Chart in Focus

Economic Indicators

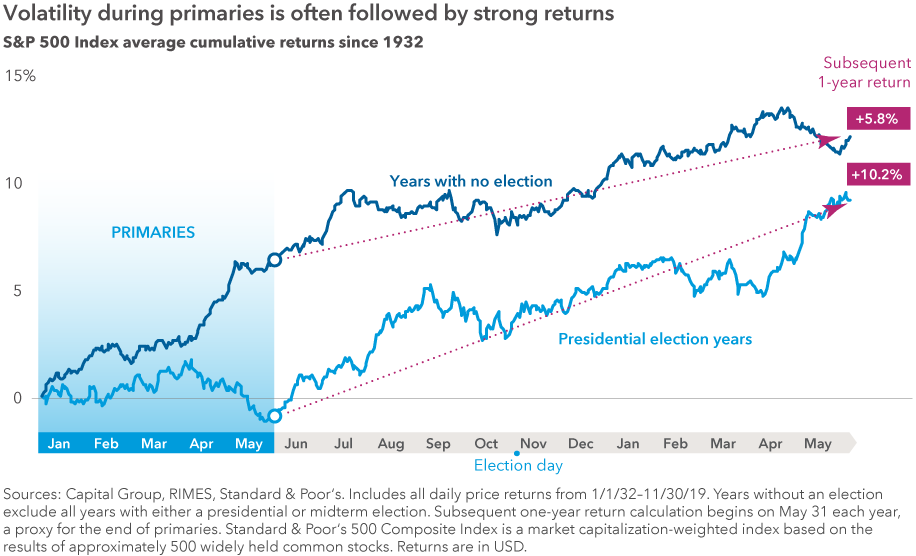

- Investor patience is a virtue in volatile U.S. presidential election years.

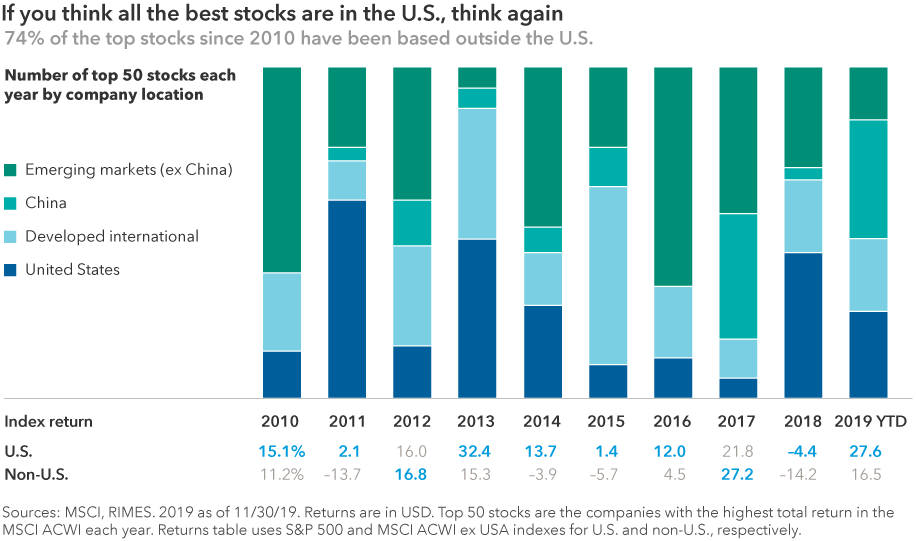

- International stocks appear attractive on a company-by-company basis.

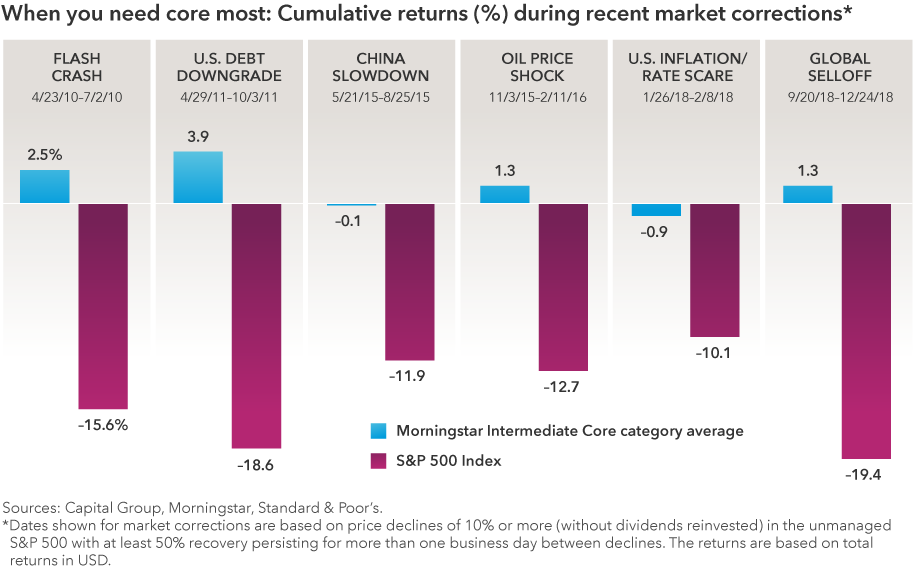

- Consider upgrading bond portfolios as rates stay lower for longer.

