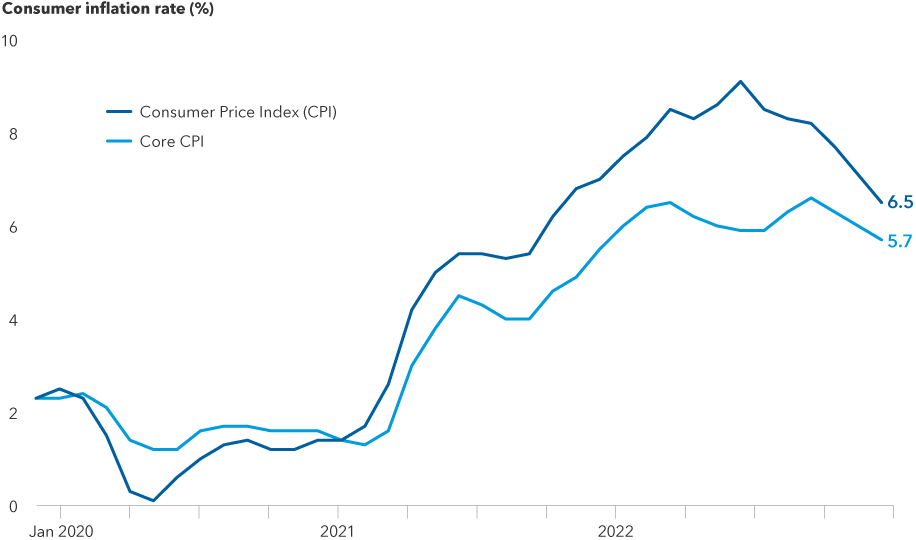

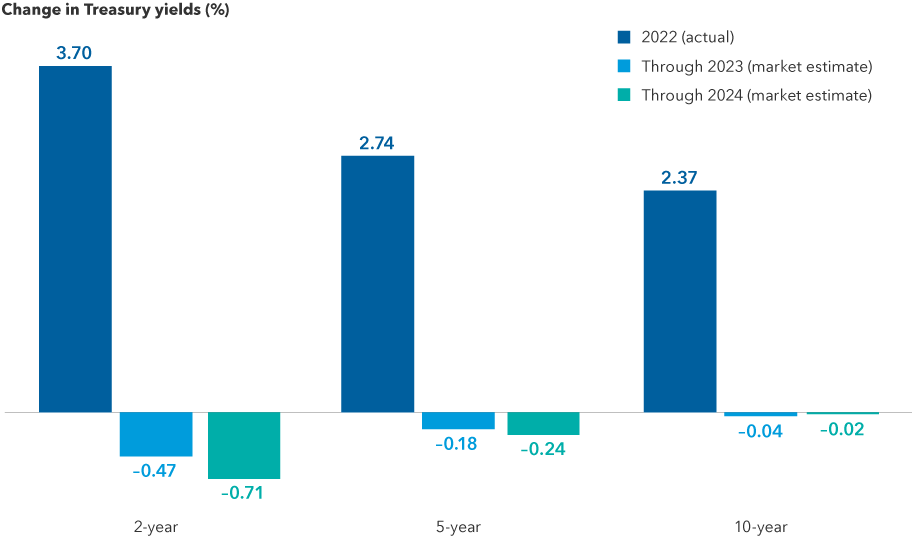

Strong yields and the prospect of a less hawkish Federal Reserve are breathing new life into bond portfolios. Although declining inflation is a reason for optimism after a difficult year, investors can’t be certain just yet if the prolonged market volatility is over.

That’s because even if the Fed’s hiking cycle is almost done, the cumulative effect of the aggressive tightening campaign on consumers and businesses remains unclear. Markets expect growth to slow and have penciled in a mild recession in the United States.

However, that picture could change as unemployment and consumer spending data come in. “We could still be in for a bumpy road, though I don’t see the same level of interest rate volatility for bonds,” says David Hoag, portfolio manager for The Bond Fund of America® and American Funds® Strategic Bond Fund.