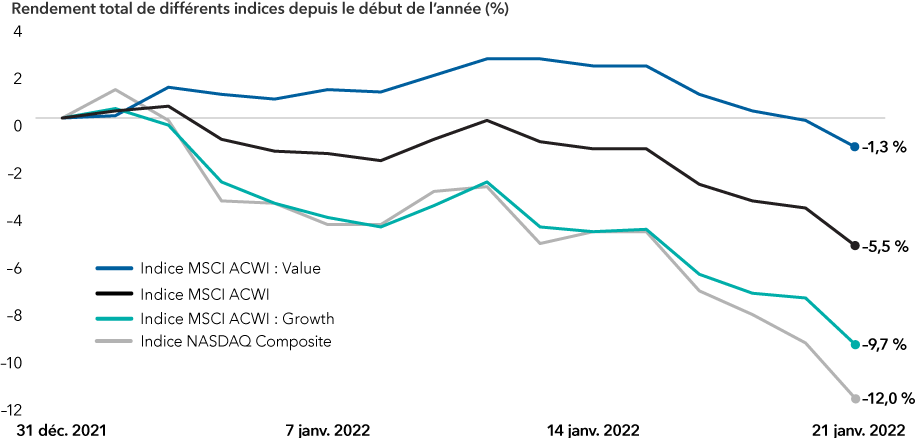

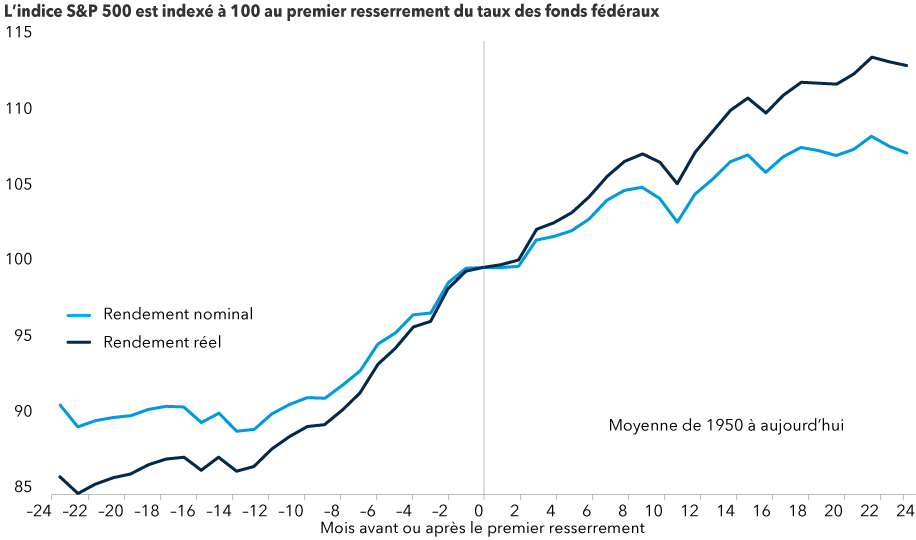

Fears of persistent inflation and tightening monetary policy have rocked markets since the start of the year. More richly valued sectors like technology suffered the initial brunt of the sell-off as their valuations came under close scrutiny with the expectation of higher interest rates. The volatility spread to blue chip stocks with the Standard & Poor’s 500 Composite Index briefly entering correction territory on Monday before whipsawing back. On Wednesday, markets gyrated again before closing nearly flat as the Federal Reserve hinted it may move more quickly than previously expected to hike rates and shrink its balance sheet.

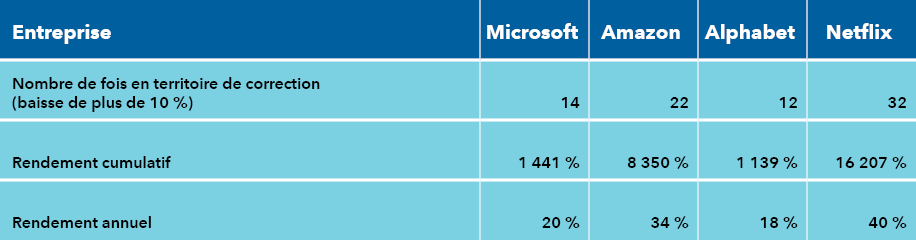

Renewed geopolitical tensions, ranging from the Russia/Ukraine border crisis to U.S.-China relations, are also fueling market uncertainty and are likely to keep some pressure on asset prices in the months ahead. While volatility is likely to persist, several of our investment professionals believe markets are healthier than many people realize.

Below are some of their views on how the market correction and Fed policy changes may provide an opportunity to adjust portfolios, taking selective action where they have long-term convictions to position portfolios for the next three to five years.