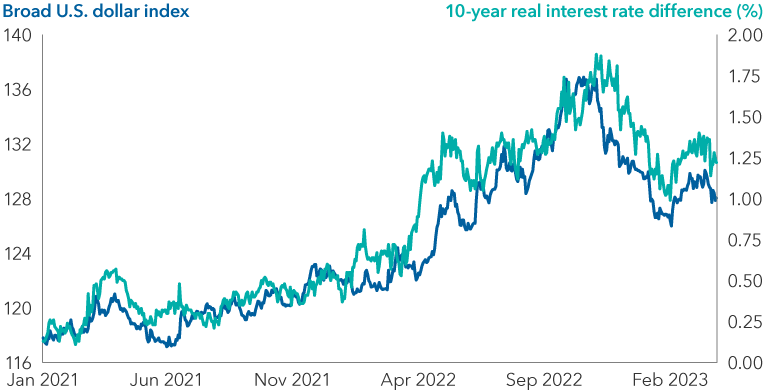

Several factors supported comparatively higher U.S. nominal and real interest rates: a hawkish Federal Reserve more determined to raise interest rates than the European Central Bank (ECB), the Bank of England (BOE) or the Bank of Japan (BOJ), plus a strong and productive U.S. economy and higher inflation.

Now this picture is changing, especially relative to the euro. The swift collapse of three U.S. regional banks — SVB Financial, Signature Bank and Silvergate Bank — has led bond markets to lower expectations for both the terminal federal funds rate and Treasuries across the yield curve. Meanwhile, European bond yields could still move higher as the ECB stays on its rate-hiking path should inflation pressures persist.

It’s also been interesting to see that in the most recent episode of market volatility attributable to the banking sector, the dollar has hovered in a range of 92 to 94 cents to the euro. Swift action by the Federal Reserve to provide dollar liquidity via swap lines with other central banks provided support to the U.S. currency. (Swap lines are agreements between two central banks to exchange currencies. They allow a central bank to obtain foreign currency from the central bank that issues it and distribute it to commercial banks in their country.)

Overall we expect the differential between U.S. interest rates and those in Europe to narrow. This could remove some support for the dollar, which was trading around 92 cents to the euro as of March 31.

One reason for a potential narrowing: The ECB started hiking later than the Fed. After raising rates by 250 basis points (bps) last year, the ECB probably has further to go if it wants to bring inflation closer to its 2% target. Meanwhile, the Fed may be closer to pausing, or potentially cutting rates, than it had anticipated before the U.S. bank failures. Markets expect the rate gap to decrease by about 90 bps (from around 1.8% to 0.9%) by the end of the year.

Meanwhile, the BOE increased its policy rate by nearly 425 bps, putting U.K. nominal and real interest rates closer to the U.S. than either the ECB or the BOJ. Its actions helped lift the pound 15% against the U.S. dollar after U.K. government turmoil forced it to an all-time low in September 2022. What happens next to the sterling will likely depend more on potential further rate hikes than any other variable. At this point, the BOE seems less aggressive than the ECB or the Fed.