Client Relationship & Service

15 MIN ARTICLE

For advisor use only. Not for use with investors.

As a financial advisor, you’ve built a career helping clients plan for financial security as they navigate through key life transitions. Are you applying that same rigor as you contemplate your goals for retirement and succession planning? After building a successful practice, it’s important to have a robust succession plan that both rewards you for that hard work and ensures the legacy you’ve built from helping clients meet their goals endures.

This is particularly important if you are among the growing cohort of financial advisors approaching retirement. In the next 10 years, more than a third of advisors are expected to retire — that’s about 106,000 advisors managing nearly $12 trillion in assets. 1 Yet one-quarter of those advisors don’t have a formal succession plan in place.2

Advisors in transition

Source: “Transitioning your practice the way you want,” Cerulli Associates, 2022; “More than 72% of rookie advisors still fail out of the industry: Cerulli,” AdvisorHub, June 2023.

Numbers aside, you wouldn’t be alone if the idea of planning your exit from a business you’ve built is difficult to consider. Cerulli says nearly 75% of advisors cite the emotional aspects of transferring clients to a new advisor as a major challenge in succession planning.2

“Succession planning can often be complicated work,” says Eric Grey, senior vice president and head of financial conglomerate and RIA distribution at Capital Group. “But delaying or poorly planning could mean risking the ultimate valuation of your practice, as well as putting key employees and clients at risk.”

Successful succession planning takes time. But even if you are on a more accelerated timeline, these six steps can help provide a roadmap for a smooth transition for you and your successor, your team, and (most importantly) your clients.

1. Analyze your firm’s strengths and weaknesses

Assess what expertise would be lost when you leave (for example, knowledge of the retirement plan business or tax and estate planning). Also, consider what expertise (say, team management experience or digital marketing skills) you would like your successor to have to better lead the firm into the future. It’s important not to assume that what worked well for you as a leader when you founded your firm will work in today’s marketplace. Be open to new ideas and strategies that your successor could bring to leadership.

Outside expert voices can help guide you in this process. For example, there are a number of third-party business coaches available for hire. You should also consider tapping into your network as an informal (or formal) advisory board that can provide valuable perspective or advice.

Keep in mind that any succession plan you create should be considered a living document. Evaluate your plan on a regular basis and make updates as necessary, such as when key team members leave, business or market dynamics significantly shift or your personal plans change.

2. Identify your successor

Clearly, the most important decision you make in this process is choosing your successor. You could coach and promote an advisor you already work with at your firm or seek an external buyer. There is no right or wrong option, but choosing the best path requires striking a balance between obtaining an optimal valuation, setting up your business for future growth, and considering the well-being of clients.

Find potential internal successors. Nearly 80% of financial advisors say they prefer an internal succession plan,3 meaning someone already in the firm takes the reins. An internal candidate brings obvious benefits: You know and like how this advisor works with your clients, and you could have maximum control over training, timing and transition.

Advisors prefer internal successors

Source: ”How to succeed in succession planning,” Barron’s Advisor, 2022.

If you haven’t already explicitly had a conversation with a potential internal successor to gauge their interest in buying the practice, consider doing so. Once you are both on the same page, it could make sense to officially groom that person for the top spot.

While there is no single right way to prepare an internal successor, it may help to set incremental career goals over time that lead to increasing levels of responsibility. This type of career path, along with additional incentives (for example, covering the tuition for a prospective successor’s master’s degree in taxation), can help you retain top talent.

Make regular check-ins or “stay” interviews a part of your overall employee engagement process to show these prospective successors you are invested in their success. Ideally, you would have some time (anywhere from five to seven years) to prepare this person, working together to organically transition client relationships and make the successor part of the everyday running of firm operations.

Look outside your firm for candidates. If you don’t have a viable internal candidate to succeed you, you may need to seek out an external buyer to serve as your successor. Working with an external successor — whether that’s selling your book of business to a peer practice or merging your team with a large registered investment advisor (RIA) or a broker-dealer — could be attractive because it may result in a quick exit and streamlined payout schedule.

One option could be connecting with a younger advisor looking at mature practices as a way to quickly build up a book of business. In fact, Cerulli says that nearly half of advisors surveyed reported that they are open to or actively looking for practices to acquire — a market demand that could result in advantageous deal terms for sellers.1

If you want to look beyond your own network, consider engaging the services of third parties to connect with these interested buyers. Some businesses offer matchmaking services connecting buyers and sellers of advisor firms. And large mega-RIAs are active buyers, steadily acquiring firms with client niches or other expertise in recent years.

“Whether you groom someone internally or bring in an outside advisor as your successor, it’s important that that individual shares your values and service mindset so that clients don’t suffer culture shock,” Grey says.

