Marketing & Client Acquisition

Marketing & Client Acquisition

Here’s a test: Go to Google, Bing or your favorite search engine and type in “financial advisor near me” or “financial advisor in [your town or region]." Does your practice come up at the top of the page, just below the sponsored results, or even on page one? If not, where does it first appear in the results? Are competitor firms closer to the top of the rankings? If so, what are they doing that you aren’t?

The answer is search engine optimization (SEO). It’s a way of organizing your website and its content with the goal of ranking highly in search engine results pages (SERPs). SEO is important to financial advisors because online is one of the first places that prospective clients will interact with your practice. And the closer you are to the top of page one in the rankings, the more likely you are to capture those prospective clients.

Simply put, SEO helps you get noticed online. Messaging is crucial, as search engines use complex algorithms to find and reward good, relevant website content with top placements in search rankings. SEO has been described as more art than science, but financial professionals can offer a key element that search engines are looking for: the expertise to provide relevant, authentically helpful content, and trustworthy answers to commonly searched questions.

“Satisfying search intent is Google’s primary goal,” says Cynthia Casarez, senior search manager at Capital Group. “Good SEO sends signals of relevancy to help people find what they are looking for. SEO content is all about matching search intent and relevancy.”

Your practice may already have ingredients that appeal to search engines, but you may need to send stronger signals. Or you may be strong in some areas and need bolstering in others. Regardless of where your skills are today, here are five are ways to improve your SEO to help drive more traffic to your website.

1. Build your online authority

Search engines do not take a cursory glance of any website. They send so-called “spiders” or bots that crawl through content across the web, seeking clues that help it sort information according to relevancy. Above all else, these spiders are looking for trusted sources of information. For example, Google’s Search Ranking Quality Guidelines use the acronym EAT to highlight their most important signals:

Expertise: The credentials and experience of you and your staff will provide some degree of expertise, but it helps to have strong About Us and staff bio pages, listing the backgrounds and designations held by members of your team. Another key to defining your expertise is a deliberate brand message, one that defines what you do, whom you serve and what differentiates your practice.

Authority: Your practice and profession automatically signal some level of authority, if the search engines are made aware of it. You can do this by creating free profiles of your business in Google and Bing, which highlight essential information about your business, including name, address, hours of operation, telephone number and even services offered. The more you include, the better your chances of appearing in local search results. Search engines may also look to third-party sites to validate your authority, which is why it helps to have your name included on content and in events published on other websites.

Trustworthiness: Trustworthy website content implies a sincere and helpful intent. Search spiders will crawl your entire website for organization, ease of use and purpose of message, distinguishing from pages that are designed to sell from those designed to inform. EAT signals are particularly important when it comes to sites offering financial services, which fall under the category of “Your Money, Your Life” – information and advice related to one’s financial health and well-being. Keeping this type of content objective and up to date is crucial to achieving high SERPs.

2. Identify top keywords for financial advisors

While many of your ideas for content will likely stem from your practice and clients (for example, answering their most frequently asked questions or providing solutions to their key issues), you may want to consider aligning those pieces of content to popular or relevant keywords. Keywords are the words and phrases that people actually type into the search engine when looking for information, and a little keyword research can help validate and refine your content ideas from a search perspective. “Performing keyword research at the start allows us to identify what our audience is searching for (which is search volume) and why (which is search intent),” Casarez says.

