ETF

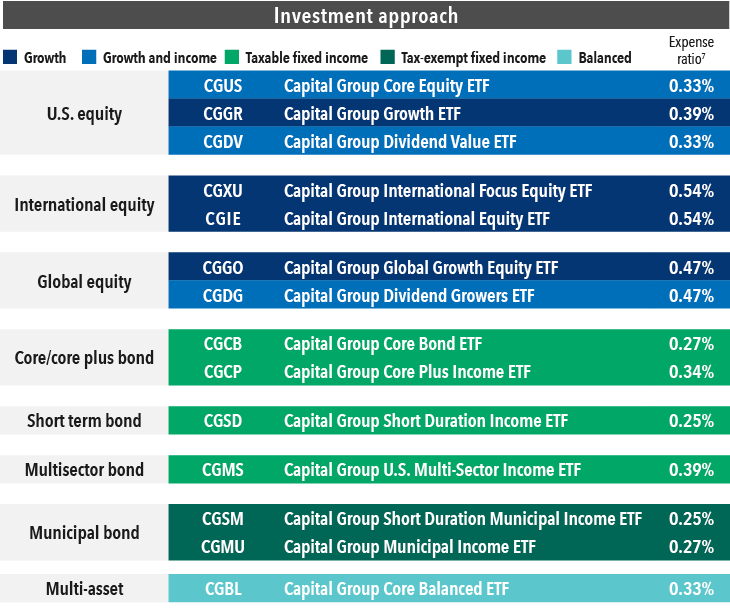

- Capital Group’s signature approach to active management is now available in 14 active transparent1 ETFs.

- Our five newest ETFs include our first multi-asset fund, Capital Group Core Balanced ETF (CGBL).

- Designed to help strengthen the core of investors’ portfolios, our ETFs are objective-oriented funds that seek better investment outcomes in a variety of markets.

Our ETF suite has expanded beyond funds in some of the most common allocations to now feature more options for refining portfolios. Our growing ETF lineup includes 14 active, transparent funds designed to offer more tax-efficient options across equity, fixed income and even multi-asset categories. Our five newest ETFs seek to better address individual client needs and aim to weather different market conditions. Here’s a brief introduction to our ETFs and a look at how they might work together to help strengthen portfolios.

CGBL: Our first active multi-asset ETF

Newly added to our suite is Capital Group’s first-ever multi-asset ETF: CGBL, Capital Group Core Balanced ETF. Backed by Capital Group’s more than 50 years of experience in multi-asset investing, CGBL seeks to provide a balanced approach to total returns (including both income and capital appreciation) that’s consistent with the preservation of capital over the long term.

Given its multi-asset makeup, CGBL could be used as a single solution for smaller accounts, offering a relatively inexpensive2 way to access an actively managed, diversified portfolio, but it could also provide a foundation onto which additional ETFs could be layered to fine tune portfolios to clients’ needs.

“CGBL offers bottom-up security selection, asset allocation and responsive rebalancing all in one fund. It aims to be a one-stop shop for a balanced portfolio, setting investors up to pursue their long-term financial goals.”

Paul Santoro

Capital Group Senior ETF Sales Manager

The fund is made up of 50% to 75% individual equities and a minimum of 25% Capital Group fixed income ETFs to pursue its objective. Investing across a wide variety of stocks from companies in a broad range of sectors and industries, CGBL seeks to construct a portfolio of quality stocks and bonds with flexible exposure to growth-oriented and dividend-paying stocks. It also offers active asset class flexibility. The fund’s fixed income allocation to one or more Capital Group fixed income ETFs seeks to provide diversification from equities and income to pursue dynamic risk management.

As with Capital Group’s other multi-asset funds, including the American Balanced Fund®, CGBL may change the mix of equities and fixed income over time, based on market conditions rather than on a prescribed schedule.

Capital Group active equity ETFs

Capital Group International Equity ETF (CGIE) is the newest addition to our international ETF offerings. With dual objectives of prudent growth of capital and conservation of principal, CGIE has a quality growth tilt that aims to show its value most in down markets. Compared with our other international ETF, Capital Group International Focus Equity ETF (CGXU), CGIE is more focused on preservation while CGXU aims for long-term growth of capital by focusing on companies of all sizes that are believed to have the strongest growth potential, including those in emerging markets. CGIE has a 10% limit on emerging markets investments and aims for less volatility and lower downside capture3 than the market.

