Market Volatility

On the surface, it seems unlikely that a 17th century Dutch painting would have much relevance in today’s volatile investment environment. But if you take a moment to look at Rembrandt’s masterpiece, “The Night Watch,” you may notice that every person depicted in the painting is looking in a different direction, each bringing a unique view to the gathering.

Flash forward nearly 400 years and “The Night Watch” is the inspiration for a multidisciplinary research team at Capital Group that seeks to gain a deeper understanding of market disruptions, assessing the risks and evaluating the opportunities that arise during times of extreme crisis. Not surprisingly, the group’s current focus is COVID-19.

“The goal of the Night Watch is to look at highly uncertain events, where the outcome is essentially unknowable, and study them from all angles,” explains Capital Group economist Jared Franz, who covers the U.S. and Latin America. “Like the individuals in the painting, we are looking out in all directions, evaluating possible scenarios and considering potential outcomes.”

Rembrandt’s The Night Watch

Scenario planning, not predictions

"The No. 1 rule of the Night Watch is: Leave your preconceived notions at the door. Don’t start with what you think will happen, look at what could happen,” adds Julian Abdey, an equity portfolio manager and active participant in the group. "This is about evaluating the possible scenarios — from very negative to very positive — and understanding what each would mean for a variety of asset prices. At the end, it is up to the different investment units and individual portfolio managers and analysts to determine how probable each one is."

This concept goes to the heart of The Capital System℠, which relies on the multiple and diverse perspectives of Capital Group’s investment professionals, combined with independent, high-conviction decision-making. The Night Watch doesn’t make investment decisions on its own, but it helps inform the larger organization.

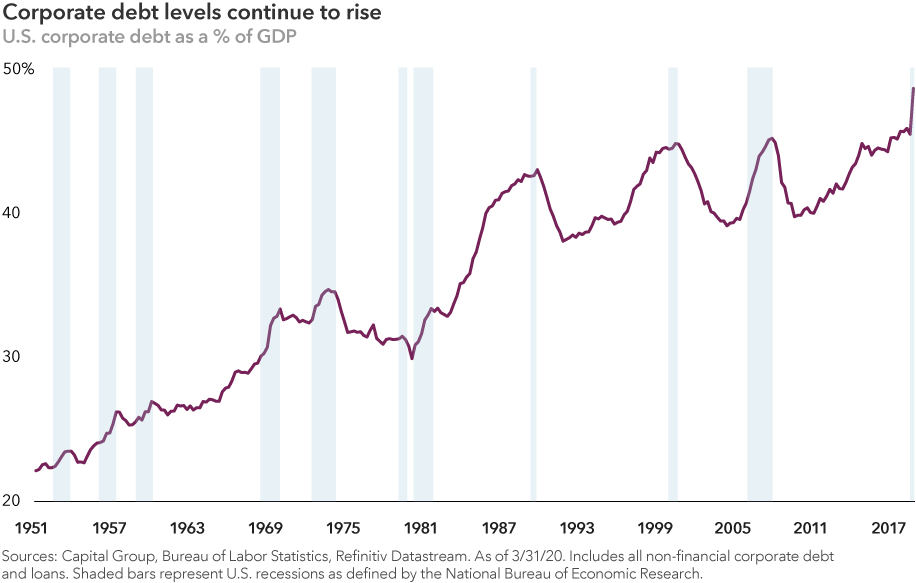

The idea for Capital's Night Watch approach was formed in the aftermath of the 2008–09 global financial crisis to engage in scenario planning around severe downside events. In more recent years, the team explored the risk of rising corporate debt levels. This year, the group took on perhaps its most daunting crisis: the coronavirus outbreak and resulting government lockdowns that have triggered the worse economic downturn since the Great Depression.

Corporate debt dilemma

In the corporate debt analysis, the Night Watch team raised an early alarm about rising debt levels and deteriorating credit conditions in the U.S. corporate bond market.

Following the financial crisis, ultra-low interest rates and central bank bond-buying activities created an environment where many companies could borrow vast sums of money at historically low financing costs. The “hunt for yield” by some investors accelerated the process, encouraging companies to continue the borrowing binge despite a late-cycle economic environment. Even more worrisome: Companies with relatively low credit ratings accounted for more than 50% of the market last year.

“We could see that soaring levels of corporate debt were producing an imbalance in the economy,” says Franz — whose formula for anticipating a recession is equal parts late-cycle economy, rising imbalances and some catalyst to set it all off. “We worked closely with our fixed income team to quantify the downside risk in specific corporate bonds so they could make those investment decisions on a security-by-security basis.”

