Americans are living longer than ever before. Everyone knows that, it seems, except investors! Retirees frequently underestimate their life expectancy and the number of years they are likely to spend in retirement. It is critical we help investors understand their accurate life expectancy and the implications for retirement income planning. While the uncertainty of longevity cannot be eliminated, we can plan and manage for it. Let’s discuss why longevity, as well as life expectancy, need to be more forefront in retirement income planning conversations.

October 25, 2023

KEY TAKEAWAYS

- Life expectancy is underestimated. 53% of retirees underestimated or did not know the life expectancy of a 60-year-old American.1

- A simplistic approach to longevity planning may overlook a client’s health and lifestyle choices, which help determine a client’s lifespan.

- It is critical we help investors understand a more complete view of their life expectancy probabilities and the implications for retirement income planning.

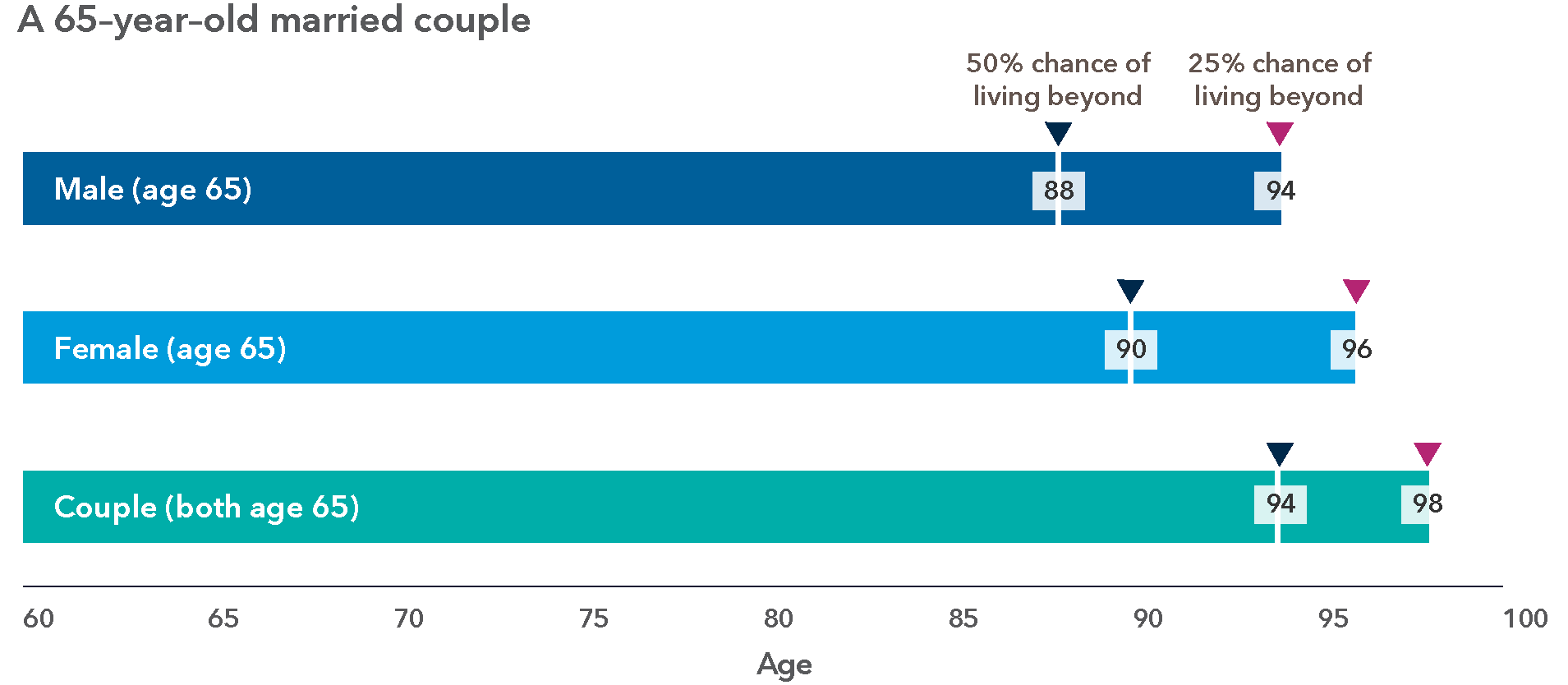

Figure 1. Life expectancy of a 65-year-old married couple

What is life expectancy in the first place? Life expectancy from birth tends to be the statistic we hear most often: a man or woman born in a certain year has X average life expectancy. This information has little relevance for someone reaching retirement age. For example, it makes no sense for a female who has reached age 84 to base their retirement-planning horizon on the statistical average life expectancy from birth of 80 years.2 For the purposes of retirement income planning, a more relevant statistic is life expectancy at attained age. In fact, an 84-year-old non-smoking woman in excellent health has a 50% life expectancy of about eight years and a 10% probability of living for another 16 years.3 The median life expectancy probability (50%) for both males and females at age 65 is into the late 80s and, for couples, one spouse is expected to live into their 90s, as shown in Figure 1.4 But this picture can also mislead planning for a retirement income horizon because these statistics are based on the median probability of the entire population. While the term lifespan refers to the maximum number of years an individual can live, life expectancy refers to an estimate or an average number of years a person can expect to live. Many of your investors may have a survival probability that is much longer than the median as there are large differences in life expectancy depending on various economic and demographic factors.

