Client Relationship & Service

Demographics & Culture

- Take time to be a sounding board: Numbering over 61,000, these individuals want the benefits of one-on-one advice, whether or not they are also served by a private bank.

- Seek to include women in conversations whenever possible: Almost 80% of these individuals are male. Nevertheless, even when women are not the primary client, they are often at least an equal partner in decision-making.

- Discuss legacy plans and meet with families: With an average age of 61, clients with a net worth in the range of $20 million–$30 million have an eye on wealth transfer. Generation X will make up the next cohort of inheritors, so take every opportunity to discuss legacy plans with your clients and to meet with their spouses and children.

- Engage with clients in what they care about, even in small ways: Sports and philanthropy are their top passions and hobbies.

In this second article in our series focusing on who the wealthy are, we look at those individuals with a net worth of $20 million–$30 million and how they differ from those with other levels of wealth.

Finding 1: Small in number, large in potential.

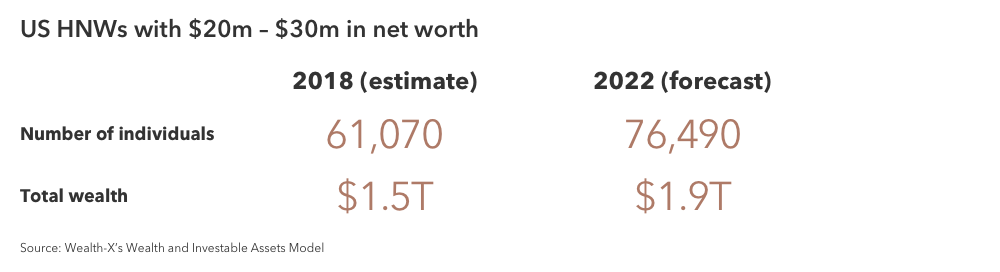

Wealthy clients with $20 million–$30 million in net worth are an important, but often overlooked, group. This subset of the wealthy population is more than 61,000 strong, and they hold almost $1.5 trillion in total net worth. Private banks focus on individuals with this level of wealth, but are not the only type of firm that serves this group. Wealthy people in this strata are looking for one-on-one advice. This presents an opportunity for advisors, even if the client has existing relationships with other investment professionals.

Indeed, in our interviews with the wealthy, we’ve found that those with $5 million or more in investable assets tend to have at least three providers to manage their finances and investments. Clients care greatly about trust and the relationship with their advisors when it comes to wealth management, and this can be provided by both large and small providers.

We expect the number of such individuals to grow to almost 76,500 by 2022, with $1.9 trillion in total net worth. Don’t assume their needs are already taken care of by a large firm. Take the time to be a sounding board for these clients. Clients with this level of net worth may focus on the future sooner than those at lower wealth levels. Expect conversations about estate planning and associated decisions to be top of mind.

Finding 2: The vast majority of clients are male: But don’t exclude others in the family from the conversation.