This approach to bond investing is an important part of maintaining a balanced and actively managed portfolio, explains fixed income portfolio manager John Queen.

“One of the real strengths of the Night Watch and other multidisciplinary research groups is the fact that we have multiple views — or multiple eyes, so to speak — on each problem,” Queen says. “We also have analysts who are investors, so when a crisis comes along, we already know the industries and the companies well, and we can act quickly if needed to address the unfolding events.”

Confronting the virus

In its ongoing coronavirus analysis, the Night Watch group has, again, studied the crisis from all angles, including the economic, market and health implications. The team has looked closely at many recession and recovery scenarios: V-shaped, U-shaped, W-shaped, L-shaped and even a Nike-style swoosh. In doing so, they’ve put together a weekly dashboard to help track in real-time which scenarios are more likely.

In terms of the U.S. economy, evidence is mounting for a U-shaped recovery, Franz says. Massive government stimulus measures are helping to soften the economic impact, but rising infection rates in many U.S. states are complicating the recovery effort.

“There’s still a lot we don’t know about the virus, and I think the next few months are going to be tough,” Franz says. “But longer term, a year or so down the road, I think the chances of developing a vaccine are good, and that bodes well for a stronger recovery in late 2021 or early 2022.”

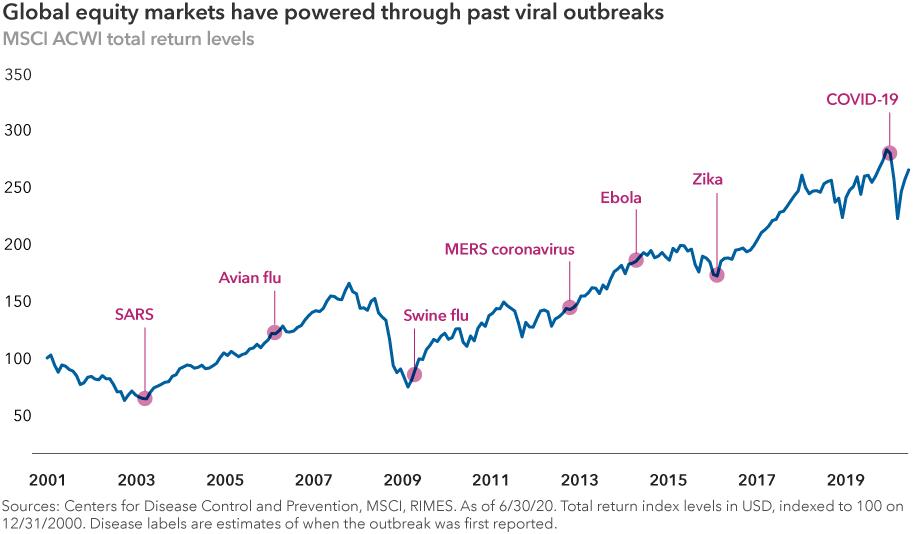

Indeed, global equity markets are telegraphing such a recovery, given the extraordinary rally since late March. From a historical perspective, that pattern has played out many times before as markets powered through previous outbreaks, including Swine flu, MERS, Ebola and the Zika virus.

Investment implications

Investing during the COVID-19 outbreak has, in some ways, accelerated trends that were already in place prior to the pandemic, such as the growth of e-commerce and cloud computing. The virus has hastened the decline of some companies, such as traditional retailers, that were already struggling to survive. But it has also devasted some industries that were previously doing well, particularly travel and tourism — meaning the outlook is very much sector-by-sector and company-by-company.

Companies such as Amazon, Netflix and Shopify have benefited greatly from the “stay at home” era, while companies such as Airbus, Boeing and Royal Caribbean have suffered. However, both scenarios may present compelling investment opportunities, notes equity portfolio manager Anne-Marie Peterson.

“My approach is more micro than macro, but there’s no question that the macro environment right now is creating a period of extraordinary change,” Peterson says. “Some companies are getting stronger, some are getting weaker and some are going away. I think what the Night Watch team highlights is that we have an incredible group of researchers that evaluates these macro events on a very deep level, helping us to understand the risks, and ultimately to act on the long-term investment opportunities that often emerge during times of crisis.”

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Julian Abdey

Julian Abdey

Jared Franz

Jared Franz

Anne-Marie Peterson

Anne-Marie Peterson