Planning & Productivity

10 MIN ARTICLE

For advisor use only. Not for use with investors.

If you think your job as a financial advisor is simply helping investors accumulate wealth through investing, it may be time to reconsider your assumptions. Today’s clients have different expectations. Yes, investments are important. But it’s also essential these days to be the steward of a client’s hopes and dreams — to help them identify their financial goals (beyond retirement at a certain age) and provide ongoing planning and guidance to help reach those goals. This is goals-based advice, and it’s what your clients expect.

Greater client demand is only one reason you should consider offering goals-based advice to your clients. Planning around goals can also help you deepen engagement and loyalty with clients and their families, lead to referrals, and ultimately help you save time. Here are nine reasons why goals-based planning can be an engine of growth — and productivity — for your business.

- Developing a specialty around your clients

- Planning for a lifetime of goals offers investment opportunities

- Demonstrating wins beyond the investment portfolio

- Retaining generational assets

- Attracting HNW assets to your business

- Helping clients may lead to new clients

- Expanding your centres of influence

- Staying competitive with industry peers

- Tying goals to investments

1. Identifying goals can help you develop a specialty around your clients and their families

Different from wealth accumulation, your clients’ goals are thoughtful, specific and tied to the things they care about most: their families and their personal milestones. As an advisor, you have an opportunity to help clients navigate toward their objectives.

This is a powerful position to be in. The process of discovering, setting and prioritizing goals alone can offer advisors a unique view into a client’s life. (Other financial professionals, like lawyers and accountants, may miss this information because of their structure of billable hours.) This view not only helps in the financial planning process, but it also offers you an opportunity to spot issues that tax and estate planners may not immediately see.

Nonfinancial topics make up the majority of advisor conversations

![Bar chart shows how much time advisors said they spend on nonfinancial topics in client conversations. 1% of advisors said "none." 9% said "very little," meaning 1-10% of time is spent on nonfinancial topics. 32% said "some," meaning they spend between 11%-25% on nonfinancial topics. 37% said "a good deal," meaning they spend 26%-50% of their time on nonfinancial topics. 22% said "most," meaning they spend more than half of their time on nonfinancial topics.]](https://static.capitalgroup.com/content/dam/cgc/shared-content/images/charts4/chart-topical-01-9-reasons-gbp-nonfinancial-topics-767x200.png)

Source: Investment News, “Beyond Finances: Holistic Life Planning Trends Among Advisors“ 2021. “Very little” is 1%–10% of nonfinancial topics discussed. “Some” is 11%–25%. “A good deal” is 26%–50%. “Most” is more than 50% of topics discussed. Figures may not add up to 100% due to rounding. Based on a survey of 360 advisors.

That may be one of the reasons nonfinancial topics have taken up more of the average advisor’s conversations with clients. These topics provide inside information that can help you become a true specialist in the lives of your clients, making the relationship with you — as well as all the client’s relationships with other financial professionals — more productive and responsive.

2. A lifetime of goals can offer more opportunities for investment

Identifying goals not only helps you provide more dynamic planning, but it can also open up additional investment lifetime. Rather than saving for a single goal, like retirement, clients may want to fund specific goals over time with additional assets or investments.

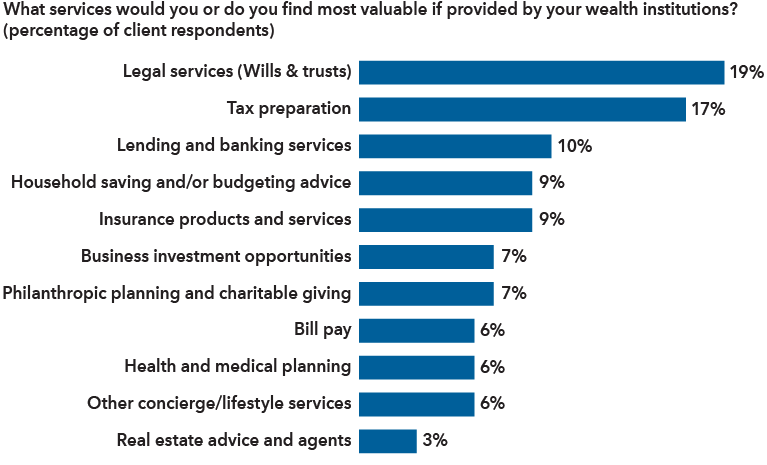

Goals and services could lead to investment conversations, more assets

Source: McKinsey & Company, "US Wealth Management: Amid market turbulence, an industry converges," January 2024. Based on a survey of approximately 7,000 respondents.

