Chart in Focus

Market Volatility

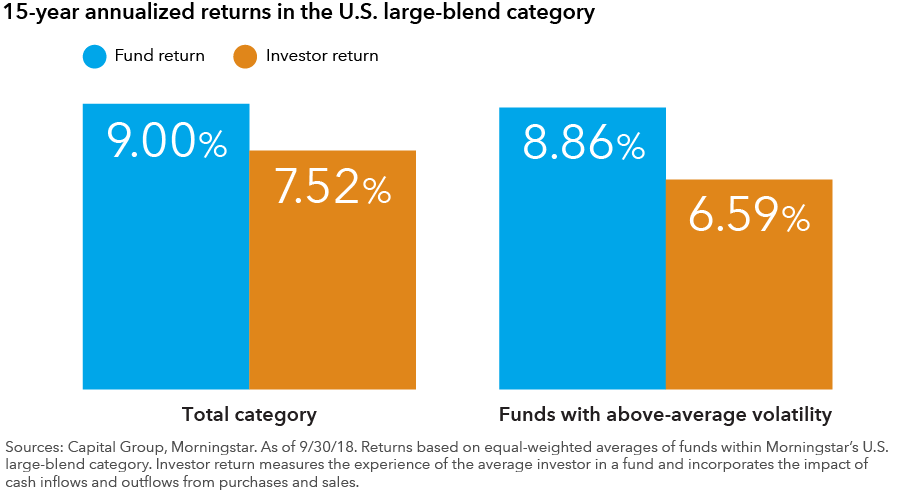

Concerned about volatility in your equity portfolio? Trying to time the markets probably isn’t the answer. Data from Morningstar shows that, on average, investor returns lag fund returns. A fund’s investor return includes the impact of purchases and sales of the fund. The difference between the two return measures is considered a proxy for investors’ ability to time markets. Investor returns lag because many investors chase past performance and end up buying funds too late or selling too soon. This effect is amplified in higher volatility funds, which are more prone to periods of sharp declines that could cause investors to sell prematurely and miss a subsequent rebound. Investors should consider a more disciplined, long-term approach to investing and avoid jumping from fund to fund, especially when faced with higher volatility.

Past results are not predictive of results in future periods.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.