“The portfolio managers in CGIE seek companies with characteristics associated with long-term growth and resilience during difficult markets. They look for companies with strong balance sheets, quality management teams, sound capital allocation policies and durable business models in hopes of providing a smoother return profile of returns in international markets over a full market cycle."

Emily Liao

CGIE Investment Director

Another newcomer to the suite is Capital Group Dividend Growers ETF (CGDG). As the second dividend-minded ETF in our lineup, CGDG seeks to deliver long-term total return by investing in the power of potential dividend growers.

“From a monetary policy standpoint, the world is very different today than a few years ago so it requires a different playbook. At some point, higher rates will have an impact on company balance sheets. Historically, companies that have grown their dividends tend to have a quality component to them, which may help them weather slowdowns. CGDG’s disciplined bottom-up approach provides investors with the growth potential of a global equity fund while pursuing less volatility, and aiming for attractive yield and dividend growth.”

Asad Jamil

Capital Group ETF Sales Specialist

CGDG could also work well alongside our other dividend ETF, Capital Group Dividend Value ETF (CGDV). CGDV is a U.S.-focused fund with a broader opportunity set that seeks to produce consistent income that exceeds the average yield of the S&P 500 Index.4 For financial professionals who build ETF model portfolios or for those looking to round out clients’ global equity allocations, CGDG could be coupled with Capital Group Global Growth Equity ETF (CGGO), which takes a flexible geographic approach in its search for fundamentally strong, high-potential companies located anywhere in the world. CGGO’s objective of long-term growth of capital may fit well with CGDG’s strict criteria for investment selection that typically results in a portfolio largely made up of high-quality companies (i.e., those whose debt is rated investment grade, BBB/Baa and above).

In addition to CGDV, Capital Group Core Equity ETF (CGUS) is the other U.S.-focused ETF with a growth and income objective. It blends many blue-chip dividend-paying companies with non-dividend payers that show attractive growth potential and can serve as a complement to an S&P 500 Index fund, potentially providing a smoother ride during difficult market environments.

Last, but certainly not least — it won “Best New U.S. Equity ETF” at the 2023 etf.com Awards5 — is Capital Group Growth ETF (CGGR). This fund resides in Morningstar’s Large Growth category and considers growth to be its objective, rather than its investment style. While it will predominantly invest in larger U.S. companies, it has flexibility across different geographies and market capitalizations to pursue capital appreciation. As a result, you may find cyclically out-of-favor or depressed companies, as well as small caps in the fund alongside companies that fit more traditional definitions of growth. It’s all in service of CGGR’s patient approach to growth.

Capital Group active fixed income ETFs

The recently added Capital Group Core Bond ETF (CGCB) brings a true core offering to our bond lineup. CGCB aims for the benefits typically associated with core bond funds: seeking to provide preservation of capital, striving to serve as a diversifier to other asset classes and pursuing consistent attractive income. CGCB seeks to differentiate itself from other core bond funds by taking a more balanced approach that’s less reliant on credit and should mean it moves less in-step with equities in down markets.

“The competitive landscape in core bond ETFs is dominated by passive offerings. The appeal of CGCB is that it aims to deliver a similar risk profile to that of its benchmark [the Bloomberg U.S. Aggregate Bond Index6], which is often the draw of passive for investors, while reaching for higher excess returns.”

Anmol Sinha

CGCB Investment Director

If CGCB strives to be the core ballast of a portfolio’s fixed income allocation, it could be complemented by the Capital Group Core Plus Income ETF (CGCP), which has a distinct income emphasis alongside its objective to preserve capital. CGCP is able to venture into high-yield corporates, emerging markets and securitized debt in pursuit of a resilient income stream, offering a portfolio with multiple potential sources of excess return.

Other taxable bond ETFs in the suite that can complement our core and core-plus bond ETFs include Capital Group Short Duration Income ETF (CGSD) and Capital Group U.S. Multi-Sector Income ETF (CGMS).

