Fixed Income

- Despite support from the U.S. Federal Reserve, downgrades are poised to be more prevalent than in previous cycles

- The full financial impact of COVID-19 on corporate America will become clearer over the next few quarters

- Investors should take a long-term view and be selective

With the severity and duration of the economic downturn still unclear, investors may be wondering what this means for corporate credit, particularly the riskier high-yield sector.

We talked with Damien McCann, fixed income portfolio manager, to get his perspective on the broader credit market and how companies are traversing the pandemic.

What’s your outlook from here?

We’re in a period of incredible uncertainty given the unknown path of the virus. We do know, however, that much of the economy has been significantly disrupted by the pandemic. Revenues and cash flows in many industries are currently under severe pressure. Other industries are faring much better. Second-quarter earnings will be ugly but should represent the bottom for most companies. More important than second-quarter earnings, however, will be what managements of companies are seeing for third- and fourth-quarter activity.

My base case is that the economy is beginning to improve as we speak, and that this recovery will continue through the remainder of the year and 2021. How fast is unknown. I expect an uneven recovery by industry and more volatility given the unprecedented economic disruption, and the many uncertainties regarding the spread of the virus, containment efforts and progress on therapies and vaccines.

Is this downturn different from the global financial crisis (GFC)?

Each is similar and different. Similarities with the GFC include the significant economic contraction and related sharp rise in unemployment. Both periods include significant stock and bond market volatility, as well as a seizing up of credit markets. Both periods have received significant stimulus and support by governments and central banks.

But the drivers of each downturn are very different. The GFC came from within our economy and markets. The pandemic is an exogenous shock, and the hit to economies is more severe than during the GFC. The monetary and fiscal stimulus came much faster this time around, and in much larger size, because policymakers have learned from the past and want to prevent a severe recession from becoming a financial crisis.

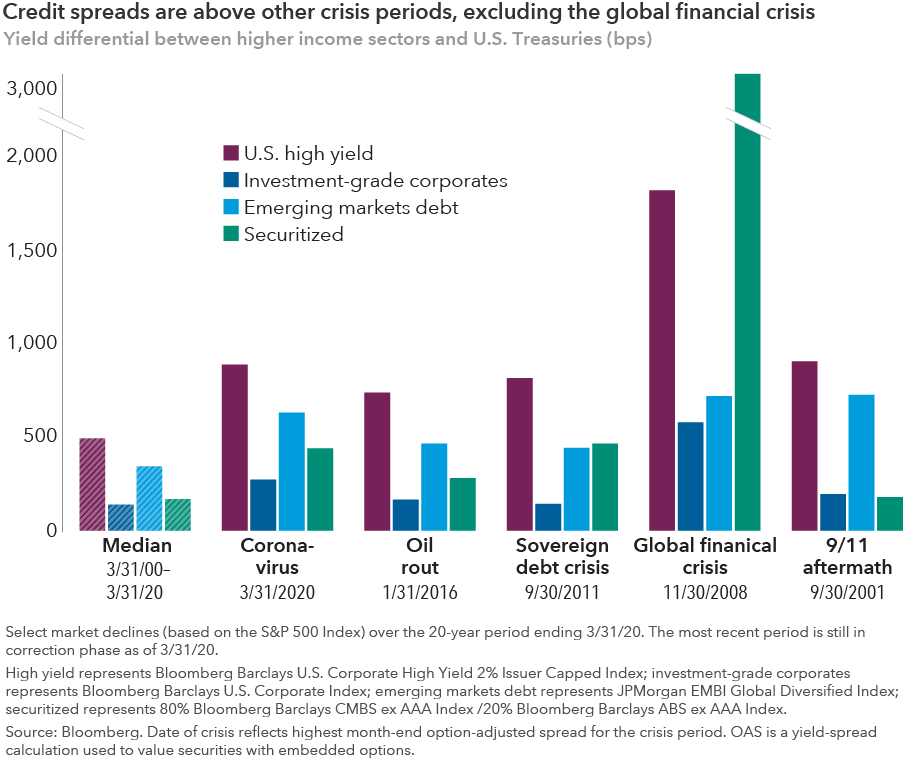

The Fed is actively supporting numerous markets — including U.S. Treasuries, mortgages and credit markets. Some of this, such as buying corporate bonds and ETFs, is without precedent in the U.S. In my view, these programs indicate a deep commitment by the Fed to ensure credit markets continue to function. This helps explain why credit markets have responded favourably and, after widening dramatically in mid-March to the widest levels on record for a few days, spreads recovered some of that widening later in the month.

What steps are companies taking to manage through this period?

Companies are grappling with a high level of uncertainty about the duration of the downturn. As a result, many companies are taking steps to bolster liquidity. In other words, companies are trying to build up a lot of cash so they can survive this period. Steps companies are taking to build cash include cutting operating expenses and capital outlays, reducing or eliminating dividends and share repurchases and raising capital.

