Market Volatility

Long-Term Investing

As we turn the page on a year like no other, we all hope for the return of old-fashioned normalcy in 2021. But as any experienced investor knows, normal rarely translates into predictable. If anything, 2020 — with its deadly pandemic, global recession, stunning market collapse and surprisingly rapid recovery — reinforced the notion that it’s impossible to know exactly what lies around the bend.

Time will tell when we’ll all feel comfortable heading out to dinner and a movie with friends again or hopping on a flight to the Caribbean, but investors can prepare themselves for the inevitable twists and turns in the markets. Here are five key themes to consider as you set expectations for the year ahead.

1. Look for stronger growth as pace of vaccine rollout accelerates

In the closing days of 2020, the U.S. Congress passed legislation providing $900 billion for COVID relief, just as earlier benefits were set to expire.

The relief measures include support for small businesses, direct payments to individuals, extended unemployment benefits, and funding for vaccine development, distribution and education support.

“With the benefit of seeing the pandemic play out in real time, lawmakers did a better job of matching need with funding than they did with the initial CARES legislation,” says U.S. economist Jared Franz.

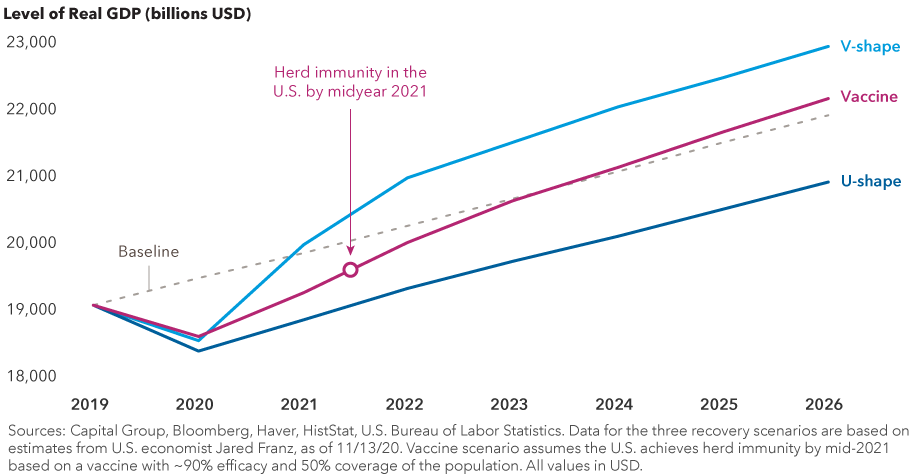

Although these measures will provide a partial offset to the slowdown in late 2020, until COVID-19 is contained it will continue to impact near-term growth. “All growth forecasts depend on the trajectory of the vaccines,” Franz adds. While administration of the vaccines got off to a slow start in the U.S., the pace picked up meaningfully in the early days of the new year, said Franz. “A further pickup in the pace of distribution could drive GDP growth above 3% in 2021, with growth concentrated in the second half of the year.”

The strength of the recovery is vaccine dependent

2. Tap into the digital future

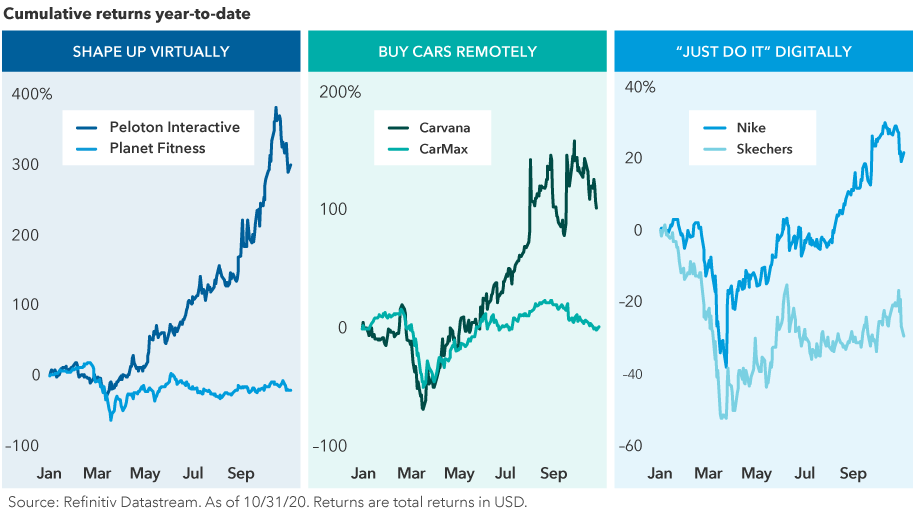

A COVID-induced acceleration of digital life is reshaping the U.S. economic landscape, changing consumer habits and expectations, and altering the competitive landscape for entire industries.

