Chart in Focus

Japan

After decades of flat to negative economic growth, persistent deflationary pressures and stagnant wage growth, Japan’s economy has experienced a sustained recovery of late. As the global economic outlook has improved this year, so has Japan’s export-oriented economy, which is dominated by prolific auto makers and innovative technology companies.

In my view, Japan’s long-struggling economy may be nearing the light at the end of the tunnel, but there is by no means any guarantee that it will emerge on the other side any time soon. Gross domestic product (GDP) growth has continued to improve this year, rising 2.5% in the second quarter, roughly on par with the United States. Export activity is on the upswing, business capital expenditures are climbing, and the labor market is historically tight.

A nation without inflation

However, one crucial element is missing: inflation. With so many other economic indicators in positive territory, one would expect to see higher inflation at some point. And, the fact is, that’s just not happening in the world’s third largest economy.

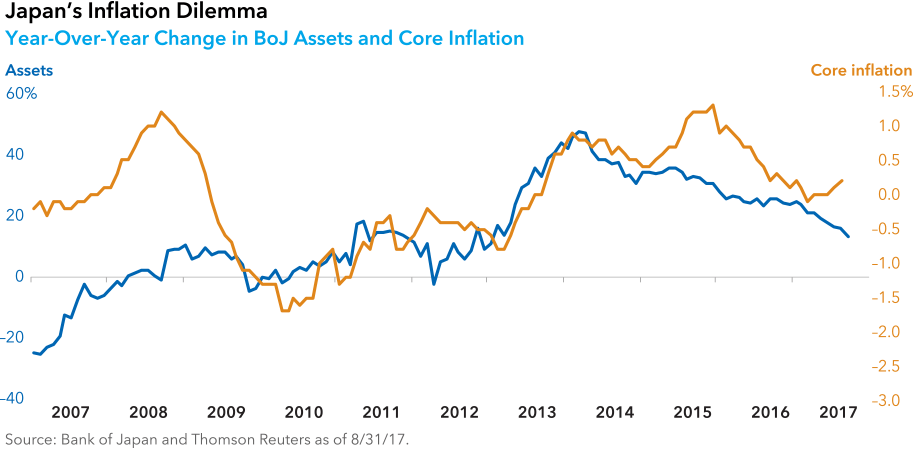

Consumer price increases generally have remained well below 1%, despite massive monetary stimulus measures from the Bank of Japan (BoJ) and many years of ultra-low interest rates. A big injection of BoJ stimulus in 2013 boosted inflation for a time, but it has since drifted lower, unable to sustain itself without aggressive central bank intervention.

The BoJ is currently buying ¥60 to 80 trillion per year of Japanese government bonds in an attempt to stimulate lending and jumpstart the economy. Japan is essentially the “grandfather of quantitative easing,” an experimental stimulus policy since adopted by many other central banks around the world, including the U.S. Federal Reserve and the European Central Bank.

But while the Fed and the ECB are now enacting or at least discussing the need for tighter monetary policy, a lack of inflation has left the BoJ in a divergent position, largely out of sync with the rest of the world. The BoJ’s core inflation target is 2%; however, it hasn’t touched that level in years, and the most recent reading came in at 0.2%.

Drumbeat of positive economic data

This stubbornly low inflation rate is especially perplexing given the long list of positive economic developments in recent months:

- Japan’s economy grew at an annualized rate of 2.5% in the second quarter, the fastest rate of growth in more than two years. It was the sixth consecutive quarter of positive growth, the strongest run we’ve seen since 2001.

- Export activity increased by 18.1% in August, the ninth consecutive month of growth and well above consensus estimates. Exports to North America grew by nearly 23%, clearly benefiting from an improving U.S. economy.

- Japan’s unemployment rate stood at a two-decade low of 2.8% in August, and the nation’s job availability index remained at a four-decade high, reflecting one of the tightest labor markets in the world

- Japanese stocks have gained 14% on a year-to-date basis through September 29, as measured by the MSCI Japan Index. They’re outpacing the rallying U.S. stock market, which has gained 13% so far this year, as measured by the S&P 500 Index. The yen, meanwhile, is up 3.5% against the dollar.

By these measures, the pace of economic activity has picked up nicely in Japan — but that’s partly due to an improving global economy. Quite a few challenges remain. Inflation is likely to move somewhat higher in the near term; however, a lack of significant wage growth could hold back more substantial and lasting gains.

The reality is that Japan’s economic revival effort is taking more time than most observers and policymakers expected. The window of opportunity to enact important fiscal, economic and labor market reforms — while times are relatively good — will close at some point, either when the global economy slows down or if there is a change in political leadership.

Last week, Prime Minister Shinzō Abe dissolved the lower house of Japan’s parliament and called a general election for October 22. Riding high in the opinion polls, Abe may be able to bolster political support for his economic reform measures, assuming the snap election goes his way.

Investors will surely be keeping a close eye on the outcome.

Past results are not predictive of results in future periods.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Anne Vandenabeele

Anne Vandenabeele