U.S. outlook: Maintain balance in this election year

Heading into 2020, there is little doubt that politics will dominate the news cycle. For investors, U.S. presidential elections often bring heightened market volatility, especially during the rough-and-tumble primary season. Add that to the U.S.-China trade war, the U.K.’s Brexit drama, slowing global economic growth, civil unrest in Hong Kong, impeachment proceedings in Washington D.C., and you’ve got a classic “wall of worry” for markets to climb.

On the surface, the 2020 presidential election would appear to be a highly consequential event with major implications for the U.S. economy and markets, not to mention the rest of the world. However, history suggests that may not be the case. U.S. markets have consistently trended upward after presidential elections, rewarding patient investors — regardless of who occupies the White House.

“Presidents get far too much credit, and far too much blame, for the health of the U.S. economy and the state of the financial markets,” says Capital Group economist Darrell Spence. “There are many other variables that determine economic growth and market returns and, frankly, presidents have very little influence over them.

“As we move into the new year, I think we will start to see some improvement in U.S. economic growth, helped along by easy monetary policy,” Spence continues. “But I don’t think the winner of the next election, whether it’s a Democrat or a Republican, will have much of an impact beyond the usual short-term market gyrations.”

International outlook: Consider a borderless approach

Investors who are worried about political risk in the U.S. might want to look overseas for a broader set of investment opportunities. Not because international stocks have any less political risk, but because the world has changed dramatically under the influence of free trade, global supply chains and the rapid growth of multinational corporations.

From an investment perspective, national borders are no longer as relevant as they used to be. Many companies headquartered in Europe, for instance, derive much of their revenue from the U.S., China or Latin America.

“Where a company gets its mail is not a good proxy anymore for where it does business,” explains Rob Lovelace, a Capital Group portfolio manager.

Moreover, many of the best stocks each year are found outside the United States. If you look at individual companies instead of index returns you’ll find that the companies with the highest annual returns each year were overwhelmingly located outside the U.S. In 2019, 44 of the top 50 stocks were based on foreign soil. Investors who opted not to go outside the U.S. missed a shot at those companies, many of which are small to mid-sized firms with potentially faster growth opportunities.

Fixed income outlook: Think about upgrading your bond portfolio

Over the past year, the bond market has reminded investors that not all is well with the global economy. Central banks around the world have cut interest rates aggressively in a bid to offset the negative effects of U.S.-China trade tensions, persistent deflationary pressures and slowing growth in China, Europe and elsewhere.

In the U.S., an inverted yield curve has suggested that a recession may be looming. In Europe and Japan, negative interest rates have spread like wildfire — with more than $15 trillion of bonds trading at negative yields.

In such uncharted waters, investors would do well to upgrade their bond portfolios as a counterbalance against periods of equity market volatility, says Mike Gitlin, head of fixed income at Capital Group.

“In an extraordinary market like this, balance is essential,” Gitlin stresses. “Amid unusual market trends and mixed economic indicators, a strong core bond allocation may be your best defense.”

2020 Outlook: Key takeaways

Stay balanced in an election year

- Patient investors can do well in election years. We looked at every election since 1932 and found that primary seasons are volatile, but markets have notched solid gains afterward.

- Recession in 2020? Not if the consumer stays this strong. In the U.S., consumer strength should continue to offset a manufacturing slowdown caused by trade uncertainty.

Consider upgrading your equity portfolio

- The best offense is a good defense. It’s not too soon to prepare portfolios for rougher seas as we face headwinds from an election year and a slowing global economy.

- Look for sustainable dividends, not just “value” stocks. The value label can be misleading; it’s not always defensive. Consider selecting companies with the potential to maintain dividend payments in tough times.

Think about upgrading your bond portfolio, too

- Consider revisiting your bond allocation. Given the late-cycle U.S. economy and weakness abroad, we think a fixed income allocation should be mostly core bonds that can help mitigate stock market volatility.

- Explore complementary assets to high-yield corporates. High-income munis and emerging markets bonds have offered similar after-tax income potential — often with lower correlation to equities.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds. Income from municipal bonds may be subject to state or local income taxes and/or the federal alternative minimum tax. Certain other income, as well as capital gain distributions, may be taxable.

Standard & Poor’s 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

©2019 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The market indexes are unmanaged. Investors cannot invest directly in an index.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

MSCI ACWI ex USA is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, excluding the United States. The index consists of more than 40 developed and emerging market country indexes.

MSCI ACWI is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Darrell Spence

Darrell Spence

Rob Lovelace

Rob Lovelace

Mike Gitlin

Mike Gitlin