Sure, people were shopping and accessing health care services online before COVID, but the pandemic has amplified demand and created new opportunities for investors and digitally savvy companies. Companies with fast and efficient online business models are soaring above the terrestrial competition, disrupting the status quo and displacing old-economy stalwarts. This broad-based investment theme crosses many key sectors, from retailing and entertainment to advertising and payment processing. Even the fitness industry is getting a vigorous digital workout.

Companies with strong online business models have an advantage

The question for investors is which of these trends are long lasting and which will fade along with the impact of the virus.

”I'm hopeful that lockdowns will be fleeting, but many of the digitization trends that were accelerated by COVID — the shift to online commerce, online doctor’s appointments and the migration to internet TV — I think all those trends are going to endure,” says equity portfolio manager Mark Casey. “People formed new habits in 2020, and those habits are going to be sticky.”

Indeed, Casey formed a new habit of his own in 2020: adopting digital payment technology on his smartphone rather than reaching for his wallet to pay cash. “I didn't want to learn how to use the tap-and-pay feature, but I made myself learn it, and I'm not going back.”

To be sure, digital acumen doesn’t automatically translate into success for companies. “There will be winners and losers,” Franz says. “Our job is to identify them — finding the growing companies that have not only benefited from the pandemic but also have the potential to continue generating solid growth in a post-pandemic world.”

3. In the search for innovative companies, go global

The U.S. has long been considered the global leader in innovation, with its cutting-edge companies, robust venture capital system and high-tech infrastructure. But to think of innovation as an exclusively U.S. story would be a mistake.

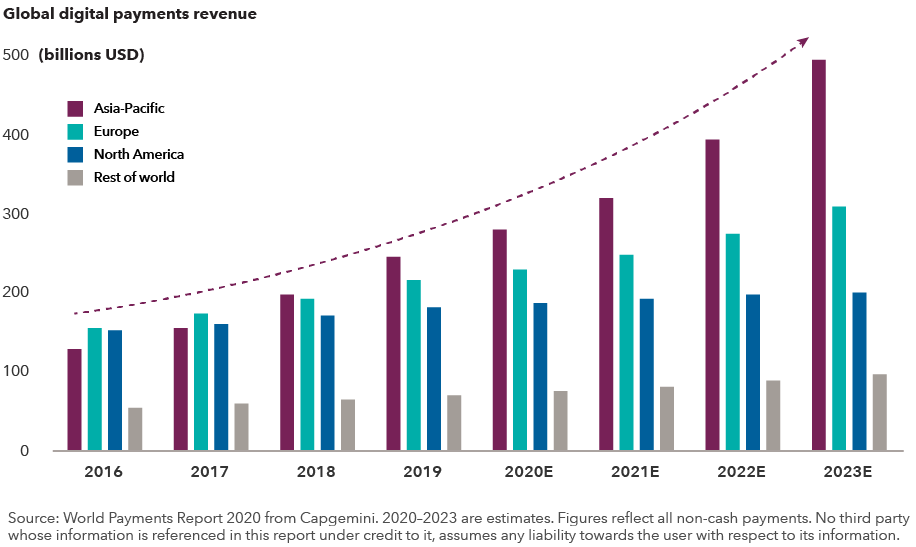

The tap-and-go payments app that Casey started using last year? He’s just now catching up to millions of consumers in China, South Korea and other Asian countries who have been using this technology for years. In some emerging markets not long ago, many people didn’t have bank accounts, but they did have mobile phones — and that led to faster adoption of mobile payments.

Simply put: Cash is no longer king, especially outside the U.S. “A decade from now, I think digital payments will be the norm and people will give you odd looks if you try to pay with cash,” says equity portfolio manager Jody Jonsson.

Asia has become the world leader in digital payments

These days, Asia and Europe lead the world in some of tomorrow’s technology, including renewable energy as well as digital payments. This serves as one more reminder why investment opportunities in international and emerging markets shouldn’t be ignored. Although the U.S. is likely to remain a primary engine for innovation, it would be shortsighted to think of it as the sole province of inventive companies. What’s more important for investors is to seek out the world’s most innovative companies in growing industries wherever they are located.

