Economic Indicators

Fixed Income

As we begin the new year, I expect the U.S. economy to maintain momentum on the back of a strong consumer and significant capital expenditure investment by businesses, even as inflation remains high and the Fed begins raising rates early this year.

I believe household consumption will remain high through a combination of further employment growth, wage gains and strong balance sheets, buttressed by savings that consumers built up over the past couple of years. And, even though the Fed is set to begin raising rates, as it indicated in its December meeting, monetary policy overall remains supportive, with real rates remaining solidly in negative territory.

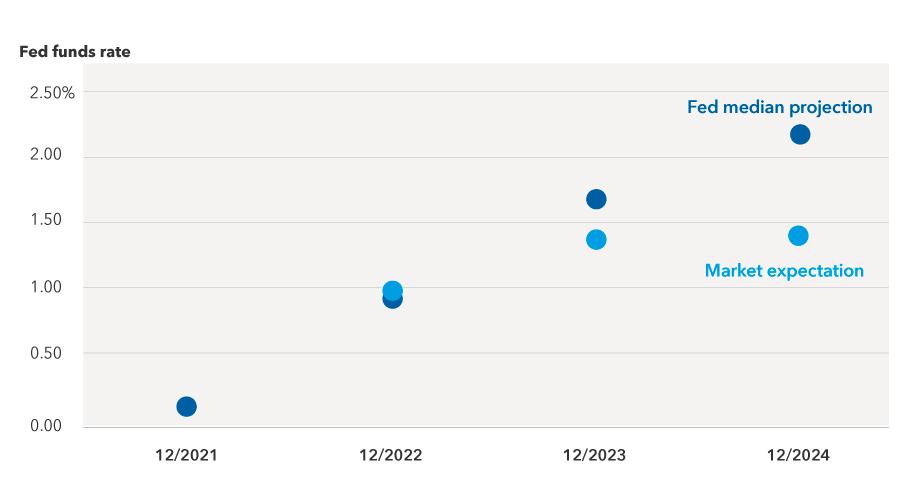

With consumer demand staying strong and supply bottlenecks being resolved only gradually, I expect inflation to persist at a level higher than what the Fed wants to see over the next year or two. The longer inflation persists, the more it gets ingrained in expectations and starts to get priced into wage negotiations. This is a gain for consumers, but a headwind for companies and, ultimately, long-term employment. And it may put the Fed in a bind. Fed board members want to support the economic recovery with gradual rate hikes at the same pace as the last tightening cycle, lifting the federal funds rate in increments of about 25 basis points per quarter. But if inflation remains elevated, they may feel compelled to raise rates faster or in larger increments to re-ground inflation expectations at 2%.

Currently, the market has priced in three rate hikes for 2022 and additional hikes in 2023. This seems very reasonable, and interest rates at the front end of the curve now seem to compensate investors fairly for these expected hikes. If the Fed raises rates 75 basis points in 2022 and 100 basis points in 2023, that would put the federal funds rate at 1.75% in two years, with the average over that period being much lower, which is consistent with current two-year yields.

With this baseline scenario, I expect a modest gross domestic product (GDP) growth rate of 3% to 4% in 2022, but I also believe there is a risk that the economy will lose some momentum toward the end of the year and may begin to look like a “late-cycle economy” in late 2022 or 2023. And if the economy starts to weaken, the Fed may not be able to carry through with all of its planned rate hikes in 2023 and 2024. This helps explain why 10- and 30-year yields have been stubbornly low even as the Fed accelerated its timeline for ending asset purchases and raising interest rates.

In addition, I believe that when the Fed withdraws monetary accommodation, market volatility will rise. And given most financial asset valuations are at or near record highs, investors need to recognize that a hawkish Fed focused on bringing down inflation may make them vulnerable to a sell-off.

Policy rates are moving higher, driven by inflation

Sources: Capital Group, Bloomberg Index Services Ltd., Federal Reserve. Fed projections as of 12/31/21. Fed funds market expectations as of 12/31/21. Market expectations based on futures pricing data. Lower bound of the federal funds target rates is shown.

Against this backdrop, my preference is for core bond portfolios that deemphasize credit risk and emphasize liquidity. Below are five themes that I will be looking to deploy in the core bond strategies I manage in 2022.

