Demographics & Culture

International

International equities, shadowed by a decade of lagging returns relative to U.S. markets, may have turned a corner in November 2020. That’s when news broke of a highly effective COVID-19 vaccine and many cyclical, value-oriented stocks suddenly caught the attention of investors.

Given the value bent of international indexes and a rapid global economic recovery, the outlook for stocks in Europe, Japan and many emerging markets looks brighter than it has in several years. Granted, November to May is a short time period, but the trends are encouraging so far, says Greg Fuss, a portfolio manager with American Funds International Vantage Fund℠.

“We’re at a very interesting juncture,” Fuss notes. “Starting in November, for the first time in years, value-oriented sectors have taken center stage. Energy, financials and industrials have rallied, and that bodes well for international markets where many of those companies are domiciled.”

Are value-oriented companies mounting a sustainable comeback?

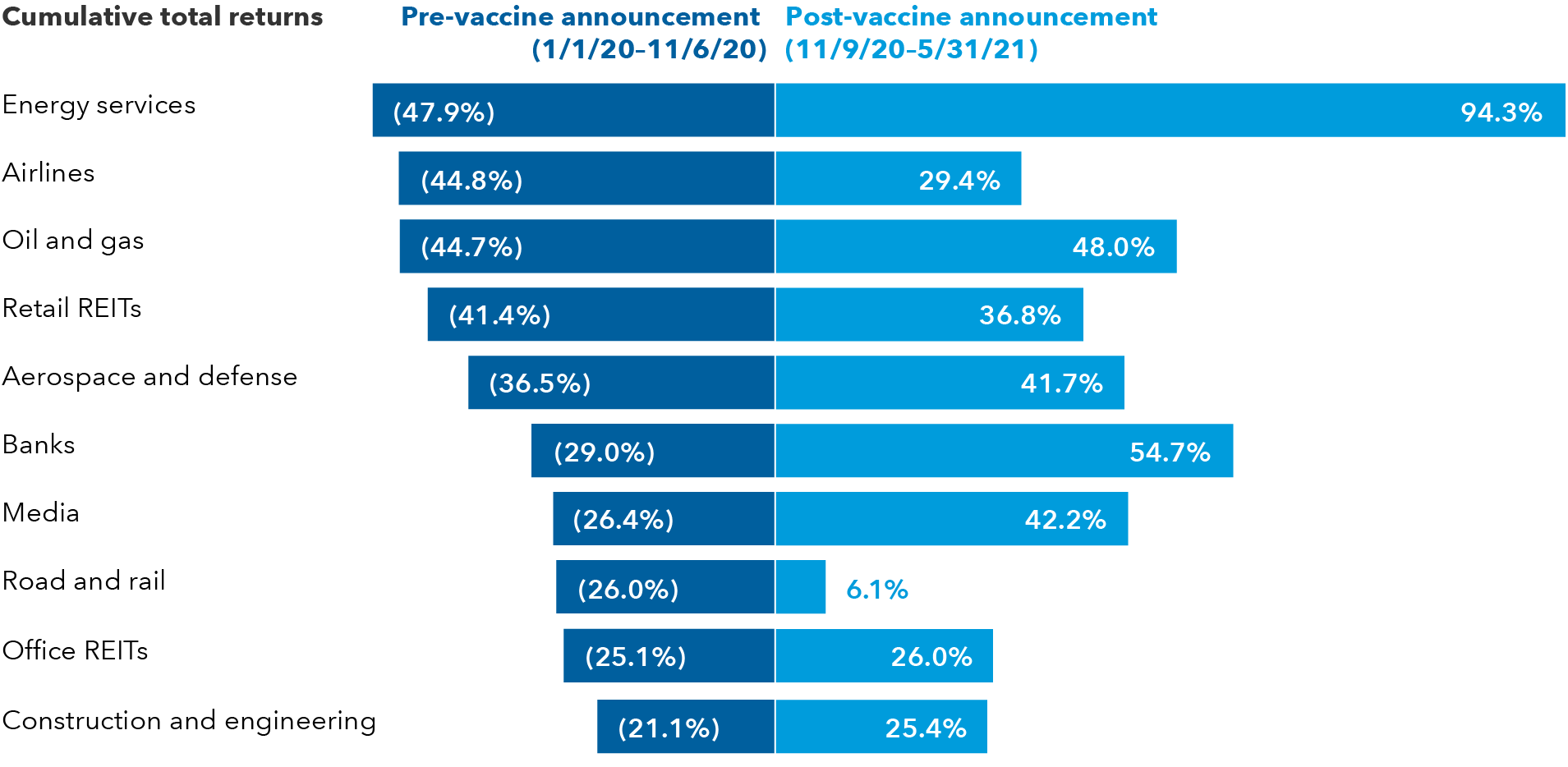

Sources: MSCI, RIMES. Industries listed are the 10 worst performers in the MSCI EAFE Index from 1/1/2020 to 11/6/2020. Returns are in U.S. dollars. 11/6/2020 was the last business day before the Pfizer-BioNTech COVID-19 vaccine was revealed to have more than 90% efficacy in global trials.