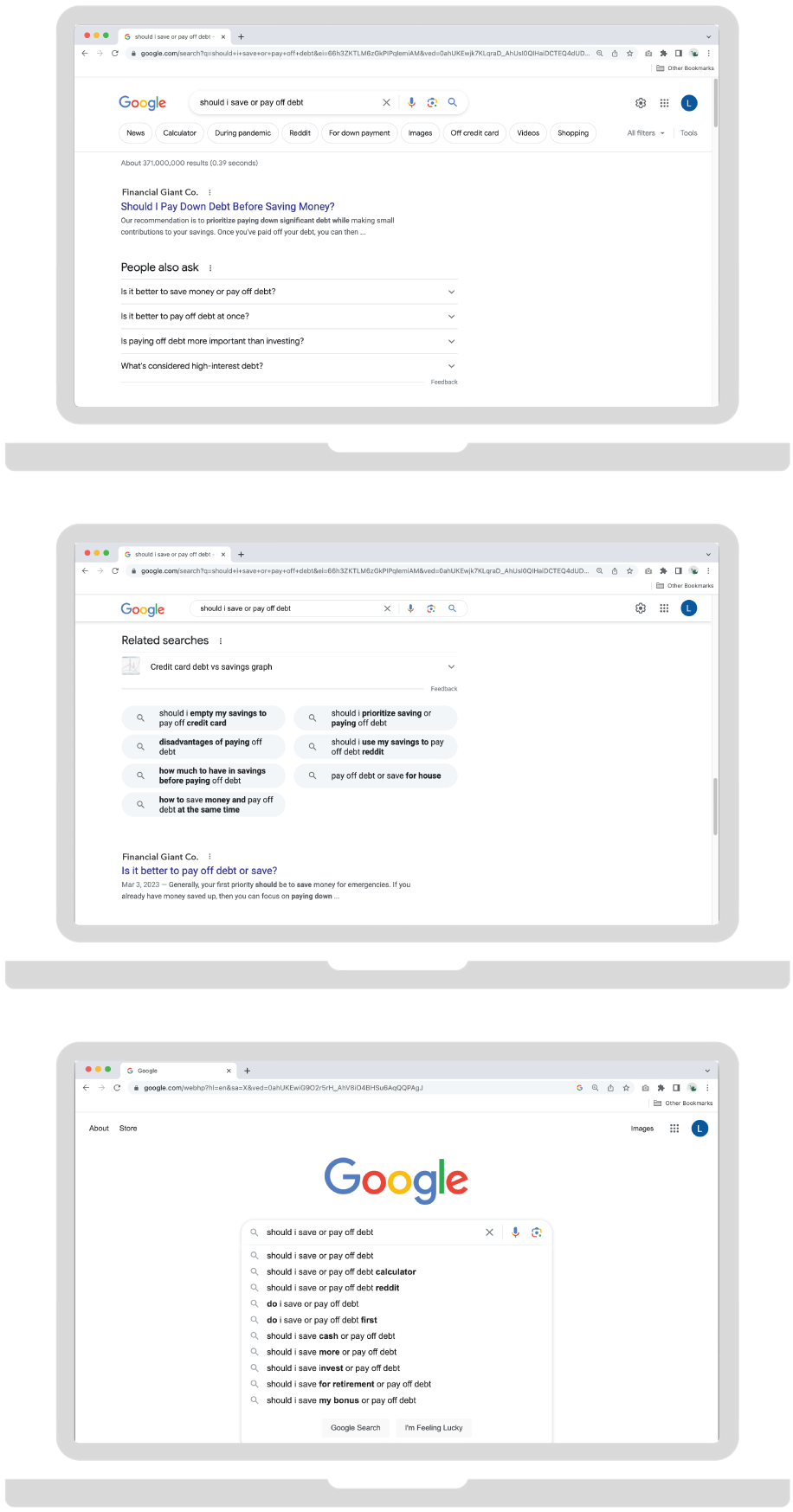

There are many ways to conduct keyword research. One easy way to get started is to search for a popular competitor to see what types of keywords come up in their search rankings. If you are looking for variations on a popular keyword term, an easy way to find them is to type in your question and see the results. Every Google Search results page includes two helpful sections: “People also ask” and “Related Searches”, typically found in the middle and at the bottom of a Google Search results page or as a dropdown in the search bar. These offer great hints for related keywords.

For example, try looking up "Should I save or pay off debt?" on Google Search, and the results will offer potential variations, such as: Is it better to pay off debt or save money? Do millionaires pay off debt or invest? Disadvantages of paying off debt. How to save money and pay off debt at the same time.

Search for clues in SERPs

Source: Google, May 2023.