1. U.S. Treasuries: Bias toward a flattening yield curve

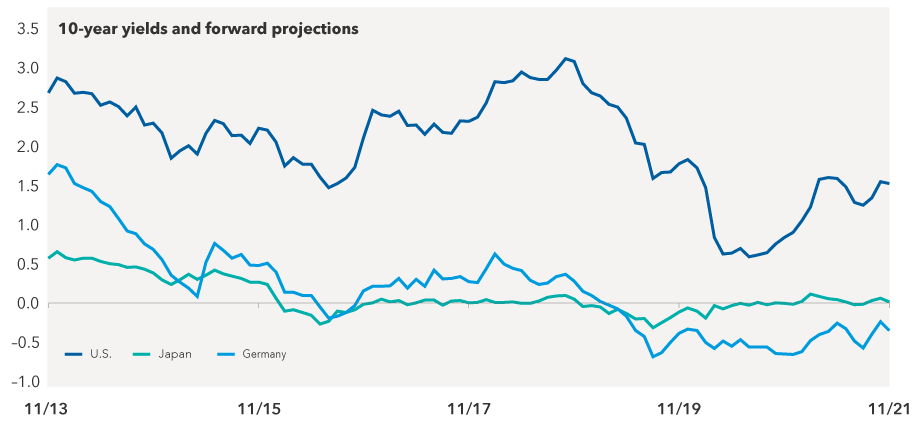

As the central bank begins raising rates, I expect short-term yields to gradually move higher and long-term yields to remain relatively stable, moving up or down in a range of 25 basis points, leading to further flattening of the yield curve. Long-end yields may be supported if long-term growth expectations are reduced as the Fed pivots from supporting growth to fighting inflation. As investors move away from the short end of the curve, I anticipate flows to be supportive of longer-maturity Treasuries, including the 30-year bond. And interest rate differentials with other developed markets, such as Europe and Japan, are also likely to support longer-maturity Treasuries as short rates continue to rise.

Should economic growth slow meaningfully in the second half of the year, the Fed might need to slow the pace of monetary tightening, which would lead me to add duration to portfolios. Six months from now, I expect my portfolios’ duration will likely be longer than it is today to both take advantage of higher rates and protect against the potential for slower economic growth.

U.S. still offers some of the highest yields in the developed world

Sources: Federal Reserve, OECD. As of 11/1/21.

2. TIPS: Attractive carry and protection from persistent inflationary pressures

I expect TIPS to remain an important part of core bond portfolios as protection against persistent inflationary pressures. With inflation running hot for the past eight months, I see a risk that higher inflation expectations could become ingrained. Looking ahead, I think inflation could remain uncomfortably high, especially in the first half of 2022.

If inflation had accelerated and come back down rapidly, it wouldn’t have been as much of a problem for the Fed because the real economy wouldn’t have had time to adjust. However, inflationary pressures have already persisted longer than expected, and we are already starting to see labor successfully bargaining for higher wages and companies beginning to adjust.

In core bond portfolios, we generally favor front-end TIPS over long TIPS. Long TIPS are typically more reflective of long-term inflationary pressures and the Fed’s credibility in containing them, and they are trading at reasonable levels by historical standards. However, front-end TIPS, with inflation at over 6% and two- and five-year breakeven rates as of the end of 2021 at 3.2% and 2.9%, respectively, seem far more attractive as places to both earn income and get some protection in case inflation continues to surprise to the upside.

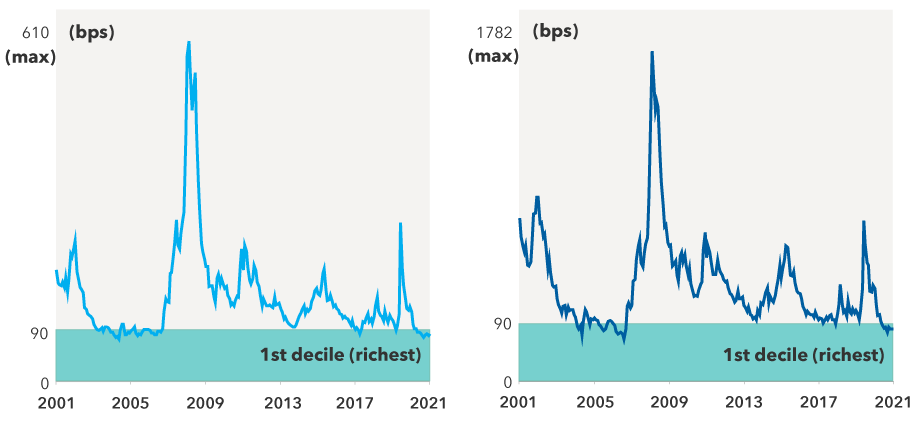

3. Credit assets remain expensive, posing greater downside risk

Periods of monetary tightening are usually accompanied by bouts of higher market volatility, and I expect the next couple of years will follow the same pattern. In my opinion, this risk of heightened volatility is not well-priced in risk markets — equities or credit. At current levels, credit spreads don’t look particularly attractive to us on the core bonds team. The incremental yield pick-up of an overweight position to investment-grade credit (BBB/Baa and above) does not seem to be worth the risk. For example, at a spread of about 90 basis points to Treasuries, a 10% overweight position in credit provides an incremental yield of just nine basis points to a portfolio, but the downside risk of substantial spread-widening in a risk-off market is much greater. Hence, we see asymmetric risk to the downside in investment-grade credit. Over the coming year, we expect our primary focus to be on generating excess return through security selection rather than simply taking on additional credit risk.

