Demographics & Culture

Finance & Banking

Regulatory changes aimed at financial professionals acting as brokers are on the way.

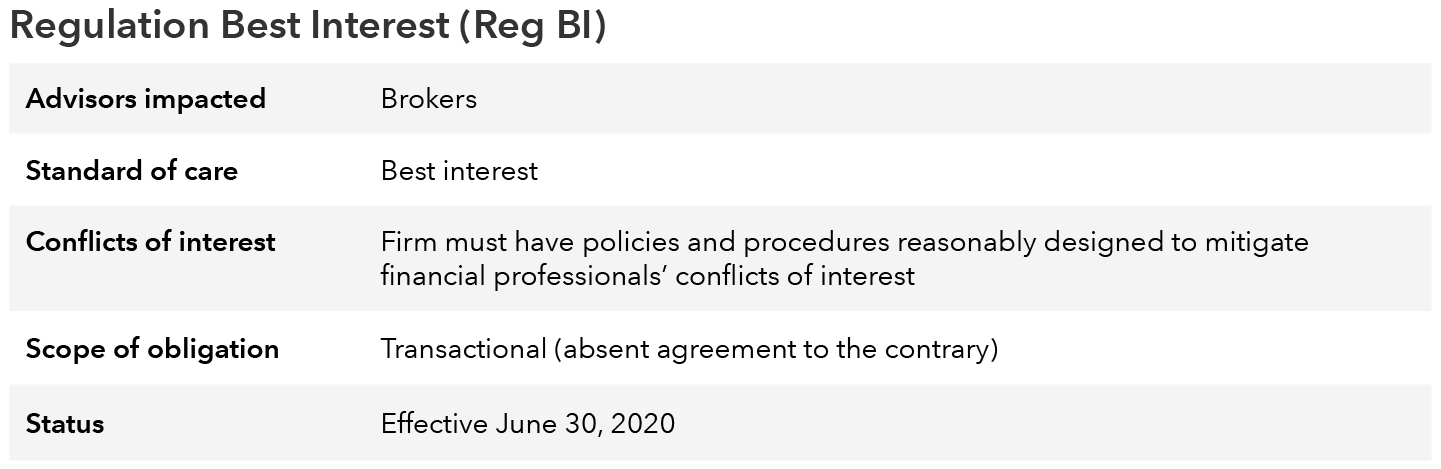

Regulation Best Interest, a new rule from the U.S. Securities and Exchange Commission, is set to take effect on June 30. “Reg BI,” as the rule is known, changes the financial and disclosure relationship between fund sponsors, investors and individual advisors.

But as the June 30 compliance date approaches, investment professionals still have unanswered questions about how to comply — and what they will need from fund shops to do so.

RIAs, but not brokers, operate under The Investment Advisers Act of 1940, which requires RIAs to disclose conflicts of interests that occur with both themselves and the firm, and to act as fiduciaries. The law further stipulates that the obligation to monitor transactions for violations is ongoing, unless the investor and the RIA agree otherwise.

Advocates say that Reg BI levels the playing field by imposing a “best interest” standard on brokers. It also requires that firms have policies and procedures in place reasonably designed to mitigate any conflicts of interest related to financial advisors acting in a brokerage capacity. The idea, officials say, is to provide protections to investors and prevent broker-dealers who, without fiduciary obligations, could sell products that benefit their and their firm’s bottom lines, instead of benefiting the investor.

Reg BI also narrows down the individuals who can use the word “advisor” in their title. “If you’re not registered as an RIA, you can’t use that term anymore,” said Russ Tipper, senior vice president and product management director at Capital Group.

An additional feature of the new federal rule is the customer relationship summary form, called “Form CRS,” which both brokers and RIAs must give to all new and existing clients. The form, which also goes into effect June 30, must provide details about each RIA’s products, fees, conflicts of interests, disciplinary history and additional information.

But critics of Reg BI say that the rule, in effect, creates an uneven playing field in which broker-dealers would operate under a lesser duty of care than investment advisors. And since many RIAs are dually registered as broker-dealers and administer both types of accounts for their investor clients, is it feasible to expect the investment professionals to switch horses midstream?

This has led to state regulators creating their own rules, like the Massachusetts Fiduciary Rule, which is expected to take effect on September 1. This rule states that advice must be given “without regard” to conflicts of interest and meet a fiduciary standard of care. Also, both the firm and the advisor have a duty to avoid conflicts of interest to the extent practicable; disclosure of conflicts alone isn’t enough.

So, which one do firms and advisors follow? “The concern people have is here is one state that came up with more stringent rules than the federal rules,” Tipper said. Similar to how California’s strict consumer privacy law has essentially become the de facto national standard, Tipper asks if the Massachusetts fiduciary standard could similarly supersede the federally mandated Reg BI.

Another unknown is who is “in” Massachusetts? On its face, any regulation issued by a state would typically pertain only to those in that state. Would those be solely broker-dealers in that state? Does it apply to those who work for a Massachusetts-headquartered firm or who have clients who live in that state? What about a broker-dealer who happens to live in Massachusetts, but whose firm and clients reside elsewhere? Could the rule pertain to all investors who live in Massachusetts?

“What are the boundaries in what is increasingly becoming a digital world?” asks Sarah Johnson, senior vice president and director of wealth management marketing at Capital Group. “How do you really draw those lines?”

Other states’ agencies have also formed fiduciary rules of their own. The New Jersey Securities Bureau, for example, has been working on a proposal that would require all investment professionals registered with it to act as fiduciaries when providing investment advice or a strategy; opening an account or transferring assets to any type of account; and the purchasing, selling or exchanging of any security.1 Also, RIAs could no longer satisfy conflict-of-interest requirements through disclosure alone.

“What do you do if you’re a firm trying to decide what is your compliance strategy?” asked Jason Bortz, senior counsel at Capital Group.

The state-sponsored rulemaking comes, in part, due to a now-defunct U.S. Department of Labor standard that called for stronger fiduciary standards in the industry. The rule was put forth toward the end of the Obama administration, but in 2018, the U.S. Fifth Circuit of Appeals struck it down as regulatory overreach.

While the Trump administration is seen as cool to such stricter standards, the administration is expected to release a new, more industry friendly fiduciary rule proposal this summer.2 Bortz cautioned, however, that a win by former vice president Joe Biden in November’s presidential election could result in a change of direction towards a “fiduciary rule that is a lot like that Obama-era rule.”

1 “New Jersey Edging Closer to Finalizing its Fiduciary Rule for Advice Industry.” Rita Taagas De Ramos, October 11, 2019.

2 “Take Three: DOL Sends New Fiduciary Rule to White House.” Beagan Wilcox Volz, June 3, 2020.