Client Relationship & Service

Practice Management

Financial advisors have seemingly unlimited choices for building out their technology infrastructure. But this key potential advantage for registered investment advisors relative to large broker-dealers is a double-edged sword that should be managed carefully.

In a recent survey of advisors by Cerulli Associates, advisors reported numerous issues related to technology. Chief among these concerns were cost constraints, steep learning curves, compliance requirements, concerns about data security and lack of support staff.

We provide five key guidelines that may help advisors avoid pain points and maximize the strategic value of their technology stack, beginning with the importance of narrowly defining your target client and how you will serve them.

- The proliferation of technology tools for financial advisors creates unprecedented choice, but also the potential for confusion and dysfunction.

- To build the right tech stack for your firm, start by narrowly defining the exact clients you want to serve and how you want to serve them.

- Given the value of an integrated system, advisors should analyze potential solutions carefully and ensure that technology offerings truly can talk to each other.

Financial advisors have seemingly unlimited choices for building out their technology infrastructure. But this key potential advantage for RIAs relative to large broker-dealers is a double-edged sword that should be managed carefully.

In a recent survey of advisors by Cerulli Associates, advisors reported numerous issues related to technology. Chief among these concerns were cost constraints, steep learning curves, compliance requirements, concerns about data security and lack of support staff.1

We provide five key guidelines that may help advisors avoid pain points and maximize the strategic value of their technology stack.

