Past results are not predictive of results in future periods.

The Magnificent Seven stocks consist of Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

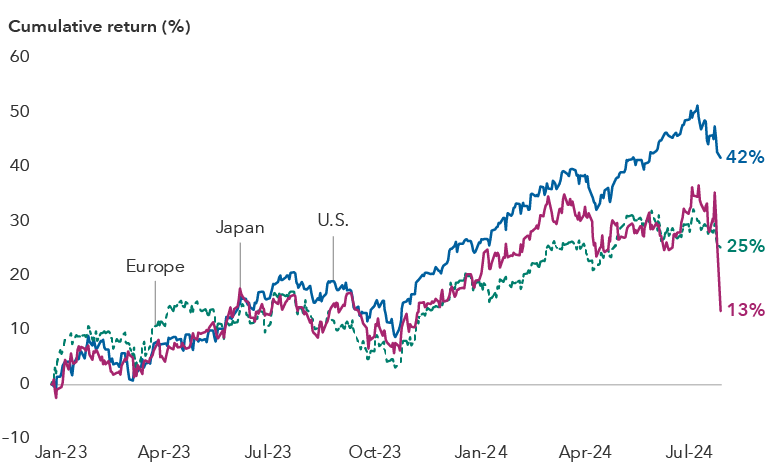

MSCI Europe Index is designed to measure developed equity market results across 15 developed countries in Europe.

MSCI Japan Index is a free float-adjusted market capitalization-weighted index designed to measure the equity market results of Japan.

MSCI USA Index is a free float-adjusted, market capitalization-weighted index designed to measure the equity market results in the United States.

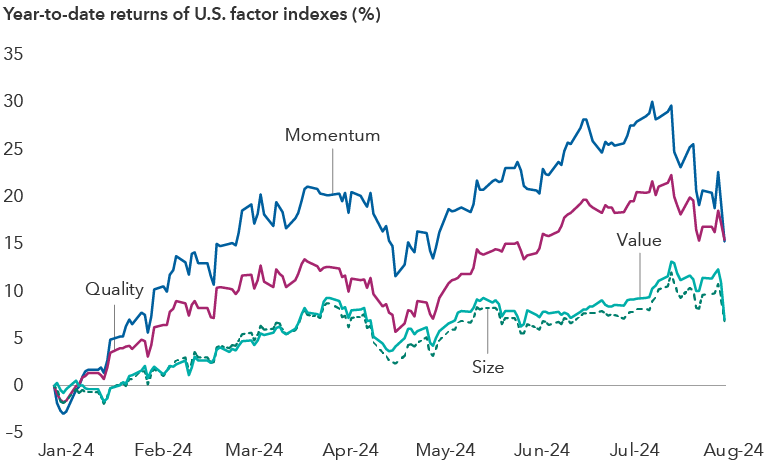

The MSCI USA Momentum Index is based on the MSCI USA Index, its parent index, which captures large- and mid-cap stocks of the U.S. market. It is designed to reflect the performance of an equity momentum strategy by emphasizing stocks with high price momentum, while maintaining reasonably high trading liquidity, investment capacity and moderate index turnover.

The MSCI USA Quality Index is based on the MSCI USA Index, its parent index, which includes large- and mid-cap stocks in the U.S. equity market. The index aims to capture the performance of quality growth stocks by identifying stocks with high quality scores based on three main fundamental variables: high return on equity (ROE), stable year-over-year earnings growth and low financial leverage.

The MSCI USA Size Tilt Index is based on the MSCI USA Index, its parent index, which includes large- and mid-cap stocks of the U.S. equity markets. The index reflects the performance of a low size strategy with relatively high investment capacity. The indexes are created by including all the constituents in the parent index and weighting the constituents using the square root of their market capitalization weight.

The MSCI USA Value Weighted Index is based on the MSCI USA Index, which includes U.S. large- and mid-cap stocks. The MSCI USA Value Weighted Index reweights each security of the parent index to emphasize stocks with lower valuations. Index weights are determined using fundamental accounting data — sales, book value, earnings and cash earnings — rather than market prices.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

For full disclosures go to capitalgroup.com/global-disclosures.