Client Conversations

Cash is a proxy for uncertainty. And when investors leave cash on the sidelines, they could be missing out on future opportunities and potentially putting long-term goals at risk.

“Some of the most uncertain times — Fed hikes, inflation, disappointing earnings — have been inflection points. In hindsight, these events were opportune times to reallocate cash in client portfolios and align them to their objectives,” says Mike Gitlin, head of fixed income at Capital Group.

With a record amount of assets sitting in money market funds and a high-yielding cash environment, your clients may be unsure if the time is right to reinvest that cash — or how to deploy it. Cash can play an important role for unexpected emergencies, such as a job loss or unplanned expenses, but excess cash can be a headwind for long-term goals.

“One of the most difficult aspects of an advisor's job is managing clients through challenging times, keeping them from acting on fears that may get in the way of their long-term success” says Chris Jenkins, a wealth management consultant at Capital Group. “Your clients may need a nudge to help them deploy cash into investments better aligned with their long-term goals, and the conversation offers a great opportunity to demonstrate your value and deepen relationships.”

When these conversations come up, it helps to have a systematic and repeatable approach. For example: There are four steps to any effective client conversation, each with a distinct goal. “First, acknowledge where the client stands. Second, provide your perspective. Third, build confidence. And fourth, share any potential opportunities,” explains Max McQuiston, an advisor practice management consultant at Capital Group. “This framework can be used in any discussion but is particularly useful in times of risk aversion or market volatility.”

Four steps to more effective conversations

Source: Capital Group.

Here’s how to talk to clients about the benefits of moving out of cash in four easy, efficient steps.

Step 1: Acknowledge client concerns

When market uncertainty runs high, it’s natural for investors to have concerns about their portfolios and to take a defensive position when fearful. Simply acknowledging these fears and being ready to listen to clients’ concerns can be meaningful. Active listening is key.

“Proactively have the conversation with clients with higher-than-usual cash balances,” says McQuiston. “You want to let them know you take their concerns seriously. Let them feel heard. But you also want to remind them to consider the long term.”

Conversation starters: Empathize, listen and identify

- “I can see why cash has been so appealing with yields so high.”

- “What concerns you most about the markets these days?”

- “What you are saying is, you feel safe now, and are nervous about getting the timing right regarding how and when to get back in. Is that right?”

- “I understand why you feel that way and agree that moving back in all at once can be unnerving.”

Step 2: Offer relevant perspective

“Today’s historically high cash balances provide a great opportunity to reengage clients on some timeless investment themes,” says Jenkins. “That includes ideas such as ‘preservation of capital vs. preservation of living’ and ‘it’s time in the market, not market timing that matters.’”

When offering perspective on investing cash, you can help clients understand that we may be at a pivotal moment in the markets. The U.S. Federal Reserve (Fed), with a goal to dampen inflation by tightening monetary policy, led to a selloff in both equities and fixed income last year. But now, the Fed appears to finally be pulling back. This changes everything.

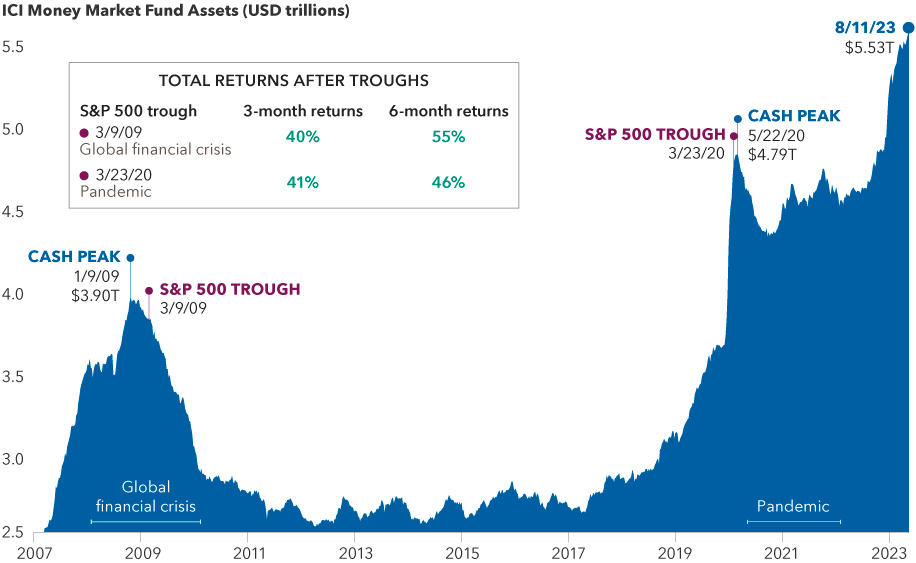

The long-term history of short-term market surges

Sources: Capital Group, Bloomberg Index Services Limited, Investment Company Institute (ICI), S&P Dow Jones Indices LLC. As of 8/11/23. Time lengths for “Global financial crisis” and “Pandemic” are approximations. Past results are not predictive of results in future periods. You could lose money by investing in money market funds. Although money market funds seek to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Providing historical context can also help investors better process today’s market uncertainty and their retreat to cash. Remind clients that we have been here before. As illustrated in the chart above, we saw run-ups in cash during the global financial crisis and again during the COVID pandemic.

