A great deal of market commentary over the past several months has focused on the potential for the U.S. economy to achieve a “soft landing.” What exactly is that?

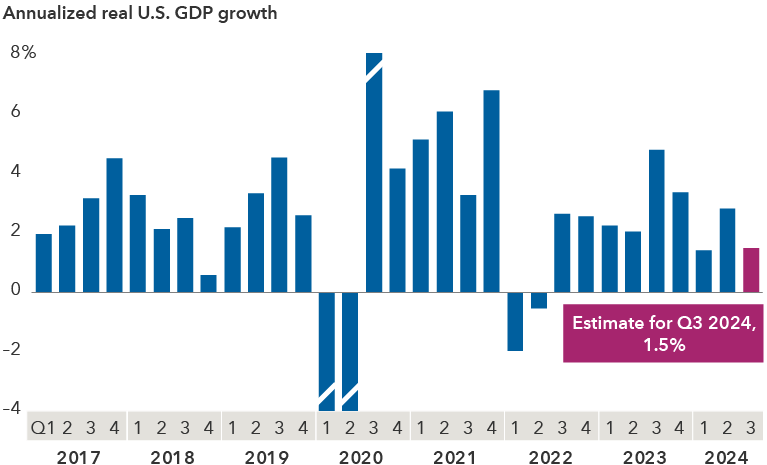

A soft landing essentially describes an economy that slows enough to allow inflation to fall, but not so much that it tips into a recession. It is an achievement that many investors doubted could occur two years ago when the Federal Reserve first launched its fight against inflation.

Even I thought the window of opportunity was narrow. However, since then, inflation has come down, job creation has cooled but remains positive, and the U.S. economy has avoided a recession. The inflation battle isn’t over, as it remains above the Fed’s 2% target. However, it is close enough that Fed Chair Jerome Powell all but promised a rate cut during his highly anticipated speech in Jackson Hole, Wyoming, last week.