The growth of target date funds (TDFs) has simplified retirement investing for many defined contribution (DC) participants. As qualified default investment alternatives (QDIAs), TDFs have provided many participants with more age-appropriate portfolios.

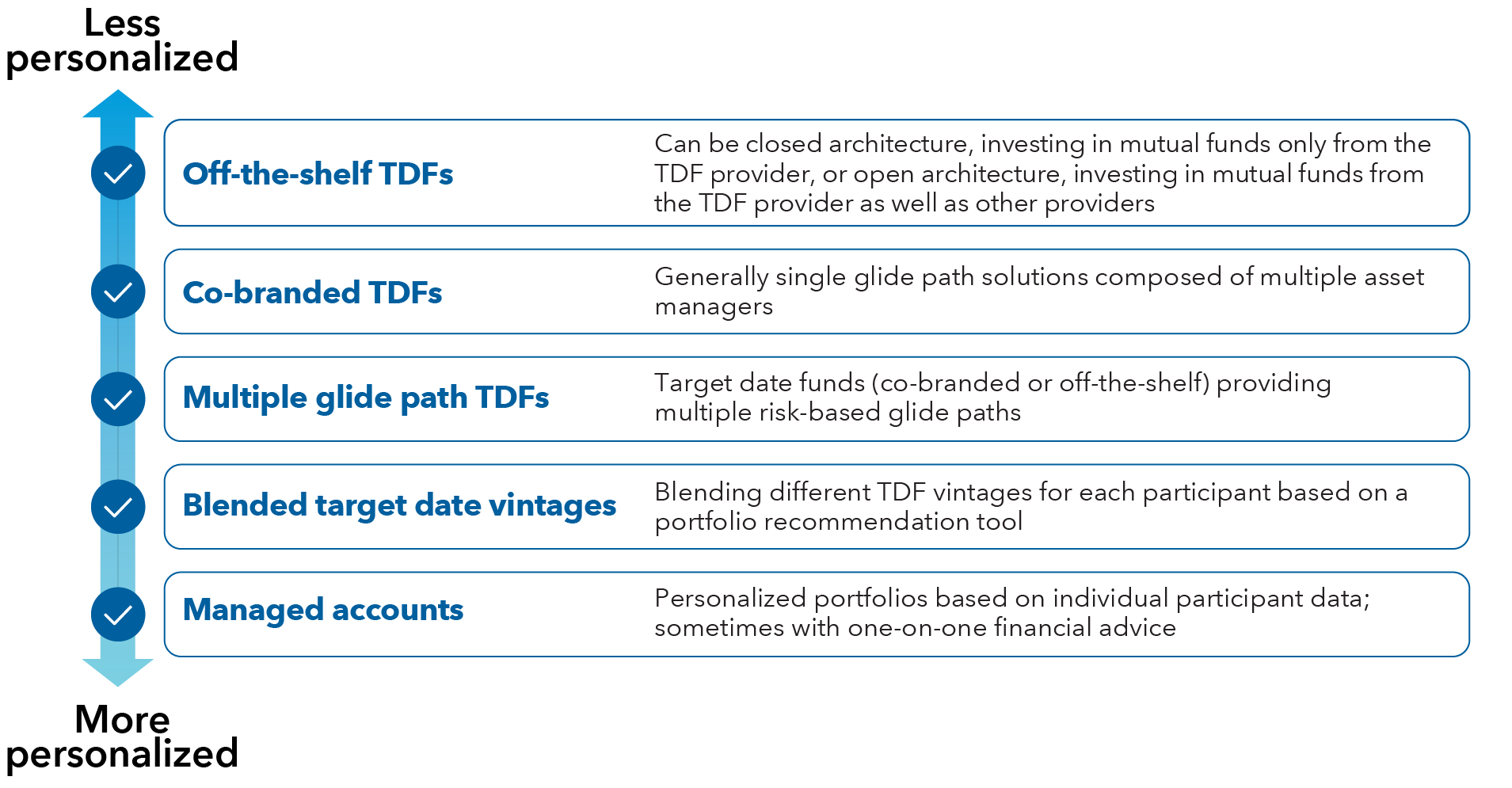

An “off-the-shelf” target date series may offer an effective solution for many participants. Yet some sponsors have found that their unique goals for the retirement plan might merit a more personalized approach.

Recordkeepers and asset managers are responding to this demand with a mix of solutions. Some are offering slightly more tailored versions of target date funds. Others are exploring QDIA solutions that provide different asset allocations based on companywide or participant-level demographic and financial data.