Clients may also be looking for help with other types of products and services, including guidance on life insurance, business investments, philanthropy and real estate decisions. Planning software can be used in the discovery process to help to define areas of need that clients may not even be considering. All of these present conversations that could lead to more assets under management.

Goals-based planning may also help you keep the investment portfolio on track, because it’s designed to shift clients’ focus away from short-term returns or market volatility in favour of longer term aspirations. This helps keep clients motivated to stay invested during times of market volatility.

Furthermore, various studies confirm the effectiveness of a goals-based approach. For example, behavioural research conducted in the 1990s by Locke and Latham1 demonstrated that individuals were more committed to goals that are personalized, important to them, specific and realistic. Perhaps because of the behavioural motivation, research from Morningstar revealed goals-based investing has been proven to increase client wealth by more than 15%.2 This doesn’t even take into account the loyalty and client satisfaction it helps build in your client.

3. A focus on goals can help you demonstrate wins beyond the investment portfolio

Shifting away from investment metrics in favour of progress made toward goals can help you demonstrate the value of your advice by highlighting clients’ personal wins rather than performance against a benchmark. Even the way you initially engage and onboard clients can be informed by how progress will be made toward their goals.

Presenting these goals in a real, three-dimensional way to clients can help them understand the feasibility of achieving various goals under different circumstances, and invite them to consider the “why” behind their decisions. For example, a dynamic checklist and timeline can help you show the work you will do for a client over time, as well as what to expect on a quarterly or annual basis. This type of visual tool can be valuable to highlighting your work as well as the client’s progress toward their goals.

This decision-making ability can be crucial to a client’s success. But keep in mind that a core component of goals-based planning is the ability to adjust the plan as circumstances change.

4. Goals may make it easier to retain generational assets

With an estimated wealth transfer of US$84.4 trillion anticipated through 2045 in the U.S. alone (according to Cerulli, as of January 2022), generational assets represent a key source of growth for financial advisors. Yet only about 25% of advisors say they are confident about retaining family wealth across generations, according to a 2021 Investment News study, “Beyond Finances: Holistic Life Planning Trends Among Advisors.” Goals-based planning may help build that bridge.

Because goals are often related to clients’ families, goals-based planning provides a view of (and potentially access to) the needs and goals of the next generation of family members. This information can put you in a good position to engage with clients’ families, and to potentially continue managing family assets during times of wealth transition. As the range of planning topics broadens in your planning discussions, so can the number of family members potentially involved in the process.

5. Goals-based services can help attract more HNW assets to your business

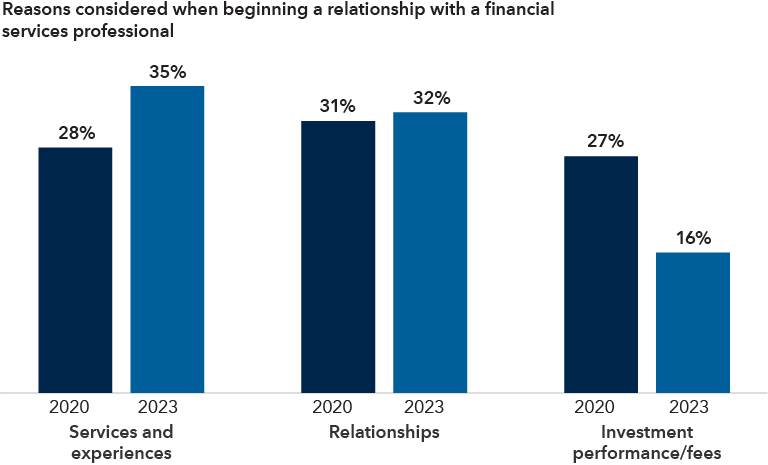

A full 42% of that projected US$84.4 trillion wealth transfer is expected to come from high net worth (HNW) and ultra-HNW households. Advisors looking to capture some of those assets should know that services and experience are increasingly more important than investment performance among HNW individuals.

