Client Relationship & Service

Demographics & Culture

- Be ambitious in aspiring to serve one of these individuals. They almost always have multiple advisors and are not quite at the level of needing multi-family offices.

- Don’t expect prospective clients in this client group to be vastly different in profile from those with less wealth. Their financial needs, however, will almost certainly be more complex.

- Create an ecosystem of support around such individuals. Their goals are broad. Over 15% work primarily in the not-for-profit sector, and many more are engaged in creating a legacy and their unique place in the world.

After addressing how well you know the HNW market and the characteristics of clients with $20 million–$30 million in net worth, now we consider the ultra wealthy and what makes them unique.

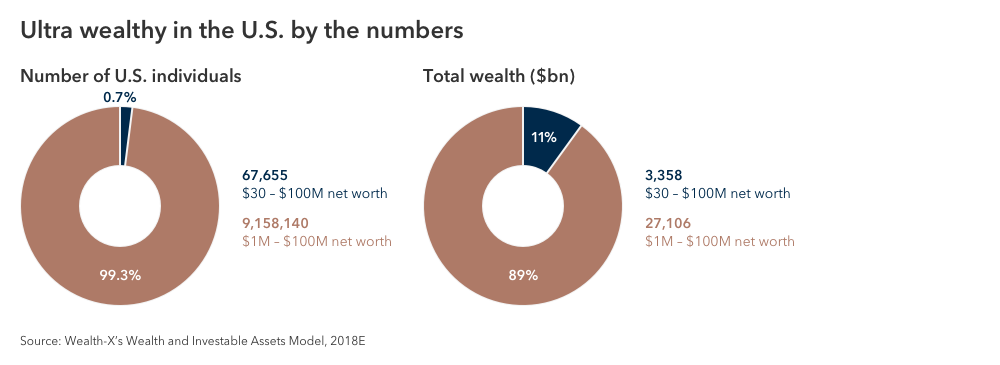

Finding 1: This client group is small in number, but large in wealth.

There are just over 67,000 ultra wealthy individuals in the U.S. — those with a net worth of $30 million–$100 million. But their combined net worth of $3.4 trillion in 2018 was greater than the value of the world's four largest companies: Apple, Amazon, Alphabet (the holding group for Google) and Microsoft. Moreover, they represent just 0.7% of the broader category of those with $1 million–$100 million, but account for 11% of the category's net worth.

Wealthy clients in this strata tend to work with multiple advisors, but are not yet quite at the level of needing multi-family offices, presenting an opportunity for advisors. Moreover, Wealth-X expects the number of such individuals to grow over the next five years, to 84,500, with over $4.2 trillion in combined wealth.

What this means for RIAs:

For many advisors, having even one client in this wealth tier is an ambitious aspiration. Yet, it’s worth remembering that such individuals tend to have multiple advisors, meaning that each advisor can have a (small) slice of the (very large) pie. In our interviews with the wealthy with $5 million or more in investable assets, many tend to have at least three advisors to manage their finances and investments in order to diversify investment strategies, minimize risk and benefit from a range of perspectives.

Finding 2: Despite first appearances, this client group tends to have more complex financial needs than those with lower wealth levels.

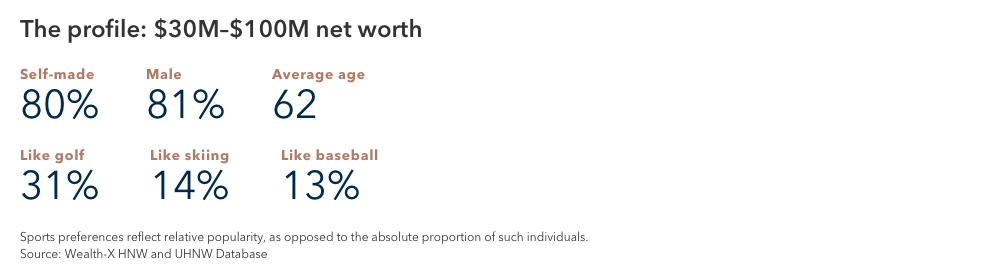

Who are the individuals that make up this select group? Despite their great wealth, their profiles are, in fact, similar to those with lower levels of wealth. For example, 80% of this group is self-made, compared to the 86% for those with $5 million–$30 million. Inheritance plays a slightly larger role, but only by a few people per hundred.

At 81% male, this percentage is only slightly greater than with the lower tier, and the average age is virtually the same, at 62. While golf is a common favorite sport, this wealthier group has a greater interest in skiing and baseball than those with less wealth.

Who are the ultra wealthy?

What this means for RIAs:

On the face of it, don’t expect prospective clients in this group to be vastly different — they will often appear similar in profile to your current clients. However, their financial needs will almost certainly be more complex. Such individuals tend to own businesses that have achieved at least a regional, if not international, scale. They’ll often have participated in multiple commercial enterprises, have family and investment accounts overseas, and have tax liabilities that are multifaceted.

In addition, such individuals tend to be well connected to other prosperous associates. According to Wealth-X’s proprietary data assets, this group has an average of 4.4 known relationships with other ultra wealthy individuals. There are likely to be others that are still unknown to us, and an even greater number of associates with lower levels of wealth. Don’t be afraid to ask for personal introductions from your current client base.

Finding 3: This client group has a broader focus, concerned with their place in the world and their legacy.

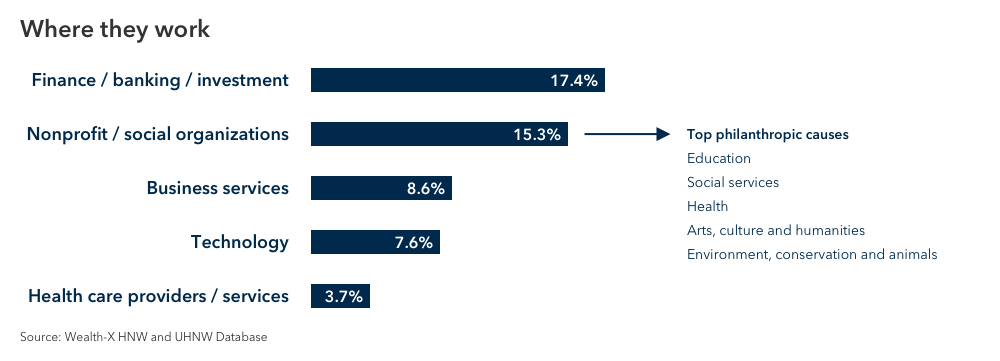

They also tend to have goals that are broader in nature than those with lower levels of wealth. Not only are they concerned with building up their wealth and securing their family’s financial future, they are also often engaged in creating a legacy and occupying a unique place in the world.

By primary industry, over 15% work in the not-for-profit sector, second only to finance. This is significantly higher than those with less wealth, indicating a propensity for these individuals to shift focus once their businesses are sold off or have achieved significant success.

With their vast estates, they can significantly shape an area within the world of philanthropy, whether it’s investing in a giving vehicle such as a donor-advised fund (DAF), setting up a foundation or recruiting a number of like-minded wealthy associates to give generously to a particular charitable cause.

Where to find the ultra wealthy

What this means for RIAs:

Expect to be more than a wealth advisor and even a life coach at this level of wealth. Clients in this bracket expect to be treated as a special class — they know their commercial worth to you. Build up the relationship by being a connector to other experts that can help them, such as tax and philanthropy advisors. Creating a mini ecosystem of support will cement your role and allow for more personal referrals.

RELATED INSIGHTS

-

-

Traits of Top Advisors

-

Practice Management

Use of this website is intended for U.S. residents only.