Bonds

Outlook

MIDYEAR OUTLOOK

Major economies are roaring back

Effective vaccines, record government support and pent-up demand are fueling a historic turnaround for the global economy. The pace of growth caused the International Monetary Fund to more than double its 2021 U.S. GDP estimate to 6.4%.

U.S. OUTLOOK

Ready to boom, zoom and consume?

American consumers, many sitting on a cash stash, are ready to take that long-delayed vacation or simply go out to dinner. And U.S. companies are using cash on their balance sheets to innovate and adapt their businesses.

Value or growth? Balance them both

Beaten down cyclical stocks in airlines, hotels and energy are getting a boost from pent-up demand as the pandemic recedes. But digital leaders across industries continue to thrive as habits shift in a post-COVID world.

INTERNATIONAL OUTLOOK

International markets benefiting from value shift

International and emerging markets equities take center stage amid a global economic reawakening.

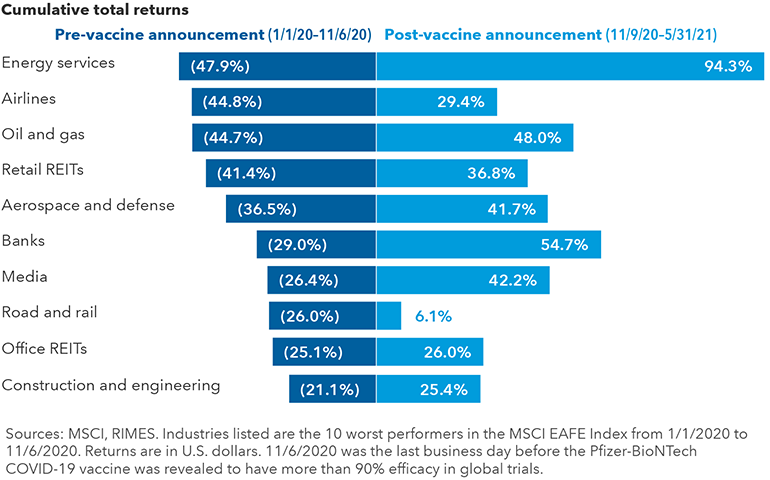

International markets reverse course on “vaccine day”

Non-U.S. equities got a shot in the arm last November when news broke of a highly effective COVID-19 vaccine. Will it be enough to end a decade of lagging returns?

FIXED INCOME OUTLOOK

Whether rates rise or fall, core bond strength matters

The fastest equity market decline in history last year and the rapid bounce back showed how important it is to continue to hold high-quality bonds as a buffer to market volatility.

Inflation worries? Keep calm and carry on

This is shaping up to be one of the more challenging years for fixed income in recent memory. Even so, reports of the death of the bond market are greatly exaggerated.