“As the world continues to recover from the COVID-19 crisis, it’s important to remember that there is no handbook,” Fuss cautions. “We don’t know how it will play out. But if we are at the start of a powerful cyclical recovery, which is exactly what it looks like to me, then cyclical stocks by definition appear to be attractive in this environment.”

Unloved sectors stage powerful rally

Since “vaccine day” on November 9, 2020, energy stocks — particularly oil and gas companies — have rebounded strongly from the depths of the pandemic. Among international stocks, oil giants such as BP, Total and Royal Dutch Shell have led the way. Oil prices soared as investors anticipated a rapid increase in demand amid a global economic reawakening. Oil and gas company shares in aggregate gained 48% from November 9, 2020, to May 31, 2021.

European banks have proved to be another bright spot following years of poor returns exacerbated by negative interest rates, non-performing loans and plain mismanagement. In sharp contrast to the prior decade, European banks have shined in 2021, returning 30% on a year-to-date basis, even as the eurozone economy has struggled to keep pace with U.S. economic growth.

Europe is a “target-rich environment,” says Fuss, given generally lower valuations compared to U.S. stocks and the preponderance of dividend-paying, value-oriented companies.

In fact, for dividend-seeking investors, international markets provide a much bigger opportunity set, Fuss notes, with 250 companies offering dividend yields of 3% or higher, compared to just 87 such companies in the United States, based on MSCI index data as of May 31, 2021. Among the largest dividend payers in Europe: Roche, Novartis and Unilever. Emerging markets offer 365 such companies.

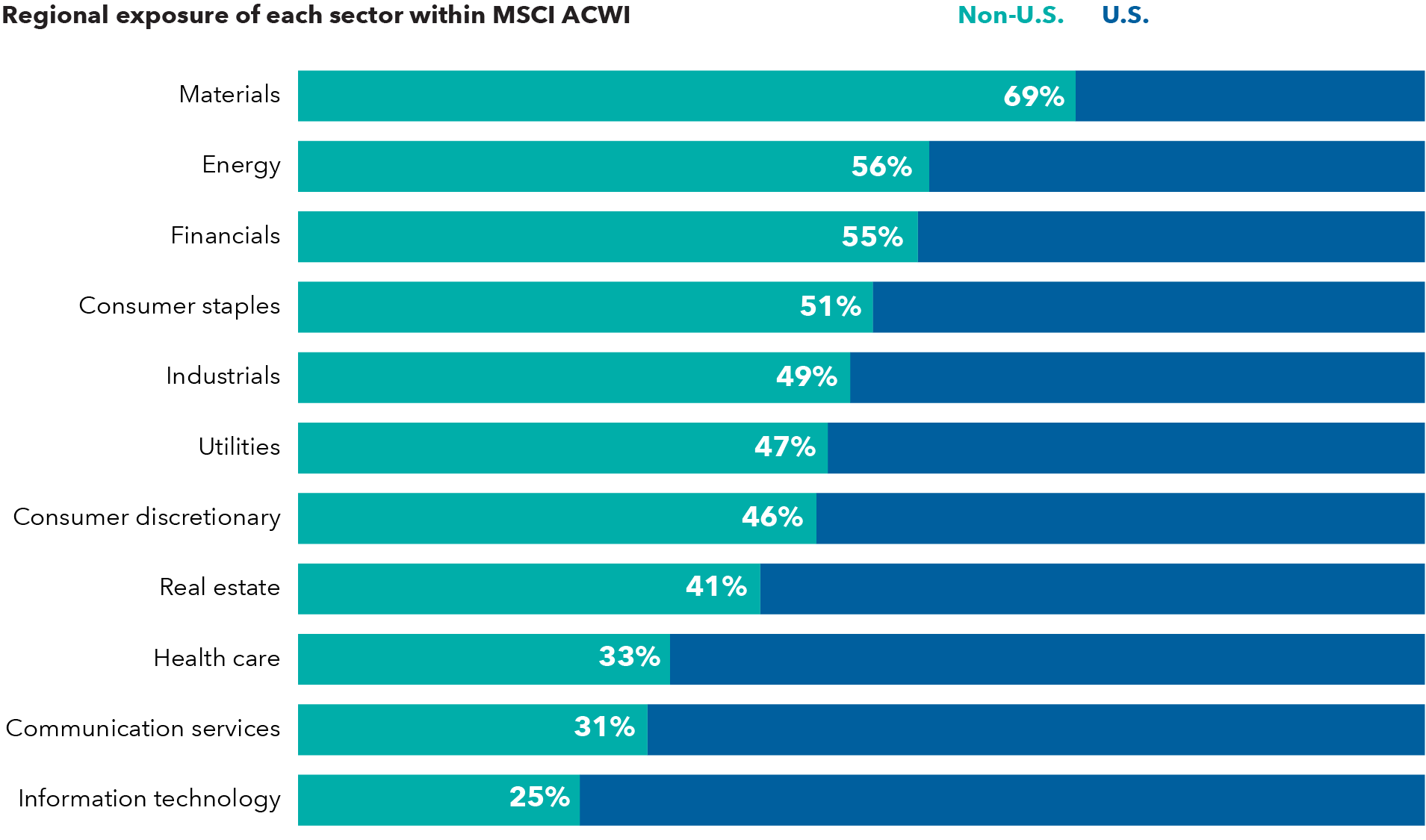

Value-oriented sectors play a larger role in non-U.S. markets

Sources: MSCI, RIMES. As of 5/31/2021.

This chart illustrates why a cyclical rally is good news for stocks outside the United States. Highly cyclical sectors such as materials, financials and energy have a greater representation in the MSCI All Country World Index ex USA. Meanwhile, in the U.S., growth-oriented sectors are the dominant areas: information technology, health care, communication services and consumer discretionary.

Indeed, the cyclical rally could continue for a considerable period of time as the global economy is still in the early stages of recovery, says Lisa Thompson, a portfolio manager with New World Fund®.

“The reopening trends that we’ve already seen in the U.S. and China are likely to appear in other markets during the months ahead,” Thompson explains. “There are concerns about India and other emerging markets that have not been able to contain the virus, but even in those areas, we are seeing signs of improvement. Vaccination rates are gradually moving up, so I feel confident that the reopening trends will closely trace the events we’ve already experienced elsewhere.”

That should happen even in the face of modestly higher inflation and rising interest rates, which have spooked investors in the first half of 2021, she adds.

“If we see structurally higher but not runaway inflation and modestly better global economic growth, companies with lower valuations should do better under those conditions,” Thompson says. “We’ve seen that framework since November, and I think it could continue as long as interest rates in the U.S. don’t rise too much. For emerging markets, that is essentially a nirvana scenario.”

Semiconductors may be the new oil

The semiconductor industry represents another compelling investment opportunity with a significant presence outside the U.S. — primarily in Europe and Asia. Simply put, chips may be the new oil. The semiconductor industry is expected to power the next decade of economic growth, much like oil fueled the rise of the industrial age.

Chips are used in a vast array of products these days, from smartphones and servers to cars, televisions and even washing machines. By various estimates, global semiconductor sales could double from about $450 billion today to nearly $1 trillion over the next 10 years.