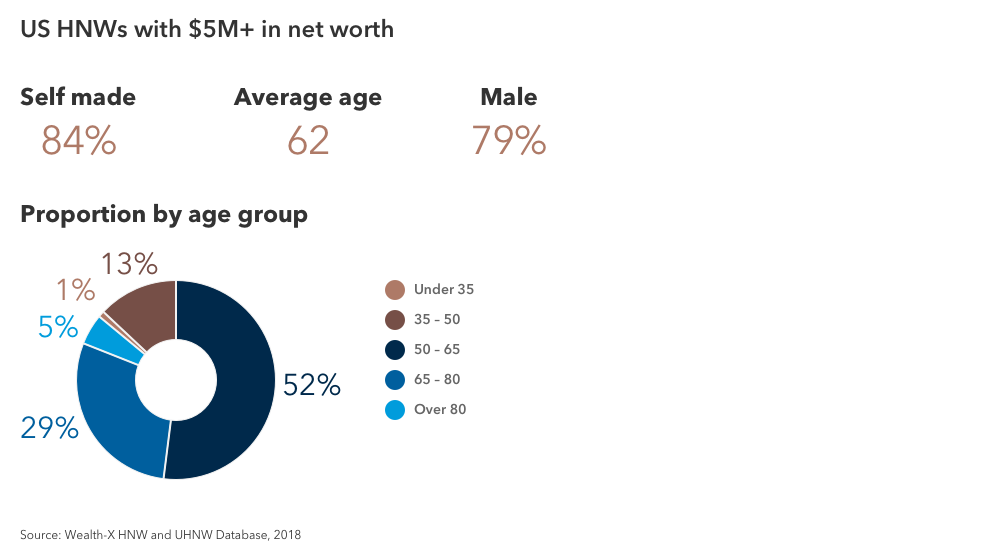

Who are these individuals and how are they distinct? Almost 80% of individuals with $20 million–$30 million in net worth are male. This is a significantly higher proportion than for those with lower levels of wealth: For example, within the $5 million–$20 million tier almost 40% are women. Yet, given the still substantial wealth gap between men and women, even at lower levels of wealth, it’s no surprise that at this level the difference between genders is significant.

Even when women are not the primary client, they are often at least an equal partner in decision making. Advisors should seek to include them in conversations whenever possible. In fact, a study of clients who work with a financial advisor found that 46% say that financial decisions are made jointly, with each spouse or partner sharing the decision-making equally.

Finding 3: The average age of this client group is 61: Concentrate your efforts on Generation X and baby boomers.

Like other wealthy individuals, the vast majority of this group have made their own fortunes (84%), more frequently than those with over $100 million in net worth (72%), but less frequently than those with $1 million–$5 million (89%). In contrast, given the time it takes to create and accrue substantial wealth, their average age is 61, similar to those in other wealth tiers. There are two facets to consider here.

Firstly, for those near and above retirement age, legacy planning is a top consideration. For advisors, this means developing a relationship with the next generation, which will often be Gen X aged 40 and over. Research shows that wealth transfers from one generation to the next have resulted in 90% of heirs changing advisors. Quite often we find that it is simply because the heirs either do not know or do not have any rapport with their parents’ advisor, and, therefore, opt to use advisors they know and trust.

Other times it is due to factors out of an advisor’s control: the heir may want to remold their new wealth in their own fashion, the advisor’s style may not suit the heir, or the wealth is split up into many parts, no longer justifying the use of an advisor. To make sure that your portfolio of clients is as insulated from these risks as possible, aim to meet their family members at least once a year. This will help gradually build trust and a rapport, even if in a small way. Discussions around legacy should be thought of as a progressive conversation, one to start and continue with your clients every now and then.

Additionally, media attention tends to focus upon wealthy millennials, with Silicon Valley and the tech sector getting a disproportionate share of the limelight. In reality, the majority of individuals who will be inheriting the bulk of their parents’ wealth are between the ages of 40 and 65. Spend your time focusing on Generation X — the demographic cohort following the baby boomers and preceding the millennials – and above. The millennials will have their time, but it isn’t here yet.

Finding 4: Sports and philanthropy are the top interests: Engage with your clients around what they care about.

Connect with your clients and their family outside of the finance arena. As we touched upon in our first article in this series, your clients’ long-term aims are unlikely to be purely, or even mostly, about generating further wealth. Their goals are likely to include business or career aims, but also a multitude of other aspects pertaining to family, friends, hobbies and passions.

Based on our proprietary data and research of high net worth individuals, sports is the leading hobby for those with $20 million–$30 million in net worth. Philanthropy is second, as a large proportion of these individuals are involved in community activities. Many also make sizable donations to charity, not only a sign of broader philanthropic goals but also a tenet of estate planning. Philanthropic causes vary, but they are often in the areas of education (e.g., scholarships, teacher training, outreach courses), social services and health initiatives.

Building trust is not just about the financial services you provide. Find out the areas your clients and their families are passionate about, and engage with them on those areas. This could be done in ways big and small, whether it is inviting them or their children to a relevant event, communicating with them around a recent news item or sharing a personal story that coincides with one of their interests. Other examples include inviting a client’s grandchild to a soccer match if they’re passionate about the sport, or sharing a story of a new scientific discovery in the battle against malaria.

RELATED INSIGHTS

-

-

Traits of Top Advisors

-

Practice Management

Use of this website is intended for U.S. residents only.