Retirement Plan Advising

Financial professionals are catching on to the potential of retirement plans to help grow their wealth management businesses. Once relegated to niche specialists, retirement plans are gaining attention among major financial intermediaries, who are asking wealth managers to cross-sell more plans.

This increased focus on plan business may be due to factors such as rollover money in motion from plans to individual retirement accounts (IRAs) and the stabilizing and growth effect of plan assets.

In Capital Group's 2024 financial professional benchmark study, the highest growth practices were more likely to service retirement plan clients with customized messaging and service, including a strategy for turning plan participants into prospects. They also had 25% or more of their assets under management in retirement plans.

What this data might suggest — and what financial intermediaries are recognizing — is that retirement plans can be a catalyst for growth. You can see this in firms’ efforts to create efficiencies and make plans more appealing to generalist wealth managers. Watch who’s adding retirement plan sales desks, fiduciary services and pooled plan solutions, and ask yourself why. What value are they seeing, and how can you capture some of it?

The evolution of retirement and wealth

Retirement plans and wealth management were once distinct practices, but they’ve since converged around clients’ broader financial planning needs. In fact, it’s an evolution of decades in the making.

![Graphic showing an evolution in which two arrows converge over time, from 1980 to 2020. One arrow is labeled, “Financial wellness; Fees, funds, fiduciaries; Independent fiduciary.” The other is labeled, “Financial planning; Portfolio management; Stock picking.” The convergence is labeled, “Personalized, holistic planning.”]](https://static.capitalgroup.com/content/dam/cgc/shared-content/images/banners4/chart-pursue-growth-01.png)

Sources: RLF Research and Capital Group, "Broker/Dealer Executive Forum," June 2023.

Beginning in the 1980s, 401(k)s and other defined contribution plans started as supplementary savings vehicles and quickly grew into the main retirement savings vehicles for many Americans. Retirement plan professionals began differentiating themselves by addressing the three Fs: fees, funds and fiduciaries.

By the 2010s, many retirement plan professionals were leveraging the workplace to make connections with participants. This helped them serve participants’ broader financial needs and grow their practices.

On the wealth management side, an evolution was happening from stock picking to mutual fund selection and then portfolio management. This eventually led to a greater emphasis on financial planning-led wealth management.

Today, retirement plans and wealth management have converged around hyper-personalized, holistic planning. You’re probably providing this level of service for your clients now, so the transition to retirement plans may be easier than you think. By evolving your value proposition, you may be able to better meet the needs of your current clients and potentially attract new clients who could benefit from your services.

IRA rollovers could help drive the future of wealth business

According to research by the Investment Company Institute, IRAs had $13 trillion in assets in mid-2023, comprising 35% of U.S. total retirement market assets. Of those households with IRAs, 62% contained rollover assets from employer-sponsored plans. And a majority of those households consulted financial professionals when conducting rollovers.

![Stylized presentation of four statistics: $13 trillion in IRA assets; 35% of total U.S. retirement assets in IRAs; 62% of households with IRAs contained rollover assets; 63% consulted financial professionals when rolling over assets from plan.]](https://static.capitalgroup.com/content/dam/cgc/shared-content/images/banners4/chart-pursue-growth-02.png)

Source: Holden, Sarah, and Daniel Schrass, 2024. “The Role of IRAs in US Households' Saving for Retirement, 2023.” ICI Research Perspective 30, no. 01 (February). Available at www.ici.org/files/2024/per30-01.pdf.

If you advise retirement plans, you may be in a better position to get a piece of this rollover action. Retirement savers often turn to the financial professionals they know or have access to. As a plan advisor or consultant, you have the opportunity to make connections with plan participants and offer your wealth management services. They may then turn to you for guidance on rollovers if they choose to move assets from the plan.

At scale, even relatively small rollover accounts can add up to significant boosts to your practice. This is also true of plan assets in general.

How plan assets tend to grow

People tend to continue contributions to their 401(k)s through automatic payroll deductions, regardless of market conditions. This means plan assets tend to remain consistent throughout market cycles.

Defined contribution plan participants’ activities

Summary of recordkeeper data, percentage of participants (%)

![Bar graph displaying the percentage of defined contribution participants who took any withdrawal or stopped contributing from each of the years from 2009 to 2023. Although precise values are not shown, it is apparent that for most years, both values are below 2%. In 2009, both percentages near 3%. Withdrawals tick up from 2020 to 2023, peaking between 3% and 4% in 2023. For those same years, the “stopped contributing” bars all remain below 2%.]](https://static.capitalgroup.com/content/dam/cgc/shared-content/images/banners4/chart-pursue-growth-03.png)

Sources: Investment Company Institute (ICI), “ICI Research Report, Defined Contribution Plan Participants’ Activities, First Quarter 2021,” June 2021 and “ICI Research Report, Defined Contribution Plan Participants’ Activities, First Quarter 2023,” July 2023; results are as of Q1 of each year.