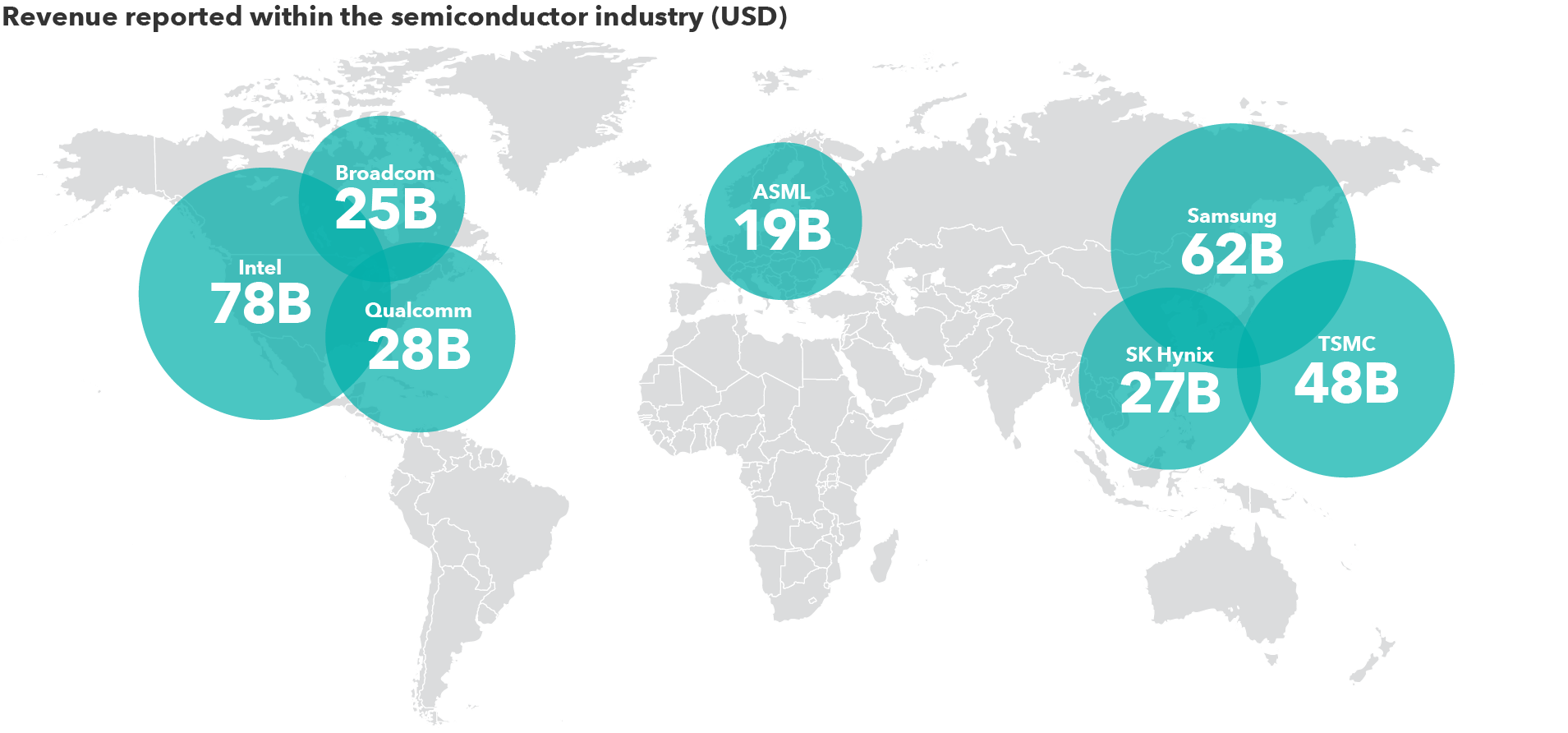

Chips ahoy! Semiconductors will be everywhere and in everything

Sources: Capital Group, FactSet. Companies selected from the MSCI ACWI Semiconductor Index (plus sales from Samsung's semiconductor division) based on highest 12-month revenue reported in each company's most recent financial statement, as of 4/30/21. Samsung is not listed as a semiconductor company, but their semiconductor division would have the second highest revenue if it was a standalone semiconductor company.

The world’s largest chipmakers — including South Korea’s Samsung and Taiwan Semiconductor Manufacturing Company, or TSMC — are spending billions to meet the surge in demand.

Some chipmakers and their suppliers have essentially gained a monopoly over key aspects of the business. Dutch manufacturer ASML, for example, builds high-tech, one-of-a-kind lithography equipment used by other companies to make the most advanced chips in the world.

“The world has come to appreciate just how important the large semiconductor companies are — for so many different industries,” says Andrew Suzman, a portfolio manager with EuroPacific Growth Fund®.

Not all the best stocks are in the U.S.

Although it’s understandable for investors to focus on U.S. stocks given their strong outperformance over the past decade, it’s also important to remember the benefits of a balanced, diversified portfolio. There have been many past periods when international markets have done relatively better, as recently as 2000 to 2009.