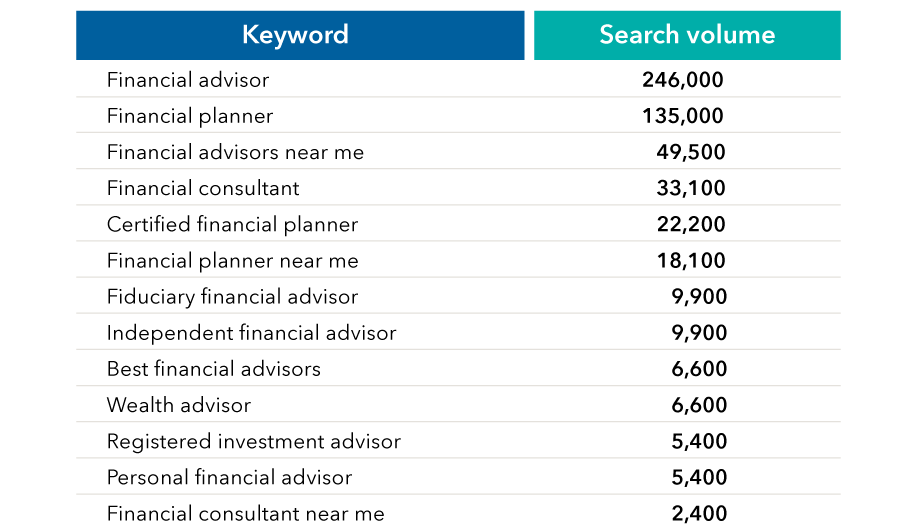

You could use a keyword search tool, which can offer you lists of related terms along with search volume, which is the average number of times that term is searched each month. Knowing the volume can help you understand which terms are most popular, but it can also help you get strategic about finding terms that are less competitive or a better fit your niche. For example, the term “financial advisor” averages nearly 250,000 monthly searches as of late May. By comparison, “financial advisors near me” has only about 50,000 each month, and “financial planner near me” gets just over 18,000.

Examples of top keywords for advisors

A keyword search tool can help you get a sense of variations and volume.

Source: Keysearch.co, May 29, 2023.

There are many free keyword tools, including Keysearch, Google’s Keyword Planner or the Ahrefs Keyword Generator to start brainstorming keywords and to get a sense of the competition. All are free, although they offer paid options that provide additional information. If you are ready to get more strategic about keyword research, a paid tool like SEMrush may also be useful.

3. Think locally

One of the ways to help differentiate your firm is to have a focus on local search. A full 87% of consumers used Google to evaluate local businesses in 2022, according to BrightLocal’s Local Consumer Review Study, 2023, and it may be easier to compete in the rankings for terms that describe your firm more directly. “Financial advisor” may be a popular keyword term, but it does not say anything about the intent of the search. On the other hand, “financial advisor for corporate retirees in Tacoma” is a less popular term, but has more of an intent and will likely lead to more qualified clicks. You may also try to rank for “Tacoma retirement planner,” “Best wealth managers in Washington” or “retirement advisor near me.” Do keyword research to help find the best phrases in your region and try to optimize different pages or pieces with those terms.

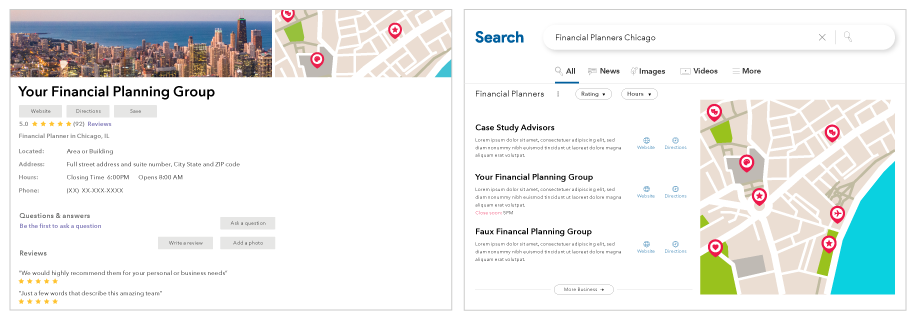

Another local search goal is to get into the “map pack” — a featured search result that literally shows your business on the map. Here is where SEO best practices come in handy. Registering your business with Google and Bing is the first step (remember to fill out as much information about your firm as possible). Getting brand or firm name mentions on other third-party sites will also help. These external mentions are known as backlinks, and they help to further signal a site’s experience authority and trust. And don’t be afraid of online reviews, as search engines tend to favor businesses they can validate through user feedback.

The “map pack” can help with local search leads

The more information you add to your business profile, the more likely you are to put your business on the map in search.

Source: Capital Group research

Google and other search engines offer opportunities for local businesses to advertise to customers searching in your area. Typically, an ad would move you to the top of SERPs above the organic results, and you would only pay for leads generated from the ad directly.

4. Consider solutions-oriented content

What really wins in search is relevant content that helps your clients and prospects solve a problem. Content can help drive traffic and build trust, showing off the expertise of you and your firm.