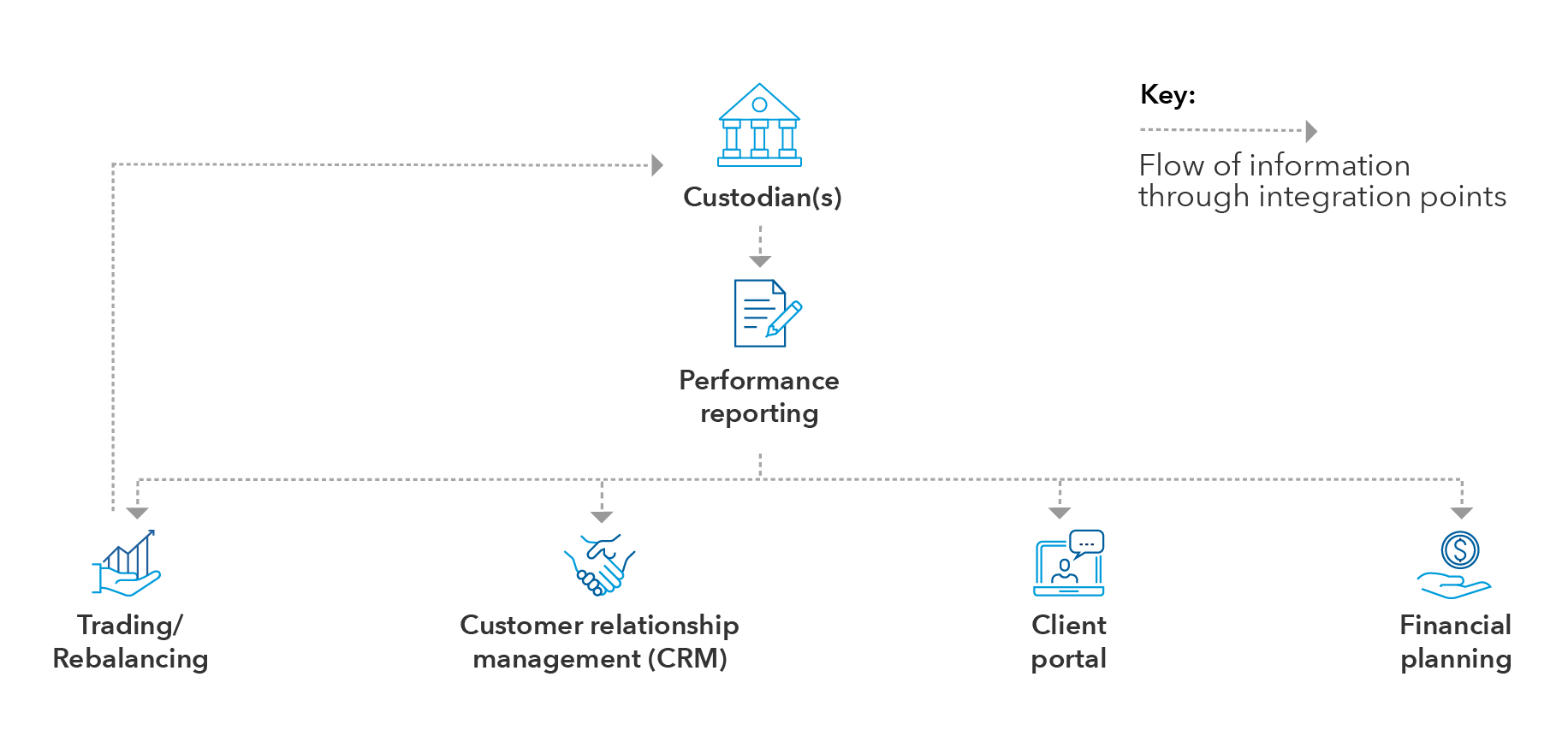

Key systems of an RIA’s integrated tech stack

1. Build your technology around your firm’s specific clients and services

RIA owners looking to build technology infrastructure for their firms naturally ask, “Which technology solutions are best?” And the answer is, “It depends.”

“When I’m asked that question, I first ask RIAs to explain the types of clients they are serving and the makeup of their investment portfolios,” said Matt Sonnen, CEO of PFI Advisors, an RIA consulting firm. “Until an advisor can identify who they are serving and how they want to serve them, they can’t begin to build out a proper technology stack.”

When PFI Advisors published a white paper in 2020 on the major performance reporting systems Addepar, Black Diamond Wealth, Envestnet | Tamarac and Orion Advisor Solutions, readers kept asking why PFI Advisors hadn’t indicated which reporting system was best. “That’s because there isn’t necessarily a ‘best,’” Sonnen said. “Some systems are better for sleeve-level reporting on SMAs (separately managed accounts), others for tracking complex alternative investments, others for portfolio management-focused models, and so on. The best technology depends on what you intend to do with it.”

For example, an RIA that runs model portfolios will likely need a robust trading system to execute orders across multiple accounts in an automated way. But this type of solution would be wasted on an advisor with customized portfolios and a need to execute trades for one client at a time.

“Advisors can’t begin to build a proper tech stack until they have clearly and narrowly defined the clients they want to serve and how they want to serve them.”

Sonnen provided another example: “If you want to automate workflows and run your entire firm through a CRM (customer relationship management system), Salesforce might pay off, despite the high price tag. But if you simply want a place to store contact information and call notes, investing in Salesforce would be like buying a Lamborghini just to get your kids to school.”

Similarly, a client portal with complex analytical bells and whistles is overkill for many RIAs. The typical advisory client is a “delegator” by definition, and they often just need a way to quickly log in and check their portfolio reports. Custodians’ portals or those built into reporting tools are usually adequate.

“With so many choices available, building an integrated technology stack that gains full adoption across the firm is difficult,” Sonnen added. “Starting with a clear understanding of who you are trying to serve and how you want to serve them can eliminate a lot of headaches down the line.”

2. Beware of too much tech — not just too little

When PFI Advisors is asked to analyze technology solutions for an RIA, they occasionally find that an RIA is trying to do too much with too little. Far more often, however, they find the opposite is true: In many cases, the RIA’s owners have continued to throw more and more technology at the staff, hoping the next tool will be the silver bullet that cures all of the firm’s tech challenges.

“This line of thinking is a problem on many levels,” Sonnen said. “The biggest flaw is that none of the tech tools have a chance of earning firmwide adoption. The staff realizes that before they have time to master a new system and reap its benefits, another tool will be headed their way.”

By constantly introducing new systems and asking staff to learn them, RIA owners distract employees from their core focus of serving clients and incur the wasted cost of systems that never achieve full adoption. They also run the risk of confusing clients.

If this scenario seems familiar, it may be time to take a step back and perform addition by subtraction. Examine why you chose a system in the first place, and determine which solution will work best for each back-office component. Removing duplicative technology and an overcomplicated architecture can improve workflows, client satisfaction and the bottom line.

3. Focus on integration

A fully integrated back office saves time, allows you to service more clients and drives revenue to the bottom line. However, “integrate-able doesn’t necessarily mean integrated,” Sonnen cautioned. Integration is achievable, but takes a lot of planning and execution to achieve. Advisors should analyze potential solutions carefully and ensure that technology offerings truly can talk to each other.