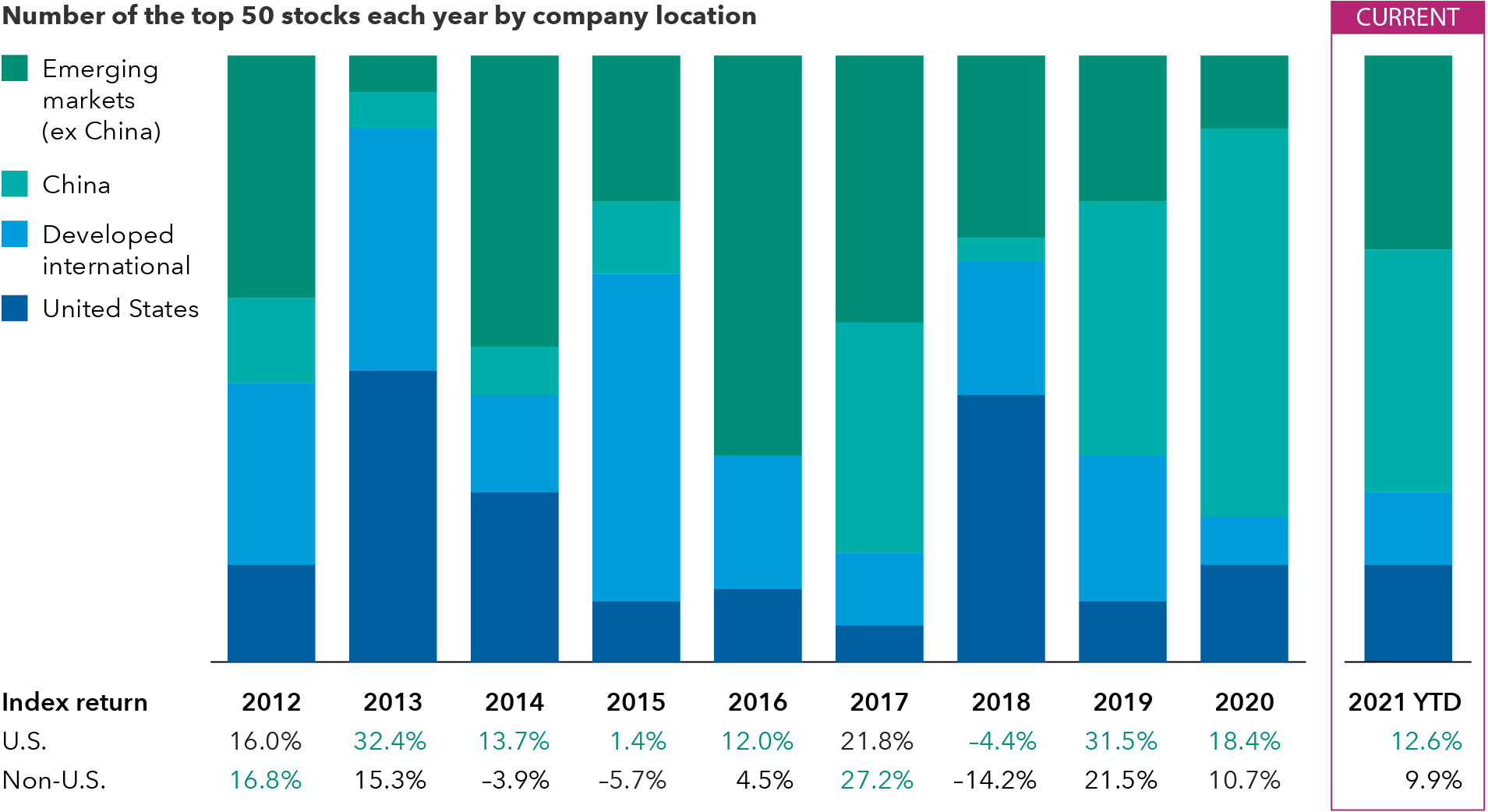

Think all the best stocks are in the U.S.? Think again.

Sources: MSCI, RIMES. 2021 as of 5/31/2021. Returns in U.S. dollars. Top 50 stocks are the companies with the highest total return in the MSCI ACWI each year. Returns table uses Standard & Poor’s 500 Composite and MSCI ACWI ex USA indexes for U.S. and non-U.S., respectively.

It remains to be seen how the current decade will shape up, but it’s likely that one long-term trend will continue: On a company-by-company basis, the best annual returns each year have primarily been generated by stocks found outside the United States — supporting the view that the world is a stock pickers’ market favoring a borderless-investing approach.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

MSCI ACWI is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

MSCI ACWI ex USA Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, excluding the United States. The index consists of more than 40 developed and emerging market country indexes.

MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization-weighted index that is designed to measure developed equity market results, excluding the United States and Canada.

MSCI ACWI Semiconductor Index is designed to measure results of semiconductor and semiconductor equipment companies within more than 40 developed and emerging equity markets.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

Standard & Poor’s 500 Composite Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

For financial professionals only. Not for use with the public.

Greg Fuss

Greg Fuss

Lisa Thompson

Lisa Thompson

Andrew Suzman

Andrew Suzman