As we navigate a new era of fiscal dominance, the bond market is poised for a very different year in 2025 compared to years past.

For a long time, fixed income investors have viewed central banks as a primary driver of markets — whether it was the ultra-low rates of the 2010s aimed at boosting economic growth and combating persistently low inflation, crisis interventions to stabilize markets and the economy during the COVID-19 pandemic, or the subsequent moves to sharply raise interest rates in response to soaring inflation. Overall, central bank actions and their forward-looking guidance have been front and center as a leading indicator for economic growth, inflation and ultimately markets.

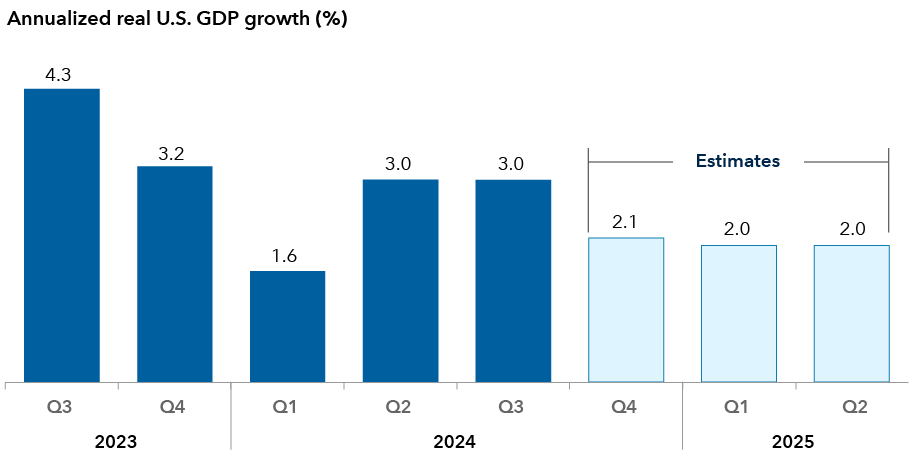

I believe 2025 will be different. Instead of being a principal driver of markets, I see the U.S. Federal Reserve taking a back seat and responding to market events after they occur. Investors will likely hear the Fed maintain a refrain of “data dependence” and “economic uncertainty” and a “meeting-by-meeting” approach. With U.S. economic growth expected to remain above 2% and inflation back within range of the Fed’s 2% target, the Fed can afford to take a more patient approach.

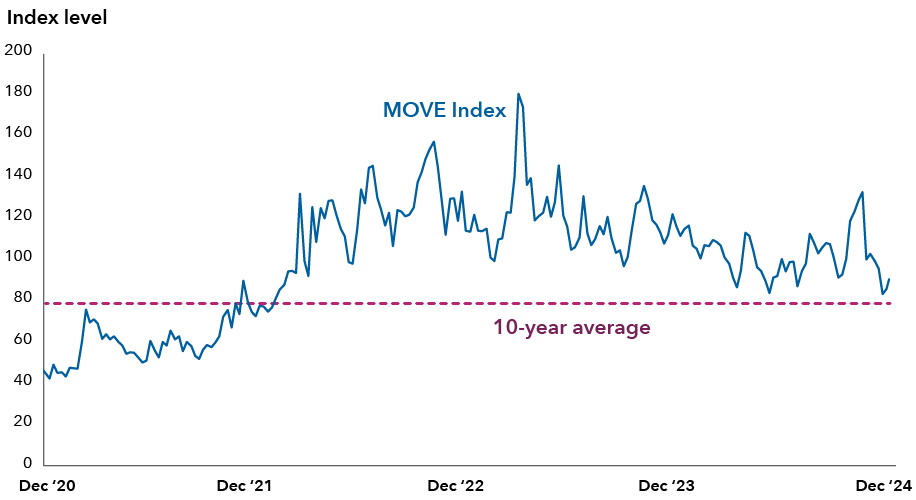

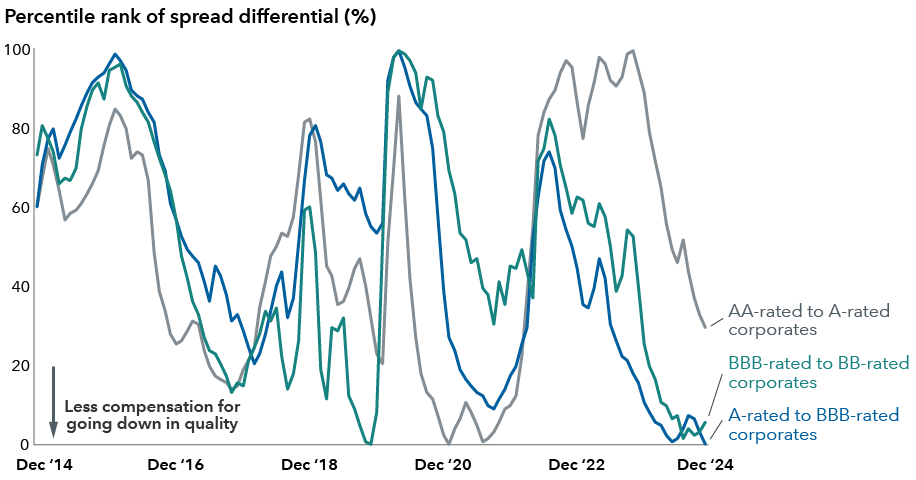

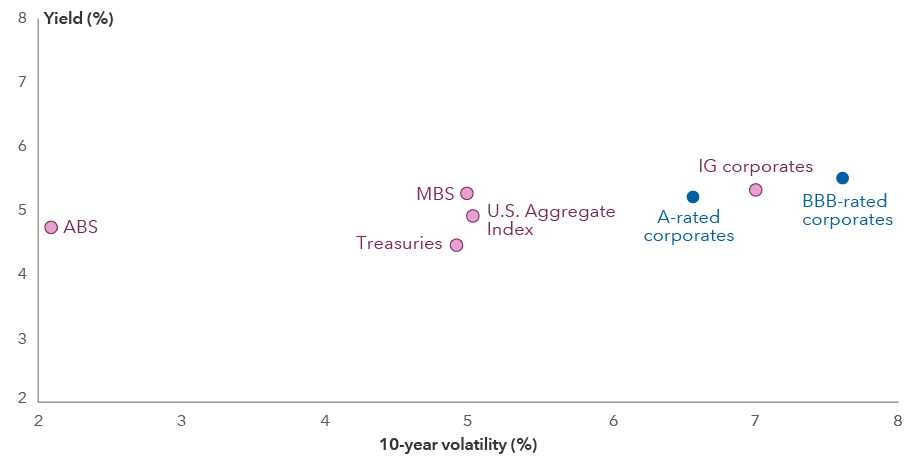

As the Fed’s stance becomes less influential, markets will instead be taking their cues from the other dominant macro force: governments. Fiscal spending and policies — on everything from trade and immigration to taxes and regulation — are all highly important to the future path of growth and inflation. With U.S. policies in flux, I believe market volatility will remain elevated, leading to both higher risk and greater opportunity for investors and active managers that can successfully navigate this period of fiscal dominance.

Against this backdrop, here are five themes that I anticipate will drive core bond portfolios in 2025: