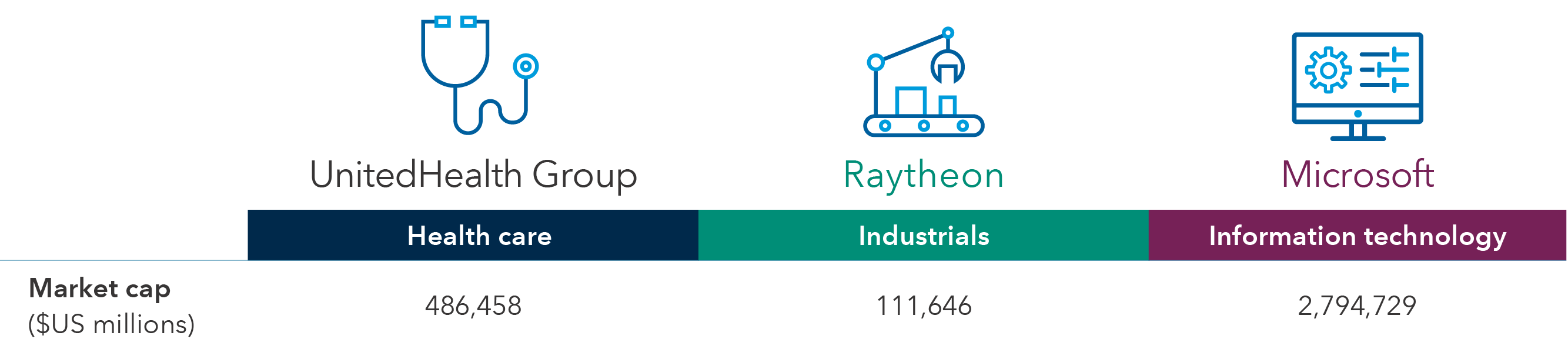

Identifying potential opportunities in a broad range of sectors

Examples of top holdings in the portfolio (as of December 31, 2023)*

Sources: Capital Group, FactSet, Morningstar.

American Mutual Fund

American Mutual Fund is offered in various share classes designed for retirement plans, nonprofits, and other institutional and individual investors.

*Companies shown are among the top 10 holdings by weight in American Mutual Fund as of 12/31/23 (Microsoft, AbbVie, Raytheon, Apple, Abbott Laboratories, General Electric, Union Pacific, UnitedHealth Group, Linde PLC, JPMorgan Chase).

Portfolios are managed, so holdings will change. Certain fixed income and/or cash and equivalents holdings may be held through mutual funds managed by the investment adviser or its affiliates that are not offered to the public.

© 2023 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Use of this website is intended for U.S. residents only.