Retirement Income

Practice Management

When defining your firm’s go-to-market strategy, your natural instinct may be to try to be all things to all prospective clients. This may be especially tempting in the extremely competitive ultra high net worth space, where advisors are competing for a small number of clients representing a large percentage of the market’s total investable assets.

There is value, however, in narrowly defining the types of clients who are the best fit for your business. A narrower — or “niche” — focus not only allows you to communicate in more interesting and tangible ways, but it can also help you run your overall organization more efficiently.

- Rather than casting a wide net, the most successful ultra high net worth (UHNW) teams narrowly define their target audience — and then tirelessly focus on the capabilities required to serve them.

- The benefits of niching extend well beyond marketing to your firm’s operations, human capital and investment approach.

- Many advisors hesitate to pursue niche strategies because they are afraid to turn potential business away, but narrowing your firm’s focus can lead to more scalable growth.

Financial advisors seeking to grow assets under management face an extremely competitive market today. This is particularly true in the ultra high net worth (UHNW) space, where advisors are clamoring over a limited number of clients who control a significant portion of the market’s total investable assets. Now more than ever, advisors need an edge if they want to build business with UHNW investors.

One way they can get that edge is by learning to tell a narrow, specific story about their value proposition. In other words, they embrace the power of a niche marketing and business development strategy -- or “niching.”

But niching isn’t just about choosing specific types of clients to serve. And it isn’t just about marketing, either. The optimal niching strategies touch every aspect of your firm, including your approach to hiring team members, managing your operations and investing capital for clients.

We highlight the principles of an effective niching strategy and how a narrower focus can help you grow your business.

Give yourself the opportunity to say something more powerful and interesting

When crafting your firm’s go-to-market strategy, it can be tempting to try to be all things to all people. But if you cast too wide of a net — for example, if you seek to serve any client with assets in excess of a certain dollar amount — you may limit your ability to communicate effectively with clients who truly are the best fit for your firm. Your message could get watered down to a point where it is no longer compelling.

A marketing message is so much more powerful when you can speak directly to a specific client type and use detailed examples to demonstrate your expertise. Specializing allows you to speak about clients’ exact pain points and how you can solve them in a very real and tangible way. If you haven’t narrowed, it is harder to say something that is relevant to the best buyers of your service, to tell interesting stories or give good examples that speak to them.

Don’t force yourself to genericize your messaging by trying to be everything to everyone.

Niching is about more than just focusing on specific types of professionals

It can be valuable to talk about specific types of professionals your firm is particularly well-suited to serve, such as business owners, athletes and doctors. There is nothing wrong with catering to specific types of clients, as this is a natural way to niche. But advisors should think beyond just the types of professionals they want to serve when designing a niche marketing strategy.