4. Hold onto strong core bonds, even when rates are low

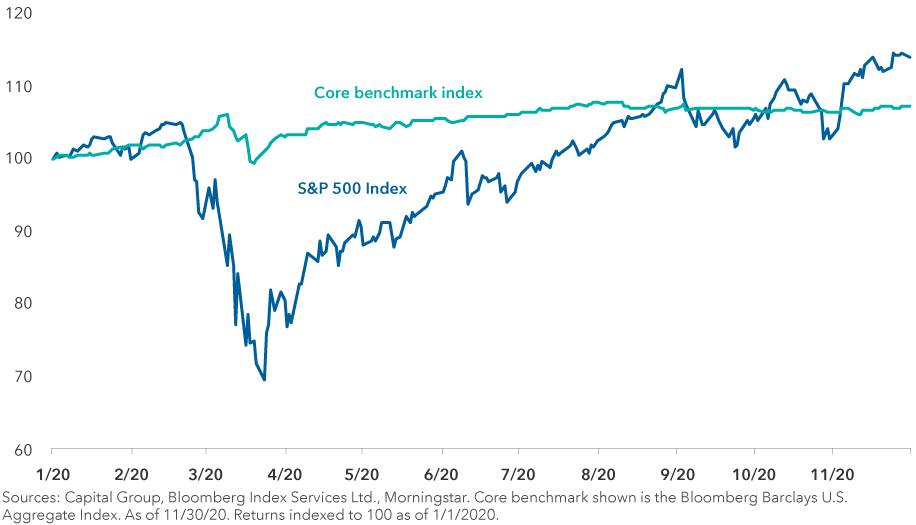

There are plenty of reasons to forget 2020. But there is one thing that investors would be well served to remember: The fastest equity market decline in history showed how important it is to continue to hold high-quality bonds as a buffer to market volatility.

During the deep equity correction, as the Standard & Poor’s 500 Composite Index plummeted more than 30%, the Bloomberg Barclays U.S. Aggregate Bond Index, a typical benchmark for core bond funds, did exactly what it was supposed to do: hold steady during times of turbulence. It declined only a few percentage points during the worst of the crisis and recovered much more quickly than the stock market. Even as equities have recovered, bonds have held up. It’s important to remember, past results are not predictive of results in future periods, but they provide an important perspective.

Although interest rates will likely remain at ultralow levels for some time, strong core bond allocations can continue to be a crucial buffer against volatility.

“No matter the environment, a high-quality core bond fund is critical to act as ballast and fortify your portfolio,” says Mike Gitlin, head of fixed income at Capital Group. “While total returns may be more modest in the coming years, the need for diversification, capital preservation, income and inflation protection in a balanced portfolio hasn’t decreased.”

The core bond benchmark held steady as stocks sank

5. Maintain balance in your portfolio

Returns for consumer tech and digital companies have dwarfed those of most other industries over the last decade — a trend that was amplified in 2020 as consumers adapted their behaviors amid the COVID pandemic. So, it’s probably no surprise that these market leaders account for an increasingly larger share of many investors’ portfolios, and it may be time to rebalance.

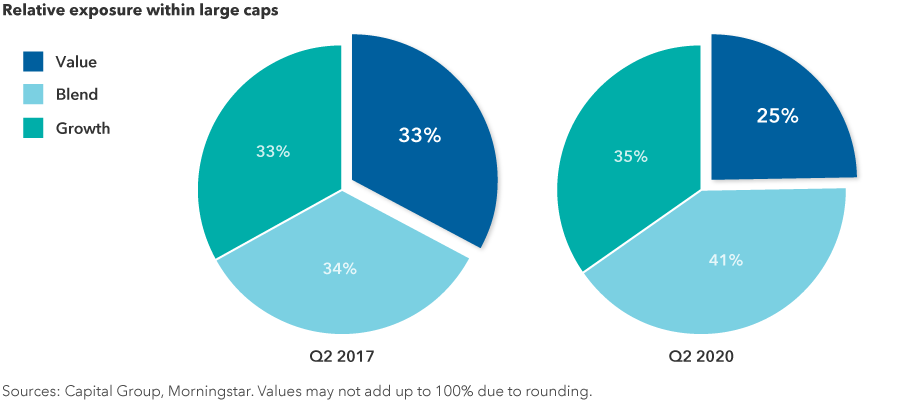

Capital Group’s Portfolio & Analytics team recently reviewed more than 4,000 portfolios and found that investors significantly reduced allocations to value equities over the last three years. The message isn’t to avoid growth stocks, but rather to ensure that they haven’t outgrown their intended position and role in a portfolio. Indeed, after years of being overlooked, many dividend stocks now trade at attractive valuations.

The start of a new year gives financial professionals a great opportunity to check if their clients’ equity holdings are still aligned with their long-term goals. Financial professionals interested in getting a checkup for their portfolios can request a personal consultation from one of Capital’s portfolio specialists.

Investors have scaled back their exposure to value funds

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Bloomberg Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

©2021 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The Standard & Poor’s 500 Composite Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Jared Franz

Jared Franz

Mark Casey

Mark Casey

Jody Jonsson

Jody Jonsson