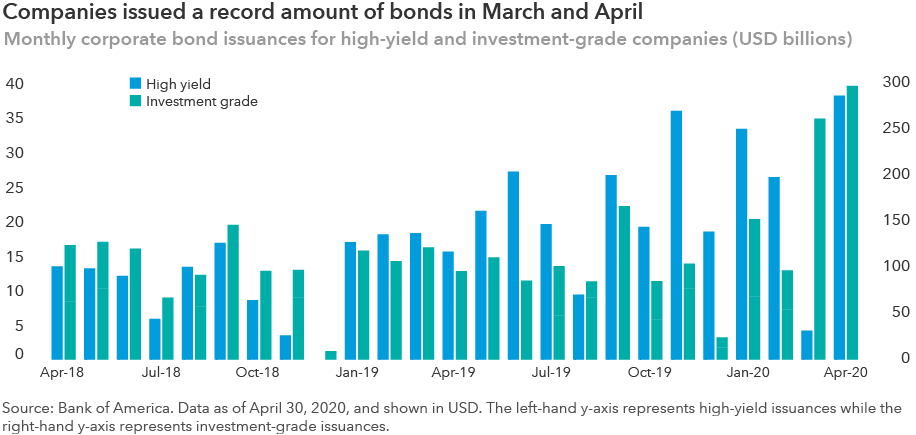

On this last point, the Fed’s injection of liquidity and its direct participation in corporate bond markets have restored order to markets and made it possible for investment-grade companies and certain high-yield issuers to borrow again.

The combination of the Fed’s support for credit markets, and the severity and uncertainty of the downturn, has led to record levels of investment-grade bond issuance in recent months. Certain companies, such as Disney, have tapped the bond market more than once in recent months. What’s more, companies in the eye of the storm — including certain leisure and travel-related issuers — have been able to access markets.

What is your expectation for default rates?

I expect defaults and downgrades to be higher than in prior cycles given the severity of the economic contraction. In fact, U.S. corporate downgrades have spiked to their highest level in more than a decade in the first quarter, according to data from Standard & Poor’s.

Companies that are more exposed to economic disruption, as well as those with more leverage and less liquidity, are most vulnerable to defaulting. Despite efforts to cut costs and preserve cash, some companies won’t be able to handle the sudden near full stoppage of economic activity.

I expect downgrades may exceed previous cycles, with the potential for bankruptcies of companies in the U.S. high yield and loan market.

Can you provide some colour on “fallen angels” — the large companies such as Ford that have recently entered the high-yield market? How does that impact the high-yield market?

Credit rating agencies have been more aggressive with downgrades in recent years. Given the magnitude of the economic contraction I expect this to continue. There will certainly be many downgrades in the months and quarters ahead.

I also expect more companies to enter the high-yield sector. Some investors fear that a rash of supply in this sector could overwhelm the market, but keep in mind that it has actually shrunk in recent years on fewer issuances and more companies turning to the loan market. In that sense, the high-yield market could use some additional supply. Also, the Fed’s move to scoop up corporate debt should help absorb the shock. In some cases, these downgraded bonds could represent attractive investment opportunities in high-yield portfolios.

In what areas are you finding value?

As I look across the corporate market, exposure to this pandemic and economic contraction varies dramatically by industry and company. For example, at one extreme are certain insurance underwriters that have become more profitable due to fewer claims in this environment. At the opposite extreme are certain leisure companies that have seen revenues fall to zero. But even within this sector, exposure varies significantly based on the business model and balance sheet. Some leisure companies adapt and survive better than others.

The variation in exposure to the pandemic represents an incredible opportunity for deep, fundamental credit research to add value in portfolios. Our credit analysts are well versed on their companies and are in regular contact with managements. They are identifying and investing in issuers they believe have the ability to navigate this period.

Market events like this can and have historically represented a good entry point for long-term investors. Spreads today are broadly comparable to past crisis and recessions, excluding the global financial crisis. I don’t believe in timing the market but I do feel that current spreads provide an opportune entry point for a long-term investment strategy.

What about relative value between investment-grade and high-yield bonds? And what about the BBB-rated area of the market?

While income opportunities are higher in both investment-grade and high-yield corporates, I’ve been finding even more in high yield. In particular, the improved valuations have led to more opportunities within health care, technology companies and consumer staples.

The BBB market is huge (nearly US$3T) and very diverse. The work our analysts have done suggests that a large majority of this particular market is unlikely to fall to high yield during this period. Some of the BBBs that fall to high yield may be attractive investment opportunities within that space, particularly if the downgrade leads to wider credit spreads.

How is Capital navigating this environment?

From a credit perspective, we are diving deep into understanding which companies will come out of this crisis intact and be able to repay their lenders. Our strong relationship with management teams and focus on fundamental credit research help us in this endeavour, as it’s our belief that that the prospects for recovery will very much be company, industry and geographically specific.

We remain very selective about our investment decisions, which are made on a security-by-security basis. This is especially important in today’s environment as downgrades and defaults become more frequent. Knowing what you’re buying helps mitigate broader credit market risks.

We also can’t stress enough the benefits of a long-term perspective, as a multiyear view may provide investors with the opportunity to capture higher returns.

Our latest insights

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Damien McCann

Damien McCann