Remind clients that in both these cases, total returns of the S&P 500 rebounded strongly, though past results are not predictive of results in the future. But investors who waited too long in cash missed a 55% rebound in the first six months after the S&P trough ending in March 2009, and 46% in the first six months after the S&P 500 trough in March 2020. In other words, the opportunity costs were significant.

You may also remind clients how yields on cash decayed quickly following a last Fed hike. Over the last four rate hike cycles, U.S. three-month T-bill rates were an average of 2.5% lower 18 months after the last Fed hike. That means that the relatively attractive money market yields currently on offer may drop sharply once the Fed changes course. That said, it’s also good to remember there is risk of loss for stock/bond investing unlike investing in U.S. government bonds or CDs (certificates of deposit), which are guaranteed.

Conversation starters: Share and educate

- “Market events tend to run in cycles, and we’ve seen similar conditions before where investors take refuge in cash.”

- “We may be at a turning point when it’s a good time to get back in the market and back to your long-term goals.”

- “There is no perfect way to time getting in and out of the market, but history would suggest that being consistently in the market may be a better long-term strategy.”

- “It’s also good to remember that high-yielding cash — while it may seem to be a ‘safe’ investment in the short term — may lead to less growth of income and security in the future.”

Step 3: Reinforce a feeling of confidence

“The confidence step is about bringing your clients back to the long-term goals you know matter to them,” McQuiston says. “It's about focusing on what is within their control. Reassure the client that a plan is still in place, but it may be time to reconfirm priorities.”

Ask clients to talk about their goals and remind them of the progress they have made. “Let them know: ‘You have made smart, responsible decisions in managing your money, so now let's discuss what matters to you most: your goals,’” McQuiston says. “Remind them that you developed these objectives together, perhaps during a calmer time. Discuss specific objectives clients established and reinforce that changes in market conditions likely haven’t changed their goals.”

Conversation starters: Prioritize client goals

- “Let’s revisit the goals you prioritized in the past. Do these still apply, and are they in the right order?”

- “We built your investment portfolio based on your goals and risk tolerance. Let’s confirm whether that allocation still makes sense to meet your goals.”

- “One way you could approach this with more confidence could be dollar cost averaging — where we move your cash back in systematically over several months.”

- “Consistently investing your cash — for example, 10% per month over the next 10 months — can take the pressure off of getting the timing just right.”

Step 4: End with opportunity

“Investor emotions are real. Past losses sting for a long time, and today’s seemingly attractive rates on CDs and money markets feel good,” says Gitlin. “But as investors, we know that markets don’t idle for long. You could become stuck in cash if you wait too long to get back into the market, as better potential opportunities emerge.“

“As rate hikes near end, historic investor opportunity may begin”

Having this type of conversation offers a chance to guide clients to consider prudent and perhaps opportunistic financial moves.

Discuss how to begin putting cash back to work:

- This is a great opportunity to help clients right-size their cash positions, rebalance their portfolios, and refresh discussions around long-term goals.

- There may also be new investment opportunities worth considering, given existing risk parameters.

- Don’t forget the how. For example, discuss ways to use dollar cost averaging* to move cash back into investments.

The case for redeploying cash into bonds:

- Bonds have historically benefited as the Fed ended its hiking cycle, with the best returns coming in the months leading up to and immediately following the last Fed hike.

- Investors who waited for the Fed to cut missed a good portion of results.

- Investors should consider redeploying cash into bonds as the Fed shifts to a normalized rate environment.

The case for equities. In particular, balanced strategies and dividend payers:

- A balanced strategy could be attractive for more cautious investors. A balanced fund tends to hold more defensive positions in dividend-paying stocks and high-quality bonds.

- Dividends have had an important impact on long-term portfolio outcomes, and dividends payers across a range of sectors have contributed to total return over time.

- Many investors may not hold enough dividend payers, which may pose risks as inflation persists and the market broadens.

Conversation starters: Give action steps

- “Let’s take a look at your portfolio and consider how we might rebalance your allocations using the cash we plan to reinvest.”

- “As we consider putting excess cash into longer term strategies, let’s take your market risk temperature. What level of risk are you comfortable with as we reposition your portfolio?”

- “How do you feel about rebalancing all at once, or would you prefer a more systematic approach as we discussed?”

*Regular investing does not ensure a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Chris Jenkins

Chris Jenkins