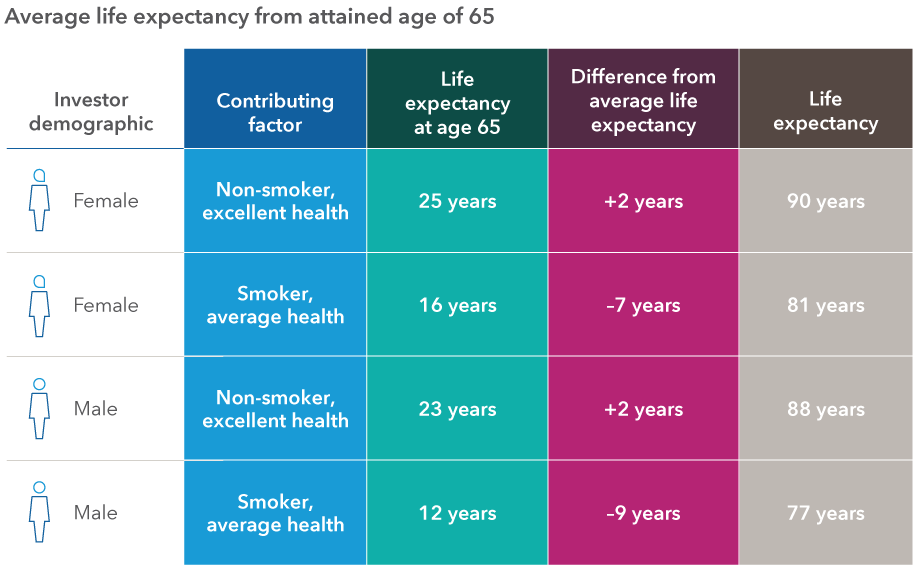

Figure 2: Planning horizon from attained age 65

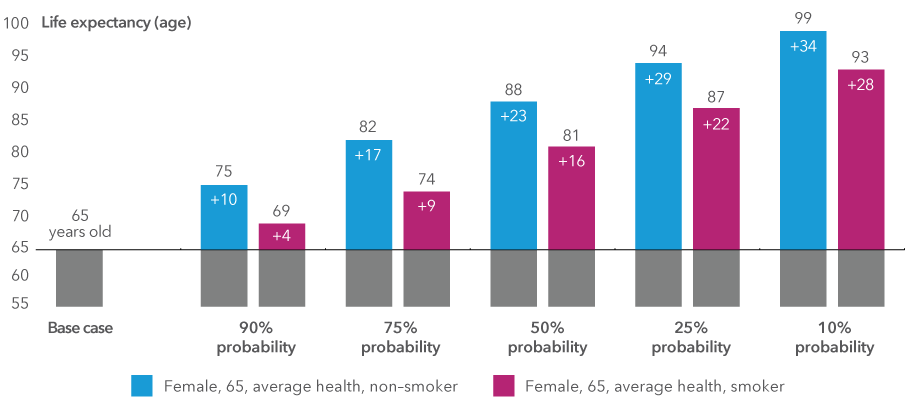

Contributing factors: OK if I smoke? To provide more perspective for clients, consider utilizing individual mortality factors such as gender, smoking choices and general state of health to sharpen the life expectancy probability.5 This will help to ensure the planning horizon matches up with their actual financial longevity risk and to provide your clients a more accurate picture of their retirement income horizon. For instance, suppose your investor is a 65-year-old woman who smokes and self-reports average health. Utilizing the Longevity Illustrator,6 she has a 50/50 chance of living at least another 16 years, to age 81, compared to age 90 if she were a non-smoker. But, as a smoker, she also has a 25% probability of living at least another 22 years, to age 87. And if she were a non-smoker, in average health, she would be likely to live another 29 years to age 94! This range illustrates the uncertainty surrounding how long someone might live and that longevity shouldn’t be viewed as a single point in time. These results may surprise many, considering that in a survey conducted by TIAA Institute, 53% of responders either did not know the life expectancy of a 60-year-old American, or underestimated it.7 Underestimation of life expectancy, together with having too short a planning horizon, can result in inadequate planning for retirement income needs. Incorporating contributing longevity factors beyond outliving the median statistics is a critical part of your client conversations.

Figure 3: Probability of living past of age 65

Reframing longevity with your clients: While the uncertainty of how long someone may live cannot be eliminated, you can help investors better understand their own unique probabilities and develop plans to reduce the likelihood they will outlive their financial resources.

Kate Beattie is a senior retirement income strategist with 18 years of investment industry experience (as of December 31, 2024). She holds a bachelor’s degree in economics with a business administration minor from Colorado State University and holds the Certified Financial Planner™ and Retirement Income Certified Professional® designations.