“In an ideal world, data flows seamlessly from an RIA’s custodian into the firm’s reporting provider, and from there is routed into the other core systems, such as the CRM, trading software and financial planning tool,” Sonnen added. Examples of proper integration include a trade file that is automatically transmitted from the trading/rebalancing software to the custodian, or a client address change that is automatically populated in all systems firmwide once it is entered into one system.

“An RIA’s technology stack is only as strong as its integration and the integrity of the data that lives in each of its core systems.”

Advisors should not assume that every tool has the ability to integrate with every other tool on the market. There are one-size-fits-all, pre-integrated platforms available, and these may be good, cost-effective choices for some advisors. Those who want best of breed in every corner of the stack, however, will need to play a technology version of 3-D chess: They will need to select one system at a time, guided by how much true bidirectional integration it offers to the systems before and after it.

To help solve this challenge, Sonnen recommends that advisors test new systems before making long-term commitments. One way to do this is by taking advantage of vendors’ free trials. Many vendors provided free trials during the COVID-19 pandemic and will likely continue offering such trials if you ask for them.

4. Don’t substitute technology for the human touch

The spread of the on-demand work culture has led financial advisors to wonder whether they should be replacing high-touch service with high-tech tools. Their clients have unlimited access to shopping, music, videos, news and more. Why not expect the same from their financial advisor?

This concern is understandable, but it may miss the point. “On demand is not the same as do-it-yourself,” Sonnen noted. “We refer to this as ‘the Amazon effect.’ Consumers want to go online, compare a large number of vacuum cleaners, and order one knowing it will fit their exact needs and arrive quickly. They don’t, however, want to go online to source all the best components of a vacuum so they can build one themselves.”

RIA clients generally aren’t seeking to take the reins and manage portfolios on their own. They want the ability to log in, check their portfolio reports and seamlessly interact with their advisor. Text messaging, video conferencing, two-way client vaults, client surveys, curated news feeds — these tools make the advisor more available to the client and make the client’s experience more central to their financial goals.

Technology should not try to replace the human relationship that is the heart of the advisory industry; it should enhance it. “Instead of trying to create a robo-like experience, advisors should think of innovative ways to leverage technology to improve communications with clients,” Sonnen said.

5. Get your entire firm behind your technology strategy

No matter how much time and money an RIA spends on technology, the investment will be wasteful if no one is using it properly. The RIA’s owners, therefore, would be well advised to commit their firm to a “total tech” strategy.

One team member should be charged with owning the tech stack. This includes keeping track of vendors, managing integration, learning best practices and training users. This is a key role that shouldn’t be assigned to a junior staffer.

“Technology isn’t meant to replace the human interaction of our relationship management-driven industry. Rather, it is meant to enhance it.”

RIAs also should be systematic about training and system adoption. “Training and adoption don’t have to be overly complex,” Sonnen said. “You can incentivize the team in simple ways. For example, once 30% of the firm starts using a new CRM according to the process we’ve laid out, reward the team with free pizza on a Friday.”

RIA leaders should also regularly review the entire technology stack, preferably at least once per year. Consider each core system and ask questions like: How often is it used? Is it user-friendly? Is it integrated enough to minimize duplication and manual entry? The answer may be to remove some of the technology pieces put in place over the years or simplify how certain tools are being used.

By continuously improving its technology suite, an RIA can reduce redundancies, free employees to spend more time with clients and increase profit margins. A robust infrastructure also establishes the RIA as a cross-functional organization capable of building scale and competing from an M&A perspective, if that is the firm’s chosen growth strategy.

Tech stack is a key ingredient for organic growth

Your tech stack is a key tool in building an efficient operational structure that can support your firm’s growth. Like any important strategic initiative, building an optimal technology system is often challenging and should be approached with a thoughtful process. For additional resources on how to foster operational efficiency and organic growth, see our recent article on leading RIAs’ strategies for driving organic growth.

1Cerulli Associates, “The Cerulli Report – RIA Marketplace 2020: Exploring Drivers of Change”

To read the full article, become an RIA Insider. You'll also gain complimentary access to news, insights, tools and more.

Already an Insider?

Matt Sonnen

Matt Sonnen