Chart in Focus

Capital Ideas

Investment insights from Capital Group

Market Volatility

In his annual letter to Berkshire Hathaway shareholders, legendary investor Warren Buffett discusses the reemergence of market volatility in recent weeks. With stocks declining sharply for the first time in years, investors are clearly searching for guidance. At Capital Group, we have lots of experience with market volatility over many years.

In this interview, Capital Group Chairman and CEO Tim Armour addresses the drivers of the sudden downturn and his long-term outlook for the financial markets.

Stocks have declined in recent days amid investor concerns about higher inflation and rising interest rates. In this interview, Capital Group Chairman and CEO Tim Armour discusses the drivers of this sudden downturn and his long-term outlook for the financial markets.

You’ve been saying for quite some time that investors should expect a pullback in the markets, and clearly that time has arrived. What’s driving it?

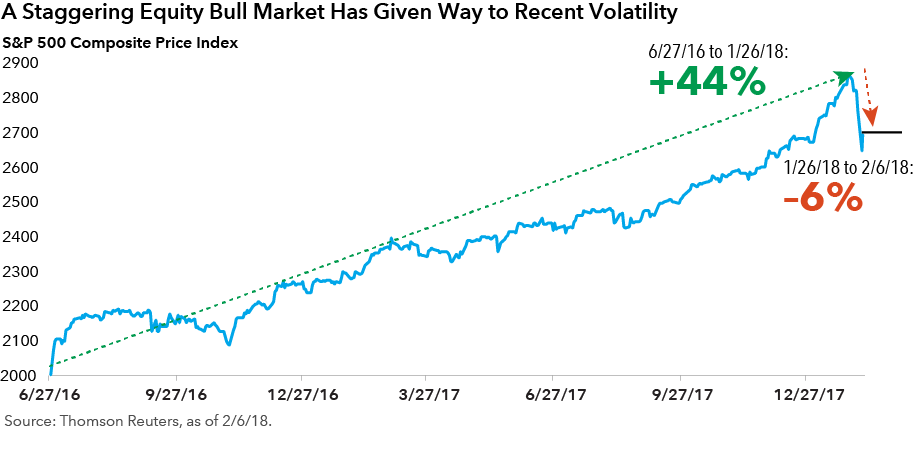

Market returns have been very strong for a long time — and for good reason. The global economy is improving. Interest rates have been at all-time lows. Central banks around the world have been priming the pumps to help us recover from the 2008-09 global financial crisis. So there’s been a very strong backdrop supporting equity prices.

We were overdue for some kind of correction. As you know, we remain focused on the long term. We still feel good about the economic backdrop for corporate earnings, and we think there are plenty of opportunities. I am not overly concerned about this pullback. Markets do better over the long term when they experience corrections periodically; they can’t go up all the time.

What’s your view on rising U.S. interest rates and the implications for equity markets?

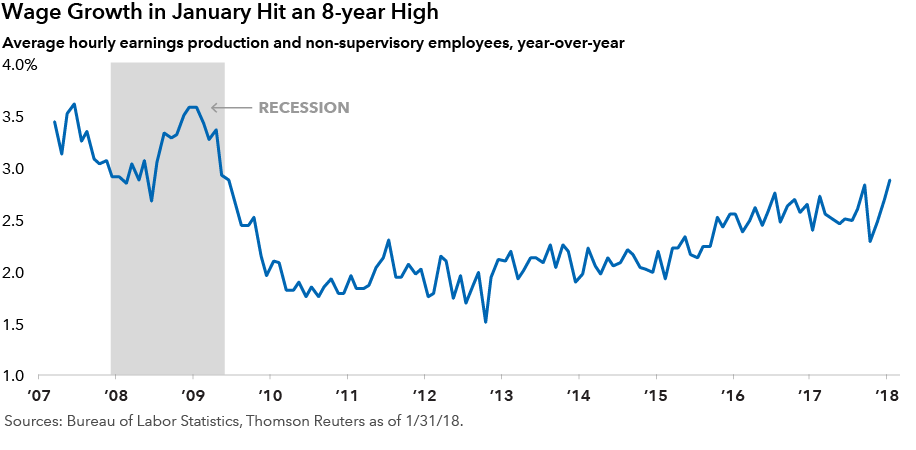

We keep a close eye on interest rates, which are always an important factor for equities. Rates have been slowly ticking up and that makes investors rightfully a bit cautious. On top of that, we’ve had unemployment levels continue to drop and economic growth is improving. Most recently, we’ve had good wage growth. That means inflation could be coming down the pike and, presumably, interest rates may continue going up.

If rates were to climb too quickly, one would have to question whether equity values are appropriate at current levels. In my judgment, that would require a pretty big move in rates and, thus far, we have not seen it and that is not our baseline expectation. So the economic backdrop remains positive and, in my view, this pullback is simply helping to get some of the froth out of the market. Some volatility is a natural part of investing and it is healthy for markets.

It appears that good economic news has not been well-received by markets, at least in the short term. How do you think about that dynamic?

Let’s take wage growth as an example. Some wage growth would be healthy for the U.S. economy. But, just like anything else, you want the right amount. Too much wage growth makes investors nervous about inflationary pressures, and not enough wage growth fails to give us the rise in personal income that helps fuel greater consumption and higher economic growth.

On top of that, with the U.S. tax reform bill passing in December, it now appears that companies are going to start investing more in capital spending, which is the other leg that can help drive faster economic growth. So the key question is, can that growth happen without the economy and inflation heating up too much? My belief is that it can happen, but we have to watch it closely and we will continue to monitor it.

What is your outlook for stocks from here?

The U.S. led the world out of the global financial crisis. Asia followed next and Europe was the slowest as Europe had some of the biggest problems in the banking system. Today, U.S. growth is pretty healthy and Europe has been growing at a faster rate off a lower base. Asia has also shown solid growth.

So I am optimistic that all the pieces continue to be in place: we have relatively low inflation, interest rates that are still low on a historic basis. Revenue growth for companies is pretty good because consumption around the world is improving. My view is that corporate earnings will continue to be strong. So the backdrop continues to be pretty good.

Were you surprised by the severity of this selloff?

I am never surprised by what the market will do in the short term. Frankly, I was a bit surprised at how fast the market was moving up in January. It seemed out of sync with the underlying fundamentals. So, in that same vein, a sharp pullback doesn’t surprise me. The sharpness of the decline was partly driven by algorithmic trading. That said, it’s clear that market volatility is on the rise and that trend will probably continue for a while.

You’ve been investing for decades. What have you learned from prior market cycles that informs your view today?

In my 34 years, I’ve seen a lot of market cycles and lived through some very volatile periods. With experience, you begin to understand that none of us can predict what the market is going to do in the short term. But what we can do is identify good companies that we think are growing and will be better and bigger companies 10 years from now. If we get that right, through all sorts of market cycles, we are going to do well for our investors.

The most important lesson I’ve learned over time is that you have to contain your emotions. It’s not easy to do on the way up, and it’s not easy to do on the way down, but it is your enemy in terms of creating wealth over time. Sticking with the fundamentals, employing good asset allocation, and maintaining a balanced portfolio with a long-term horizon is the best approach.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Tim Armour

Tim Armour