Ben Wong, a San Francisco-area advisor, says he considered several options when thinking about his own succession plan. Ultimately, he realized that selling to an outside advisor or to someone on his team wouldn’t provide what he saw as the optimal outcome for his ensemble team. Additionally, he said that he wanted to continue serving clients, just not run a business. The result was him selling to and consolidating his billion-dollar advisory business with Mariner Wealth Advisors last year.

3. Understand your practice’s market value

The industry has seen robust deal-making among buyers and sellers of advisory firms in the last decade, so it could make sense for you to evaluate your practice to try to maximize its value. Both hard and soft metrics can determine your practice’s value. These can include:

- Percentage of fee-based business (and average fee) vs. commissions

- Average rate of return for the fee-based portion of the business

- Products and services sold (financial planning, insurance, retirement plans) and percentage makeup of each

But what about future growth? Discounted cash flow can point to organic growth going forward. Buyers will also look for indicators like the mix of age ranges among clients and a strategy to serve the next generation. “One way to catalyze practice growth is to form relationships with your client’s children and grandchildren,” Grey says. “If a majority of your clients are nearing or in retirement, that could signal a slowdown in revenue and overall practice vitality.”

Take a look at your brand. Does it speak to a variety of audiences, or is it starting to become stale? Buyers want to invest in a practice with broad appeal that crosses over a number of industries and ages, rather than one limited to one typical client “type” or “persona.” Being able to attract clients from different backgrounds and experiences can be an indication of a practice's skill and versatility, and can illustrate how your team adapts to changing opportunities within the financial services industry.

Another aspect of goodwill — a measure of value on top of that derived through tangible assets — is evidence of client tenure and retention, which indicates high levels of client satisfaction for extended periods of time. Buyers tend to place additional value on long-standing businesses with well-established client bases.

Consider ways to finance a sale. Typically, there are three ways to structure the sale of a practice: a sale of assets, an “earnout” and a stock sale. What you and your buyer choose will likely depend on the profile of the buyer. Is this an internal subordinate who is taking over the practice, or a young advisor seeking to expand a practice by purchasing yours? In either case, the buyer might not be able to secure financing for what could be a seven-figure total sale price. If you have five to seven years, however, one solution is to transfer equity over time to help the buyer build up wealth and enable them to complete the purchase.

If you are selling to a larger RIA, that firm likely has the financial capacity to close the transaction with a down payment and the balance paid out in exchange for staying with the business for an agreed period of time.

Tax considerations are also a variable in deciding how to structure a sale. In a sale of assets, most of the value would be considered as capital gains and taxed at a maximum rate of 20%, with a portion of the proceeds being taxed as income at 37% because of recapturing depreciation. One benefit for the buyer here is that liability isn’t transferred, and they will be able to amortize and deduct the amount paid for the assets over 15 years. Stock sales are typically used when the buyer is someone already at the firm or a family member, and liability is less of a concern.

Lastly, an earnout allows your successor to make a down payment and then pay installments over a period of time. Only the down payment would be considered a capital gain; the rest would be considered taxable income. The successor, however, could deduct the full amount of the earnout payments every year.

Of course, when considering any of these structures, it makes sense for both sides to have legal representation since the buyer's and seller's interests can diverge in such a negotiation.

4. Make your team part of the succession plan

You will choose your successor based on the idea that you believe that person will serve both your team and clients well. Now, use the transition period to illustrate to your team why and how you believe this person will succeed leading them and serving your clients.

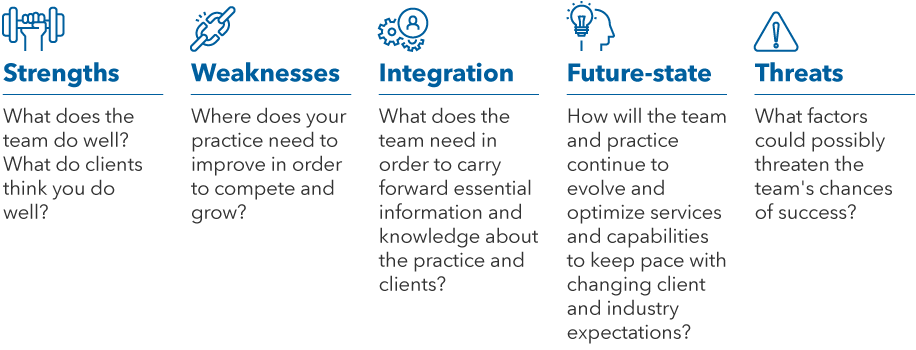

To help you do this, we suggest deploying what we’re calling a SWIFT analysis to understand your firm’s strengths, weaknesses and threats. Similar to the SWOT analysis (strengths, weaknesses, opportunities, threats) process you might already have deployed, SWIFT also incorporates two additional concepts: integration and future-state. This exercise is best done with your entire team, perhaps at an off-site event, where everyone is invited to provide their ideas and perspective on each of the SWIFT elements.