Consider that very few people take withdrawals or stop contributing during a variety of markets — with notable exceptions in 2009 and the upward withdrawal trend in the wake of COVID-19. But, even at the highest level we see here, only 3.3% of participants took withdrawals, which you may recognize as a stark contrast to your wealth management assets.

With both automatic payroll contributions and relatively low withdrawals, it’s easy to see how plan assets have the potential to grow over time. Here’s how that could play out in a hypothetical scenario.

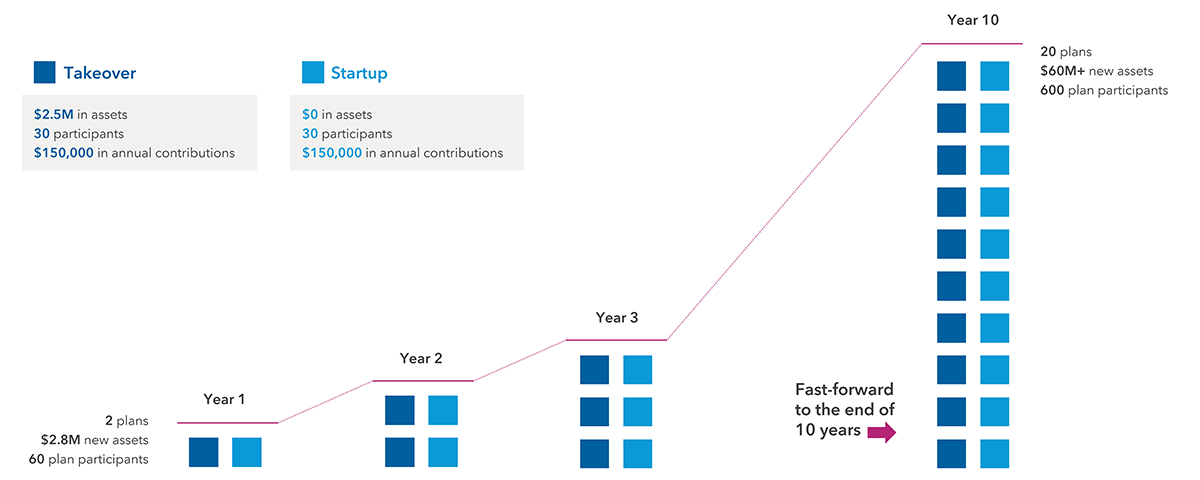

A hypothetical two plans a year

If you win just two plans a year, each with 30 plan participants, by the end of 10 years, that’s 600 new plan participants you can get in front of and help prepare for retirement. In this hypothetical example, that could be an added $60+ million in assets.

Winning just two plans a year can add up over time

Hypothetical example for illustrative purposes only. Not intended to portray an actual investment. Assumes 8% average annual investment growth, a $2.5 million asset transfer from a takeover plan each year and $150,000 in new annual plan contributions from both plans each year.

What this hypothetical shows is the potential for a long-term incremental growth strategy — and a conservative one. As many wealth managers who have shifted attention to plans could tell you, winning plans can get easier over time. As you gain fluency in the process and employers’ needs, you may be able to outpace that “two plans a year” metric while still maintaining a strong wealth management practice.

Twin engines for new plan formation

Another reason now is a great time to start focusing on retirement plans is that within the past few years, several regulatory shifts have created potential opportunities for pursuing plan business. Namely, these are the SECURE 2.0 Act of 2022 and the rise of state mandates.

SECURE 2.0 passed at the end of 2022. It included provisions that may prompt more businesses to start retirement plans for their employees — and may promote greater participation among those that do.

As state-sponsored retirement programs gain traction, more businesses may be exploring their retirement plan options. This presents an opportunity to talk with businesses about their options now, before they get shuffled into a state program.

Combined, these two forces help create an environment that could lead to a boost in retirement plan coverage for businesses with fewer than 100 employees.

Get started today

Although there’s no “right” time, now is a great time to start pursuing retirement plans. Resources, including your local Capital Group retirement plan team, are available to help you navigate the process of acquiring plans and growing the business you already have.

Renee Grimm

Renee Grimm