ETF

- It may be time to fortify core bond allocations. As the threat of a U.S. recession looms, bonds can provide diversification from equities.

- Tax-loss harvesting opportunities abound. Consider harvesting your clients’ losses before markets recover — and consider reinvesting assets in active fixed income ETFs.

- Yields are very attractive at this stage of the cycle, even on traditionally lower risk fixed income assets — suggesting it may be an opportune time to invest. However, quality is important. Active fixed income ETFs can help you pursue value across sectors.

- With interest rates and Federal Reserve policy uncertain, active fixed income ETFs can help you manage interest rate risk* and may provide greater tax efficiency to portfolios over the long term.

The higher rate environment has resulted in more attractive yields across fixed income, making it a compelling area to consider. Bonds are offering significantly higher yields without having to take on more risk, which means you don’t have to venture too far on the risk spectrum to pursue higher income in a portfolio. Whether you’re tax-loss harvesting and wondering where to reinvest assets or unsure how to navigate fixed income allocations amid unpredictable Fed policy, we’ve identified three reasons why bonds (and active fixed income ETFs) appear compelling in the current environment.

Reason 1: The importance of diversification

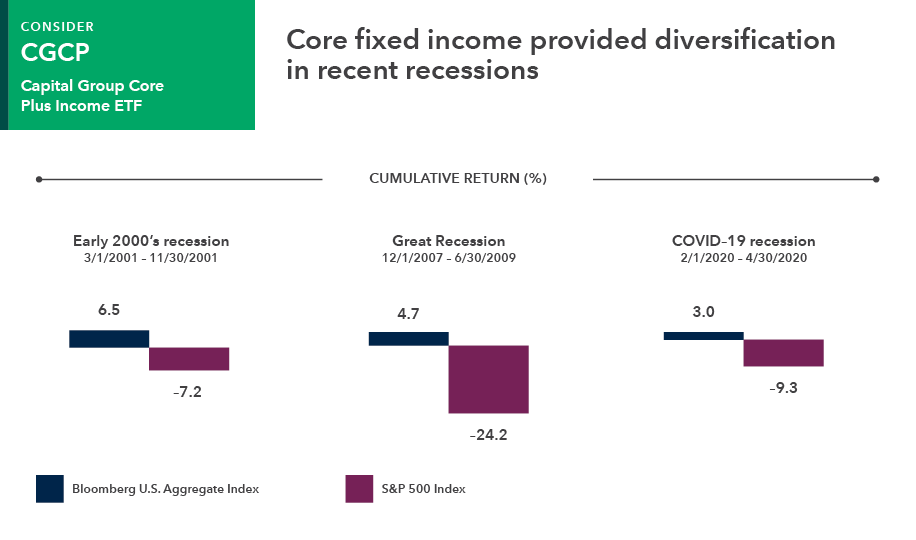

Bonds are expected to return to providing diversification from equities, which will likely be beneficial if there’s a recession.

- Expected rate hikes have largely been priced into the market based on the Fed’s consistent message to anticipate additional rate increases.

- Core and core-plus bond funds’ diversification benefits appear to be normalizing, returning core bond funds to their traditional role of helping to cushion volatility in equity markets as they have over the past three recessions.

- Furthermore, attractive bond yields provide a compelling opportunity set amid continued macroeconomic uncertainty.

- Consider fortifying the core of portfolios with an active core or core-plus fixed income allocation, such as the Capital Group Core Plus Income ETF (CGCP).

Sources: Morningstar, Bloomberg Index Services Ltd. Recession periods defined by the National Bureau of Economic Research. Correlations calculated using daily returns. Returns shown are cumulative. Past results are not predictive of results in future periods.

Reason 2: Option to tax-loss harvest in bond funds

If you’re still holding fixed income funds purchased in early 2022 or before, there may be an opportunity to generate losses to offset gains elsewhere, if any, and lower tax liabilities. However, fixed income tax-loss harvesting opportunities may become scarcer if bond markets continue to recover and inflation pressures recede.

- Tax-loss harvesting allows investors to realize losses by selling funds that have lost value, reinvesting the proceeds and using the capital loss to offset capital gains on other investments.

- Active fixed income ETFs may be an interesting reinvestment option for transitioning assets while realizing losses because they offer more transparency and better liquidity in comparison with mutual funds. They also may provide greater tax efficiency to the portfolio over the long term.