Sitting within the Morningstar Short-Term Bond category, CGSD pursues income with low interest rate sensitivity. ETFs within the category range from capital preservation-minded funds with lower income profiles to ETFs that are more focused on income opportunities and tend to have higher volatility. In comparison, CGSD takes the middle road. It pursues attractive income opportunities using a research-driven approach — not by compromising on quality.

CGMS, in contrast, pursues a high level of current income and the opportunity for capital appreciation. Seeking to maintain a broad portfolio across U.S. bond markets, the fund’s portfolio managers have the flexibility to pursue income opportunities in high-yield corporates, investment-grade corporates, securitized credit and other opportunistic areas, including in securities rated Ba1/BB+ and below (also known as below-investment-grade debt).

Within our municipal bond offerings are the Capital Group Municipal Income ETF (CGMU) and a short-term option: the Capital Group Short Duration Municipal Income ETF (CGSM).

CGMU is a core municipal fund that seeks a tax-exempt income stream over a full market cycle while preserving capital. It leverages a broadly diversified municipal bond portfolio with multiple potential sources of return.

CGSM is our newest municipal ETF. It pursues current income exempt from regular federal income tax across a variety of municipal sectors. The goal behind the fund was to build a short-term municipal ETF where we could be very competitive, which is where the fund’s credit flexibility comes in.

“When it comes to credit quality, this portfolio has flexibility. It can add up to 10% of its assets in below investment grade [BB+/Ba1 and below] to pursue income and really take advantage of the individual credit research that we do here at Capital Group.”

Gregory Ortman

CGSM Investment Director

CGSM could be an interesting option for investors either looking to step out of cash or money market funds to pursue greater total return and potentially defend against the loss of purchasing power. Or it could also serve those looking to step down from an intermediate duration municipal fund if aiming to reduce interest rate sensitivity and volatility.

Capital Group ETFs: Building blocks and core strategies to help investors pursue their long-term goals

Capital Group’s signature active management in a tax-efficient vehicle

Our ETF suite brings what financial professionals know and expect from Capital Group investment solutions to the ETF vehicle. We’re offering Capital Group’s hallmark capabilities: deep experience and our time-tested multi-manager approach, core-focused funds for common advisory allocations as well as actively managed, high-conviction, fundamental research-driven investing in the tax-efficient ETF vehicle.

1 Different types of ETFs offer varying degrees of transparency, but most ETFs disclose information about holdings more frequently than mutual funds, which appeals to investors who want to know exactly what they're holding. Passive and active transparent ETFs disclose their actual holdings daily while other types of active ETFs typically reveal holdings on a quarterly or monthly basis. Some may also release a mix of actual and proxy holdings on a daily basis. Additionally, transparent ETFs have the ability to invest in fixed income securities and non-U.S. securities. (Semi- and non-transparent ETFs must use American Depository Receipts, ADRs, to invest in non-U.S. securities.)

2 With an expense ratio of 0.33%, CGBL is in the lowest quartile of fees among ETFs within Morningstar’s Moderate Allocation category.

3 Downside capture refers to a strategy's performance in down markets relative to the index.

4 The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

5 etf.com Award winners are selected in a three-part process designed to leverage the insights and opinions of leaders throughout the ETF industry. The awards process began with open nominations in which nominations (and self-nominations) were submitted via a publicly available submission form. Following the open nominations process, the etf.com Awards Nominating Committee, made up of etf.com editorial staff, reviewed the nominations, which were screened for eligibility (appropriate timing and category). If more than five unique entries were received in the nomination process, the members of the Nominating Committee force-ranked their top five, resulting in a final slate for each category. Votes were resolved on a majority basis, and ties were broken, where possible, with head-to-head runoff votes. If ties couldn't be broken, more than five finalists were allowed. Winners among the finalists were selected by a majority vote of the etf.com Award panel of judges, a group of independent ETF professionals from the ETF industry. Judges recused themselves from voting in any category in which they or their firms appeared as finalists. Ties were decided, where possible, with head-to-head runoff votes. Results were announced at the etf.com Awards ceremony in April 2023 and published on etf.com.

6 The Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

7 The expense ratio is as of the fund's prospectus available at the time of publication. Expense ratios for ETFs are estimated.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.