The type of content you create is less important. It could be articles, blog posts, Q&As, videos, white papers, infographics — whatever format works best with your target client. (And it doesn’t hurt to experiment and do a little of each.) Not only will it signal to search engines that your site is a source of trusted information, but the content can also be used in client emails, posted on social media and potentially shared by other websites.

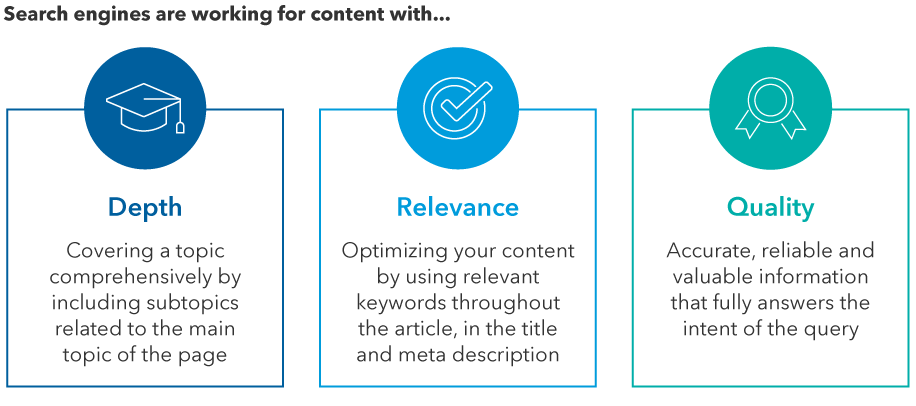

Great content can drive search interest

Source: Google; Capital Group research.

Typically, the questions you hear most from clients will correspond with topics that are searched most often by investors. Creating content that answers some of those top questions is a great place to start. If there are topics that appeal directly (or exclusively) to your ideal client, those might take priority. You can also use these questions to start your keyword research to find variations you may not have thought of.

5. Pay attention to site structure and keyword placement

How your website is structured is important to your business and your clients. You want to create an experience that is user-friendly and leads to a conversion, of course. But the right structure can also help you signal to search engines what’s most important to you, by having a hierarchy of information, links from one page to another, and a breadcrumb navigation trail that helps users find their way back to where they started.

Also, be sure to fill out the meta title and meta descriptions on your site’s backend. Metadata is the language best understood by search engines, and it’s what users see in search results. These titles and descriptions should be clear and well optimized for search.

It can also help to optimize each page of content or article, which involves repeating the keywords throughout the page. Indeed, SEO experts say there are certain places on the page where these keywords are even more important. These include:

Meta title: The meta title is the title that will appear in search results, which may be the same as the page headline but does not have to be. Either way, titles should include strong keyword terms. If you have used a given keyword on another page, subsequent pages may need keyword variations.

Meta description: The meta description is the blurb that accompanies search results. It helps add context and drive the user to click.

H1 or H2 headline: The headline on each content page should be the most important thing on the page, which means using a strong H1 or H2 heading in Hypertext Markup Language (HTML).

Subheadings or subtitles: Subheadings can break up a page according to subtopics and help readers find information quickly. Search engines will scan these looking for keywords or keyword variations. Using H3 subheads in HTML can help search engines find them.

Internal and external links: Hyperlinks to additional content and resources generally get high marks from search engines, particularly if the linked text is related to the target keyword. Consider linking to quality content created by subject experts providing useful research or source material, video tutorials, how-to guides, tools and other resources. These external links may also help you get relevant backlinks to your page or site.

Ready to take the next step?

If you have tried a hand at SEO and want to take a next step, you may want to explore paid search or search engine marketing (SEM). Remember those sponsored results at the top of the rankings page? Businesses get there through SEM ads, which are marked as sponsored and appear above the top-ranked organic result. These ads come at a cost based on the competitive value of the keyword term, and they are sold at ad auctions according to cost per click, or CPC. (SEM is also known as “pay-per-click” advertising.) The strategy is not for every firm — financial terms tend to have higher CPCs, and success may depend on your marketing budget and the audience you are trying to reach.

Experimentation is key, so don’t be afraid to try new things. Additionally, there are plenty of resources to turn to for help, including online experts, books, software solutions and creative agencies.

SEO checklist

Not sure where you stand in terms of search engine optimization? This handy checklist can help.

SUPPORTING MATERIALS

Cynthia Casarez

Cynthia Casarez