- If you’re unsure where to reinvest, consider active fixed income ETFs. As of 12/31/22, the average yield to worst on the Capital Group Short Duration Income ETF (CGSD) was 5.6% and it was 7.2% on the Capital Group U.S. Multi-Sector Income ETF (CGMS).

"When it comes to tax-loss harvesting, our active fixed income ETFs can be a compelling investment during the wash sale period† as a way for investors to preserve their allocations and maintain exposure to a changing market while still booking losses."

Holly Framsted

Capital Group Director of ETFs

Capital Group active fixed income ETFs can serve as tax-loss harvesting swaps for many common fixed income allocations

Source: Morningstar Direct, all data as of 12/31/22. Yield to worst is the lowest yield that can be realized by either calling or putting on one of the available call/put dates, or holding a bond to maturity.

§Tax-equivalent yield as of 12/31/22. The taxable equivalent yield assumptions are based on a federal marginal tax rate of 37%, the top 2022 rate. In addition, we have applied the 3.8% Medicare rate.

Reason 3: Late-market cycle opportunities across fixed income sectors

The global economy appears to be in the late stages of a market cycle, possibly offering an opportune time to invest in fixed income securities — if you know where to look.

- The bond market appears to be normalizing and may present an attractive entry point for investors as lower valuations present some compelling opportunities.

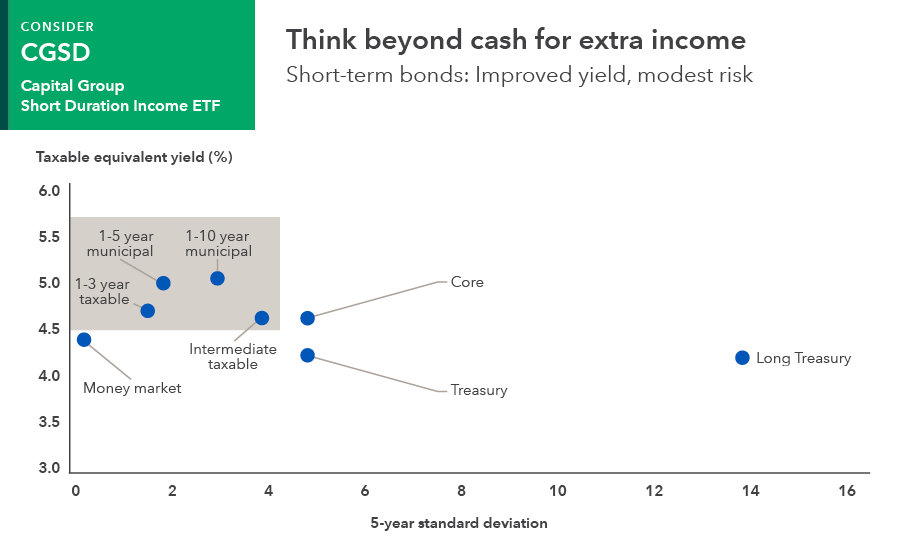

- Higher yields in short-duration, high-quality bonds appear to present an opportunity to earn more income than cash without taking on a significant amount of risk.