In portfolios that I manage, I am increasing exposure to high-quality asset-backed securities, which I see as a lower-risk approach to picking up yield. I continue to see some value in high-yield but it is very security and issuer specific. In 2021, we saw several “rising star” high-yield-rated issuers upgraded to investment-grade. I expect this trend to continue in 2022, which will help us further de-risk portfolios organically. Within investment-grade, we’re moving from triple-B-rated credits to single-A. So, we are staying conservative on credit in both quantity and quality.

Credit spreads are historically tight

Sources: Bloomberg Index Services Ltd. As of 10/30/21. “U.S. investment-grade corporate spreads” are based on the Bloomberg U.S. Corporate Investment Grade Index. “U.S. high-yield corporate spreads” are based on the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index.

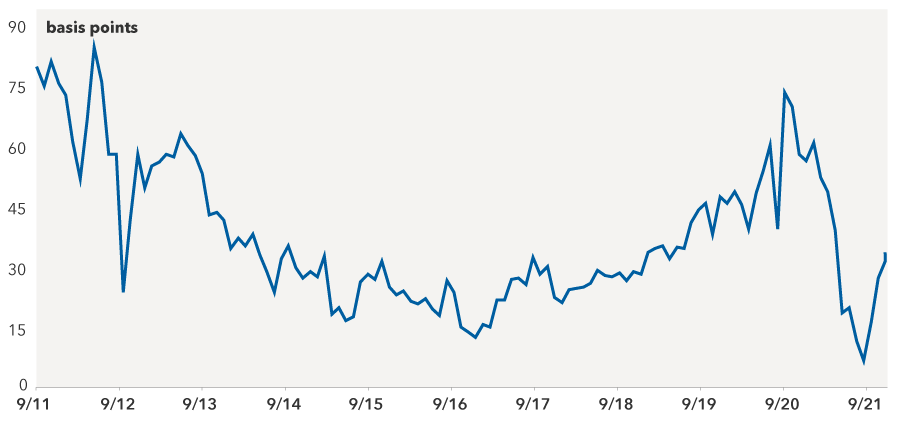

4. As the Fed tapers, mortgage-backed securities may become more attractive

Although agency mortgage-backed securities (MBS) have cheapened since the announcement and acceleration of the Fed taper (reduction of asset purchases), they’re still at the richer end of what we think is fair value. Steady interest rates and a robust housing market should mean the supply of MBS remains healthy. And as to the extent that we get higher market volatility, our mortgage analysts expect mortgage spreads to widen further. For agency MBS, there are a number of potential risks in the near-term. Once those are reflected in spreads, mortgage-backed securities are likely to be more attractive and we will look to add mortgages to the portfolios.

Mortgage-backed securities: Preparing for a taper

Source: Bloomberg. As of 11/30/2021.

5. Liquidity and quality: An opportunistically conservative approach

As we move into and through 2022, the core bonds team will increasingly be leaning toward a risk-off posture. Our approach is that of a gradual contrarian. As yield spreads move tighter, we will continue to harvest our gains and upgrade the portfolios’ quality and liquidity. And if spreads widen and volatility rises, we will look to cautiously add back bonds that our analysts like at more attractive valuations. Similarly, if yields continue to move higher beyond what we think is a reasonable expectation for Fed hikes, we will likely extend the portfolios’ duration.

That said, my base case expectation is for long-term rates to remain stable and I don’t expect a sharp sell-off. With short-term interest rates moving higher in recent months, we on the core bonds team believe that investment-grade fixed income can provide a measure of downside protection to investors when market volatility rises. And with the Fed becoming increasingly hawkish and valuations at or near all-time highs, I believe that a core bond strategy remains an important part of an investor’s overall asset allocation plan.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg's licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity and quality requirements. Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%.

Bloomberg U.S. Mortgage Backed Securities Index is a market-value-weighted index that covers the mortgage-backed pass-through securities of Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

Pramod Atluri

Pramod Atluri