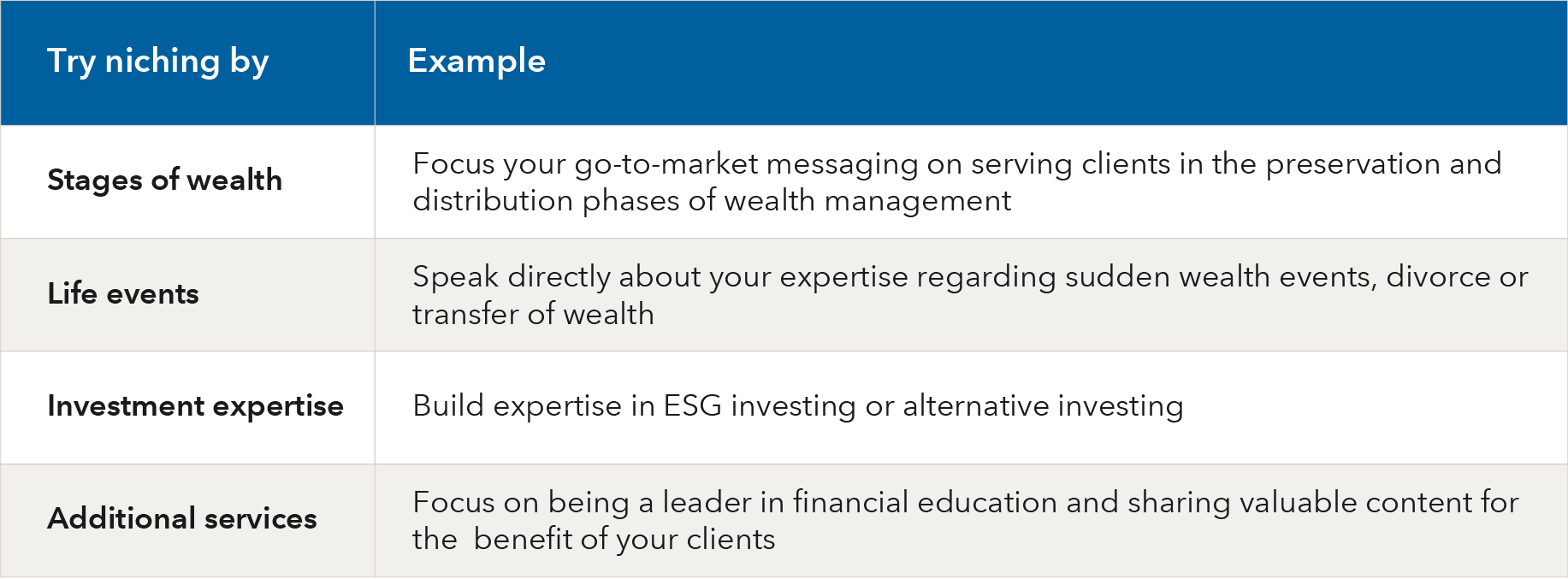

Other ways you can pursue a narrower go-to-market strategy:

Clearly, there are many different ways to niche. The good news is you don’t have to choose just one — advisors can niche across multiple dimensions.

Benefits of niching extend beyond marketing to operations, investments and human capital

Niching doesn't just simplify and strengthen your messaging — it can also help your firm operate more efficiently. By more narrowly defining the types of clients you serve and issues you address, you also narrow your focus on the best people to hire, systems to invest in and expertise to build.

On the human capital side, niching can help you zero in on the types of people who are best equipped from an experience and personality standpoint to serve your targeted areas. For example, if your objective is to build a practice focused on UHNW investors in general, it will be difficult to filter the potential additions to your team beyond their experience serving wealthy individuals and families. On the other hand, if you more narrowly aim to build a practice focused on serving UHNW women, particularly those going through a divorce or the death of a spouse, you can be much more specific in the types of team members who are the best fit for your business.

Niching can also benefit your investment approach, because it allows you to identify the specific types of investments that are particularly relevant for your narrowly defined audience. This enables you to build expertise in those areas and limits the risk that your team will be spread too thin. For example, if your practice focuses on serving young entrepreneurs who have rapidly accumulated wealth, you may seek to build expertise in growth-oriented investments, cryptocurrencies and alternative investments like private equity and venture capital. Narrowing your focus allows you to build investment expertise in a more efficient way that would be impossible if you had cast too wide of a net.

Embrace the power of saying no

It’s natural to fear that a narrower marketing message may push away some clients who could still be a good fit for your firm. But there is a difference between the clients you describe in your go-to-market message and the clients you ultimately serve. If a client who falls outside of your targeted focus areas wants to work with you, you can still serve them.

There is, however, power in saying no. The truth is that there are limitations on your firm’s resources — including time, money and mindshare. You and your team have only so much energy you can expend, and saying yes to one thing might mean saying no to another. Being explicit about the types of clients and situations that aren’t a fit for your firm can help you stay focused on the opportunities that truly are the best fit.

A competitive edge for your firm’s growth strategy

The market for new client relationships is extremely competitive today, and it is vital to have an edge, particularly when seeking to build business with wealthy clients. Niching can provide a valuable edge to your marketing and messaging strategy, allowing you to speak directly and in a more compelling way to the clients who are the optimal fit for your firm. Niching can also help improve your firm’s overall operations and help you get the most out of your resources.

Capital Group is focused on helping advisors improve their ability to serve the UHNW client segment and drive organic growth. For additional perspectives, see our recent articles below and look for more to come.

- Keys for building an ultra high net worth practice

- How to build the optimal technology stack

- Leading RIAs share their key drivers of organic growth

To read the full article, become an RIA Insider. You'll also gain complimentary access to news, insights, tools and more.

Already an Insider?