Strengths include ways you provide clients differentiated, high-quality service or specialized niches in which you have developed an expertise. For example, this could be “high-touch customer service.” Next, honestly discuss and get feedback on areas that could be considered weaknesses, such as whether your practice needs to better connect with your clients’ next generation and sow seeds for future growth. (Is an aging client base a threat to your team’s future success?)

Build team confidence through the SWIFT framework

Source: Capital Group research.

Integration encourages you and your team to examine whether you have processes in place to, say, capture and share institutional knowledge in a format that is accessible to everyone. And future-state is focused on identifying new skills and capabilities the practice should have to address future client needs or industry trends. One example of this is how your practice can deploy technology to provide more customized client service.

Of course, you should also do this exercise from your client’s point of view. Would their answers be the same as your team’s?

The results from the SWIFT analysis can help gauge how the team is feeling about the transition. Is everyone aligned in terms of how the team will function going forward? Make sure there is a shared understanding of how team roles and responsibilities are evolving, and how those changes are all grounded in delivering top client service. Let team members know that you have stressed to your successor that supporting their professional development and growth is an important focus.

Also, work with your successor to address any challenges you think he or she might face as the firm’s new leader. For example, could your successor use some coaching in managing team dynamics and operations? Start to have them co-lead team meetings and client reviews as well as help co-create scripts for client conversations once you have left the practice.

“It’s critical to have an ongoing series of conversations connecting your successor with your team and helping forge that relationship between them so that client service continues to be of the highest quality,” Ryan says.

5. Prepare your clients for the transition

Once you, your successor and your team are on the same page strategically and operationally, turn your focus to your clients. You want to make sure that the people you’ve spent years or decades helping know they will continue to be taken care of. Think of it as practicing what you preach. After all, you have probably advised business-owner clients, for example, to start thinking about succession planning and retirement.

In fact, having preliminary conversations with your most trusted clients is a great way to find out their biggest concerns and to learn what they need to feel comfortable continuing to work with you and your team during a transition. Ask them how far in advance they would want to know about your retirement. Or check in with clients to see if they feel the rest of your team understands and fulfills their needs as they believe you do.

Develop a client communication plan.

It helps to create a plan for how you will inform all clients of your succession, introduce your successor and anticipate the questions clients have and the reassurances they seek.

First, consider using our four-box framework for in-person discussions. You want to convey four key messages to clients: acknowledge that you know change can be uncomfortable from their point of view, share how you’ve designed this transition in a way that puts their needs first, emphasize that you chose your successor specifically because of their expertise and your belief that clients will continue to receive the service levels they expect, and close the conversation by scheduling a meeting with you and your successor so your client has an opportunity to interact with both.

You should be prepared to tailor these conversations to fit client profiles, such as asset size and relationship, but also to client life stages and related needs. If you can, have your successor accompany you to those client meetings to help illustrate your confidence in their abilities to care for clients like you have. Encourage clients to interact directly with your successor so that they might begin building their relationship.

Key ingredients to the client conversation around succession

Source: Capital Group research.

In addition to in-person client meetings, you should also inform clients through email newsletters and webinar events. During this transition, look for ways to promote the successor’s expertise. For example, have them run webinars and spotlight them in marketing materials and on the firm’s website.

Of course, once you map out the various components of your communication plan, create a timeline to help organize your efforts, working backwards from the date you plan to fully step away from the practice.

6. Create your life after succession

If you are at the start of your succession planning and your departure is still a few years out, take this time to map out what you want in this next stage of your life. Maybe you plan to stay at your firm post-sale in a part-time or consultant capacity, but what after that?

Retirement today is no longer considered a slowing down or a transition to a more sedate life. In fact, Capital Group research shows that today’s retirees see this time as an opportunity to truly explore their own passions away from obligations of caring for others. In fact, you’ve probably had these sorts of conversations with your clients as you’ve helped them prepare for and navigate retirement themselves.

“You’ve spent your working years building resources for this point,” Grey says. “And while that financial planning is crucial, modern midlife success is also dependent on finding connection, purpose and joy. You can plan for all of it.”

1”More than 72% of rookie advisors still fail out of the industry: Cerulli,” AdvisorHub, June 2023.

2“Transitioning your practice the way you want,” Cerulli Associates, 2022.

3”How to succeed in succession planning,” Barron’s Advisor, 2022.

Related content

-

Client Relationship & Service

-

Team Management

Financial professionals should review their firm’s compliance policies and procedures prior to engaging in marketing strategies described herein.