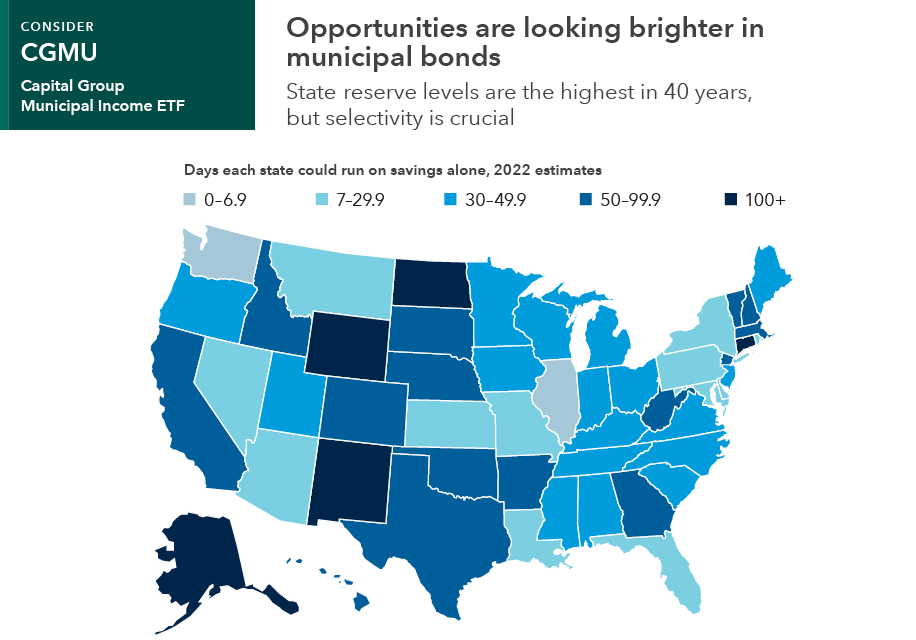

- Within municipal bond markets, solid credit fundamentals and high reserves suggest issuers are well positioned to weather a potential recession.

- High-income areas of the fixed income market look appealing but it’s important to rely on research and be selective. In the current environment, it’s not necessary to take on a lot of risk to get attractive yields.

"CGSD, our short duration income ETF, has relatively low interest rate sensitivity and aims for income and capital preservation. In comparison to other short duration offerings that are income oriented, CGSD emphasizes higher quality as well as more diversity in the income-producing sectors reflected in the portfolio. We believe that may lead to less volatility over time while still delivering attractive income and returns relative to much of the yield-focused peer group."

Anmol Sinha

Investment Director for CGSD

As of December 30, 2022. Source: Bloomberg Index Services, Ltd., Morningstar. Money Market: Morningstar Prime Money Market Category average. 1-3 year taxable: Bloomberg U.S. Aggregate 1-3 Year Index, Intermediate taxable: Bloomberg U.S. Aggregate Intermediate Index, 1-5 year municipal: Bloomberg Municipal Short 1-5 year Index, 1-10 year municipal: Bloomberg Municipal Short-Intermediate 1-10 year Index, Core: Bloomberg U.S. Aggregate Index, Treasury: Bloomberg U.S. Treasury Index, Long Treasury: Bloomberg U.S. Long Treasury Index. Yields for indexes are yield to worst. Money market yield is 7-day SEC yield. Taxable-equivalent-rate assumptions are based on a federal marginal tax rate of 37%, the top 2022 rate. In addition, we have applied the 3.8% Medicare tax. Standard deviation is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility. Past results are not predictive of results in future periods. The indexes are unmanaged and therefore, have no expenses. Investors cannot invest directly in an index.

"CGMU has the flexibility to act on what managers believe could be potential weaknesses in municipal credit spreads that may pop up to create attractive valuations."

Greg Ortman

Investment Director for CGMU

Sources: Capital Group, Pew Charitable Trusts; National Association of State Budget Officers. Data is reported by each state for its fiscal year, which ends June 30 in all but four states: New York (March 31), Texas (August 31), Alabama (September 30) and Michigan (September 30).

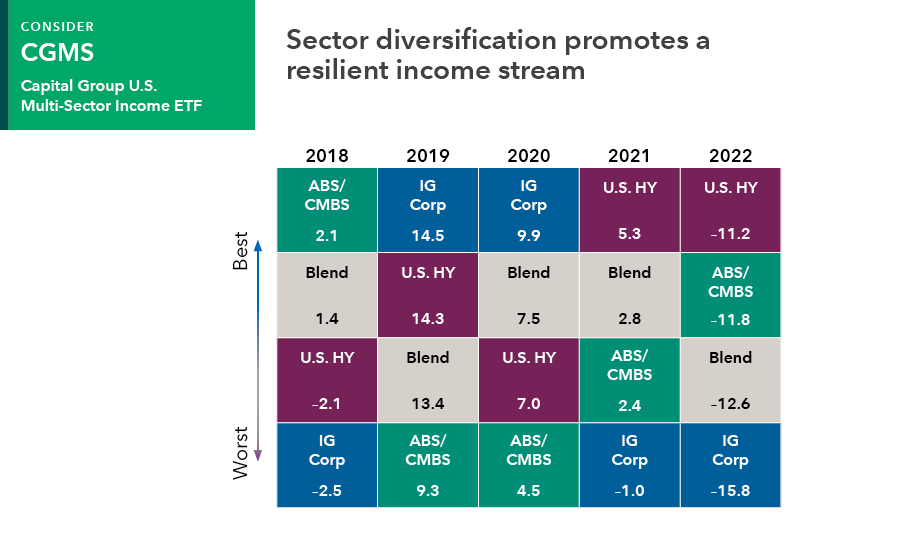

In the current bond environment, it’s important to be selective about sources of income, which is where an experienced active manager can help, particularly with a multi-sector income strategy. Such strategies allow flexibility across sectors to help focus on areas that have potential to offer the most added value.