Services increasingly important to HNW individuals

Source: MarketCast, Cerulli Associates, ”The Cerulli Report: U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2023,” January 2024. Respondents include those possessing US$5 million or more in investable assets. Based on continuous research and analysis of the marketplace, including surveys of private wealth managers and asset managers conducted through Cerulli’s proprietary survey engine. Data is also included from Cerulli’s partnership with MarketCast, with online surveys of nearly 10,000 households throughout the year.

Services that are rapidly increasing for these clients include estate planning, tax preparation and wealth transfer planning. Even private banking and trust planning are being offered more often, according to Cerulli.3 Advisors do not need to be experts in all topics to provide benefits to the client — just adding them to the conversation can help with issue spotting and make you more valuable to clients.

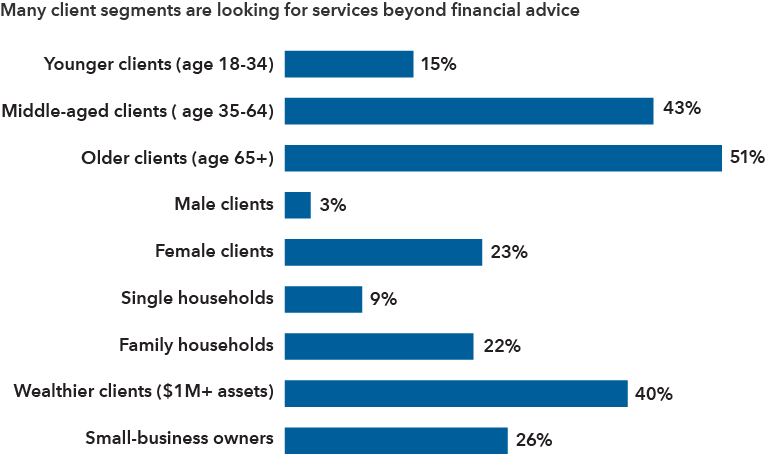

The more you can help your clients define and achieve their goals, the more likely they are to refer other people who may be potential clients. For example, business partners, extended family members, charitable organizations or individuals within affinity groups may be a regular source of referrals to advisors who focus on goals.

Furthermore, many client segments are likely to demand broader services beyond financial advice, according to Investment News. For example, those looking for additional services included 43% of clients between the ages of 35 and 64, 51% of clients older than 65, 26% of small-business owners and 40% of wealthy clients having more than US$1 million in assets.

Source: Investment News, “Beyond Finances: Holistic Life Planning Trends Among Advisors,“ 2021. Based on a survey of 360 advisors. Asset value range is in USD.

Offering broader services, such as goals-based planning, may lead to new clients. And if these individuals share characteristics of your ideal client, they may be a particularly rich source of organic referrals.

7. Goals can even help you expand your centres of influence

While a majority of advisors cite referrals as a primary driver of business growth and client acquisition in Capital Group’s latest Pathways to Growth: Advisor Benchmark Study, research also shows one potential area for improvement is getting referrals through centres of influence (COIs). A focus on client goals may make it easy to connect to and work with COIs.

That’s because some professionals, such as attorneys, tend to be risk averse and are less likely to recommend a financial advisor based on investment performance. A COI is more likely to respond to the work you do satisfying your clients’ overall goals, or refer individuals based on how you meet a specific need for clients. Some COIs build such strong working relationships with advisors that they ultimately operate as a team.

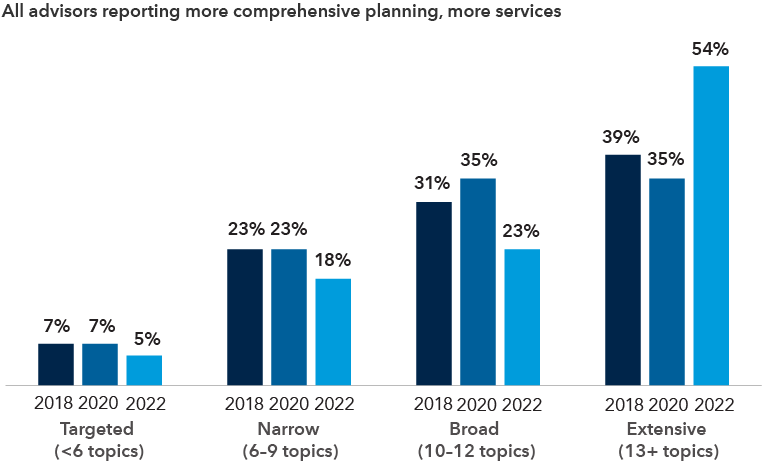

8. Comprehensive planning can help you stay competitive with industry peers

Among the strongest reasons for offering goals-based planning is that clients are demanding it — and your competitors are doing it. Advisors overall are offering more comprehensive planning as part of an industry trend.

Advisors reporting more comprehensive planning, more services

Source: Kitces.com “How Actual Advisors Do Financial Planning,” 2022. Based on a survey of 767 U.S. advisors.

The number of services offered by the average U.S. advisor practice has grown since 2018, when only 39% of advisors were offering extensive planning on 13 or more topics. In 2022, that number grew to 54%, according to Kitces.com. Similar trends are seen among HNW practices tracked by Cerulli, whose 2024 U.S. HNW and Ultra-HNW report found that HNW practices offered 12 services on average in 2023, up from fewer than 10 services just five years before.4 This suggests that goals-based planning is essential just to stay competitive.

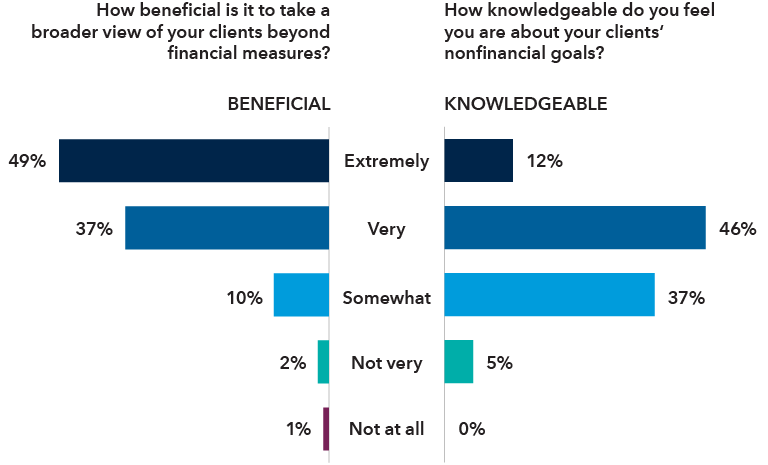

Needs are broader, but knowledge may not be

Source: Investment News, "Beyond Finances: Holistic Life Planning Tools Among Advisors," 2021. Based on a survey of 360 advisors.

Advisors who learn to successfully navigate goals-based topics may also have a distinct advantage. Despite clear growth in services, not all advisors feel comfortable having holistic, nonfinancial conversations. For example, Investment News found that rates of nonfinancial conversations are not standard. And while 86% of advisors say they believe it is extremely or very beneficial to take a broader view of clients beyond financial measures, only 58% admitted to being very or extremely knowledgeable about nonfinancial goals. This suggests that advisors who are skilled in goals-based topics may have a competitive edge.

9. Tying goals to investments can help with portfolio management

Ultimately, it’s the investment portfolio that helps clients reach their specific goals. Goals-based planning should not hinder portfolio construction, and can even help clarify the strategy behind it. Once established with a client, goals can be easily translated into investment objectives and weighted according to prioritized goals. Depending on the needs of the client, a portfolio with multiple objectives can be built to accomplish multiple goals.

Working with an investment partner can help. For example, model portfolios can solve for multiple objectives and save you time to focus more on nonfinancial topics that clients want most. That’s a goal worth striving for.

Related content

-

Planning & Productivity

-

Planning & Productivity

Advisor Benchmark Study: Pathways to Growth

1Notion, "What´s goal-setting theory, and how does it work?" May 2023.

2Morningstar, "How to Make Goals-Based Investing More Effective," February 2024.

3,4Cerulli Associates, “The Cerulli Report: U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2023,” January 2024.