"When pursuing higher income, you want a diversified fund for two reasons: first, diversification offers the potential for better risk management and second, no single income sector always comes out on top — therefore flexibility is a key to uncovering the best relative value across sectors and maximizing longer term risk-adjusted results. Given the complexities of credit markets, you'll want an active manager to be pulling those risk levels for you."

Harry Phinney

Investment Director for CGMS

Data as of December 31, 2022. U.S. HY represents Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index; IG Corp represents Bloomberg U.S. Corporate Investment Grade Index; ABS/CMBS represents 80% Bloomberg CMBS Ex AAA Index/20%Bloomberg ABS Ex AAA Index. Blend is Multi-Sector Income Fund Custom Blended Index comprises: 45% Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index, 30% Bloomberg U.S. Corporate Investment Grade Index, 15% J.P. Morgan EMBI Global Diversified Index, 8% Bloomberg CMBS Ex AAA Index, 2% Bloomberg Ex AAA Index. Past results are not predictive of results in future periods. The indexes are unmanaged and therefore, have no expenses. Investors cannot invest directly in an index.

Active fixed income management may hold added appeal in an uncertain environment

The current fixed income environment presents opportunities that may help position portfolios for the year ahead. However, if you hold passive fixed income strategies, it’s important to remember that you will need to carefully monitor interest rate risk and duration across those funds. For support in these areas, consider investing in active fixed income funds, particularly active fixed income ETFs, which may offer additional liquidity, transparency and tax benefits. Our portfolio construction team has experience identifying opportunities to simplify fixed income allocations, potentially lowering clients’ fees and allowing you to spend more time supporting your clients and growing your business. To learn more, request a consultation today.

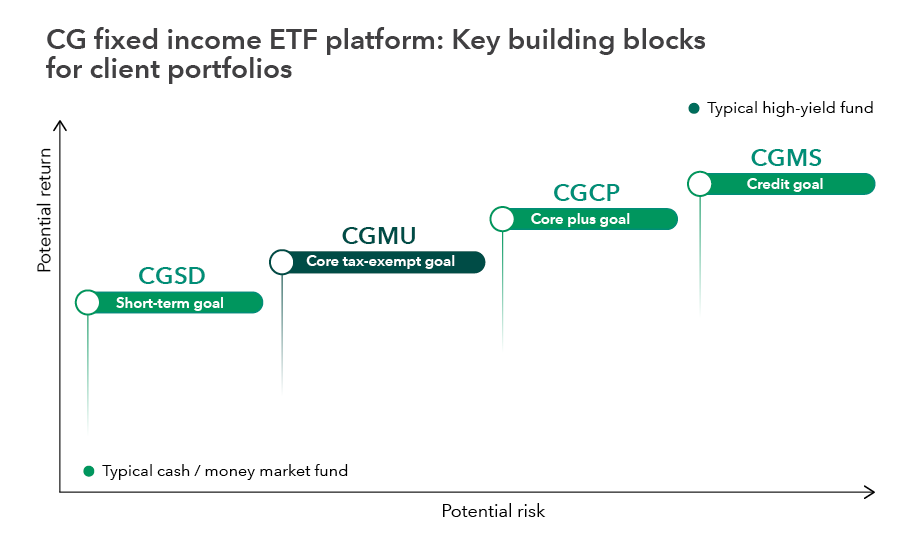

The typical cash/money market fund and the typical high-yield fund are for illustrative purposes only and are not plotted to an index.

*Interest rate risk is the risk of a decline in the value of fixed income assets due to a change in interest rates.

†The Internal Revenue Service's wash-sale rule regulates the timing around how quickly a substantially identical security can be purchased after the underperforming asset was sold to realize a tax benefit from tax-loss harvesting.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

RELATED INSIGHTS

-

The biggest trends for active ETFs in 2023

-

ETF

5 ways RIAs are using ETFs in client portfolios -

ETF

How to effectively measure ETF liquidity

- Expense ratios are as of each fund's prospectus/characteristics statement available at the time of publication.